Last Updated on December 25, 2020 at 7:22 pm

Here is a step by step guide on how to use a stock screener and identify financially sound and good businesses. This is a guest post by Indraneal Balasubramanian, a passionate equity enthusiast who blogs at cognicrafting. Indraneal needs no introduction to Facebook group Asan Ideas for Wealth regulars. The following can be thought as a sequel to Krishna Kishore’s guest post explaining the features of screener.in and as a guide to the Freefincal Excel Stock Screener

~~~~~~~~~~~~~~~~~

Information is a double-edged sword when it comes to investing in stocks. Investors are constantly bombarded with information about stock prices, macroeconomic data, news, which in turn could lead to suboptimal decision-making because people are more worried about the scoreboard than the field of play, which is the characteristics and performance of the business.

However, on the flipside, the internet and technology have also made it a lot easier to screen stocks and get historical as well as current information on the businesses they represent. Since when you buy the stock of a company, you are in fact buying a claim on current and all future earnings of the business, so long as you hold the shares of that company.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

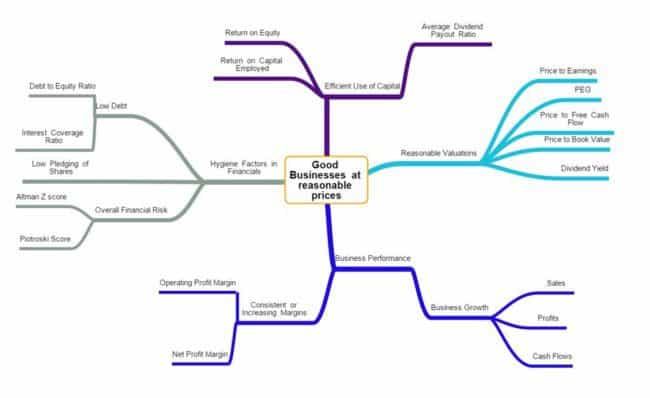

In order to construct a stock screen, the first step would be to think about what some basic characteristics of a financially sound, good business are. I created a mind map to help me think about this (click to enlarge).

How to use a Stock Screener: Overview

This is not a comprehensive list by any means, but I think it is a decent place to start. I’ve categorized what I want to look for into 4 basic categories – Hygiene factors in Financials, Business Performance, Efficient use of capital and Reasonable valuation.

How to use a Stock Screener: Hygiene Factors

Charlie Munger has often said, “Tell me where I’m going to die, that is, so I don’t go there”. Hygiene factors are aspects of the financials that are red flags and should be used to weed out potential sources of trouble.

Low Debt: Companies get into trouble when they take on leverage due to high interest expenses which have to be paid out before the bottom line. In crunch times, debt holders will still expect to be paid which means less money flows to the bottom line.

- Debt to Equity Ratio: It indicates the capital structure of the company and is typically calculated using – Total Liabilities / Shareholder Equity. Less than 1 is ideal, though I like to take a value lower than 0.5 for safety’s sake.

- Interest Coverage Ratio: Indicates the ability of the company to service its interest commitments on debt. Calculated as EBIT / Interest Expenses, and the higher the better. Look for minimum of 5-10.

Low Shareholder Pledging: Promoters can pledge their shareholding as collateral in order to secure financing. Typically a cover in terms of the share value to loan value is maintained, with a clause that if the value falls below a threshold, the promoter will have to pledge more shares to maintain the minimum cover. If the promoters are unable to unable to do so or fail to service the debt, they will need to sell pledged shares to pay off the debt. This could leave to severe corrections in the share price and hurt minority shareholders.

Overall Financial Risk

Altman Z score: It is a sort of credit strength test to measure the likelihood of bankruptcy. Look for a value above 3.

Piotroski score: A 9 point score based on 9 fundamental components. Use low scores to weed out companies. I typically look for a score of atleast 4 or better

1 Efficient use of Capital

The company’s management are not only there to operate the business, but are capital stewards who are supposed to use capital judiciously to enhance value. There are a lot of ways to check this, but these are the most common. Emphasis on rising or at least consistent values over 5 to 10 year periods.

- Return on Equity = Net Income / Average Shareholder Equity

In order to really understand the components of Return on Equity calculation, you should look at the DuPont model. I wrote about this in a Quora answer a while back

- Return on Capital Employed = EBIT / Total Capital Employed.

This is a way to determine how effectively the firm is using its capital to create value. There is some ambiguity about this because the definition of capital employed and hence the denominator may vary in certain calculations. Screener.in defines Capital Employed as Fixed Assets + Working Capital, which I think is a fair way to go about it. Total Assets – Current Liabilities is also used.

- Dividend Payout Ratio = Dividend per share / Earnings per share.

All things considered, I like firms paying dividends. Not only is the presence of a consistent dividend an indication that profits are real and not merely accounting gimmickry, but also a sign that the management is willing to payout cash that cannot be effectively used to grow the business rather than hoard it or use it in a less than efficient manner. I consider a minimum of 15%.

2 Business Performance

As far as businesses go, boring is better for investors. Warren Buffet’s wit is on offer in his 2001 Berkshire Hathway Shareholder letter as he quips – “I will tell you now that we have embraced the 21st century by entering such cutting-edge industries as brick, carpet, insulation and paint. Try to control your excitement”

Stable businesses in industries that don’t change a lot are less vulnerable to newcomers challenging their position or a shift in the inherent nature of the business. For example, I don’t know what a technology company might look like 10 or 20 years from now, but I can feel fairly sure the odds of a biscuit or toothpaste company not changing much are pretty good.

- Margins: If margins are coming under pressure, it could indicate either higher input costs, increased competitiveness, while high, stable or rising margins relative to industry players could indicate competitive advantage.

- Sales, Profits and Cashflows. Again, look for consistency and trends emerging over 3, 5 and 10 year periods.

Valuations

The form of valuation that I covered in the mind map is known as relative valuation, because it makes business parameters comparable through a form of standardization. There are dozens of ratios, but some of the commonly used ones are –

- Price to Earnings: Typically, this is calculated as the Current Market Price / Trailing Twelve Month Earnings per Share (Add up last 4 quarterly EPS). It is often an expression of investor sentiment, as it reflects how much an investor is willing to pay for each rupee of earnings. Stable, well known businesses will command higher multiples as the market feels they are more predictable, which is why you will often see FMCG companies trading at higher P/E multiples to the rest.

A company with a high P/E is not necessarily expensive, contrary to common belief. Professor Sanjay Bakshi explained this beautifully in this article.

Warning: Cyclical stocks can look cheap on a P/E basis after a few growth years. Do not be fooled!

- PEG Ratio: First used by Peter Lynch, this is P/E Ratio divided by Annual EPS growth. Most screeners will use EPS growth last year, but I recommend calculating EPS growth over 5 and 10 year periods to determine whether the business is undervalued relative to its long term earnings growth.

- Price to Free Cash flow. Arguably a better metric than P/E, because all things being equal, a firm with higher Free Cash Flows (Operating Cash flow – Capital Expenditure) is superior.

- Price to Book Value: Current Market Price / Book value per Share

This is typically used to value banks and capital intensive industries. I would check the value relative to the industry to determine potential overvaluation and undervaluation. Firms that employ lower amounts of fixed assets like consumer companies and software companies will typically show much higher average P/BV than others.

- Dividend Yield: People neglect dividend yield thinking that since they are only receiving say 1-2% of their invested amount as dividend, it should be neglected. However, over long periods of time, dividends can not only reduce the cost basis of shares to a negligible amount, if reinvested they can produce mind-boggling differences in results.

Warning: Don’t be seduced by overly high dividend yields (often seen in commodity stocks). If share prices fall rapidly, it can push up dividend yields to unsustainable levels. Dividend yield should be looked at in conjunction with stable earnings growth and dividend payout ratios.

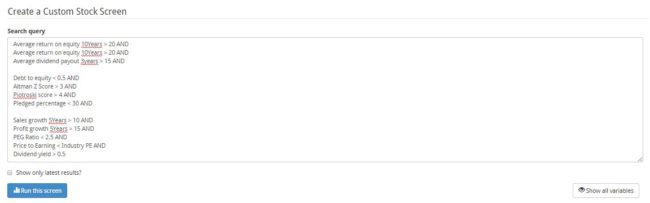

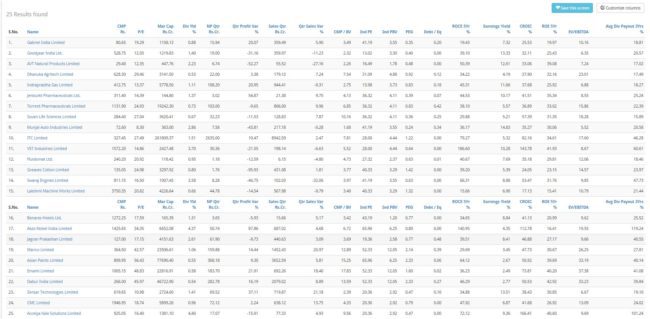

3 Putting it all Together in a Screener.

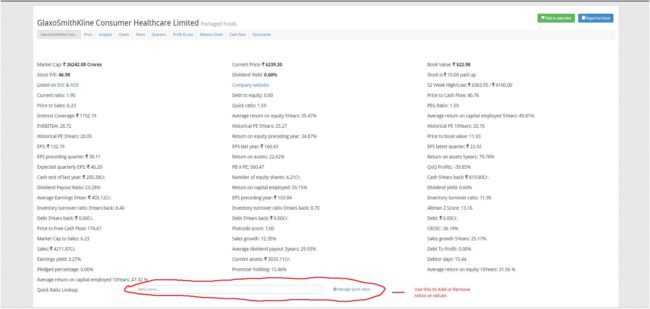

Now that we know what to look for, we can use a screening tool to help us identify stocks that meet criteria. I like using Screener.in because I find its interface very intuitive and versatile in customization options. Not only does it give you the option of writing your own custom screens, but there are also many user created screens for you to play around with.

If you like what you see, you can export the financials to excel (top right blue button) for further analysis, or add the stock to a watch list (green button)

If you need help on how to define the variables, click the “Show all variables button on the bottom” right.

Summary

After generating a screen and look at the financials, I typically look at downloading and reading the last 5 years Annual Reports to get more detailed information on the business. Key things to note are disclosures to financial statements as well as management commentary on strategy and future growth. Look for honesty above all else, I would rather that the management recognizes challenges and has a roadmap rather than present a uniformly rosy picture.

I hope this article gives you a basic idea on how to go about generating stock ideas through a screener. You do not have to rigidly follow the values I have taken either as there are many more permutations and combinations to what I have discussed, and I highly encourage you to experiment with the tool as well as the metrics involved.

Download the Freefincal Excel Stock Screener

~~~~~~~~~~~~~~~~~

Do join me in thanking Indraneal for a comprehensive guide to use a stock screener. Now that you know how to get a short-list of sound business, check out this automated stock analyzer to finalize your picks!

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)