Last Updated on October 8, 2023 at 1:41 pm

Last week, Pranav Surya and I had announced our new book: Gamechanger. In the second part of his guest post, Pranav explains about what to expect from the book. Pranav is a mechanical engineer with an MBA in hospitality and tourism. He has worked in 4 countries across 3 continents and is currently working in the tourism industry. He is an expert backpacker with extensive travelling experience. I urge you to sign up for Gamechanger book release notifications and some juicy offers using the link mentioned below.

While the following will make sense independently, you can also consider reading part 1 first and then come back here: Announcing my new book – “Gamechanger”

=-=-=-=-=-=

Very much around the time that Facebook popularised ‘Done is better than perfect’, I came across this 20th-century economist, Vilfredo Pareto. He was an Italian engineer, sociologist, economist, philosopher and so much more. Like the modern Indian, he was an engineer first and later moved into management and economics. He taught at Lausanne University and was the one who found that 80% of the wealth was held by 20% of the people. He applied this principle to various fronts which won him accolades that would fill any 3BHK flat in suburban Mumbai. But his most notable theory according to me was:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

- 80% of the results can be obtained through 20% of effort

- 20% of effort brings 80% results and in some cases up to 90 – 95%

In the digital age, Tim Ferriss outcries that 80-20 means:

- For SME sales people the 20% is in making your existing customers – lifelong fans instead of long hours cold call outreach.

- With your work, this will be the 20% time you allocate for output your boss has a tangible measure on – not the time spent on email, trello or slack correspondence.

But with your personal finance, 80-20 means that you:

- Identify your big goals (money-wise) in life

- Understand Compound Interest

- Consistency (done is better than perfect)

In a week, usually, a salaried employee spends 60-70 hours commuting, discussing or at their work. About 50-60 hours are spent at sleep and menial activities. In a total of 168 hours, the waking hours spent for leisure are 58. When you spend about 90% of your salary on purchases and expenses, it means money always goes out faster than it comes in. A rough estimate of a new graduate IT recruit shows that earning is at the rate of 73.4 Re per hour while spending is at the rate of 73 Re per hour. In such a scenario, when the reader gets married and has additions to the family, money will always fall short.

Compare two people trying to make their mark in life:

Krishna, 24, earns 64,000 after tax as a Senior Software Engineer at Cognizant. He used to have 3 lakhs in college debt and 50,000 from credit card debt due to overspending. He has been paying it down over the last 3 years and has 24,000 consolidated debt now. How? He followed the conventional advice: he set-up an excel budget tracker, tried to cut back on dinner expenditure with friends and gave up the little pleasures of life. Yet, last week, when he took a long look at his life, over street-food dinner with some friends, he realized he was treading thin ice. Despite paying off big loans, he had no investments, no real savings and something always came up that made him guilt over his budgeting practice.

Pratik, 23, earns approximately 40,000 after tax as a data analyst at Flipkart. Pratik had joined Flipkart right out of graduation and racked up 60,000 in credit card debt within 6 months. Most days, he’d barely get-by in the high expense Bangalore environment and would eat the free snacks at the office. Yet in hindsight, within 18 months, Pratik settled his debt, bought a new bike for 89k without EMI, invests 10k monthly in mutual funds for his dream home, lavish spends on his girlfriend, saves for his MBA and enjoys 5k as guilt-free money to spend on anything that comes up. To do this, he prioritized what he wanted and was decisive as a fox over expenses that he didn’t feel fancy about. He automated the system of repaying debts, negotiated a lower rate with the Bank and turned automation on its head by allocating clear streams for specific purposes.

The difference between the two people?

Krishna focused on the small, minutiae aspects of his life and appeared breathless as the month drew to a close. He did what the experts told him he should do. Pratik decided he doesn’t need fancy advice or elaborate systems and took a decision to focus on the big goals. He focused on the Big Wins and realized the tiny details fall into place anyway.

If you had to use willpower to cut back on 100 ₹ small diners and networking coffees, versus hunting-down the customer care to re-negotiate a recurring ₹1000 per month subscription, which one would you choose?

Detail-focused people try to focus on everything, rarely prioritizing. Goal-focussed people look at the bigger picture and make small-work of the process.

There are a few Big Wins in Life, where, if you get them done, you almost never have to debate over the minutiae.

Most of us have no fixed ideas on what to do after graduation and it certainly is true when it comes to money. The people I went to school with, upon getting an IT job after graduation, but didn’t have the slightest conviction they were worthy of a job offer, were all suddenly sure of what their future entailed in relation to money. This wasn’t because they read something and synthesized it. This was because they had parents whispering ideas in their minds.

When bad money habits creep-in, they’re tough to get rid. If parents wanted us to believe that buying a house with EMI’s are the right thing to do, we’re going to do so. Once committed to a home purchase, getting out of it is nigh impossible. Half-way through the loan period, we turn back, learn about other avenues of investing and curse bad-luck. If educated baby boomers were this bad, then the minimal attention millennials are doomed.

But the mid-20’s guy, perfect in finance is in-fact a couple of desks away at your work. In-fact more and more engineers have started showing interest at managing their finances. The bright recruit for Flipkart from IIT-M knows more about his money than my mate who works at ICICI and who has an MBA. You know how he changed it around: he kept reading.

As you keep accumulating knowledge, your mind starts forming opinions. Opinions change into ideas. Ideas make characters. Characters make habits. Habits ingrain knowledge into the mainstream. Only then you have discipline in action.

If only the world wasn’t this tough to conquer

The reason that Alibaba conquered the world, because in the early-days they replicated the Zhejiang wholesale market on their website. With competitors being inspired by Google’s clear design approach, many others tried the clear homepage option on their e-commerce site. This didn’t resonate with the Chinese consumers who were used to seeing things muddled up on one-another in the physical-market. Slowly, the competitors faded into oblivion and Alibaba’s tremendous work-ethic paid off. They fended big competition from eBay and Yahoo and weathered several storms along the way.

From the consumer’s point of view, what made Alibaba attractive is that they understood what consumers wanted and acted accordingly. Keeping in mind the traditions and their playful nature, Alibaba made shopping a fun experience. The website was set-up like a game that people would return often, instead of a plaid business-centric approach. This formula has tasted success till-date in the Chinese market. When WeChat introduced the red-envelope system where people gifted small pockets of money (usually 0.15 yuan) as a well-wishing token to their friends and family, it took the market by storm. Soon, Alipay cloned the idea and the interest from the Chinese population was palpable. Consumer usage of the red envelope rose 550% YOY and the amount of Yuan enclosed increased 6000% over festival days.

While being functional at it’s core, a customer-centric approach (fun modelled) paid rich dividends in grabbing customer loyalty for both companies.

With a similar outlook, I approached Prof. Pattu in writing a book that was functional in it’s personal finance advice and fun in terms of showing the ways to enjoy life.

The book Gamechanger will be functional when analyzing personal-finance. It illustrates how to do everything with a step by step process like how Google Maps takes you to your destination. Instead of saying ‘choose the best bank to park your money for short term’, Gamechanger identifies which option is the best and points to the specific URL for the reader. With an emphasis on why you need to be smart with money, closely followed by how to set-up the cash-flow and automate the process, you’ll have a ball reading the conversational tone throughout. Pattu over-delivers on simplifying the investment process and gives you simple action steps that is sure to bound you to guilt if you don’t take action.

The fun portions that will make you loyal fans will include insider knowledge on:

- The cheapest ways to travel

- How to find Cheap Flights

- How to find cheap accommodations during vacations

- How to fund your vacations even if you can’t save a single penny right now

- How to properly utilize credit cards

- When Credit cards can be a secret sauce to paying less on your home loans

- How to get the most out of them in-terms of cashbacks, rewards and miles

Functional. Fun. Customer Centric. To the point. Insider Knowledge. 80-20. Compound Interest. Cheap Flights. Cool accommodations. Cashflow. Early retirement. Automation. Big wins. Equity. Real Estate. Mutual Funds. Narrative. Racy. Action steps. God-damn truth.

Now, that’s one hell of a promise to keep and a roller-coaster of a book to write!

After reading the book, I’m not sure if my mate (mentioned in part 1) will still buy the iPhone but he’s definitely going to make a decision and forgo the guilt. KUDOS!

For those already looking forward to reading the book, use the link below to be updated with the release.

Fun-tastic: The first few beta readers who sign-up to give their feedback will be mentioned in the book.

Click to Sign up for Updates on the Gamechanger

=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

New Delhi DIY Investor Workshop April 23rd 2017

Register for the New Delhi DIY Investor Workshop April 23rd 2017

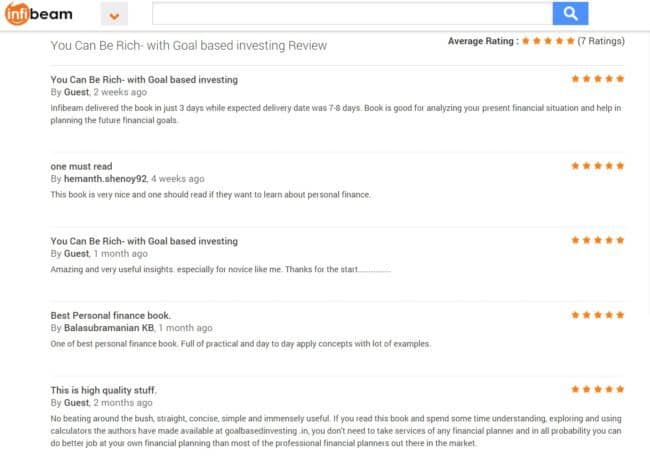

You Can Be Rich Too With Goal-Based Investing

is a book that I have co-authored with PV Subramanyam. if you have not yet got the book, check out the reviews below and use the links to buy.

Reader Quotes:

Gift it to your Friends and Relatives whom you care more. Already follower of Pattu and Subra’s forum. Ordered 4 more copies to give gift to my friends and eagerly waiting to read

The best book ever on Financial Freedom Planning. Go get it now!

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 317. 21% OFF

Kindle at Amazon.in (Rs. 307)

Google Play Store (Rs. 307)

Infibeam Now just Rs. 307 24% OFF.

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Bookadda Rs. 344. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)