Last Updated on October 8, 2023 at 1:32 pm

The physics PhD students of IIT, Madras invited me to speak on the rudiments of personal finance in their weekly meet on Oct. 24th.

Here is a transcript of the talk. Since I spoke impromptu (following an outline!), I cannot reproduce everything that I said, but will try to list the important points covered.

Was delighted to note that the hall was packed. It is so refreshing to find youngsters interested in a talk on money management. I Am happy that this happened at a time when their scholarship has increased: 25K pm (from 16K pm) for the first two years and then 28K (from 18K pm) for next three years.

1. Introduction

How would you like to change the way your family has always looked at money? That was the central theme of the talk.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

2. Fortifications: Building barriers

If a change has to make its mark, it has to permanent. Thus just like any construction, one has to begin with fortifications.

Life Insurance

A research student died while on a trek recently. Their parents were entirely dependent on him. They knew this. So no effort was needed to convince them about the need for a term life insurance policy.

Related Post: How to Buy a Term Life Insurance Policy

Health insurance

Same here. These were not school kids. They were postgraduates. So they knew the value of health insurance.

Subra suggested that I talk to them about the importance of getting their parents health cover. Done.

Related post: How to Buy a Health Insurance Policy

Accident insurance

This was suggested by Mr. R. Balakrishnan when I posted about this talk in the facebook group, asan ideas for wealth.

Emergency fund

See below

Related post: How Long Should I Maintain an Emergency Fund?

Will

Urged them to get their parents to write a will. Again a suggestion by Subra.

3. Analysing Cash Flow

I suggested that the students do the following with their monthly scholarship

For at least 1 year

i) 30% fees + food + needs

ii) 30% family or to the bank (say a flexi-deposit) – partly to build an emergency fund

iii) 30% for long-term investment (money you will not touch for many, many years) – see below

iv) 10% buffer for wants … from time to time

After about an year or when emergency fund is close to 1 lakh:

i) 30% fees + food + needs

ii) 30% family or partly towards long-term investment

iii) increase long-term investment (money you will not touch for many, many years) – see below

iv) 10% buffer for wants … from time to time

There was unanimous agreement that this was possible.

4. Frugal Living

Do not connect money and happiness.

Do not take your degree and future positions too seriously and buy stuff because of some ‘status’ nonsense or because of peer pressure

5. Never take a loan

Except a home loan and that too only if necessary.

6. Say no to credit cards

If you have a credit card, you need to pay it in full each month, anyway. Meaning you need to have the money ready. So why have one at all?

Ignore all the perks associated with credit cards. They do not account for much.

You do not need a credit card to keep track of your expenses

7. Say no to any kind of insurance products

Except pure term life insurance. Enough said

8. Do not talk to an insurance agent or bank relationship manager

If you need something from them, tell them what you want. Never ever ask an intermediary, what to do

9. Do not buy land as investment

It is not liquid, not well regulated, demand is artificial etc. etc.

10. Do not buy gold as investment

Since I was talking to physicists I could afford to say the following.

Gold glitters simply because gold is a metal. An electric field cannot exist inside a metal. Otherwise, the electrons inside would flow!

When light (which contains a fluctuating electric field) shines on a piece of gold, or for that matter any piece of metal, the nimble electrons move around like a gooey fluid and reflects most of the light. Some of it gets absorbed. So the resulting colour is golden-yellow. No big deal!

If our eyes could sense ultraviolet light instead of the visible light (VIBGYOR), gold would appear like a slab of glass because metals are transparent to ultraviolet light.

11. Give money to charity

Help others in need. When you are in need, someone would turn up to help you. That is my strongest religious belief.

12. Understanding long-term investments – the chai shop analogy

Only one persons parent ( out of nearly 100) invested in stocks. No surprises here I guess.

To introduce them to the idea of stocks and bonds, I used the following analogy.

Imagine a tea stall outside the hostel gate. You frequent it each day, you like the owner and you like the tea even more. One day he says he has to shut shop because he has huge debt.

You want to bail him out.

You have the following choices.

1) Lend him say 50K and ask for 8% interest each year for 10 years. This is called a bond. Since he is in your debt, this is called a debt instrument. If the person is trustworthy there is no credit risk involved.

Whether he gets a profit or not, he has to give you the 8% interest. So there is no ‘risk’ for your investment in the sense that payments will be regular.

You reinvest the payments in the same shop and get the same interest or say, put it in a bank FD

2) You give him 50K but tell him that you want a share of the profits. That is you own the company. This is called equity. If there is a loss, you get a loss. If there is a gain, you get a gain.

There may be intermittent losses but over a long period of time, you expect the annual gains to outnumber the annual losses. You expect this because:

- students need a place to hang out outside the campus. So they would frequent tea shops.

- If the tea is good (and it is in this case) then more students would come and more often.

- Thus, there is a chance for consistent profit.

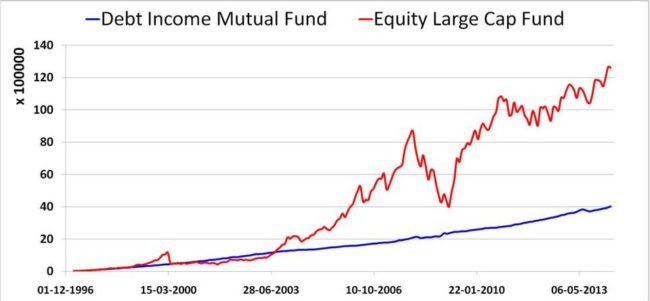

After several years, the equity and bond investors net worth would look something like this (drew this on the board).

If I apply 30% tax to both equity and debt, the value will reduce.

Now I must take into account the effect of inflation.

I asked for the price of chai when they had it for the first time ever in their lives.

Rs. 1, Rs. 2.50 were some answers ( not all are from metros!)

This was 10 years ago.

Now the price is about Rs. 7

So this is about 11% inflation with the starting price as Rs. 2.50

So after having devalued the corpus due to tax, we must devalue it due to inflation.

Now who do you think got the better deal? The fellow who had the courage to stomach annual fluctuations or the fellow who wanted ‘steady’ growth with practically no volatility

Which investor is likely to change the way their family handles money?

Knowing which chai shop to back may be tough as there are too many of them around the campus. Also, why only back chai shops? There are several Xerox shops, supplies shops etc.

What about our campus bank (SBI)? It makes a lot of money by offering attractive fixed deposit rates. It then offers different kinds of loans (car, personal, house, for companies etc.) at much higher rates and bags a neat profit.

Why not buy the banks stock? Why not observe the spending habits of the undergraduates and find out which brands they prefer? Those brands could then form a shortlist for further investigation.

Yes, knowing where to invest (either equity or bond) is tough. It requires confidence, discipline and the time to analyze and track.

There is a much simpler alternative: mutual funds. You pay a sum to a fund manager who pools in all contributions and invests in a diversified folio of stocks, bonds or both.

I urged them to build fortifications asap, learn the basics of equity and mutual funds and begin investing.

There were some intelligent questions like:

- Why do you expect stocks to increase all the time?

- Why is a home loan the only loan that one should get?

- Which term policy should I choose?

- Can I buy real estate if I want to farm in it?

- If one gets rich, does it mean someone else gets poor? (Tough one!)

Ten commandments of investing

When I discussed about this talk at facebook group, Asan ideas for wealth, Prof. Parag Rijwanji, institute of management Nirma university laid down ten commandments a young earner should follow. This is a must-read.

To access it:

1) Join Asan ideas for wealth (get on facebook if you are not there. Totally worth it)

2) Search the group for ‘PhD’. You will find two threads started by an idiot.

You will find the commandments in the second thread.

New Delhi DIY Investor Workshop April 23rd 2017

Register for the New Delhi DIY Investor Workshop April 23rd 2017

You Can Be Rich Too With Goal-Based Investing

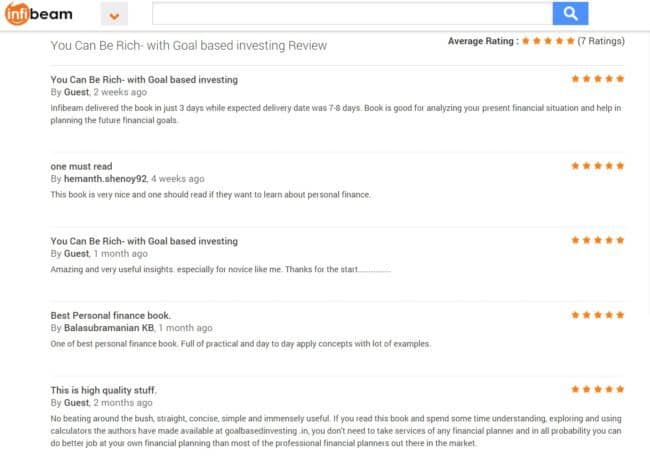

Happy to announce that my book with PV Subramanyam has been selected as part of Amazon Best Reads Mar 2017. Now 50% off. fThank you for your support and trust. If you have not yet got the book, check out the reviews below and use the links to buy.

Reader Quotes:

Gift it to your Friends and Relatives whom you care more. Already follower of Pattu and Subra’s forum. Ordered 4 more copies to give gift to my friends and eagerly waiting to read

The best book ever on Financial Freedom Planning. Go get it now!

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 199. 50% OFF

Kindle at Amazon.in (Rs. 307)

Google Play Store (Rs. 307)

Infibeam Now just Rs. 307 24% OFF.

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Bookadda Rs. 344. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)