Last Updated on February 12, 2022 at 6:20 pm

On 19th June 2008, I started investing in mutual funds. These ten years have changed the way I look at risk and even day to day money management. This is my story and the lessons I have learned. The broad trajectory should be well known to regular/old readers. This is an account of how I went from spendthrift to debt-bearer to financial independence: The Financial Arrow of Time and My journey: driven by the fear of making the same mistakes again. My story was featured in Livemint

I had already shared my lessons from mutual fund investing – this was specific to mutual funds. In this post, I discuss other aspects of portfolio management and outlook on money growth. First of all, let me make it clear that ten years is not a big deal. I know many investors who have been investing in the markets and/funds for much, much longer. Since we suffer from solved example syndrome, the stories of such investors will sell well, but they are too private to discuss their journey.

This is only a personal milestone. There is so much to learn. Be it the stock market or life, the moment you sound like you have some experience, you will get kicked to the ground. The simple truth is that out of a million ways to go from point A to point B in ten years, life selected one for me. This does not mean, this is the only way to success (or failure).

How it all began

It was late 2007. My father had passed after an 18 month bed-ridden battle against multiple myeloma. We were all emotionally exhausted. Two months after he passed, my mother was diagnosed with Parkinson’s disease – there is nothing fair or unfair about life, it is just pot luck.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Finally, I had some time to take stock of my life. Since I had a hospital expense debt of about 3 lakh (thankfully interest-free as it was from my brother-in-law), I swore that I should never put my family in such a money-situation again.

I started reading news articles and this idea of beating inflation with equity caught my eye. So I asked my health insurance agent about investing in mutual funds. Like many, my first mutual fund was an ELSS fund (in hindsight, this is an unnecessary mistake, but that is life).

So my first fund was Sundaram Tax Saver Dividend Option. I had no idea what that meant and how it was different from growth. This fund and this option were selected by him and since my investment was small, I did not mind. So I started with a SIP of Rs. 1500.

When I started the stocks markets all over the world were in chaos thanks to the Lehmann crisis – but I had no idea (thankfully). About a year or so later, I called my agent again and wanted to start another SIP. He said he will send someone home – but no one came. Why?

From Aug 1st 2009, SEBI had banned entry load in mutual funds. This meant that sales guys would only get commissions from the investment value and not investment amount. Perhaps because of the climate then (post-crash), perhaps because of innumeracy I was told many distributors quit over this ban. They perhaps did not realize that commission taken out of the investment value will grow at the same rate as the investment.

Whatever the reason, this forced me to DIY. If no one would come home to set up a SIP for me, I decided to go “directly” to the AMC. Perhaps it is a generation thing – I did not look for the next easy option – “invest via the bank”.

So I became a direct investor almost 3 years before the introduction of direct plans. So for 3 years, amcs were gobbling up the commission money as there was no distributor. If I wanted a Sundaram Fund, I went to their office. If I wanted a HDFC fund, I went to their office. I had no idea who or what CAMS was.

Around this time, AMCs started opening up proper investing portals. It was possible to buy and sell units online. Then on Jan 1st 2013, the no of funds that I held doubled. All my funds had a regular plan and a direct plan. The new SIPs were automatically routed direct.

By this time, I had stopped my SIP gradually as the amount I was trying to invest each month became higher and higher and I could not lock that much into a SIP as it may affect expenses. So I began buying units manually each month. The first time I did that, I realised a SIP = monthly lump sum. This was about 5-6 years ago.

Initially, I used to invest manually at the start of the month. Then to train myself with the volatility, I used to wait for a “dip” within a month and invest then (the stupid things we do!). Then I did not care. I just invested when I could. Sometimes they were more than a month apart if expenses became high. I religiously started to track investments from 2010 or so in this excel sheet: Using Excel to track investments. I still use it.

By this time I was also making calculators for retirement and other needs (these seeds of freefincal were sown in late 2010ish). I made a financial plan template projecting future needs. This latter became this popular template: Create your own financial plan with this financial planning template and then this: Download the Freefincal Robo Advisory Software Template

Once I realised the power of tracking investing after setting clear goals, I stopped tracking expenses: How tracking investments instead of expenses changed my life! From that point on, it was all about reviewing portfolio growth (not individual funds) based on goals and periodic rebalancing.

My portfolio

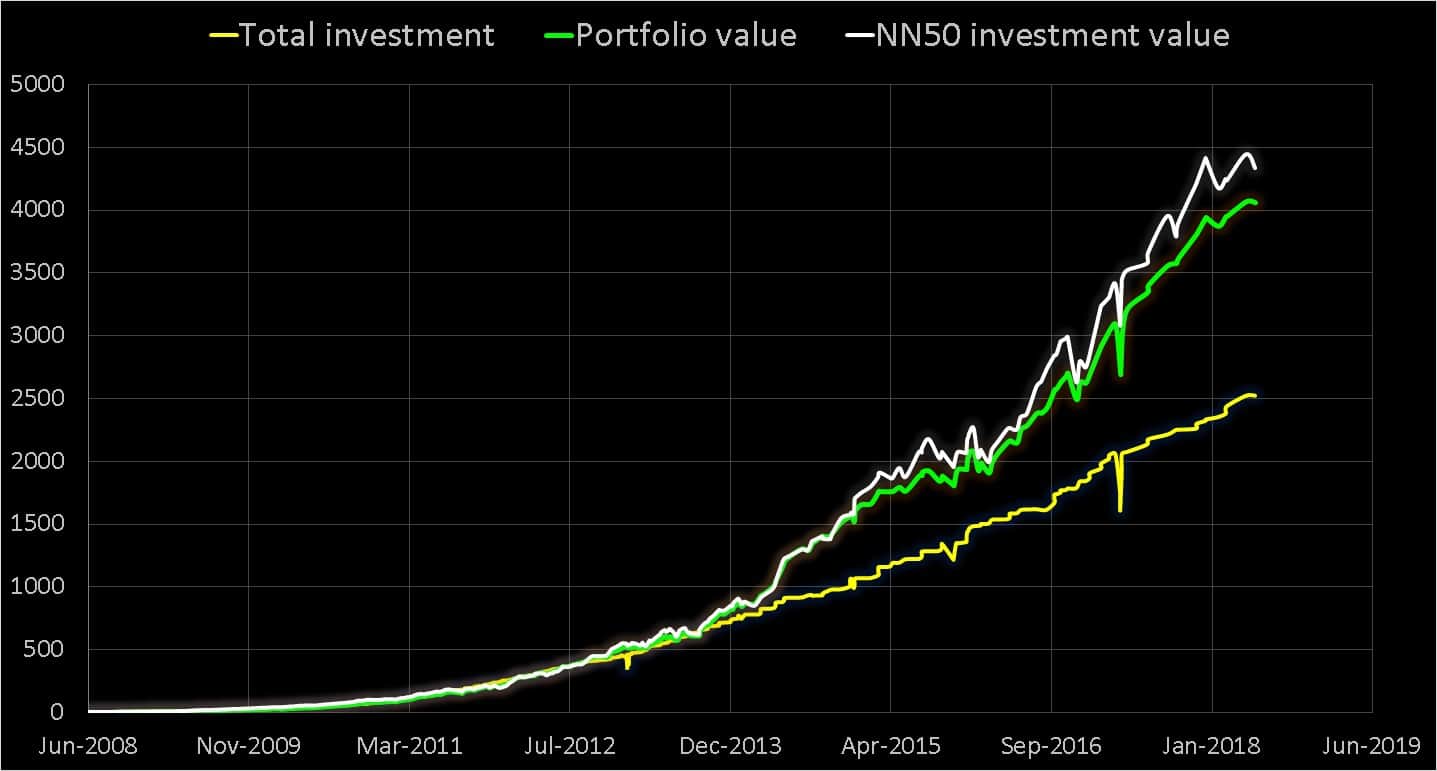

So this is the normalized growth of my portfolio and investment in NIfty Next 50 (same dates and same amounts, excluding dividends).

The y-axis values have no meaning (to you). Please don’t start thinking “If I had invested in NN50 ten years ago”. See this analysis: This is my portfolio vs Sensex, Nifty Next 50

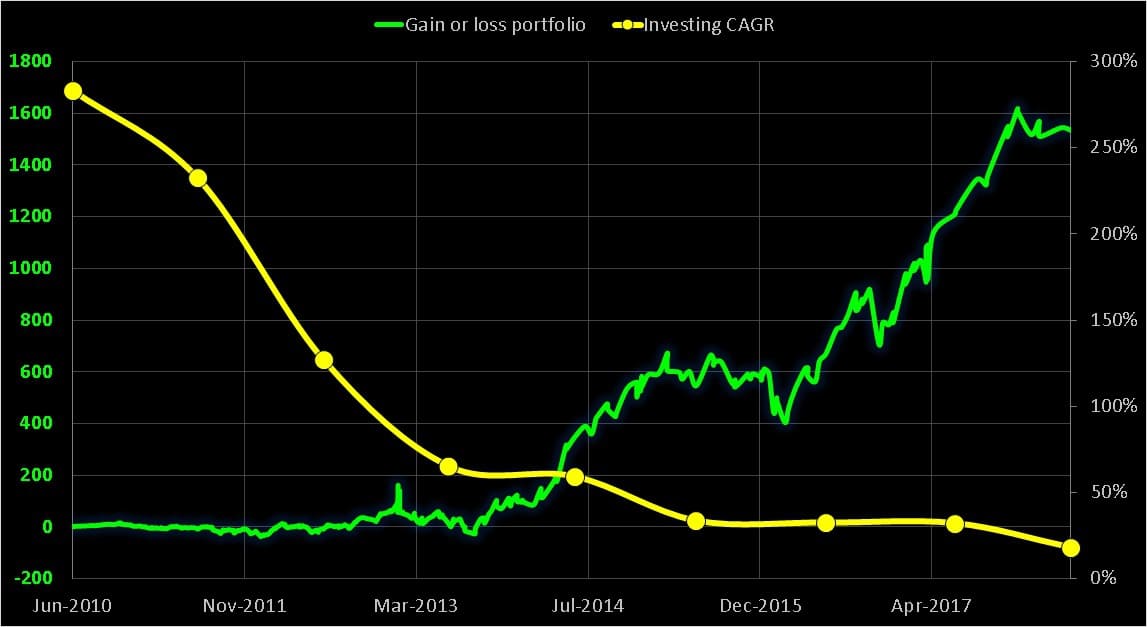

This the gain or loss in both portfolios.

Notice for the first 5 years and three months, the returns were zero. The reason you see the gains suddenly shoot up was due to this:

The gain or loss is again plotted (green). The yellow dots represent the annual increase in investment amount. Or What I refer to as the investing CAGR (not investment CAGR). Notice the huge year on year increase in the amount invested in equity mfs in 2010, 2011, 2012. When you dump in money when the market moves sideways, you reap the gains when the tide turns – in my case around the time when economic conditions were favourable and NaMo was announced as the PM candidate -sheer coincidence.

Please note the above does not mean I invested more in 2010,11,12 than now. That is not possible as I am salaried. What you see above is merely big jumps in equity investment. This was possible because I already had some NPS and PPF investments. So equity had some catching up to do in order to get to 60% in the portfolio. Today my investing CAGR has stabilised (it has too!)

I am pointing this out to show I am an unintelligent brute force investor who was lucky enough to invest more

Do you wish to view your portfolio growth like this? Then download: Mutual Fund Portfolio Growth Visualizer With Index Benchmarking (revised and updated June 2018)

My lessons

If I can call myself successful, then it is only because of one aspect: I did not monitor my portfolio every day. I did not seek information every day and worry about it. I let my money grow peacefully with occasional gardening. My portfolio growth has nothing to do with my ability to choose “good funds” or my education or training. By nature, I am disciplined and hate information.

If I had to list my lessons (no one is asking!), they would be:

1: Get a life! Identify your goal, invest in them and leave them be until it is time for your annual review.

2: Get rid of Financial contacts or groups on WhatsApp, Twitter and Facebook. An investor is defined by her ability to process information – and the best way to do that is to avoid information. Just like the best way to manage time is to avoid work (or learning to say ‘no’).

3: Invest like your rear end is on fire or life will light it up for you later.

4: If your needs are far away and you see a sideways market, pump in money. That is the best time to invest. Of course, not many can do this.

5: Never forget that these gains are notional. A single event can decrease your holdings by half. Mountaineers believe that they can climb a peak “if the mountain lets them”. Markets are not different. Remember notional losses are real losses. Only notional gains are notional.

6: Your attitude towards money itself and towards profit and loss depends on how much money you have. I have seen my portfolio gain or lose 10s of Rs, 100s –> 1000s —> ….. And along the way I realised that to be successful we need to not only learn to lose/gains lakhs every day but not also yearn for it.

7: Money is a drug. The more you have, the more you want to have. So at some stage, you will have to draw the line. Increasing the amount you give away to help others at the same rate at which your portfolio grows will keep us grounded.

8: To be rich, we must first think like a rich person. Have 10Y, 25Y or 35Y year view of your life. Want To Get Rich? Write Yourself A One Crore Cheque!

9: We cannot buy stuff with returns. Having enough money is more important than getting high returns and no, they are not the same.

10: Concentrate on the portfolio return the most. Individual funds will have up and down ride. As long the portfolio is moving along at a healthy pace, it is fine. This is the main reason for developing the freefincal mutual fund and financial goal tracker This is the only sheet I use to track my goals and investments. When I see kids today talk about “having all investments in the same place for consolidation”, I can only chuckle. This consolidation business is hugely overrated. Investing directly with a few AMCs and using Excel or Google spreadsheet (try this one) or online free tracking portals is more than enough.

11: To make money, two things are necessary: money and time. Returns are not in our control. Those who want to become financial free much invest like their lives depend on it. For all others, try to invest for retirement at least as much you spend or as close to it as possible. So ask yourself: What is your investing growth rate (CAGR)?

12: Get a proper hobby so that you forget about money. Freefincal is, unfortunately, my hobby. Just because I write about investing, does not mean I look at my portfolio daily and tinker with it. Every statue was once a rock. If we do not know when to stop sculpting, it will become a rock again.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)