Last Updated on December 18, 2021 at 10:46 pm

“This is a guest post from Abhinav Gulechha. Abhinav is a Certified Financial Planner and writes at www.sohamfp.com. Views expressed are personal.”

~~~~~~~~~~~~~~~~~~

In today’s credit-driven economy in which we live, one can buy anything provided you have the income to support it. Owing to an easy availability of home loans and rising salary levels, it becomes all the easier for young couples to purchase a flat in a very young age.

While this is very good, today I want to share some not-so-glamorous aspects of the deal. The objective is not to scare you, but to help you take a balanced and well thought out decision.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

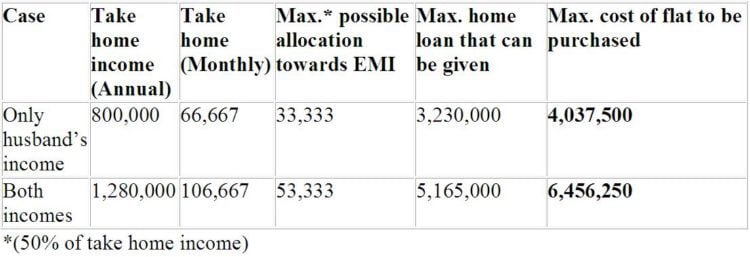

Take for example. Mr. A and Mrs. A is a young couple; they are a few years into their respective jobs, both being professionals, and now want to purchase a house. Their take home is of Rs. 8 lac and Rs. 4.8 lac a year respectively.

When they approach the home loan company for a pre-sanction, they were told that if they applied singly (i.e. only husband applies for the loan), the eligibility will be Rs. 32.30 lacs, which would mean they can buy a house worth max. Rs. 40.37 lacs.

On the other hand, if they apply jointly (which means that the home loan company will consider their combined monthly income for calculating the max. amount of loan that can be given), the eligibility will increase to Rs. 51.65 lacs, meaning thereby that they can look for a flat worth Rs. 64. 56 lacs.

(Calculations are home loan eligibility calculator at LIC Housing Finance website www.lichflc.com. Rate of interest is assumed at 11%. All figures are in Rs.)

Note that for the couple, this difference of Rs. 24 lacs in property cost (Rs. 64 lacs – Rs. 40 lacs) can make a big difference. For a family in Mumbai, it can mean a difference between continuing to stay on rent or having own 1 BHK flat, for a city like Pune, it might mean buying a 1BHK vs buying a 2BHK……

For the builder and the home loan company, they will have no issues. The bigger the flat you buy the better for them (the builder will profit moreand the home loan company will earn far more interest income from you over the loan tenure).

However, for the couple, they will definitely want to push themselves some more and go for a higher eligibility, and the primary logic/ argument for that will be:

- The salaries will not remain static: they will grow over time, so the pressure of EMI on monthly take home will ease off

- Home purchase is the biggest and most important investment in their life – they want it to be the best. Buying 1 BHK now and then selling to buy a bigger house is a no-no. It is better to buy a 2BHK in the first instance itself

- Joint home loan means both partners get tax deductions of Rs. 1.5 lacs each

- We will try to cut costs, reduce expenses, and sacrifice on other financial goals

Fine with that, no issues. I am not trying to be a spoilsport telling you to settle for something small. But having seen some very bad real-life experiences of people around me, who believed in the above assumptions and found them later to be false, I want you to at least be mindful of the some points which can help you take a balanced and well thought out decision:

Sudden job loss/ Not able to get the expected salary hikes:

Anybody who is in salaried employment over the past few years will agree to this. People who bought loans between 2005-2007 periods, expecting that the era of year on year 25% or more increments will continue were in for a rude shock. Not only were people laid off during the recession of 2008, those who survived, increments were either nil or in single digits.

So, if you were amongst the ones who stretched yourself assuming that things will ease out with a rise in salary, recessionary phase would have proved you wrong big time – worse, people had to even vacate their homes as they were not able to pay off the EMIs. In such situation, those who were having an EMI/ Total income ratio at 25% or below might at least have sailed above water and were able to re-negotiate the terms with the home loan provider to avoid foreclosure of their loan.

Not able to start a family due to increased EMI burden:

Starting a family comes with its big time costs: both in terms of money, time and effort (read my earlier post on this point). Ifcouple had taken a big loan, a major part is spent in servicing that loan, making the decision to start a family a difficult one. Note also from a medical point of view and what I know, there is a prescribed maximum age (usually 35) for women for childbirth beyond which the pregnancy becomes a high-risk case. So, big home loan exposes the family to not being able to enjoy the pleasures of a baby and also exposes the mother to health risks due to delayed childbirth.

Wife not able to take a job-break on child-birth:

I’ve seen this in many cases. Couples take a bigger loan to buy a bigger flat to satisfy their ego and prestige in society. After that, to satisfy the parents’ pressure for a baby, they decide to have a baby too. Baby requires full time, attention and care especially in its early years. Due to the home loan EMI burden, wife cannot leave her job, even if she wants to. For her, it’s then a double responsibility of keeping a job as well as raising a family that puts tremendous strain on her physical and mental health and also results in quarrels between the spouses.

Had the couple settled for a smaller house initially, it might have been easier for the wife to take a break for some years till the child is small, so as to allow herself to recuperate as well as take full care of the child when he/she is small. Due to lower EMI, it would not even have created a pressure on monthly income even if the wife stops earning.

Higher the EMI, higher the worry/ anxiety:

What use in staying in a bigger house if you cannot sleep and are always haunted by the thought ofbank foreclosing your loan for non-payment of EMI? I will not further explain this point – every home loan customer who has a home loan on his head (including me) understands this so well:)

Plan of action: What you can do?

If you are in the planning stage of buying a flat, both partners should think a bit into the future on the following aspects and then take a decision:

- When you both plan to start a family?

- Are you prepared for the additional monthly recurring expenses that will get added due to childbirth and schooling?

- Does your wife plan to take a break to raise the children in a proper way?

- What kind of schooling are you expecting your children to go for (for e.g. fees in IB schools are way high as compared to CBSE and SSC schools)

- Are you/ your wife willing to work till a considerable portion of your loan tenure or would want to pick up light consulting work/ business some years in the future: this will reduce your overall income in years to come?

If you are the one who already is into the circumstances I have covered in this post, don’t lose heart. You can do the following things:

- Make pre-payment of loan your only financial goal (stop planning for other goals/ investments) – read my detailed post on this point here

- Build a decent enough contingency fund (consider shifting your home loan to SBI Max gain – you can refer my detailed review of SBI Maxgain here and my post on how to create a contingency fund)

- Risk-proof your family (read my earlier posts on insurance here)

- Avoid purchasing anything on credit or taking fresh loans

- On a personal note, have faith in the Almighty, don’t delay on starting a family just because you have a big loan, it will be taken care of:)

If you have reached by here, I guess at least there was something worth reading, so thank you for your patience. If you liked the idea, please spread it by sharing with at least one of your friends.

I will love to know your thoughts/ stories on this point. I have mine to share too, so please share yours in “comments” section.

~~~~~~~~~~~~~~~~~~

“This was a guest post from Abhinav Gulechha. Abhinav is a Certified Financial Planner and writes at www.sohamfp.com. Views expressed are personal.”

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)