Last Updated on October 8, 2023 at 1:34 pm

Here is a list of lessons I have learnt from eight plus years of mutual fund investing and countless hours spent studying and making analytical tools for the blog.

Perhaps many of these may seem trivial to regular readers, but for the record here goes.

1 Past performance matters, but not as much: Before choosing a mutual fund, it is common sense to check how it has fared. However, that is no guarantee of future success.

2 Selecting the right mutual fund is not possible This is naturally related to the above. Many frighten investors that it is important to choose the right fund else returns may be poor. This is nonsense. Active management is essential.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

3 Reviewing is more important than selection. Thanks to this realisation, today I can choose funds in under ten minutes. You can do it in under 30 minutes for start :). Whatever fund I hold, whatever its past performance, if I am not able to properly review its performance with personal benchmarks, the time spent in selection is of no use. Read more: How to review a mutual fund portfolio

4 Returns are not important I have now learnt to review mutual funds or any other instrument without worrying about returns. Considering only what the current corpus is worth keeps me calmer. Low expectations also helps. Read more: Review Your Financial Freedom Portfolio in Seven Easy Steps

5 SIP is not a strategy We keep a SIP running and hope everything will turn out all right in the end. As mentioned above, active management is necessary and this is possible without stopping SIPs. Read more: Simple Steps to De-risk Your Investment Portfolio

Remember SIP <> Discipline!

Just because we have set an alarm clock to ring each morning at 5 am, does not mean we have become disciplined. We still need to get up. Starting a SIP means little. We need to learn how to systematically reduce the risk associated with a SIP

6 Go beyond SIPs Although I am a fan of systematic investing, I found a SIP too stifling. Discipline is not a problem for me and it takes under a minute to make an investment online. And I am not that busy that I cannot spend a few minutes to invest manually. This does not tie me down to a single fund. Not recommending this, just a lesson for me.

7 Star ratings are useless They are flawed in multiple ways -trying to rank an inhomogeneous group, assuming returns fall on a bell curve etc.

The key issue is that the start rating analyst looks at fund performance at a different period that than that you have invested in. This can make a world of difference. It is like the Blind Men and the Mutual Fund!

Read more:

Here is why you should ignore mutual fund star ratings

Part II: Here is why you should ignore mutual fund star ratings

8 Peer comparison is useless after we start investing in a mutual fund Even if we compare category peers for the exact investment dates as ours, it is not productive. Due to several requests, I making a tool that enables such a comparison but …

I prefer a simple check to see if the fund is outperforming the total returns index of its chosen benchmark. This can be done either with:

Multi-index Mutual Fund Rolling Returns Calculator or

Mutual Fund SIP Rolling Returns Calculator or

9 I have better things to do than to time the market Forget the fact that there is no evidence that timing the market will work. Even if we assume that timing fans will get more returns, I don’t care. I have better things to do.

10 Do not hesitate in choosing new funds Just because a fund is an NFO or has not much history to speak of, does not mean it should be shunned. I am happy to buy funds from AMCs who I trust and fund managers with proven record. Not because new funds can perform better. Just a nice clean start. As mentioned above, reviewing performance is more important.

11 Stay away from popular funds Investors exhibit a lot of herding tendencies and flock to a fund that others are investing in. When this happens, the AUM swells up in a short time and the fund is unlikely to remain a “top performer” for very long.

Instead, I prefer consistent performers with 3-star ratings and not so high AUM that many people are not aware of. I am happy to be an inconspicuous investor.

12 Keep it simple and minimalist You live and learn. For the first few years, my purchases were not focussed. If I had to start over, I will build a minimalist portfolio with just 1/2 funds per portfolio per goal (yes, I prefer to have separate funds for separate goals).

13 Expenses are important, but so is alpha I have never bothered to look at the expense ratio of a mutual fund. The shift from regular to direct immediately upon introduction helped me save considerably. Other than that I am happy with my alpha, for which I need to pay. Perhaps this will change in future and indexing will be better. Happy to shift when I see evidence that an actively managed portfolio of active mutual funds cannot beat the index.

14 There is no right or wrong. Only grey! There is no right or wrong. No optimal way to do things because it appeals to common sense. Volatile instruments provide returns which are highly irregular. When it rains, it pours and when it is dry, it is draining.

We have to choose a method and have the conviction to stick to it, and/or have the ability to analyse alternative methods and evaluate if it would be suitable.

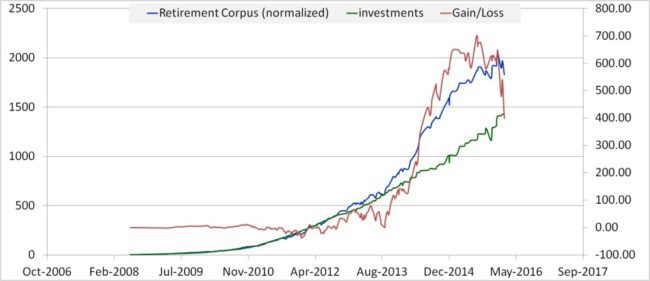

15 Patience is key I love sideways markets. It is a great time to accumulate units without noise about how overvalued the market is. When the markets eventually move up (they many not!), the seeds sown will bear fruit rapidly. Here is an example.

Notice the how the investments made during the sideways market after 2008 zoomed up around Aug 2013. Read more about my Mutual Fund Investing Journey.

Or see the Animation: Gain or loss in my retirement portfolio (June 2008 to May 2017)

16 The past is prologue. There are valuable lessons to be learnt from the past. And all of them revolve around how much returns can fluctuate.

These are my lessons. I am not a one-trick pony to claim that my experience is the best way to do things. Therefore, this should not be construed as investment advice. Only as one of the many possible ways to go from point A to B.

Over to you. Happy to learn your key investing lessons.

_________________________________

Ask Questions with this form

And I will respond to them in the coming weekend. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

GameChanger– Forget Startups, Join Corporate & Live The Rich Life You want

My second book, Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want, co-authored with Pranav Surya is now available at Amazon as paperback (₹ 199) and Kindle (free in unlimited or ₹ 99 – you could read with their free app on PC/tablet/mobile, no kindle necessary).

It is a book that tells you how to travel anywhere on a budget and specific investment advice for young earners.

The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when traveling, how traveling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download)

You can Be Rich Too with Goal-Based Investing

My first book with PV Subramanyam helps you ask the risk questions about money, seek simple solutions and find your own personalised answers with nine online calculator modules.

The book is available at:

Amazon Hardcover Rs. 271. 32% OFF

Infibeam Now just Rs. 270 32% OFF. If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Flipkart Rs. 279. 30% off

Kindle at Amazon.in (Rs.271) Read with free app

Google PlayRs. 271 Read on your PC/Tablet/Mobile

Now in Hindi!

Pre-order the Hindi version via this link

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)