Last Updated on December 29, 2021 at 5:52 pm

In this article, we analyse the dividend payouts of ITC and discuss if the stock is worth buying for its dividend payouts. This is a followup to the detailed analysis of the stock published a few days ago: Should you sell ITC and book losses?

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) Stock Analysis: Is Reliance Industries Ltd Worth Buying? (5) Stock analysis: Is Tata Consumer Products share worth a buy?

Investor community esp. ITC shareholders have been split into two groups, one of them advocating the hefty dividend payouts from ITC stock and justifying the dividends as an indicator of its health of the businesses esp. consistent cash flows generated out of the businesses that the company operates.

The Other one blaming the hefty dividend payouts originating from the argument that the company doesn’t foresee any further prospects or businesses to grow hence would like to distribute cash flows to shareholders; thus, leading to lacklustre stock performance.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Moreover, at this juncture, ITC offers a dividend yield of 5.5% as of today, which is undoubtedly more than Fixed Deposits offered by the leading banks in India. [e.g. SBI Fixed Deposits <5% for 1-2 Year Term]

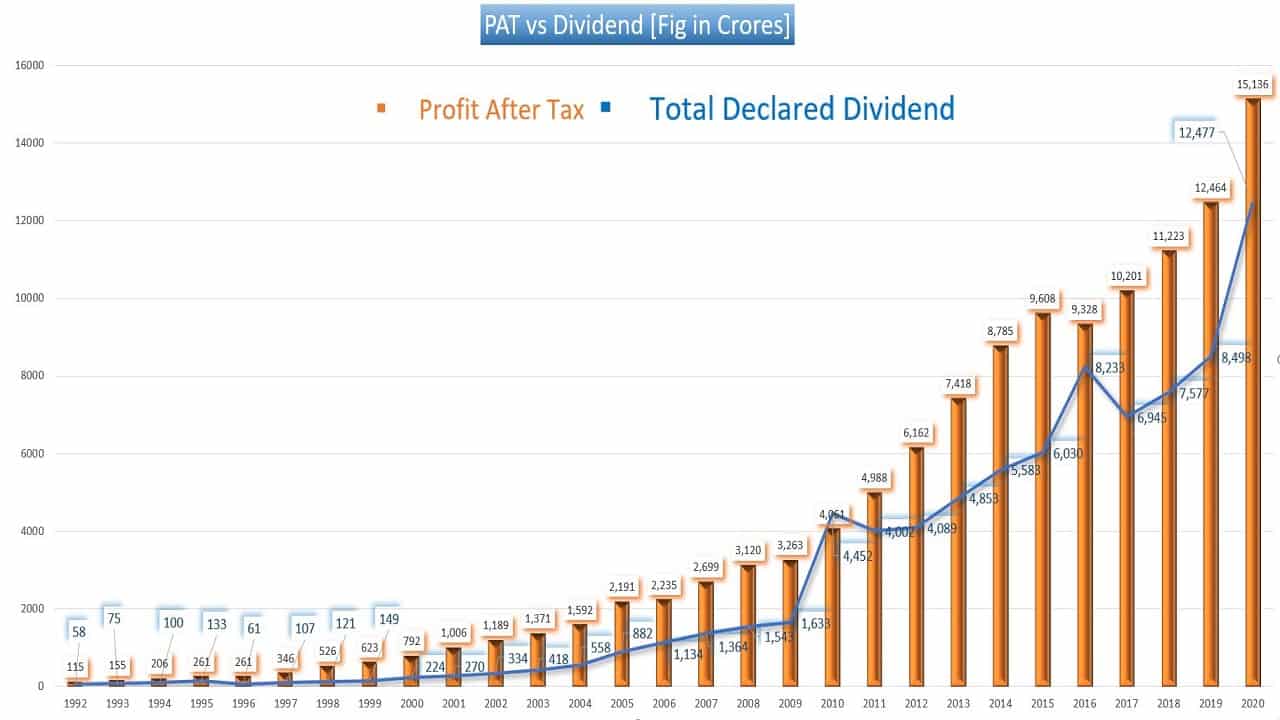

To analyze this situation further, we have compiled data from ITC Corporate website to compare the dividend payouts made by the company and Profits after tax declared by the company in the past 30 years. As visible in the graph, the PAT [Profit after Tax] declared by the company has been growing consistently over the past 3 decades. The dividends declared by the company during this period of 3 decades have been matching with the growing volume of PATs as well. This implies that dividends declared by the company have been growing at a consistent rate, along with Profits after taxes.

The period of 3 decades has been deliberately chosen to remove any short-term fluctuations in PATs due to ‘other incomes’ or special situations arising out due to sale outs, divestments or exits, buyouts, etc.

What investors should note here: Dividends are paid by the company after deduction of taxes, net of investments, and any retained earnings as surplus, which means the company has been consistently generating healthy cash flows to meet any investment opportunities (net of taxes and retained earnings). Now many investors would point that the company doesn’t have enough investment opportunities, this is resulting in higher dividend payouts, and ultimately stock price would suffer owing to poor or no growth in future revenues/sales or any potential future businesses.

To analyze that aspect, we would need another data point from the company’s corporate presentation in the recent exchange filings on the NSE website.

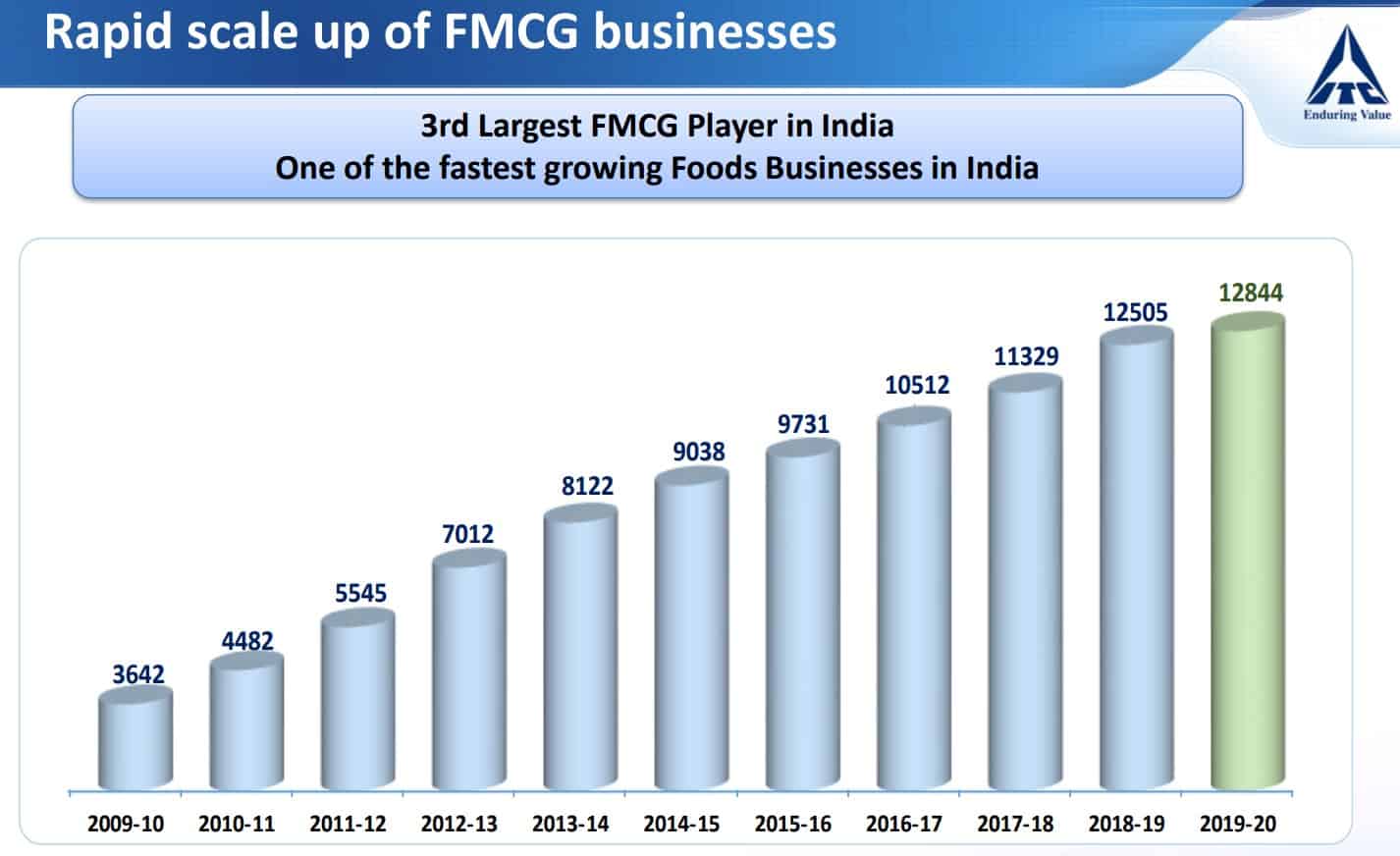

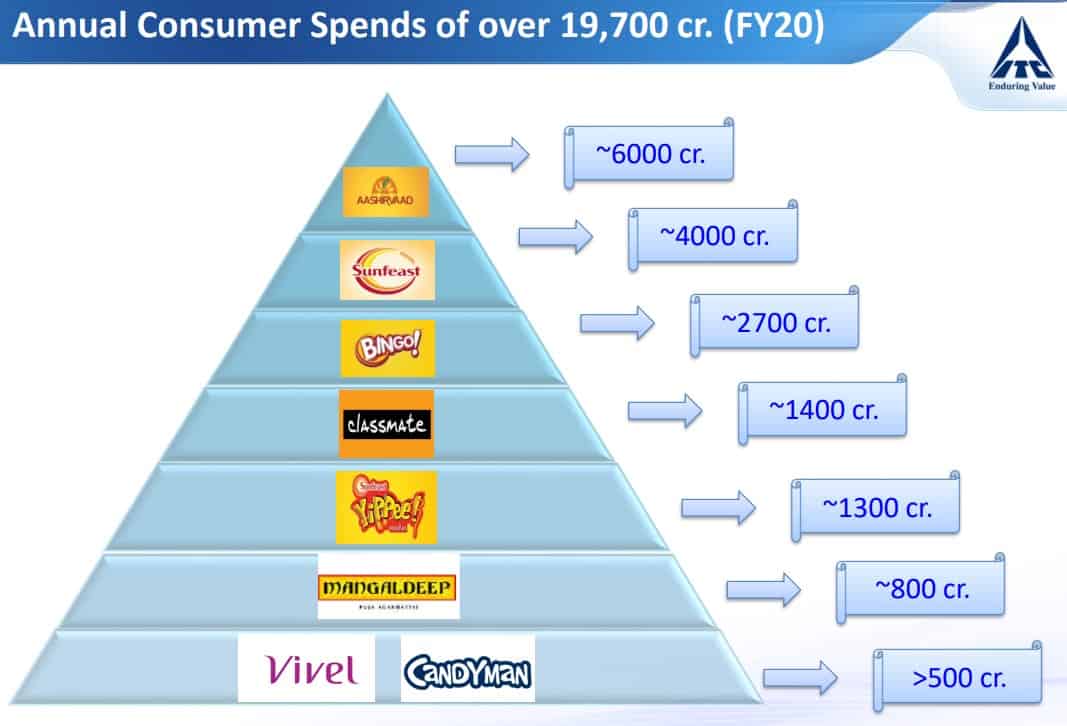

Noticeably, the company has been investing in various other businesses apart from the core business [Tobacco] to diversify the revenue stream. The company has invested heavily into FMCG, Agri-Business and Hotel business in the past 2 decades to diversify revenue streams. Undoubtedly the investments into the FMCG segment have led to the generation of some trendy brand names as well. Building Brands in the FMCG space, which is known for tough competition both at the national as well as the local level is not child’s play, as this requires heavy investments. Brand recall is the foremost important reason for FMCG revenues, and this requires investments for a longer period of time and that too consistently, ranging from advertising spends to delivering quality products.

The company has built a lot of brands organically in the past 2 decades, e.g. Aashirvaad, Sunfeast, Bingo, YiPPee! to name a few.

However, the company has also acquired a few brands [inorganic growth] to strengthen the FMCG brand portfolio, e.g. Savlon, Shower to Shower, and Sunrise Spices.

Brands: Savlon and Shower to Shower: The company spent almost 250 Crores in Feb 2015 to acquire these 2 brands from Johnson and Johnson [J&J]. What should catch investor’s attention is that the company launched almost 70 products during the H1 FY2020 mostly under the Hygiene product brand portfolio and ‘Savlon’ did go well on the market shelves too. The company expects the ‘Savlon’ brand itself to be the first 1000 crore brand in the personal care brand portfolio.

Sources:

- ITC to acquire Johnson & Johnson’s ‘Savlon’ and ‘Shower To Shower’ brands

- Savlon on track to be ITC’s first ₹1,000-crore personal care brand

Sunrise Spices: The company had entered into a share purchase agreement to acquire 100 per cent of the equity share capital of Sunrise Foods Private Ltd (SFPL). Source: ITC to acquire spice-maker Sunrise Foods – The Hindu BusinessLine

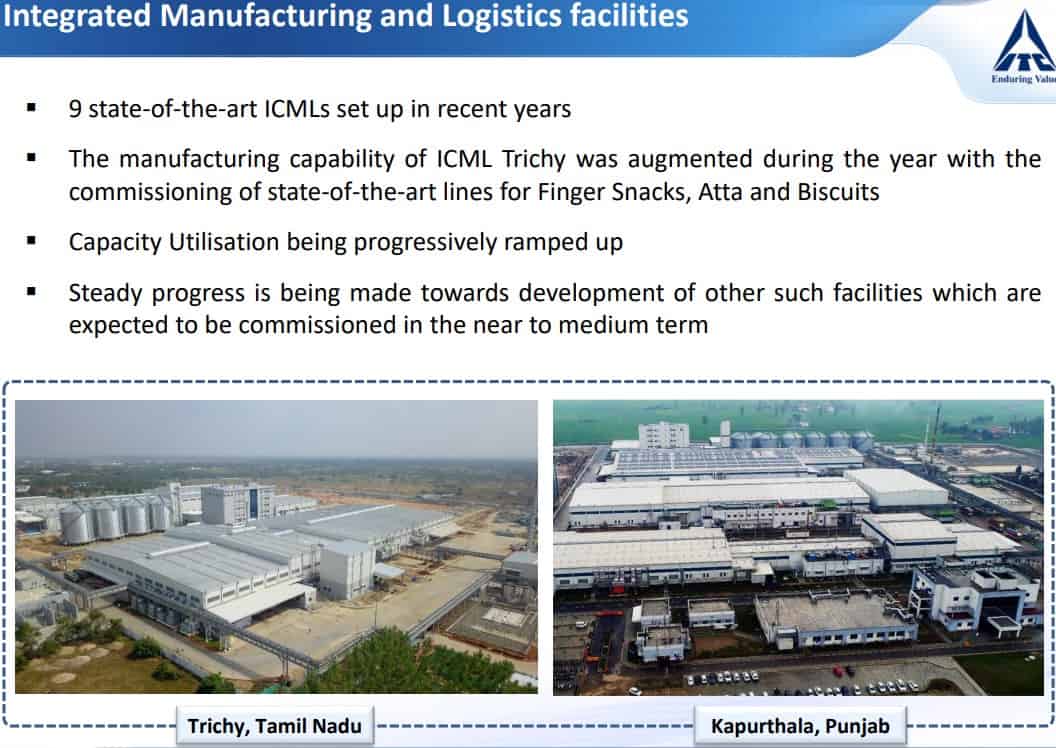

This implies that the company has been investing in the building and strengthening the FMCG portfolio. Another point of interest to investors would be that the company has been investing in building manufacturing facilities close to the source of supplies, and again this requires upfront investments ranging from logistics to machinery and equipment.

Moving onto another business that has been a growing concern for the investors is the hotel business where the company has made upfront investments. Hotel business requires upfront investments to be made, e.g. Real Estate, Buildings, Staff expenses etc. and recently, the company has announced this business segment as well.

“Diversified business conglomerate ITC Limited said on Monday that it would pursue an asset-light strategy in its hotel business to reach the next milestone of 30:70 ratio between owned and managed hotel properties, from the present 40:60 mix, as it seeks to scale up the room capacity faster.”

Source: ITC to follow asset-light strategy for expansion of hotel biz: Sanjiv Puris

Coming back to the dividend payouts and strategy of the company going forward. Recently the company announced that the company would be declaring the majority of the earnings as dividends for the reasons highlighted below.

Announcement: “ITC has decided to offer 80-85 per cent of its profit after tax (PAT) as dividend to its shareholders, which will be effective from the current financial year. This would be applicable in the medium term.”

Sources:

- ITC fixes dividend payout for shareholders at 80-85% of profit after taxes

- Dividend Distribution Policy

Points worthy to note for investors:

- “Call has been taken as most of the capital expenses have been undertaken and are underway in its hotels and food processing segments”. [Excerpts from the recent announcement by the company]

- What this means for investors is: the company has already made investments into the FMCG business in the past decade, and it has no further plans to make investments at the same scale and profits generated out of the existing businesses can be largely distributed to the shareholders.

- The company is exploring an asset-light model in Hotel businesses. With this model, along with the existing investments into the hotel business, the company is now in a position that heavy CAPEX is no longer required into the hotel business.

- The company has also invested heavily in setting up 20 Integrated Consumer Goods Manufacturing and Logistics (ICML) facilities that will aid the company with economies of scale, freshness and close-to-market distribution.

Overall, the company is now in a position where it no longer requires heavy CAPEX to expand businesses and the profits generated out of the existing businesses can be largely distributed to the shareholders. This means shareholders can expect the majority of the profits to be distributed in the form of dividends, and it does not necessarily imply that the company doesn’t have any lucrative business opportunities to expand businesses.

Noticeably, the company has already been paying dividends over the past 3 decades matching them to the tune of the declared PATs, and the consistency is the declaration of the PATs and declaration of dividends cannot be ignored.

Currently, given the share price as per the exchange rates of NSE/BSE, i.e. Rs. 180, dividend payout comes to 5.5% yield, which is healthy considering the deposit rates of most of the leading banks in India. With healthy yields offered by ITC as Dividends, investors should not ignore this aspect of investing. Dividends are paid net of taxes and retained earnings, and this also means the company is generating healthy cash flows to meet operational needs.

A wise man once said, “Trust Cash flows, not Earnings per Share”.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)