Last Updated on October 1, 2023 at 5:40 pm

Here is a step by step guide to e-file income tax return (ITR4) for AY 2020-21. Please consider forwarding this to a person who is going to file returns for this first time. You can also consult Guide to e-file Income Tax Return: ITR2, ITR3 and ITR5

About the author: Anjesh Bharatiya is a 30+ taxman by profession and a Chemical Engineer by education. He has been an investor in the stock market since age 15! He likes to write about personal finance, stock markets, government policies, taxation, philosophy and football. Also, by Anjesh: (1) Want to trade in stocks? Here is how your income will be taxed. (2) How to use Tax benefits on HRA and home loans (3) How to get tax benefits under a Hindu Undivided Family (HUF). (4) Payment of difference bet compound interest & simple interest in loan accounts: Will you benefit?

How to file ITR using efiling website:

- Go to this site: https://incometaxindiaefiling.gov.in/

- Click on Register on the top-right, to create a log in. A page will appear asking for details.

- This blog targets common people and not any other user type listed. Out of the two options in the first line of the “User Type” page, select individual, unless you know that you are HUF.

- Follow the steps. Be sure to enter the correct First name, middle name and Surname as per PAN database. Otherwise check it in this link, using your PAN. https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html

- Enter all the necessary details correctly, your registration will be successful. PAN no will be your user ID

- Know which ITR you are supposed to file: Use this article to find out Which ITR Form Should I use for A.Y. 2020-21?

a)If you have an income from just salary, one house property and bank deposits (Savings, FD, RD, Flexi RD), it is ITR1 (total income up to 50 L).

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

b)If you have income specified in a) and income from selling Real Estate, Stocks, Mutual fund units, derivatives, gold etc, or you have withdrawn EPF/PPF, it is ITR2 (individual or HUF with no business income)

- c) If in addition to the above, you (or HUF) have income from a business or proprietorship, ITR3

- d) For people having a presumptive business it is ITR4 (no capital gains allowed). This form is for Individuals, HUFs and Firms having income up to Rs 50 lakh and having business income from Business or profession which is computed under the presumptive taxation schemes (sections 44AD, 44ADA or 44AE). Income from Salary, one house property and bank deposits can also be filled in ITR 4.

Presumptive taxation schemes

The presumptive taxation is available under the following three sections:

- Section 44AD: Any taxpayer who has a business with a turnover of less than Rs 2 crore can opt for this scheme. The profits are calculated at a fixed rate of 8% for cash receipts or 6% for digital/cheque receipts. Life insurance agents and commission agents can’t use this scheme. All eligible businesses are available in the drop-down menu in Schedule BP of the return as we will see later. If your business has lower profits than the 6%/8% rate prescribed, you’ll have to maintain books of accounts, get them audited by a CA, file the audit report and use ITR3.

- Section 44ADA: This section is for taxpayers offering professional services like doctors, CAs, lawyers etc. having gross receipts upto Rs 50 lakh. Freelancers can also use this section. Here, profits are taken at a flat rate of 50% of gross receipts. The details of the eligible professionals are provided in Section 44AA of the Income Tax Act. As with Section 44AD, the list of eligible businesses is available in the drop-down menu in Schedule BP of the return form. As seen above, this section cannot be availed if you want to claim a lower profit than 50%. You’ll have to maintain books of accounts, get them audited by a CA, file the audit report and use ITR3 in that case.

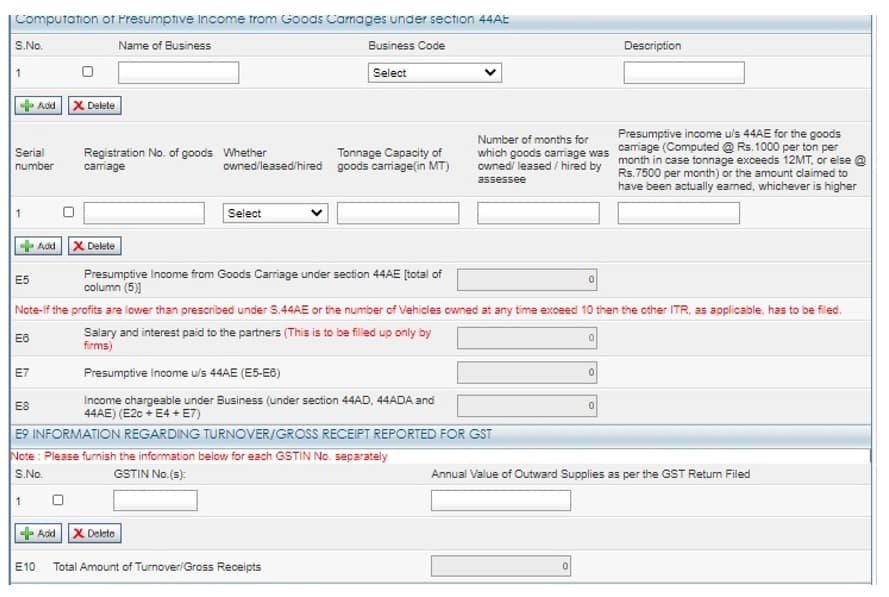

- Section 44AE: This section is applicable to small transporters having upto 10 goods carriages and engaged in the business of plying, hiring or leasing such goods carriages. The profits will be calculated at Rs 1000/- per ton of gross vehicle weight or unladen weight per month per vehicle for heavy goods vehicle. For all other types of goods vehicles, the profits will be Rs 7500/- per month per vehicle. An additional benefit in this section is that in case of firms, salary and interest paid to partners can be deducted from the income. The limits on salary and interest will be as per Section 40 Clause (b) of the Income Tax Act. For showing lower income, you will have to use ITR3 and there are also accounts maintenance and audit requirements.

- e) For all others, it is ITR5 (other than an individual)

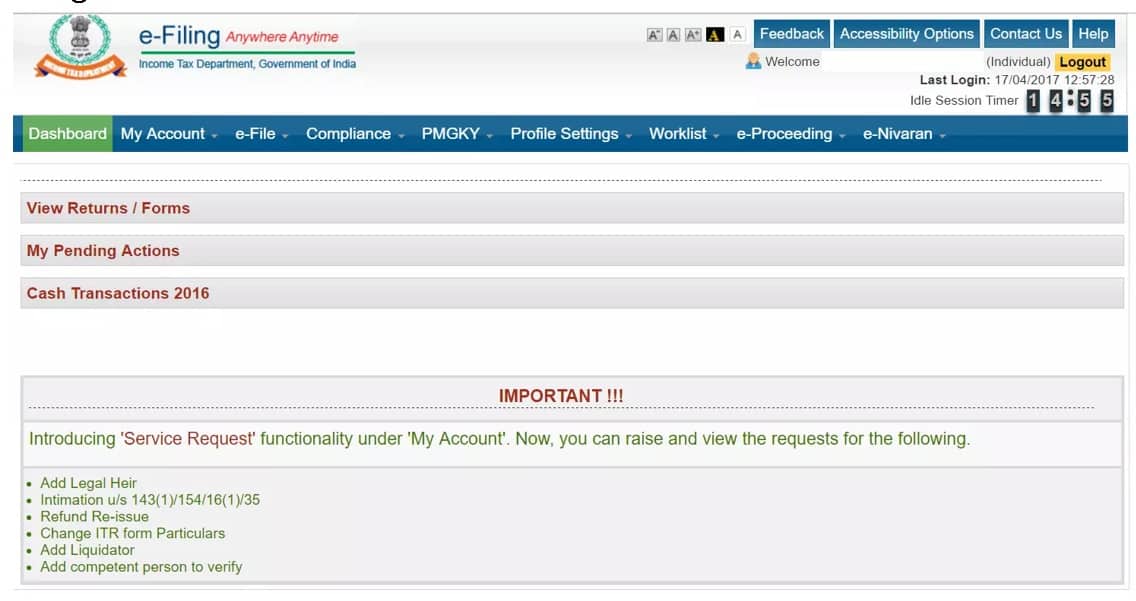

Login using the PAN number and password created above. You will see this image

First click on “View Form 26AS” under “my account”. This will take you to the TDS-CPC website to find out your tax credit by your employers and banks.

If your return type is ITR1 or ITR4, then you can submit the return online. For others, you will have to use the java utility and upload the XML file.

If your return type is other than those mentioned above, get them from here https://www.incometaxindiaefiling.gov.in/downloads/incomeTaxReturnUtilities. Note that you can see both excel and java utilities for ITR1, ITR2,ITR3 and ITR4, If you have java runtime Environment Version 8 installed, or you are willing to install, it is advisable to use java utility. The reason is it is neater and easier to use with a Graphical User Interface (GUI) than excel utility. You will get a zip file. Java can run in linux as well. Windows batch file and linux script files are provided for running. Now that you have all the tools ready, here is how you go about filling the form.

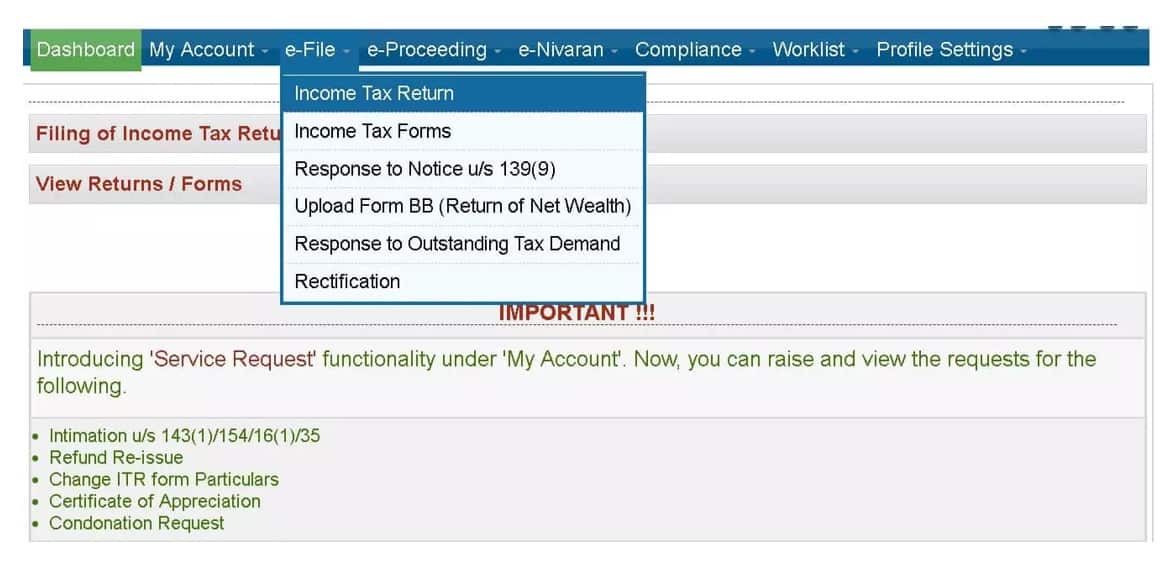

Choose e-file —> ITR

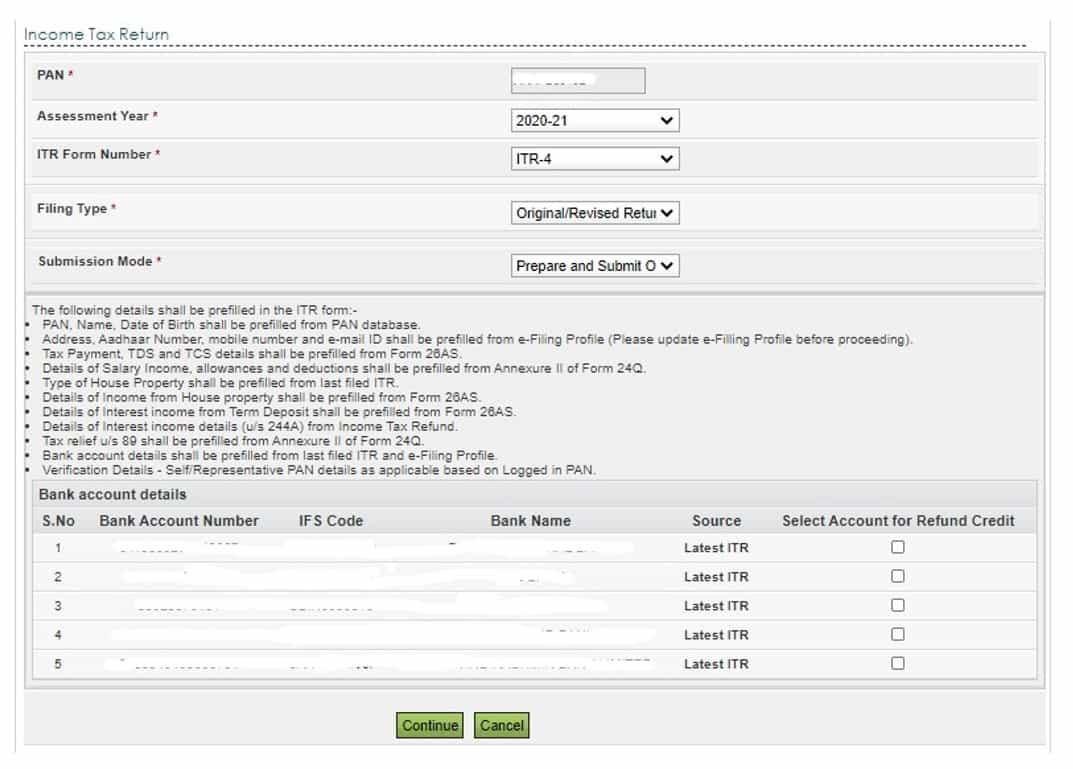

Select the form named as ITR4 and Assessment year as 2020-21 (that is the financial year 2019-20), this is where newbies get confused first. You will get this screen. This screen shows the details that will be prefilled in the return form and prompt you to select on or more bank accounts for refund credit.

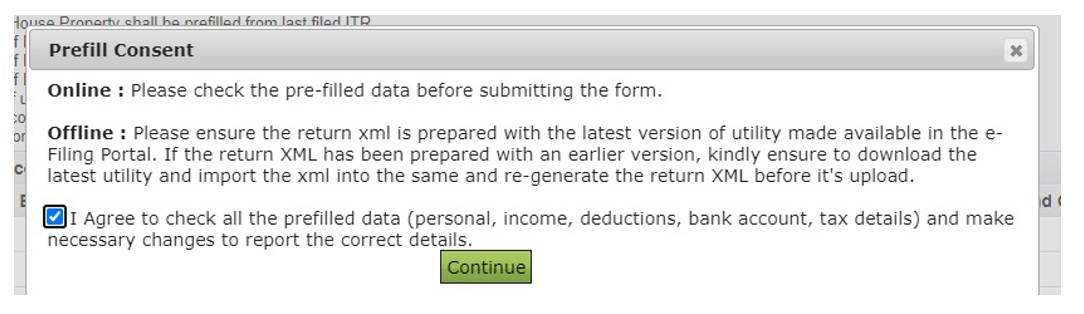

The next screen asks your consent for prefilling the data:

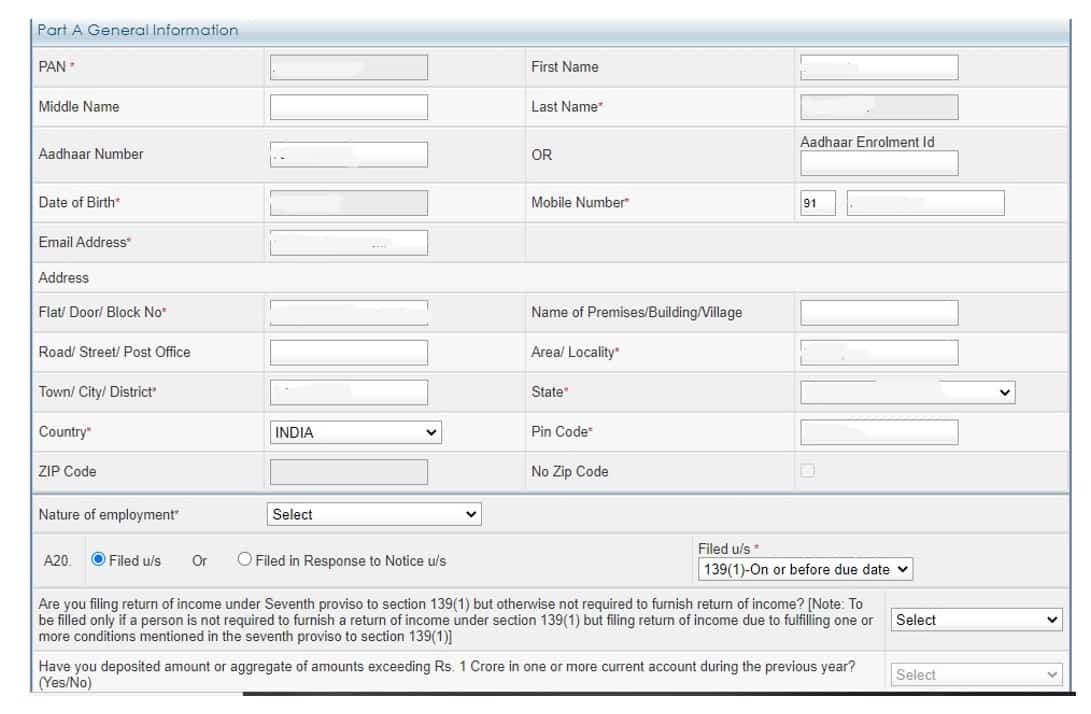

Next a web interface appears which will have tabs equal to the number of sheets in ITR4 excel sheet utility or number of tabs in java utility. There is a one-one correspondence between all these 3 options. With the quick e-file option, you are doing now, most of the personal information, and tax details would have got filled automatically. Note that you can fill only white cells and not grey cells. Keep saving the work often.

Check the personal information tab that will be pre-filled.

Filing Status: Entries here are fairly easy to fill. In A20, choose section 139(1) if you are filing before November 30 or section 139(4) if you are filing afterwards. Section 139(5) is to be filled if you are revising your return.

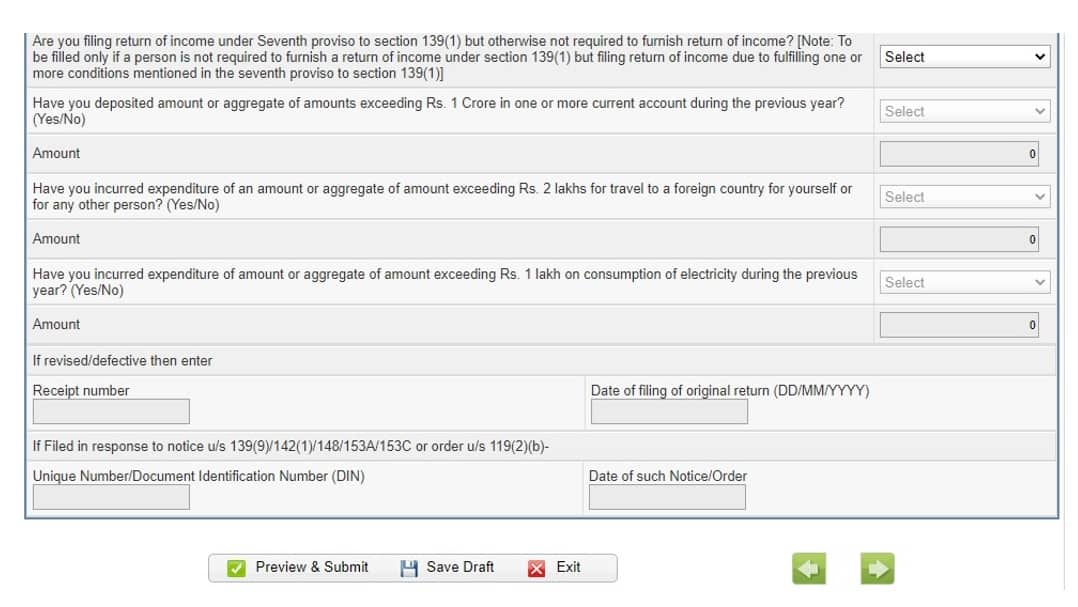

In the section where the form asks if you are filing your return under Seventh proviso to Section 139(1), you have to select ‘Yes’ if you are falling within one of the parameters below but otherwise, were not required to file your return (i.e. you did not have taxable income):

(a) deposited more than Rs. 1 crore in one or more current account maintained with a bank or a co-operative bank;

(b) incurred more than Rs. 2 lakh for himself or any other person for travel to a foreign country; or

(c) incurred more than Rs. 1 lakh towards payment of electricity bill.

Remember that if you have taxable income and fulfil one or more of the three criteria above, you have to select ‘No’ above. However, the details of the above-specified transactions have to be filled if you have made them.

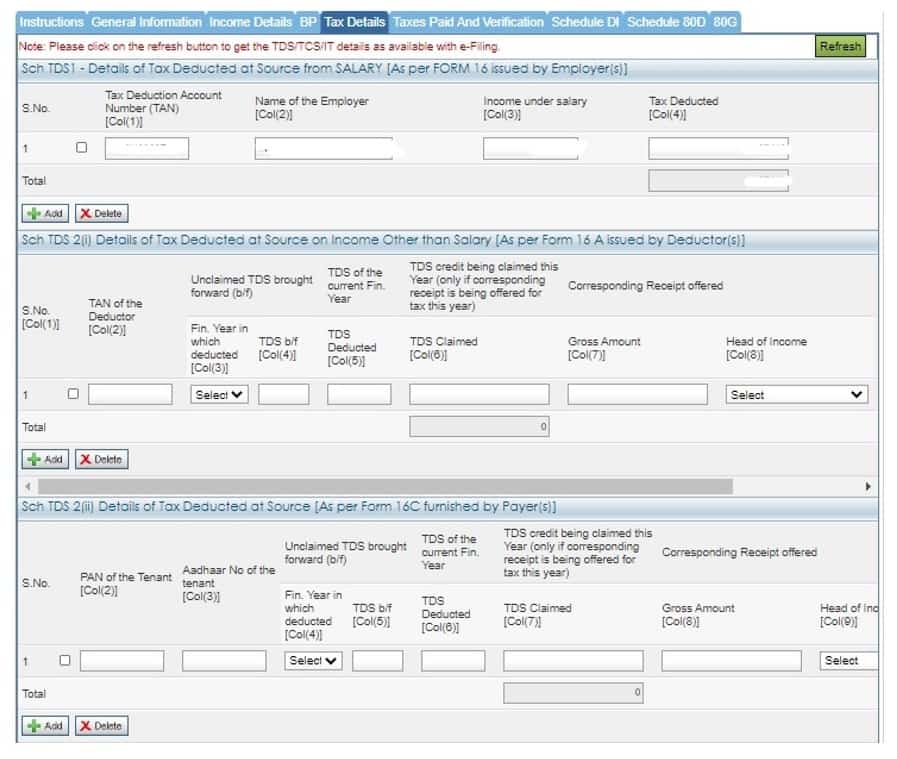

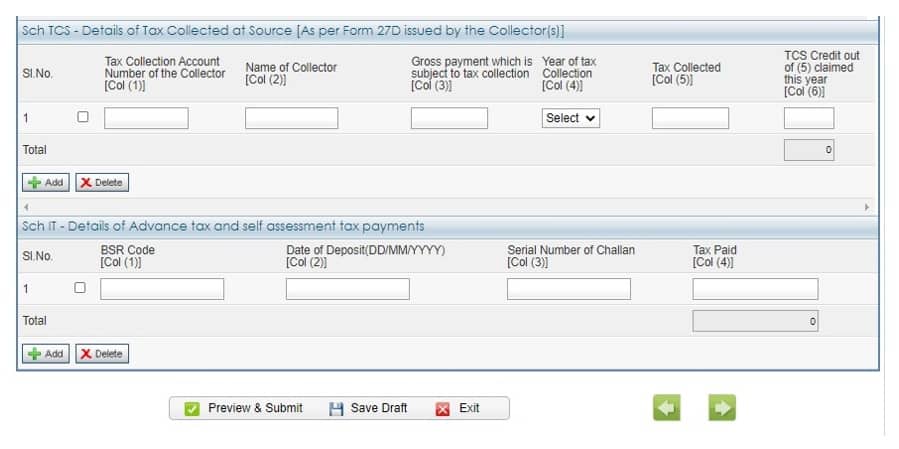

Now move to the Tax Details tab. Your TDS information as in Form 16 provided by the employer and TDS information if any tax got deducted by the bank where you hold FDs should be there already. If not, it is time to contact the bank and check why they have not deposited the tax. The details of any advance tax (deposited by you before 31st March) and self-assessment tax (deposited by you after 31st March) will also appear here.

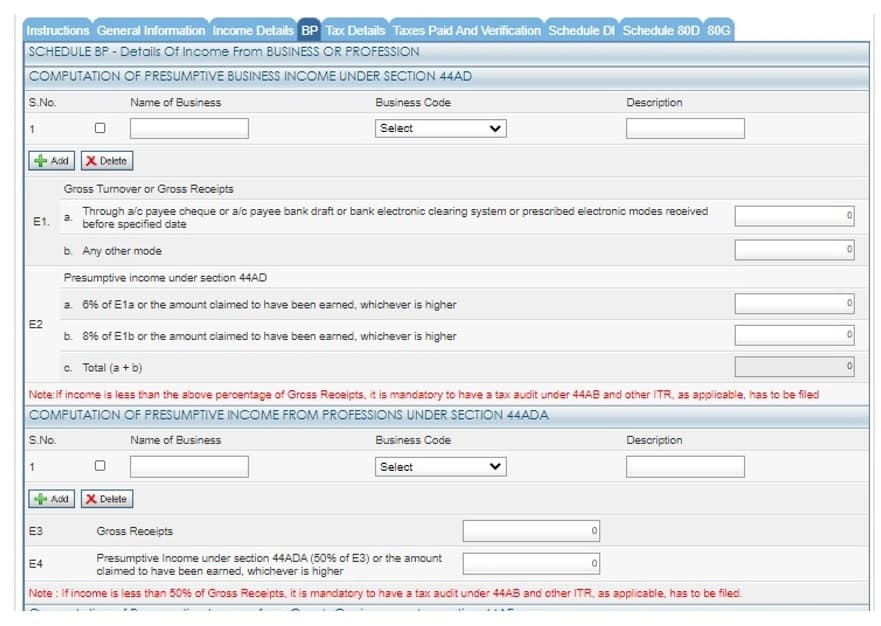

Go to BP tab. Most of the columns are self-explanatory. Use the 44AD, 44ADA or 44AE section as applicable. Select the nature of business in the Business Code carefully.

If you have taken a GST number, fill it in E9 and also provide the details of outward supplies (gross receipts) as per the GST return. If you are outside the purview of GST law, you can skip this section. Businessmen opting for GST composition scheme are also required to fill this section.

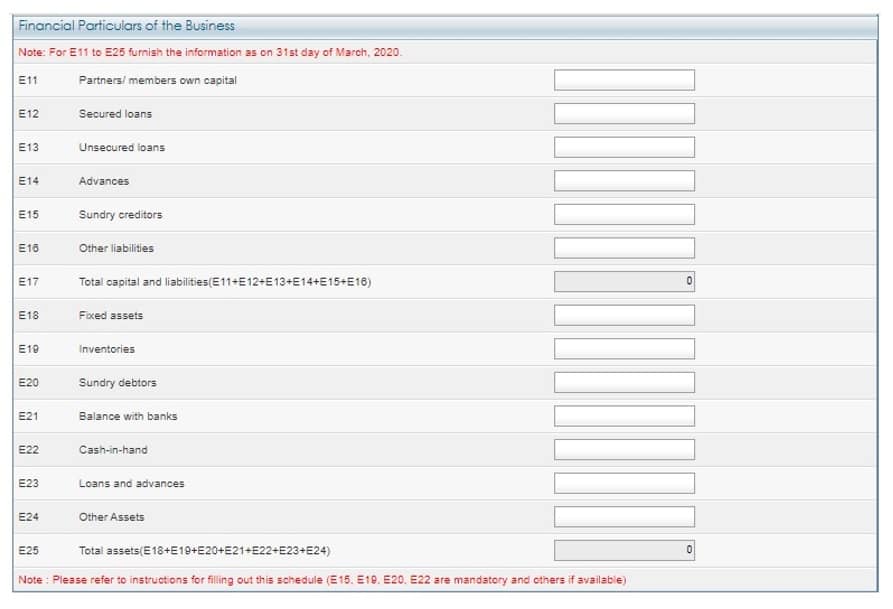

In the next section, you are required to fill in the financial particulars of the business. You can fill in zero in fields which are not applicable to you. For example, a professional can enter zero in the field ‘Inventories’. The fields can be filled to the best of your knowledge and are just for reporting purposes. However, details of loans and bank balance should be accurate. If you have maintained proper accounts and prepared a balance sheet for bank loan purposes, you can fill these fields easily.

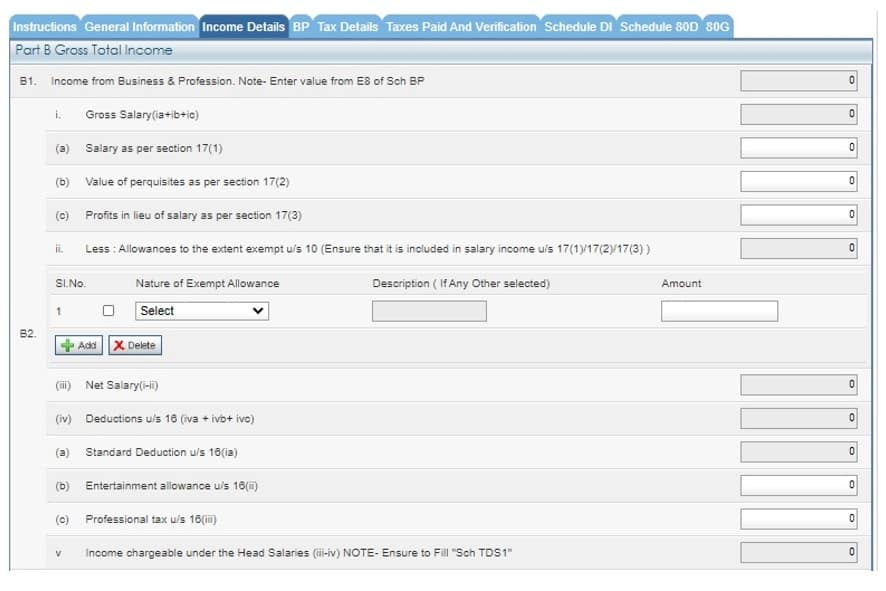

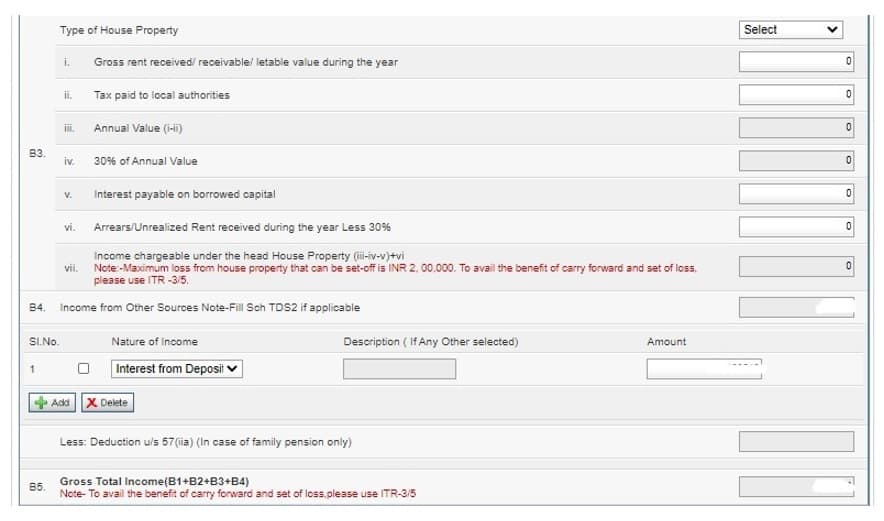

Now, go to the Income Details tab. Fill income under salary (if applicable) as per the Form 16. The business income will be auto-populated in B1 column from Schedule BP.

Select house property if you have. Note that if it is self-occupied, you cannot claim HRA under section 10. If it is let out, declare the rent income in the next row.

Enter the income from other sources. This should include accrued income under Savings bank account, FD and RDs across all banks. Accrued means not necessarily credited, in case of FD and RDs.

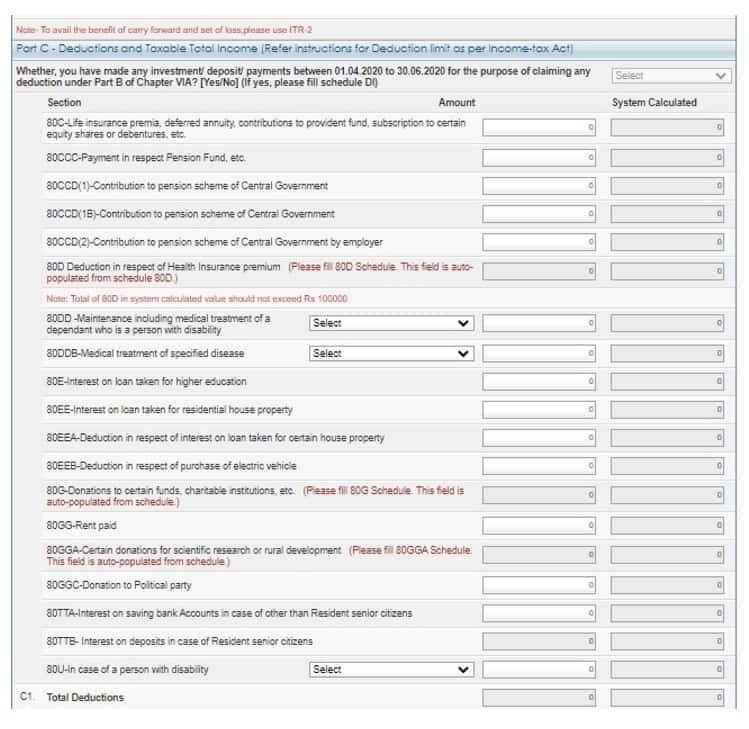

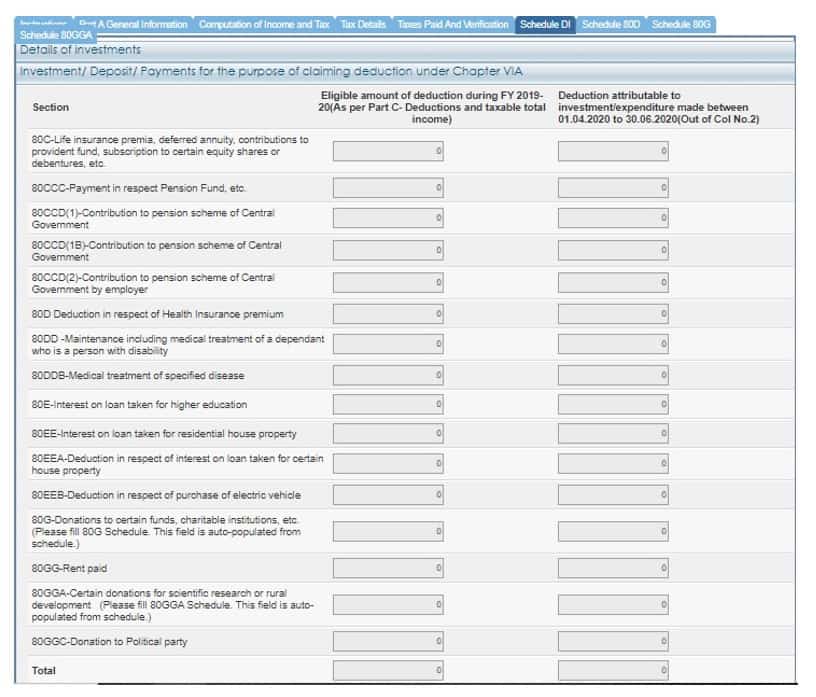

Start filling deductions under Part C. You can claim exemption up to 1,50,000 under 80C. Note that any investment made under 80C from April 1 to June 30 for AY 2020-21 is also to be filled here as well as a separate Schedule DI that has been provided for the same. Claim exemption up to Rs 10,000 on the savings bank portion of B4, under section 80TTA.

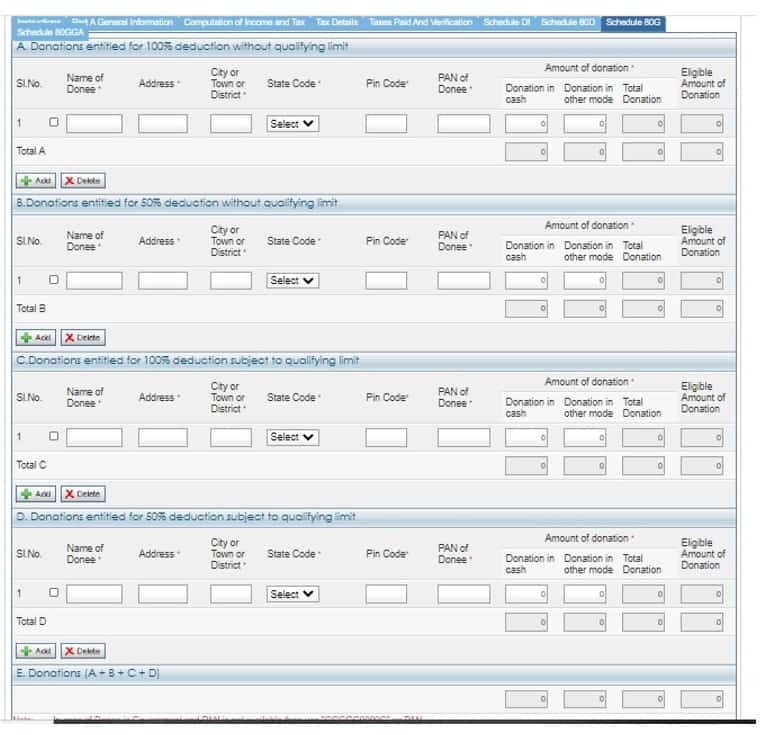

If you have made any donations that are qualified for income tax exemptions, go to the last tab 80G and enter the details. You can do this, only if you have received a certificate with the details of the donee.

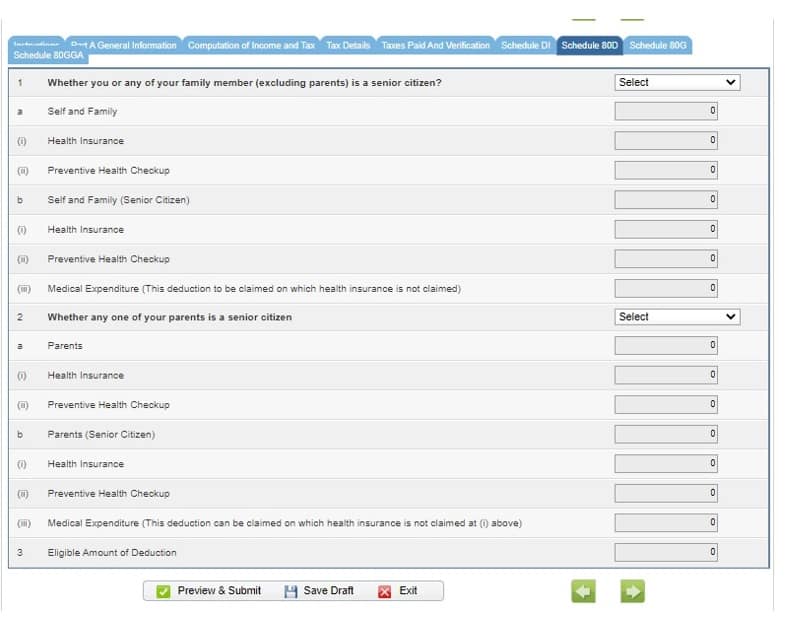

Claim health insurance premium under 80D under the separate 80D tab

Self+spouse+children (all < 60Y of age) 25000 + parents: 25000 (<60Y of age)

Self+spouse+children (all < 60Y of age) 25000 + parents: 50000 (>60Y of age)

Self+spouse+children (one or more > 60Y of age) 50000 + parents: 50000 (>60Y of age)

For senior citizens above the age of 60 years (including super senior citizens aged above 80) with no health insurance, the deduction is allowed for Rs 50,000/- towards medical expenditure.

Investment made under 80C, 80D,80G etc. during 01.04.2020 to 30.06.2020 is to be filled in the Schedule DI tab. Please note that even though the time limit for making the investments has been extended, the total eligible amount remains the same.

Come back to the Income Details tab.

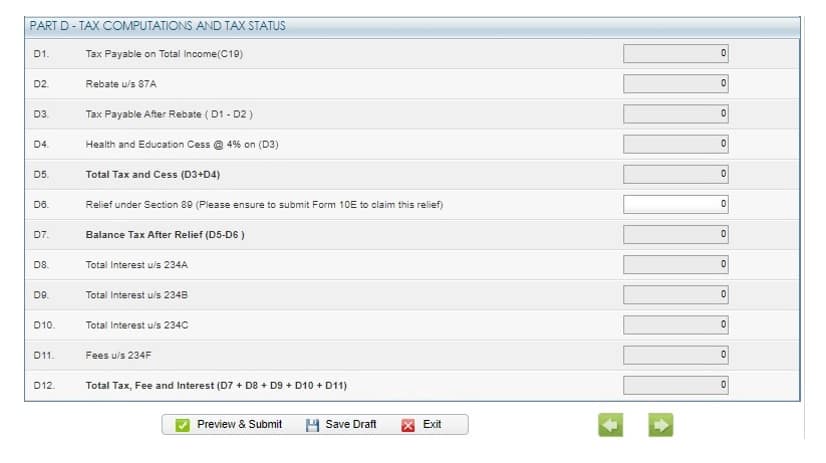

- Have a look at D1…D11 See if D6 is applicable to you. Try to understand all of them.

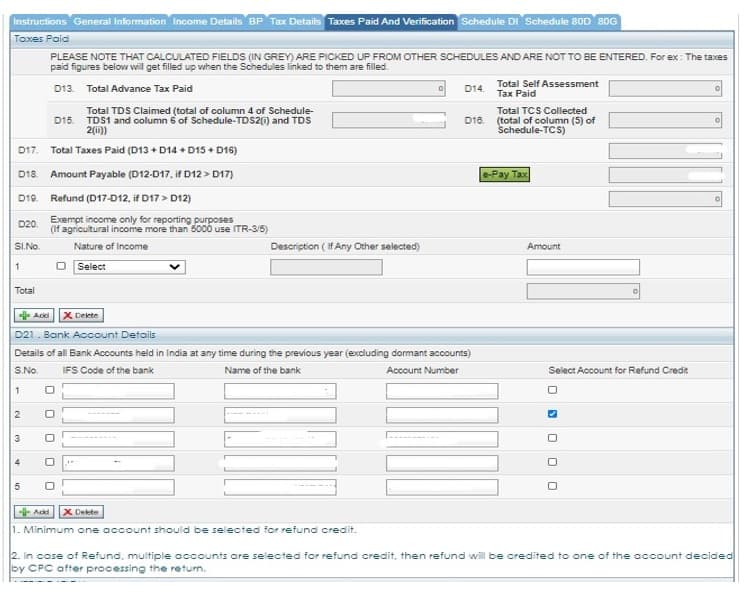

- Go to Taxes paid and Verification tab.

- If D18 is a positive number, you need to pay “Self assessment tax”(SAT). Do this by clicking on “E-Pay Tax” on the left. One way to avoid this would have been by paying “Advance Tax” before March 31st. No interest needs to be paid in that case.

- After Paying SAT, my guess is, it would appear automatically under Tax paid tab, if not, manually fill it

- Report any small exempted income (less than or equal to Rs. 5000) in the Exempt Income section, for example, agriculture income or dividend received.

- Details of your bank accounts will be visible in D21. The account(s) selected for credit of refund will be ticked. You can add any other account you have here.

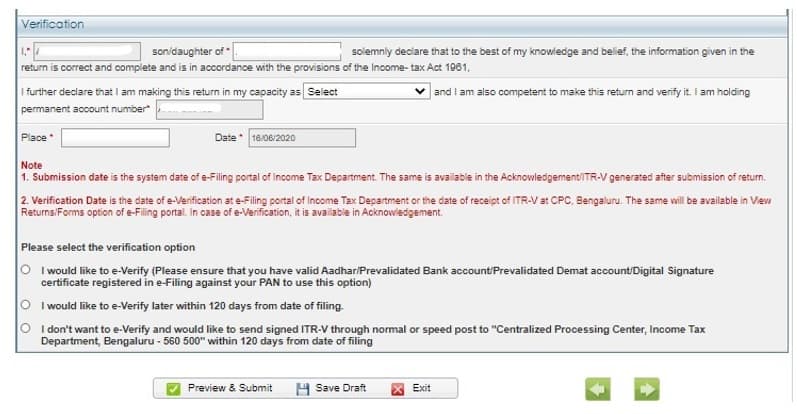

Fill in the Verification details. You can opt for Aadhaar OTP or pre-validated bank account/demat account/digital signature-based e-verification. Aadhaar would be better.

- Check once again all the tabs and press submit.

You can e-verify the return by obtaining the OTP from the mobile no registered with Aadhaar.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)