SEBI RIA Ajay Pruthi continues his discussion on the education loan. This is part 1: Education Loan for Higher Studies – Who Pays for the Borrowed Dream?

The convocation ceremony is the peak of the mountain. The black gown is worn. The degree is held high.

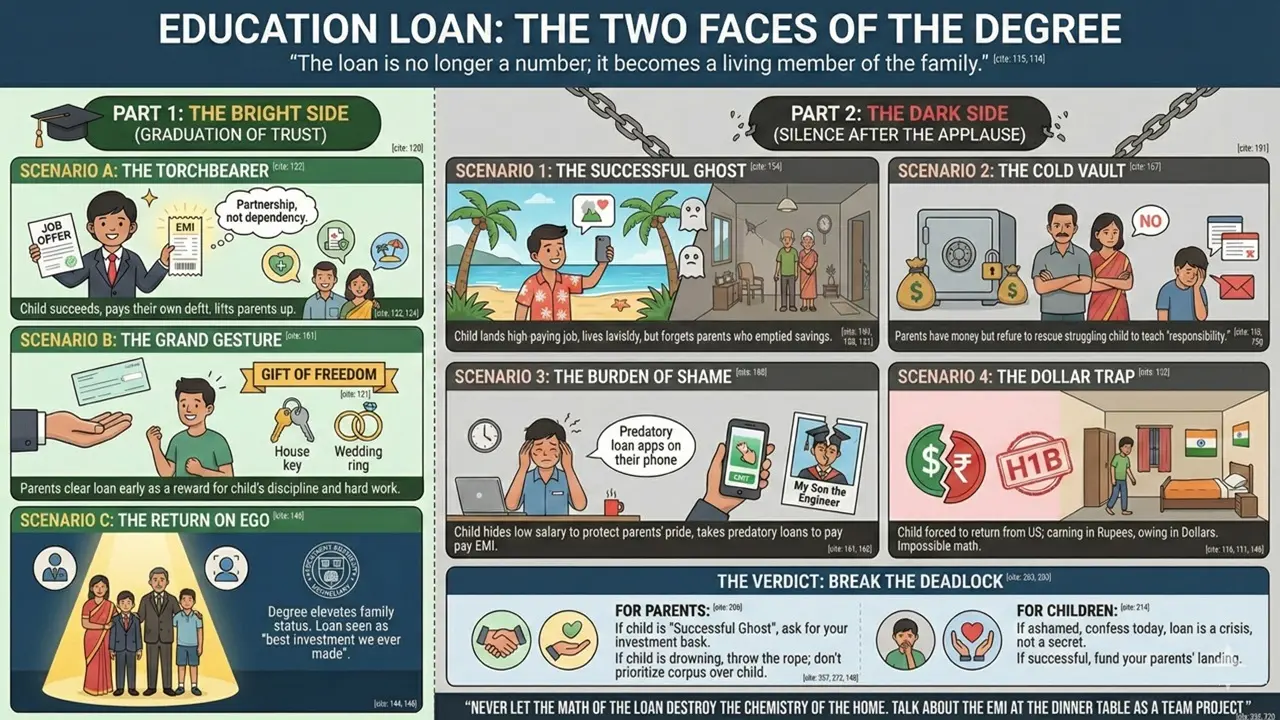

But as the applause fades, the real story begins. The loan is no longer a number on paper; it becomes a living member of the family.

This story can be split into two very different paths: The Bright Side, where the loan becomes a bridge to prosperity, and The Dark Side, where it becomes a wall of silence.

About the author: Ajay Pruthi is a fee-only SEBI-registered investment advisor. He can be contacted via his website plnr.in. Ajay is part of the freefincal list of fee-only advisors and fee-only India.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Part 1: The Bright Side (The Graduation of Trust)

When the gamble pays off, the education loan doesn’t just fund a degree; it funds the transformation of a child into a responsible adult. It shifts the relationship from dependency to partnership.

Scenario A: The Torchbearer (The Cycle of Gratitude)

(The child succeeds, pays their own debt, and lifts the parents up.)

The son or daughter lands the target job. They don’t just pay the EMI; they take pride in it.

- The Psychological Shift: The first time the child pays the EMI from their own salary, a switch flips. They realise the weight of money. They stop asking parents for pocket money.

- The Outcome: The parents breathe a sigh of relief. They see their child handling finances maturely. The loan becomes a badge of honour—a proof that the child is self-made. Often, once the loan is cleared, this child naturally starts contributing to the household, funding the parents’ medical needs or vacations, not out of obligation, but out of gratitude for the initial trust.

Scenario B: The Grand Gesture (The Gift of Freedom)

(Parents clear the loan because the child has proven their worth.

In this beautiful scenario, the child gets a job and starts paying the EMI diligently. They live frugally, skipping parties to make prepayments.

The parents watch this struggle with pride, not pity. They realize, our child is responsible. They have learned the value of hard work.

- The Action: Since the parents have a surplus in their retirement corpus (and the child has proven they aren’t reckless), the parents decide to intervene. They write a cheque to close the loan early.

- The Logic: They tell the child; you have shown us you can carry the burden. Now, we want you to start your life—your marriage or your first home—debt-free. Consider this our graduation gift.

- The Emotion: It isn’t a bailout; it is a reward. It strengthens the bond, as the child enters their 30s with a clean slate and a deep respect for their parents’ generosity.

Scenario C: The Return on Ego (The Validation)

(The degree elevates the family’s social status.)

Sometimes, the loan pays off in social currency. The daughter returns from the US or an IIM with a prestigious designation. The EMI is high, but the salary is higher.

- The Result: The parents, who might have lived a middle-class life, now see their family name associated with global success. The loan is seen as the best investment we ever made. The financial stress of the past few years evaporates when they see their child commanding respect in the world. The Risk has officially turned into a reward.

Part 2: The Dark Side (The Silence After the Applause)

But not every gamble pays off. When the salary doesn’t match the EMI, the Ticket becomes a Chain. The story shifts from pride to panic in four distinct, heartbreaking ways.

Scenario 1: The Successful Ghost (The Ultimate Betrayal)

(The child gets the high-paying job, but the parents are left empty-handed.)

This is the most brutal psychological twist. The son or daughter lands that dream job in Bangalore or London. The salary is high. The lifestyle is upgraded—new cars, vacations, Instagram stories of living the best life.

But back home, the parents are silent. They liquidated their Fixed Deposits and mortgaged their retirement home to fund the margin money or help during the course. They have zero savings left, assuming our child is our pension.

But the money never comes back.

The child pays their own EMI to the bank, but conveniently forgets the informal loan taken from their parents’ old age.

- The Child’s Psychology: They rationalize it. I am paying the bank ₹50,000! I have my own expenses! Parents can manage; they always have.

- The Parents’ Reality: They are too proud to beg their own child for money. They suffer in silence, cutting down on milk and medicine, watching their successful child eat at 5-star hotels online. The pride of the convocation turns into the bitter ash of abandonment.

Scenario 2: The Cold Vault (The Financial Standoff)

(The child fails to get a job. Parents have money, but refuse to rescue.)

The degree didn’t work. The campus placement failed. The child is sitting at home, crushed by rejection emails. The bank is calling the child for the EMI.

The parents have the money. They have a retirement corpus sitting in the bank that could easily clear the debt.

But they say no.

- The Parents’ Psychology (Fear masquerading as Discipline): They are terrified. If we pay this EMI, he will never learn responsibility. He will think we are his ATM. Or worse, we can’t waste our last savings on a sinking ship.

- The Child’s Psychology (The Orphaned Feeling): The child feels like a failed investment, not a son or daughter. They see the money in their parents’ account as a sign of a lack of love. They would rather see the bank harass me than part with their cash. The dinner table becomes a war zone of silence.

Scenario 3: The Burden of Shame (The Silent Suffocation)

(The child is struggling but is too ashamed to ask for help.)

This is the tragedy of the Good Child.

The son didn’t get the high package he promised. He is working a low-wage job or is unemployed. The EMI date is approaching.

He knows his parents would sell their jewellery to save him if he asked.

But he cannot bring himself to ask.

- The Psychology: He remembers the pride in his father’s eyes when he signed the loan papers. He remembers My Son, the Engineer, boasting. He cannot bear to shatter that image.

- The Result: He takes new loans from predatory apps or credit cards to pay the old education loan EMI. He digs a hole of debt so deep that by the time the parents find out, it is often too late. He suffers in isolation, crushed by the weight of expectations he couldn’t meet.

Scenario 4: The Dollar Trap (The H1B Nightmare)

(The Geographical & Currency Shock.)

The loan was taken in Rupees (₹50 Lakhs), but with the calculation that it would be paid back in Dollars ($80,000 salary).

The plan was perfect.

Then, the H1B visa lottery fails. Or a US recession hits.

The child is forced to return to India.

- The Math of Misery: In the US, a $1,000 EMI is just a fraction of the salary. In India, earning ₹60,000 a month, that same EMI (converted to Rupees) is ₹80,000. It is mathematically impossible to pay.

- The Psychological Fall: The Foreign Return tag was supposed to be a badge of honour. Now, it is a badge of failure. The child is back in the same bedroom they left, but now with a debt that is 5x their Indian salary. The parents watch helplessly as the interest compounds, realizing their American Dream has eaten their Indian reality.

The Verdict: What Should You Do?

If you find yourself in one of these scenarios, silence is your enemy. Here is the playbook to break the deadlock.

For the Parents:

- If your child is a Successful Ghost: Drop the hesitation. It is not begging to ask for your own money back. Have a formal sit-down. Show them your bank statement. Say, we invested in you. Now we need you to invest in us.

- If your child is drowning (Scenario 2 & 4): Throw the rope. If you have the money and your child is genuinely trying but failing, pay off the loan. Do not hold onto your corpus while your child destroys their mental health and credit score. Money can be earned again; a broken relationship (or a broken child) cannot be fixed easily.

For the Children:

- If you are Ashamed (Scenario 3): Kill the shame before the interest kills you. Confess to your parents today. A ₹50 Lakh loan is a family crisis, not a secret. Your parents would rather lose their money than lose you to depression or debt traps.

- If you are Successful: Look at your parents’ shoes. Are they old? Look at their house. Does it need repairs? Don’t wait for them to ask. If they funded your flight, you must fund their landing.

The Final Word:

A loan is financial. A family is emotional.

Never let the math of the loan destroy the chemistry of the home. Talk about the EMI at the dinner table—not as a taboo, but as a team project.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)