Last Updated on December 29, 2021 at 5:54 pm

Here are some practical aspects of real estate investing that retail investors should be aware of. The article considers real estate as an investment and does not pertain to property purchase for self-occupation.

Dynamics & pragmatic nuances of real estate investments for retail investors: At the outset, I would like to thank Pattu for giving me an opportunity for sharing my thoughts on his forum, freefincal. It’s a privilege indeed, nothing less.

The readers may want to take a note that this column is entirely fiduciary in nature with no conflict of interest or sponsorship etc. I do not intend to endorse, dissuade or market any view, product or service. The sole intention is to state the facts & peel off the veneer from myths if needed. The readers are at liberty to scrutinize the column, understand, assimilate, do their own analysis, seek professional assistance and then act based on their personal circumstances.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

This column should not be construed as investment advice. While there is a lot more that can be added to this disclaimer, I will keep this short & trust that the readers acknowledge ‘in letter & spirit’ the rationale underlying this disclaimer. With no further ado, let’s start rolling!

Investing in real estate has had its own charm over centuries, not only in India but across the world. We have heard umpteen apocryphal narratives & anecdotes that make us yearn all the more! The feeling of status, ownership, peer pressure, physical existence & tangibility of real estate adds to the aura. The sweet-talking broker or developer does the rest!

If we are really looking at real estate as an asset class (presuming that the reader already owns a place to stay, has a surplus amount of cash and is seeking to invest the same), its more than worth to get down to the nuts & bolts which ultimately reflect the cold hard numbers like return on investment (ROI) or internal rate of return (IRR), & see how the numbers stack against the other conventional asset classes like equity & debt. Mind you, the focus is only on retail investors, not corporations or ultra-high net worth individuals like Ambanis’ or Adanis’. Personal finance is mostly personal & meagrely finance so there is nothing right or wrong with any asset class, its only about the individual owning them.

Different forms of Investing in real estate

Buy & Hold

- Owning & leasing out a commercial space

- Owning & leasing out a residential space

- Owning & leasing out a piece of land

- Buying units in real estate investment trusts (REITs)

We will look at the first three, the fourth one is more like a mutual fund & far more hassle-free. So, basically, investors intend to make money from real estate via cash inflows in the form of rent and long-term appreciation of the asset. This is analogous to cash inflows from dividends & long-term appreciation of the stock price in equity. Amusingly, the similarity ends there!

Buy & Flip

- Buy (low), refurbish (spend), sell (high), repeat (perpetually)! Ensure that high > low + spend

If the investor has to achieve any of the above, sustainably, over a long period of time, irrespective of the market conditions, the investor ought to be equipped with the following:

- Love for ‘property’ — should be able to smell money in a potential deal and within a matter of seconds can tell if the deal is worth it or not.

- Thorough understanding of risk-return expectations, choice of the asset class, financing methods – strong credit lines, holding time frames et al.

- Uses unique methods to exploit various opportunities that come thy way. E.g. locating & nailing distressed sellers.

- Active participant with a strong network that keeps one tipping about potential offers.

On most occasions, it is possible only when this is being done professionally & full time, unlike ones who have a regular different day job. For professionals too, it may not be a certainty, just that the probability of success may be more.

While calculating the return on investment, the following cash flows (whichever applicable, most would be, actually) should be tabulated chronologically to derive the actual figure. It’s too naïve (or perhaps foolhardy) to say that an investor bought a property for 1 crore & sold it for 2 in say 6 years which comes to about 12% annually (Rule of 72).

- The actual cost of the property

- Interest component paid on home mortgage

- Home mortgage processing fees

- Stamp duty, Registration, One-time maintenance & parking charges

- Society formation charges at the outset

- Buyside brokerage charges

- Lawyer fees to validate the titles & property paperwork.

- Annual & ad-hoc refurbishment expenses like painting, waterproofing, basic furniture, rebuilding compound walls due to act of God events like falling trees, earthquakes et al.

- Society maintenance charges

- Property tax

- Cost of power of attorney (for renting purpose) in case one is not staying in the same location.

- Rental agreement charges

- Conveyance charges of travelling to the location for buy, sell-agreements if need be.

- Sell brokerage charges

- Advertising charges for seeking prospective tenants & buyers

- Physical security, building perimeter charges, mowing & caretaking charges in case it’s a piece of land.

- Actual rental income

- Earnings on the security deposit

- The actual cost of selling

- Once the property is sold for a ‘profit’, the capital gains tax (long-term or short-term) will creep in which also needs to be a part of the equation. The investor would normally pay in the highest tax bracket given the magnitude of real estate transactions.

After all this, the investor is expecting a positive real rate of return (Nominal minus inflation).

The investor has three options after the property is sold:

- Invest the profit in another property so that the tax on capital gains is saved — This implies that the investor gets into a cycle of selling & buying and doesn’t really enjoy or consume the profits unless the investor is smart enough to buy a property costing less and take some money off the table. For all practical purposes, this appears to be easier said than done & doesn’t seem sustainable perpetually, as one would hit a floor price soon.

- Invest the long-term capital gain up to 50 lakhs in 54EC bonds with a lock-in period of 5 years & 5% annual coupon (as of November 2020). Pay tax on any profit above 50 lakhs. Also, pay tax on the income generated on the bonds, each year, ideally.

- Do not invest in the above two vehicles, pay tax on the complete capital gains amount & move on.

The investor will have to check how all the above three scenarios pan out and then make an informed decision.

Aspects that need care

There are some intangible pragmatics in the real estate world that the investor needs to be careful about —

- As a buyer, the investor needs to find a good promoter/developer, who would deliver the asset in the promised time & quality. Frauds run rampage in this industry. You lose money, you lose peace. Too much is at stake. Imagine that an investor has bought a flat under construction, it runs into issues, the investor is paying the EMI as well as rent where he/she is staying. It looks like selling a ‘call option’, unlimited downside.

- As a landlord, finding a decent tenant who would pay in time, abide by the rules, keep your house in good shape.

- Black Swan events like Covid-19 do happen (we know now) which implies that your vacant real estate can remain so for a long period of time or tenant renegotiating the rent or just vacating the real estate. All of them imply foregoing rent which ultimately erodes ROI. Also, good to be cognizant of the fact that rentals appreciate at not more than 5% to 8% YoY.

- Housing societies have the liberty to charge an investor an annual maintenance charge as they deem suitable if the apartment is rented out. That means that if other members are paying X, the investor may be asked to pay anything between 1.1X to 2X because the investor is making money out of rent! There is no strict regulation around & there is no option other than to pay. The only implication for the investor is a further erosion of ROI. Add to that the maintenance charges may increase at a rate of 10% or more YoY.

- Hope that the mortgage interest rates do not rise else ROI is screwed.

- While selling, get a decent deal and not a distressed sale. Not being a victim of anchoring or confirmatory bias. Selling real estate is a combination of skill, art & luck. If it remains on the market for too long, unsold; perceptions change, ‘problems’ arise, rumour mongering starts.

- Lack of regulations & no mechanism to discover the market price is an inherent problem. It would not be smart to assume that real estate prices only go up & in a hurry. In fact, there are long periods when they go nowhere.

- Liquidity, especially due to all or nothing nature may create problems.

- When the stakes are high, prospects start using different tactics, political nexuses, unholy clouts, unwanted advances… all means. Though that seems straight out of a Bollywood movie, that does happen, and investor needs to be prepared for different eventualities. It may pan out into a ‘who blinks first’ game.

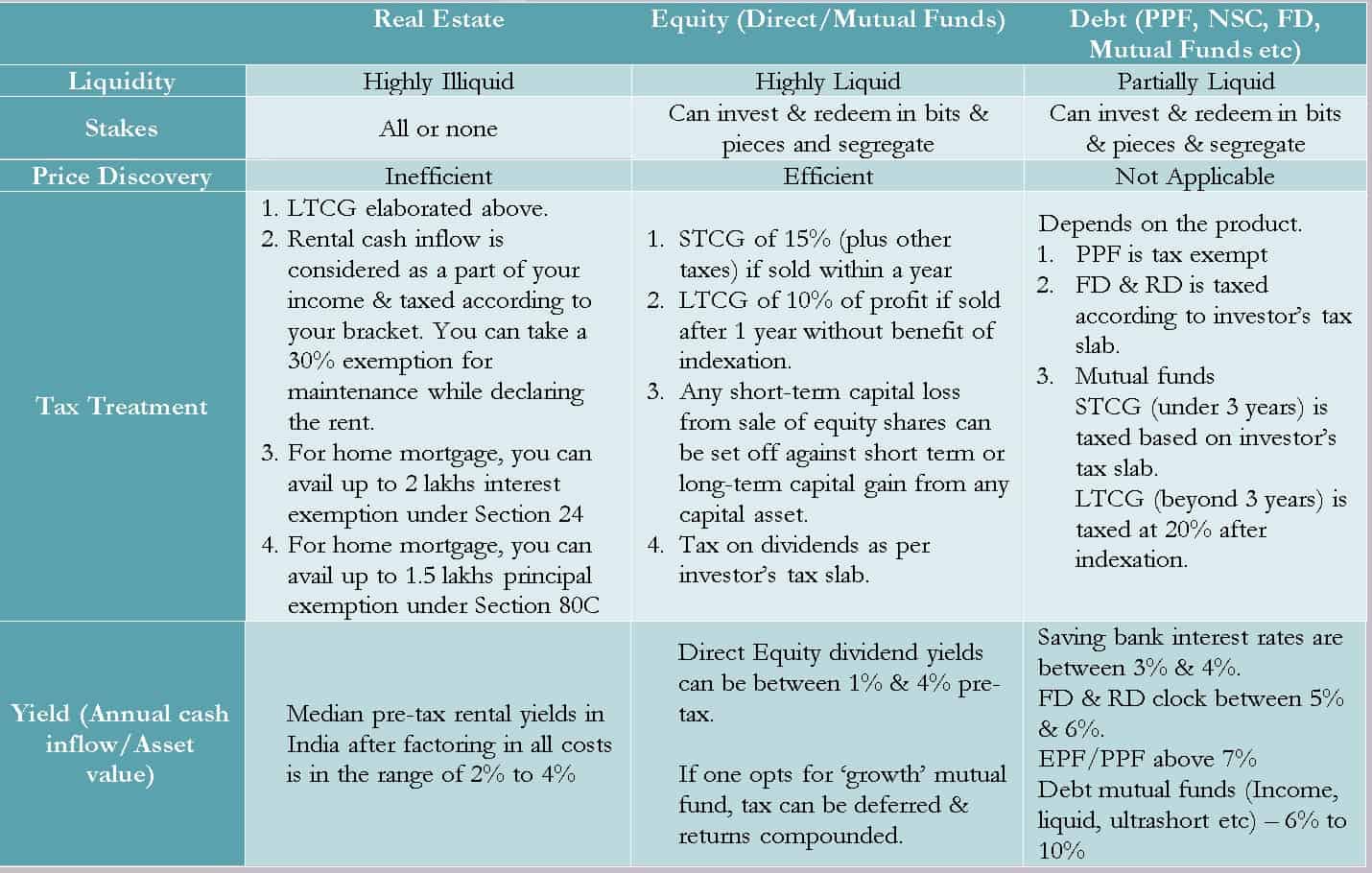

Comparison of parameters across asset classes

Finally, am attaching a sheet that illustrates the actual calculation about the ROI that I mentioned earlier. Even with conservative assumptions, numbers are for you to see & they don’t lie! You can key in your own numbers, more conservative or aggressive until your heart’s content.

As is said, it’s not the asset class that makes money, it is the brain behind it! I would not think twice before appending heart, stomach & temperament to it… Happy investing.

Editor’s note: Interested readers may download this free Real Estate Returns Calculator.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)