Last Updated on April 10, 2016 at 11:26 pm

Buying a term life insurance policy based on an insurers claim settlement ratio (CSR) is a meaningless exercise. All it does is offer psychological comfort to the buyer who refuses to understand that each death, and therefore each claim settlement is unique. When a nominee applies for a claim, the insurers CSR is irrelevant.

That said, when a young earner wants to know, ‘which policy should I buy?”, or ‘how to choose a term policy?’, we typically say, ‘choose an insurer you are comfortable with, just be honest while applying’.

Unfortunately, I find that this is not of much use, as the person still needs a simple way to define a comfort zone and short-list insurers inside the zone. The honesty part is of course always relevant!

Therefore, in this post, much as I do not like it, I would like to propose a simple way, based on the CSR, to short-list insurers for purchasing a term plan.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

The whole process should take you no more than 15-30 minutes.

One good thing that has come out of the CSR hype is that the insurers (incl LIC) have also fallen for it! Some make it a point to flaunt their CSR. This might be a good development from the (future) customers point of view. If the CSR drops, insurers have begun to realise that it could impact image and therefore sales.

Deconstructing IRDA’s Death Claim Settlement Table

First, let us touch upon aspects from IRDA’s death claim settlement table, obscured by the claim settlement ratio.

Let me start with an analogy between an insurer and a teacher evaluating answer scripts. As the teacher starts evaluating scripts, he/she gets a sense of what the average mark of the class would be. When a student scores little or no marks in the first few questions, the teacher realizes that the total mark would be much lower the class average. Therefore, the tendency would be to be a bit generous in the next few questions so that the total is bolstered a bit.

On the other hand, if the first few questions are well written, the tendency would be to scrutinize, the whole paper(!) a bit closer. This is normal human tendency and even a teacher with no pressure from the administration is likely to do this.

Why won’t an insurer who receives a big-ticket claim scrutinize it tougher? After all, there is much more at stake.

The point is, LIC or private players, no one is likely to offer term cover claim settlement on a platter. Of course, there is a due process clearly mandated by IRDA.

The following is a screenshot from the IRDA annual report 2010-11 (click to enlarge).

Trouble is, what a claimant considers a delay and what is legally allowed, are two different durations!

There is a crude way to point out that higher the claim amount, higher the scrutiny, resulting possibly in a repudiation or delay.

The claim settlement table published by IRDA has the total benefit amount along with the number of claims intimated, pending and repudiated.

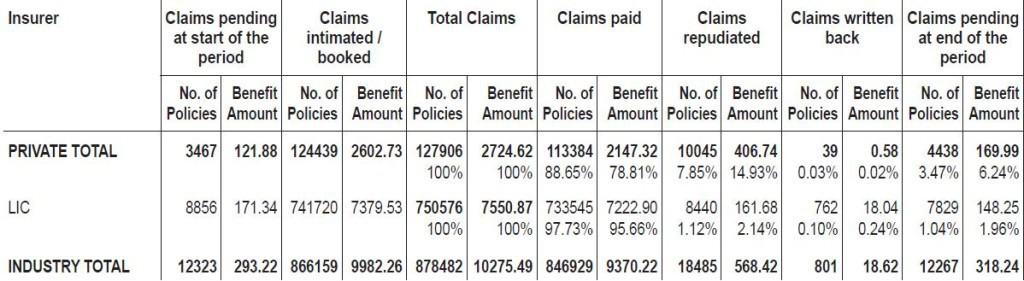

This is a screenshot from the individual death claims table of the 2012-13 annual report. The entries have been merged with the column headings to aid reading.

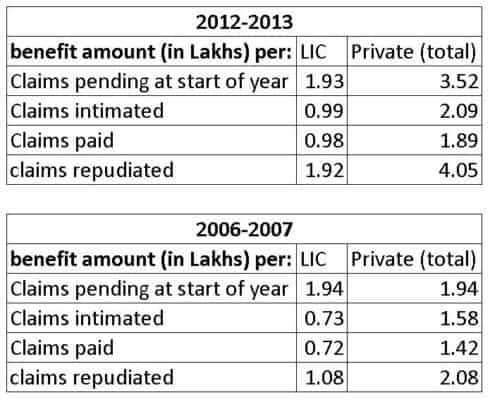

The benefit amount per claim when compared over time can shed some light on the ‘average’ claim amount handled by the insurer. Of course, this ratio is not a sound way to make any solid inferences. Let us however run with it and see where it takes us. Before you pan me in the comments section, remember that I acknowledged this!

The claim amount (Lakhs) intimated per policy was 0.73 was LIC in 2006-07 and 1.58 for privates.

In 2012-13, this increased by 36% for LIC and nearly 33% for privates. It must be kept in mind that the number of private players increased by about 50% in this period.

Thus, there is a significant increase in the claim amount per policy handled by LIC.

Even more striking is the 78% increase in the benefit amount per repudiated claim (1.08 to 1.92) . How would you interpret that?

For the privates, the benefit amount per repudiated claim has increased by a whopping 95% (2.08 to 4.05) .

For LIC, the claim amount repudiated per claim can only increase from now (their e-term policy is only one reason). For the privates, I think it should come down in the future or at least not increase so dramatically.

One could argue that the new insurers would have processed early claims and hence would have scrutinized stringently. However, let us read too much into this.

Simply because it is clear enough (even without this data) that the privates are likely to scrutinize claims tougher than LIC.

This can also be seen by

1) comparing benefit amount per claim paid with benefit amount per claim intimated. These are comparable for LIC. For the privates, the benefit amount per claim paid is always lower than the benefit amount per claim intimated.

2) Privates have more claims pending at the end of the year than the start of the year (not shown). The converse is observed for LIC.

The number of pending claims at the start of the year decreased from 9574 in 2006-07 claims to 8856 claims in 2012-13 for LIC. While it nearly doubled for the privates, primarily because the number of such life insurers have increased.

Notice that the amount per claim pending at the start of the year has doubled for privates, from 2006-07 to 2012-13, even though the denominator (number of claims) has nearly doubled (from 1894 to 3467 in 2012-13).

When the denominator doubles, the ratio can double only if the numerator (benefit amount) quadruples!

This implies that the privates are handling much higher claim amounts than LIC (not much of a finding!). One could argue that this is the reason, their CSR is lower.

Even if you don’t wish to make much of these ratios, I hope that you agree with my contention that if the claim amount is big (as in a term insurance policy), LIC too would scrutinise it carefully. Simply because such an amount would be higher the average claim amounts they process.

Claim settlement ratio

Claim settlement ratio ignores the

1) nature of the policy. LIC typically has a higher number of small ticket claims.

2) the time it takes to settle. It can take up to six months or even more to settle a claim. As long as a claim is settled within the FY, it will be counted for computing CSR. From a nominees point of view, that is a ‘delay’.

Consider this:

In 2012-13

LIC settled 7.33 lakh claims out of 7.51 lakh claims. A claim settlement ratio of 97.7%

The privates settled 1.13 lakh claims out of 1.27 lakh claims. A claim settlement ratio of 88.6% (incidentally a significant improvement from 72.7% in 2006-07 despite a 50% increase in number of private pl.ayers)

Now, if the privates had a CSR equal to that of LIC, they should have settled 1.24 Lakh claims (instead of the actual 1.13 Lakh claims).

This is less than 10% off. This is approximately the difference between the CSR’s, but when you look at it this way, I think it does not appear so bad!

If you are worried about this, then you should have enough money (including possible loading if any) to afford an LIC policy (offline or online).

If you don’t, why bother?!

I suggest you pick a private life insurer who has been around for at least 10 years (with no plans to leave – check recent news reports) with a CSR close to, or above the total private average.

Even better, if the insurer has a CSR history consistently higher than the current private average.

It will take you less than 30 minutes to access the IRDA reports, locate the “Individual death claims” table and scan the necessary numbers.

Once you can short-list 2-3 insurers, compare the price for a policy (without loading, but inclusive of service tax) using the premium calculator available at their websites.

Choose the cheaper among the two.

Apply immediately. Do not ask anyone else for an opinion.

Calculating the insurance amount required

Should have appeared first in a ‘how to’ post!

For Young earners: Insurance Calculator For the Young

For the family man: Insurance + Child Planner

For the meticulous planner: Comprehensive Insurance Calculator

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)