Last Updated on December 29, 2021 at 5:50 pm

The stock price of ITC has frustrated investors for the last few years. This can be concerning even for best of the breed long term investors who invested in the company looking at the fundamentals of the company, cash flows, monopoly business, strong brand recall, professional management or even the dividend yield etc. Does it make sense for investors to hold on to it? Or should they sell? An analysis.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Stock Analysis: Is Reliance Industries Ltd Worth Buying?(5) Stock analysis: Is Tata Consumer Products share worth a buy?

Reasons attached by the investor community to this dismal performance vary from:

- Diversification into cash guzzling or asset-heavy businesses like Hotels

- The Institutional investor’s not showing interest in the stock owning to ESG concerns

- Cigarettes business not considered a merit business from a societal point of view

- No visible ‘Value Unlocking’ from the conglomerate point of view

- Demerging FMCG business or other un-related businesses to attract the interest of institutional investors

- Potential selling of stake by Govt of India or SUUTI [Specified Undertaking …]

Before we objectively answer this question, we need to look at the data first.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Profile: Company is engaged in the following businesses:

- Consumer goods

- Cigarettes

- Apparel

- Education

- Hotels and Resorts

- Paperboards & Specialty Papers

- Packaging

- Agri-Business

- Information Technology

How ITC has evolved into an FMCG giant, let us look at historical data to understand what the company has gone through in the past 2 decades. Unless we take stock of the situation and compare across ~20 years, we are not talking long term here.

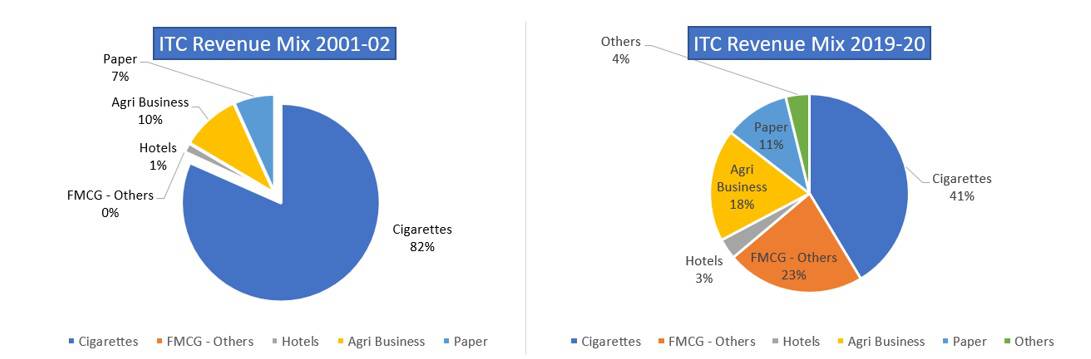

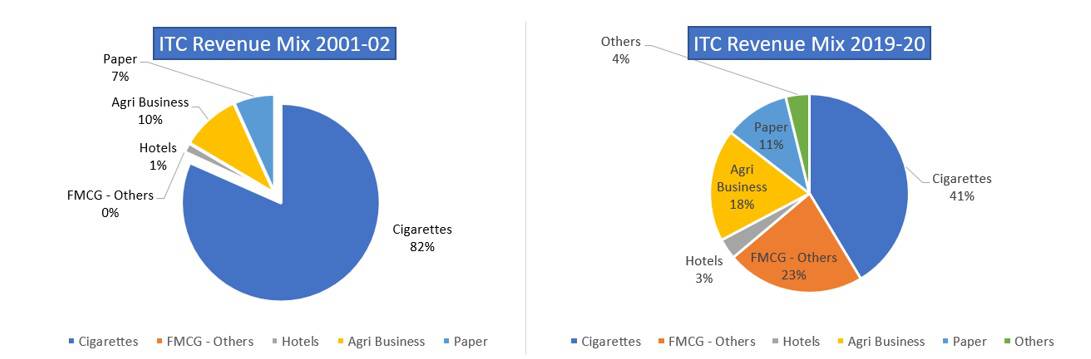

This is the comparison of the Revenue mix of the company from FY 2001-02 and FY 2019-20. The diversification of the revenue streams is clearly visible from Cigarettes heavy to businesses such as Agri-business, FMCG-Others which is mainly Food products and packaged foods.

Source: https://www.itcportal.com/investor/index.aspx

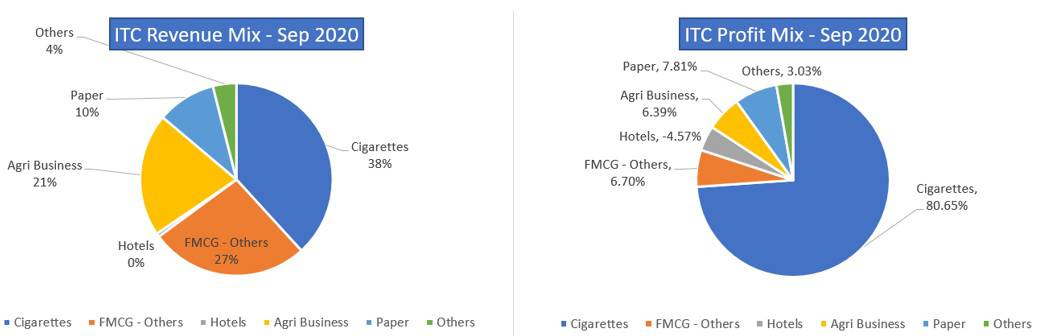

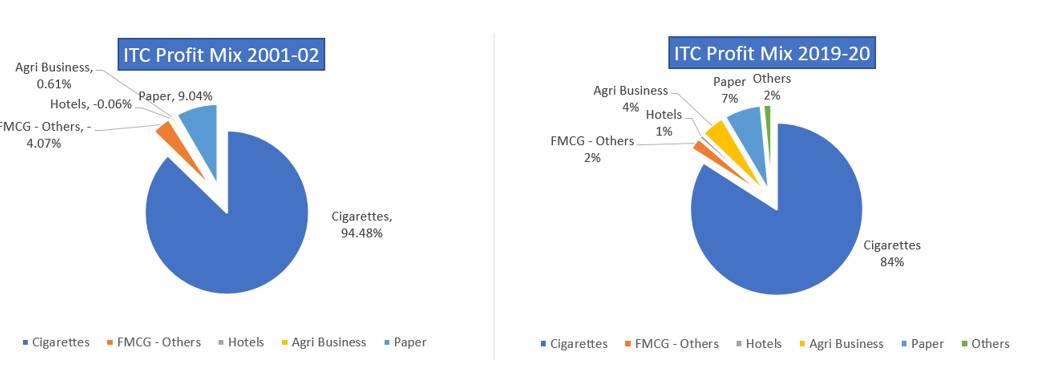

As noticed from the profit mix comparison of the FY 2001-02 with the FY 2019-20, it is observed, though the revenue mix of the company has got fairly diversified from Cigarettes heavy to the other businesses, the major chunk of the profits still come from the cigarettes business, which is why investors are reluctant to give FMCG valuations to the company despite company investing heavily into the FMCG business.

Let us take a deeper look into what is happening in the FMCG business and why its taking long for the business to turn around.

ITC Profit Mix comparison 2001-02 and 2019-2020Before we dig deep into FMCG business, it’s important to analyze the Q2 2020 numbers first.

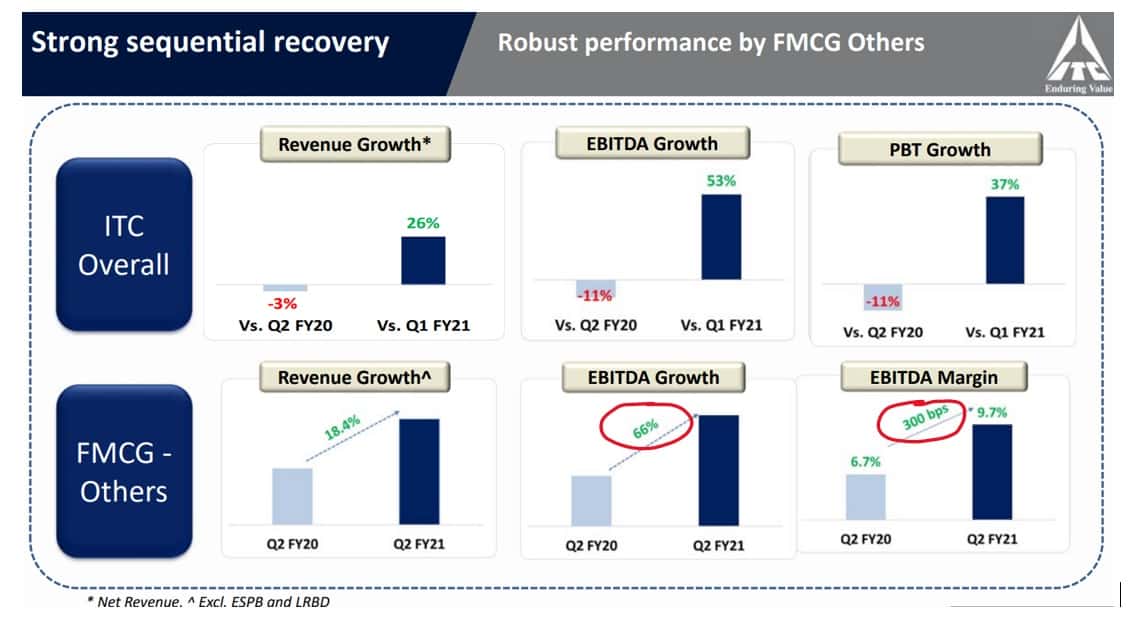

As the chart reveals, the cigarettes business took a beating due to lockdown [COVID-19] and closure of commercial activities and the FMCG business has given a cushion to both the revenue and profit streams of the company. Not only Cigarettes business took a beating, but the Hotels business also lost ground to the lockdowns and travel restrictions, additionally, hotels are an Asset heavy business accounting for upfront heavy investments (like Real Estate, buildings, equipment and staff), though the Hotel business still accounts to <4% of the company’s revenue stream.

However, there is a trend which is clearly emerging from the investments made by the company in the FMCG business.

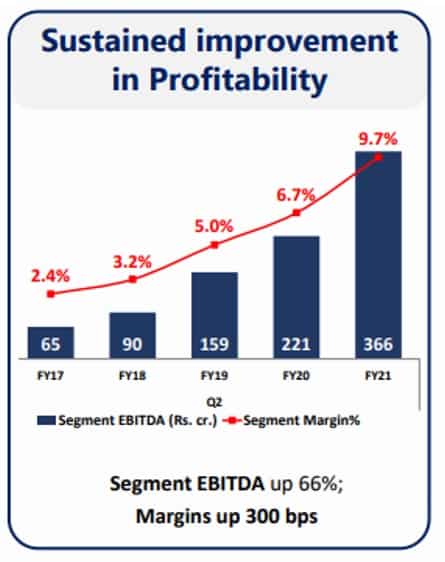

During the Q2 of FY 2020, the FMCG business has shown improvement in Margins by 300 bps which is a significant achievement considering the stiff competition in this sector. Additionally, the FMCG business is showing the improvements consistently since FY2017 and noticeably, this business has turned EBIDTA positive in past 5 years from being EBIDTA negative.

From the corporate presentation, the message from the management is clear that focus is towards strengthening of the FMCG business, as visibly the company has launched 70 new products in the H1 of the FY2020.

The FMCG business depends on the brand strength and brand recall primarily, which is why it took almost a decade for the company to turn the business EBIDTA at the scale which can move the needle from being cash guzzling to cash-generating business.

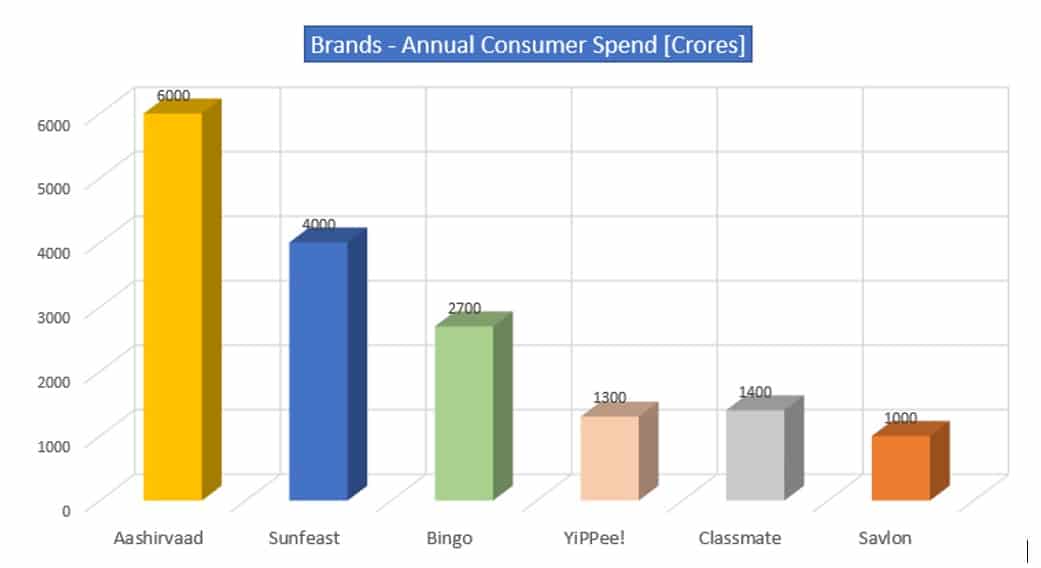

Moving on to the brand recall and annual spends by consumers:

The brands built by the company over the past decade have gained traction in the consumer spending and made their space in the market shelves, where most of the brands have gained market share despite a huge presence of unorganized players in a diverse country like India.

Aashirvaad ~ 28% market share

Sunfeast ~ 25% market share

YiPPee! ~ 25% market share

Classmate ~ 25% market share

Bingo ~ 15% market share

The company expects Savlon to become a Rs 1,000-crore brand in terms of annual consumer spend by this fiscal end, backed by heightened demands for hygiene products. Last fiscal, consumer spend on this brand was around Rs 250 crore. [Source: Financial Express]

This answers 1 of the concerns by the investor which is investments into cash guzzling businesses which are taking a longer time to generate cash flows. As visible from the EBIDTA analysis, the FMCG business has turned EBIDTA positive and gained both market share as well as margins despite the presence of stiff competition in the sector.

Now, let us look another concern from the investor community which is investments into the asset-heavy Hotel businesses.

During the COVID-19 lockdown restrictions, hotels business has taken a beating but even before how was the performance of the business and its impact on the overall stock performance.

Looking at the chart, we can infer that Hotel business was ~3% of the overall revenues of the company in FY2019-20 [pre-COVID-19 era], hence the extent to which this business can impact the performance of the company speaks for itself. Another concern from the investor community is low margins and profitability generated by this particular business and its impact on the overall company. Though the company has realized this business being asset-heavy and requires upfront investments, the management is exploring strategies to tackle the challenge.

Moving on to the ‘core business’ of the company which is also attributed as ‘Cash Cow’ business i.e. Cigarettes

ITC Profit Mix comparison 2001-02 and 2019-2020The business generates 80% of the profits for the company and it’s a virtual monopoly that the company enjoys due to significant market share. Cigarettes being a high entry barrier business, gives advantage to the company to generate cash flows and utilize the cash flows towards other lucrative opportunities.

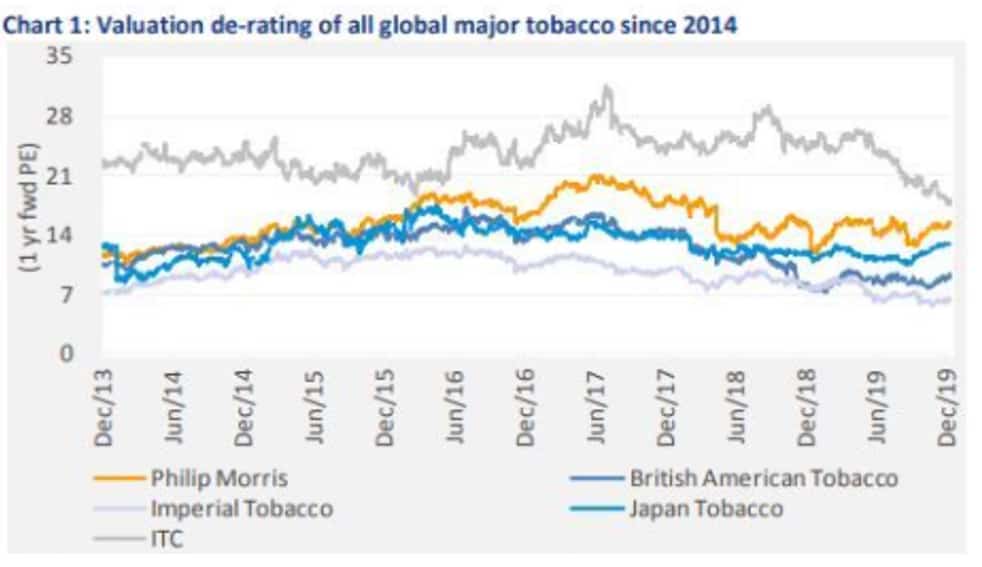

There have been concerns from the investor community due to high taxation levied by the tax authorities as the cigarette business is considered a demerit business from societal point of view and the health concerns it invites. Looking at the valuations across the peers, stock has corrected from the premium valuations it enjoyed in the past but that phenomenon is visible across the tobacco stocks. From pure business point of view, it’s a high cash generation and high margin/ROCE business and the company had rightfully identified investment opportunities.

Investors should look at the other markets leaders across businesses and they would find each n every company has a business which is eyed as ‘passe’ [cash cow businesses] and ‘low margin’ business considered as future growth drivers.

Consider the case of

- Reliance: Petroleum and Oil&Gas business are considered as passe [Cash cow business?] and Retail & Telecom despite being low margin are considered [future growth drivers?].

- IT: Cloud considered as low margin [and also the future growth driver?]

- Automobile: Conventional ICE considered a ‘passe’ and Electric vehicles being] future growth driver?]

Agri-Business: Another business arm of the company which has gained traction has given an advantage to the company in its FMCG business is the agribusiness. The company has a wide reach and presence in the country through its network and e-choupals.

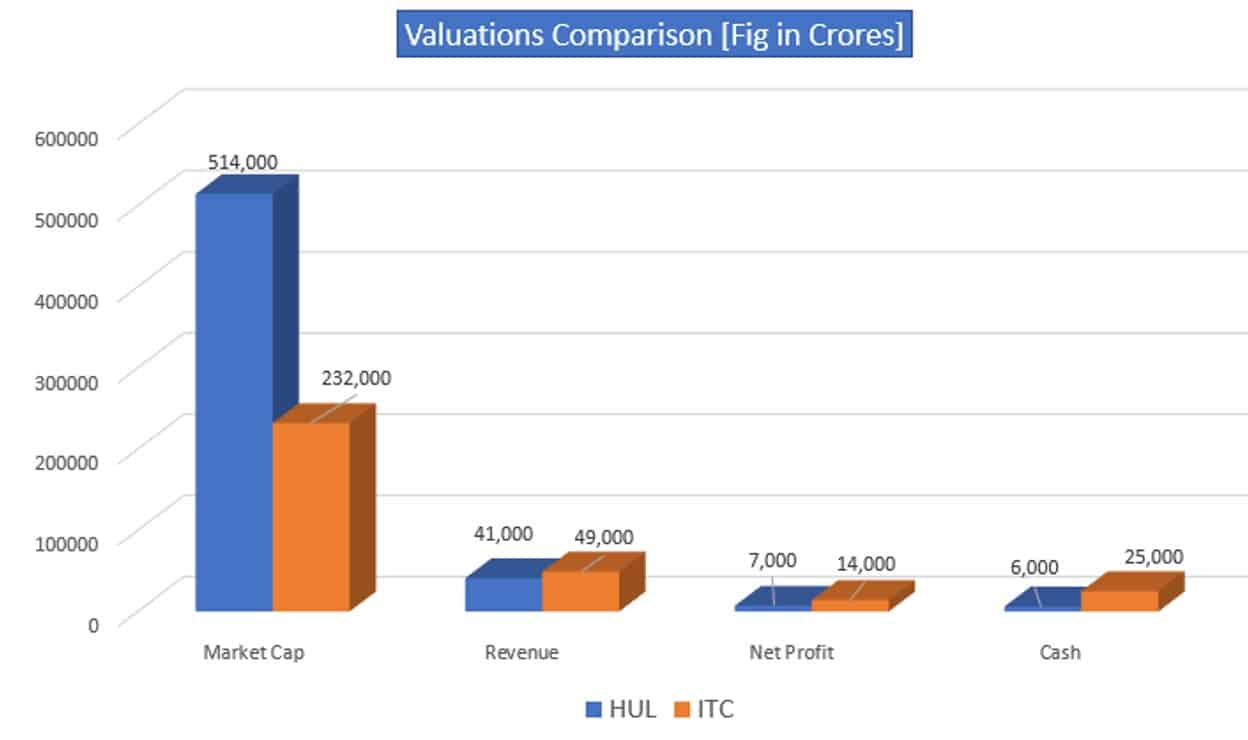

Now, let us look at another interesting chart which should attention of the investor community is valuations.

Though the HUL company is pure-play FMCG as investor community would like to attribute it, and ITC is ‘yet to be’ FMCG play. Looking at the numbers from the chart, valuations enjoyed by the HUL is surely making ITC investors feel dwarfed. However, another factor that should catch investors attention is revenues generated and net profits generated out of those revenues.

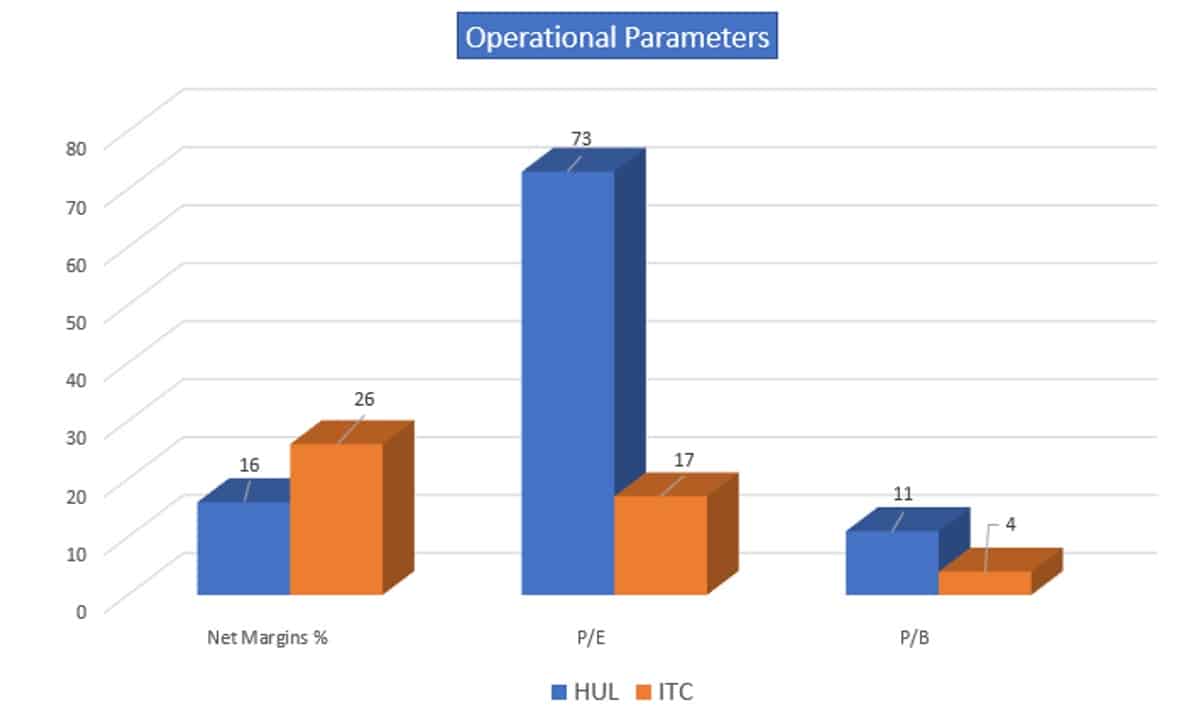

Next, we look at the operational parameters of both companies.

It can be inferred that the company doesn’t enjoy premium valuations like HUL despite generating higher revenues and profits.

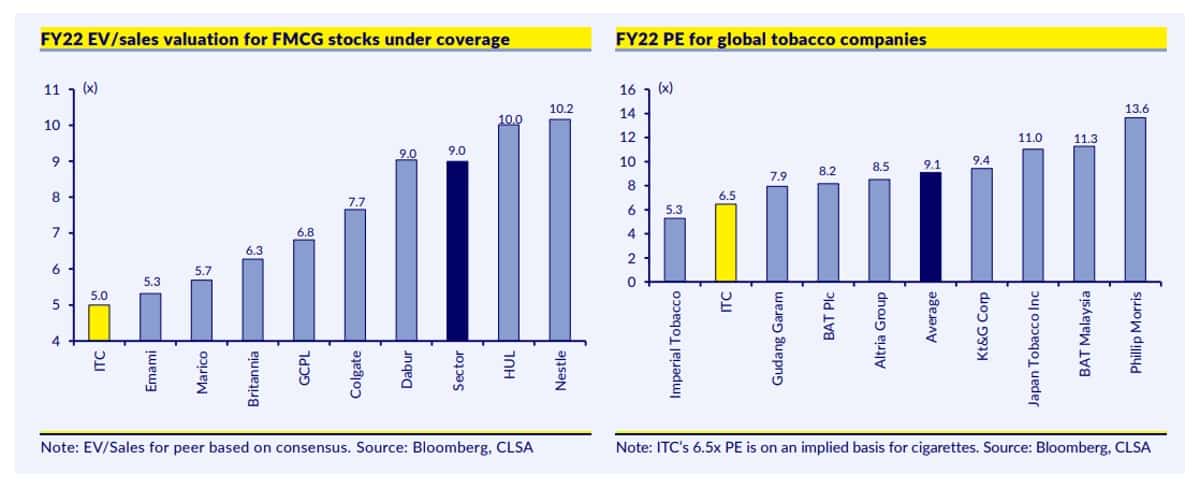

Comparing the company with peers across the board makes the picture all the more clearer.

Company has been punished on the valuation’s aspects in the FMCG space as well as the global tobacco peers’ landscape, the reason could be the concerns raised on account of the high taxation on the ‘cash cow’ and FMCG business yet to improve profitability.

Conclusion: valuations are a subjective phenomenon and investors should not hold them captives to the narrative set over the media. Looking at the data out of the sales, profits and cash generated out of the businesses and strong brand recall, investors should expect valuation catch up to the play in the coming years in the ITC stock. The company has made strong efforts to make the FMCG business turn profitable and management is addressing the concerns raised by the investor community on the asset-heavy hotels business. Earnings of the company are the ultimate driver of the stock performance over the long term if the reasons you invested in the stock are still valid, there is no need to exit the stock based on the short term fluctuations.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)