Last Updated on May 17, 2024 at 9:23 pm

So many people have asked me or told me in the last few days that, “if the BJP loses, the stock market will crash; what should we do”. From those above 50 to college students, many seem convinced that the market will hold only if the BJP stay in power. There are several problems that need addressing here: (1) what does a market crash mean? A 5% fall, a 40% fall or a sideways market? (2) How can one prepare for market crashes and the key question (3) Do economic growth or stock market growth depend on who is in power? This is a non-political non-aligned article.

The first two questions are fairly easy to understand/answer, but hard to implement. For new investors (and at least 70% of all stock investors today are fairly new), any movement of the stock index other than up seems to a “market crash”! Well, they will live and learn. How should one prepare for market crashes (if we go with the accepted definition of a crash as a fall of more than 20% from peak): There are many choices available and you can one choose that you like (just do not ask which is the best).

(1) Goal-based risk managed with suitable asset allocation and diversification. To implement this, you can use the open-source robo advisory template. This is the easiest option for most retail investors as no special action, skills or monitoring is necessary. (2) Tactical asset allocation where the asset allocation is changed according to market conditions assessed by technical indicators (not events or news) is an option suitable for the disciplined investor (3) Investors seeking stronger “fall protection” will have to consider tail-risk hedging strategies (more on this later) but will have to shell out the necessary costs as “big falls” may take years to recur.

Now with that out of the way, let us get back to the titular question: “If BJP loses Lok Sabha Election 2019, will the stock market crash?” Why are people asking or saying this? Is this is because of what happened in 2014? Have we forgotten that the last five years includes a two-year fall and recovery period with no growth? Whoever comes to power, it will be a coalition government directly or indirectly (BJP had alliances in 2014 too).

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

If any other alliance gets a clear majority, why should the market fall? There is no need for FIIs to pull out immediately. Yes, if there is no clear majority and if there is a “Karnataka” kind of situation where all major parties fall short by a small number of seats, we can expect turbulence in the market and FII may pull out or not add more money. Only those who need money in the 5-6 years and having100% equity allocation will have to worry about this scenario. For those with goals decades away this might well be a small blip.

If Congress or any other non-BJP alliances come to power, will the markets never recover? This is the actual fear/implication in the titular statement. How would the “India growth” story come to a grinding halt if X or Y party does not come “back”? There is no proof to back this up. In fact, as we shall see below, coalition governments (regardless of party) have contributed to business development and economic growth.

I strongly belileve unless we go back to the stone age in terms of policyregulations, our economic growth is largely independent of who comes to power. India will shine in spite of its politicians

Governance is contiguous. Governments are not.

A couple of months ago, R. Srivatsan who has published a few articles here, sent me the following term paper written when he was a student. I think this is the best time for us to read and introspect on the following:

Indian Coalition Governments and their impact on business policy

About the author: Srivatsan would only like to be referred to as a “long time reader” of freefincal! He has written several articles before and is responsible for adding the Earnings power box feature in the stock analyzer:

- It’s Earnings That Count: Forget the next Infy; Can you identify the next Satyam?

- Automated Earnings Power Stock Analysis With Screener.in data

- Want financial success? Budget time & energy before money!

Executive Summary

We provide a narrative to show that coalition governments did and do help India’s business development contrary to the popular perception that Indian coalition governments result in “Policy Paralysis”. The article was written before the 2019 Lok Sabha election and has an appropriate tone. We have not changed that. The number in square brackets [1], [2] refer to references mentioned at the end of the article

Methodology

- Conduct a survey of published literature from various journals of political science/economics by Indian authors. We chose Indian authors because we felt that Indian researchers can bring in perspectives and contexts that a non-Indian researcher cannot do so very easily.

- Look for research done post 2000s as we felt this would capture India’s growth story as well.

- Look for empirical research supported by hard facts and not political jingoism.

- Look for studies that showcase the state as well as central governments and their impacts.

- Summarize the findings and conclude whether coalition governments help or hinder businesses.

Summary

- India’s watershed moment of liberalisation in 1991 was done under a coalition government and the rest, as we say, is history.

- As shown in section 2, India’s economic growth has in fact, been faster under coalition governments contrary to public perception.

Conclusions

Coalition governments have been GOOD AND BAD for India’s economy. One cannot make a sweeping generalization.

1 Background

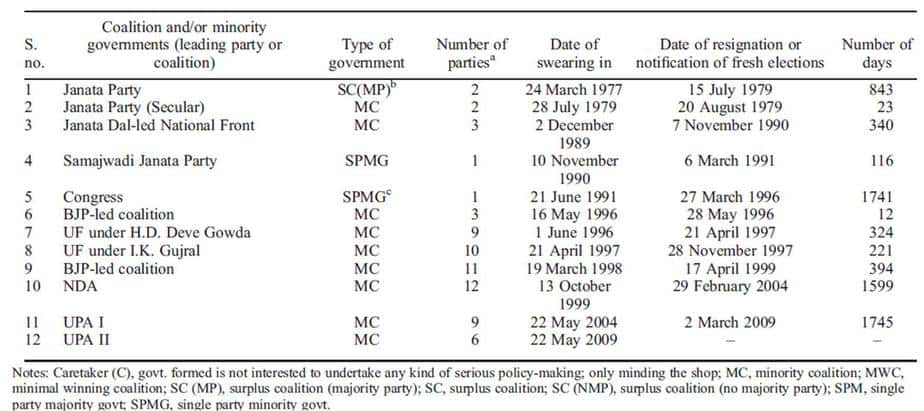

When it comes to coalition governments, India is a glaring anomaly. There is a high prevalence of minority governments and among them, minority coalitions, among non-single party majority governments, as well as the predominance of very large coalitions of 6-12 parties as shown in Fig.1 [1].

The classification of governments is as follows [2]:

- Single Party Government: one party takes all government seats.

- Minimal Winning Coalition: all participating parties are necessary to form the government.

- Surplus Coalition: this comprises those coalition governments which exceed the minimal-winning criterion.

- Single Party Minority Government: the party in government does not possess a majority in Parliament.

- MultMulti-Partyority Government: the parties in government do not possess a majority in Parliament.

- Caretaker Government: the government formed is not intended to undertake any kind of serious policy-making, but is only temporarily minding the shop.

Coalition governments seem to be the order of the day. Seven general elections from 1989 (1989, 1991, 1996, 1998, 1999, 2004 and 2009) have resulted in hung parliaments, with no single party getting more than 206 (or 38%) of Lok Sabha seats in the last five.

All governments since December 1989 have been either single-party minority governments or coalitions, including minority coalitions, with only the Congress government of 1991-96 attaining majority in the second half of its term. Many of the 17 major states with 10 or more Lok Sabha seats each, have been ruled in recent years by parties with a base only in a single state or couple of states, and/or with explicitly regional/ethnic ideology [3].

2 India – By the numbers

Let us look at India’s economic development over the years since independence [4].

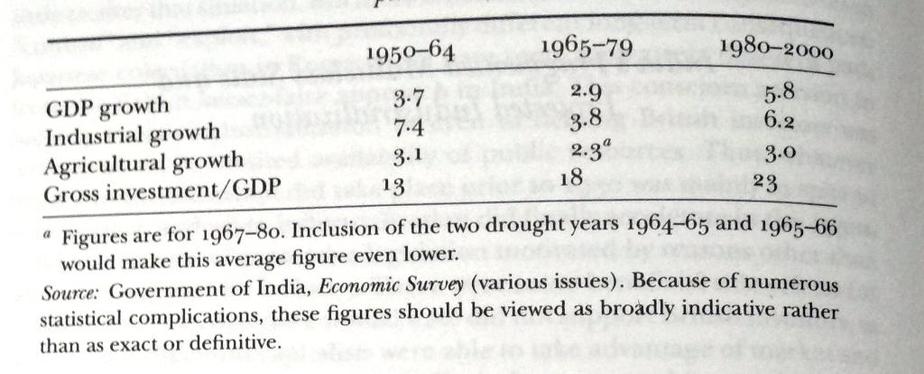

Fig.2 depicts three distinct periods in Indian political history – first period until the death of Nehru in 1964, the second one till the Janata government in 1979 and the third one beginning with Indira Gandhi’s resurgence in 1980 till the 2000s.

From Figs.1 and 2, we see a stunning parallel – Since 1980, 9 out of 12 governments formed were minority coalition governments and India’s GDP growth, industrial growth, agricultural growth and gross investment rates are significantly higher during this period!

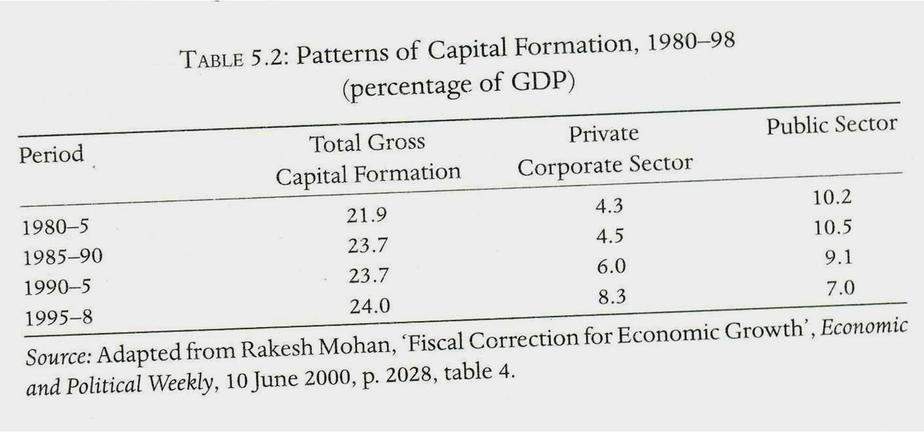

We see a similar trend in capital formation data as shown in Fig.3 [5] with contribution from the private corporate sector increasing vis-a-vis public sector decreasing during coalition governments.

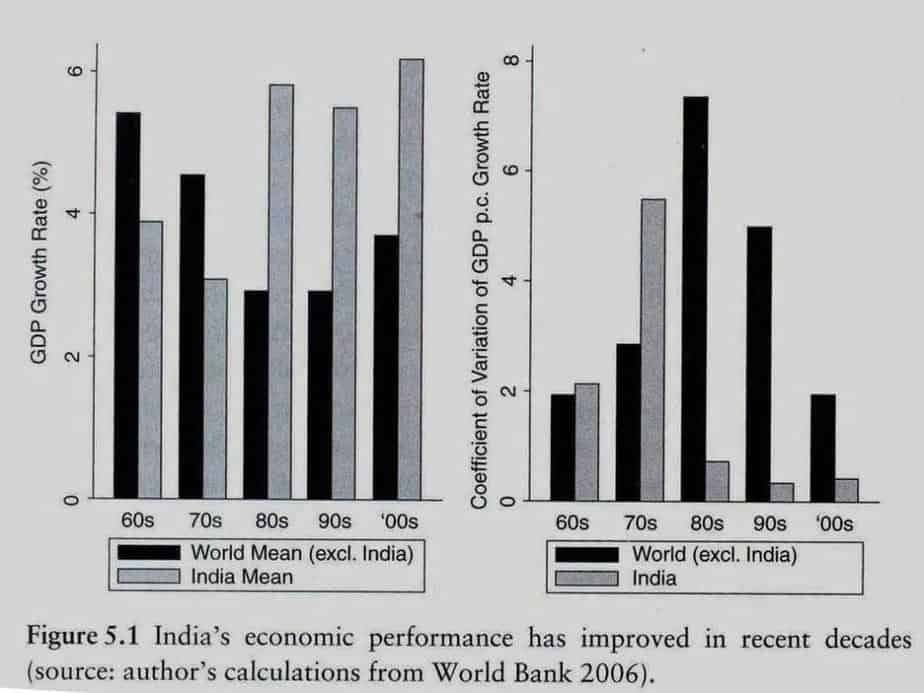

With extensive data-backed research, [6] argues that during the coalition governments, India not only witnessed significant growth but also lower volatility than the rest of the world as shown in Fig.4. [6] also argues that while significant attention is paid to growth rates, very little attention is paid to volatility in growth rates and goes on to show that higher volatility and not slower growth is the real problem for developing economies.

3 Why the contradiction?

Conventional wisdom says that for a nation’s economic development, a strong majority government at the centre is indispensable for effective and long-term policy-making. In fact, [4] postulates that

…creation of effective states within the developing world has generally preceded the emergence of industrializing economies…

[4] strongly argues that there are three forms of states with decreasing effectiveness of industrialization:

- Cohesive-capitalist – Ideal and most effective for rapid economic growth like South Korea under Park Chung Hee.

- Fragmented multi-class – characterized by limping growth like India.

- Neo-patrimonial – characterized by stunted growth like Nigeria as vested interests undermine national development.

However, India presents the following stark contradictions:

- Growth faster than “Hindu rate of growth” – during the periods of minority and coalition national governments, high party fragmentation and electoral volatility.

- Relatively stable economy – under minority coalition governments. Fluctuations in growth rate are very small even when fully exposed to global shocks due to globalization.

Based on the above facts, two questions that loom large in front of us are:

- Whether India’s growth is due to coalition governments? or

- Whether India’s growth is despite the coalition governments?

A quick public opinion poll would reveal that the general consensus overwhelmingly favours option 2. However, quantitative analysis of business surveys and national economic data support option 1 [6].

Let us explore the reasons for the apparent contradiction.

4 Credible constraints

[6] postulates the concept of credible constraints faced by any government undertaking policy decisions. There are two dilemmas faced by business and the government:

- GThe government wants to make pro-investor and pro-growth policies. However, businesses want to avoid drastic and arbitrary policy changes.

- Government wants to convince investors that it is serious about its pro-investor policies. However, without a solid institutional basis (like independent central banks, legislature, judiciary), there are no checks and balances.

So, how can a government bolster its credibility regarding its business policies? [6] suggests 4 ways:

- By Signalling – delegating authority to independent central banks, legislation review by an independent judiciary, entering into loan agreements contingent on successful implementation.

- Via Accountability – institutionalized mechanisms for punishing governments that violate promises like voting the government out in elections.

- Through Gridlock – Policy-making authority dispersed among multiple parties whose preferences diverge. Most commonly encountered when different parties capture control of the executive and legislature.

- Through Forced Compromise – Due to gridlock, policy makers can claim to have their “hands tied” and come to a compromised policy satisfying all coalition members.

In developing economies like India, gridlock and forced compromise are far more practical and found to be more effective. There have been several instances where uncooperative central bankers and “difficult” judges have been removed by the governments. Hence, signalling and accountability mechanisms are good on paper and not viable politically.

What the credible constraints do in a coalition government is the following:

- Policies initiated are more incremental and closer to the ideological centre.

- There is a strong status quo bias making policy reversals harder.

5 What Do Businesses want?

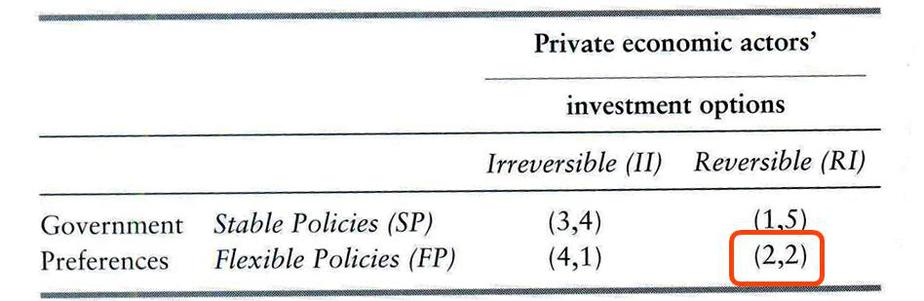

Fig.5 depicts a classic “prisoner’s dilemma” scenario. Governments ideally would like to have flexible policies and at the same time expect private economic actors to do long-term irreversible investments. However, if the private economic actors feel that the government policies are fickle, they would like to minimize their risk by doing reversible short-term investments. While the ideal scenario for the nation would be the pay-off (3,4), governments and private economic actors settle for a suboptimal Nash equilibrium of (2,2).

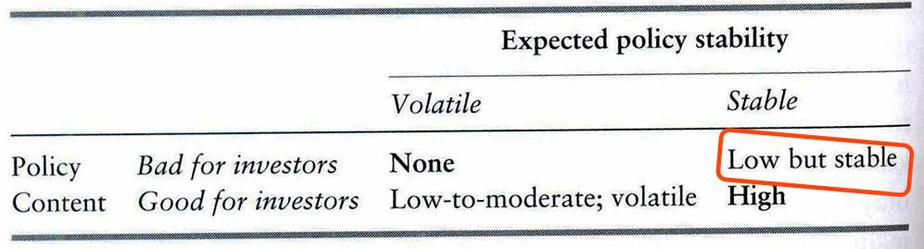

What ends up happening is depicted in Fig.6. The utopian scenario of a stable and pro-investor policy never materializes. However, even if the perceived policy quality is bad, if there are credible signals of stability, investments do happen as businesses are confident that no abrupt or drastic policy changes, reversals are expected.

6 Summary & Conclusions

Thus, coalition governments seemingly suffering from “policy paralysis” actually help business investments and economic growth.

Coalition governments:

- Ensure that policy changes will be incremental and not drastic and arbitrary.

- Policies would be stable as policy-making is based on shared consensus (forced compromise)

Under this environment, businesses:

- that are generally “risk-averse are encouraged to invest more.

- Investments are less likely to “flee” on the first signals of trouble.

Thus achieving slow and steady economic growth.

References

- Sridharan, “Why are multi-party minority governments viable in India? theory and comparison,” Commonwealth & Comparative Politics, vol. 50, no. 3, pp. 314-343, 2012.

- Woldendorp, Jaap, Hans Keman, and Ian Budge. “Party Government in 20 Democracies: An Update (1990-1995).” European Journal of Political Research 33, no. 1 (1998): 125-64. doi:10.1111/1475-6765.00378.

- Sridharan, Coalition Politics in India – Selected Issues at the Centre and the States. Academic Foundation, 2014.

- Kohli, State-directed development: political power and industrialization in the global periphery. Cambridge University Press, 2004.

- Kohli et al., “Democracy and development in India: from socialism to pro-business,” OUP Catalogue, 2010.

- Nooruddin, Coalition politics and economic development: Credibility and the strength of weak governments. Cambridge University Press, 2010

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)