Last Updated on September 6, 2019 at 11:49 pm

This is a guest post by Krishna Kishore who writes a refreshing blog on stock investing at tyroinvestor.com. He readily agreed to write this post, explaining the features of a stock screener, upon my request.

~~~~~~~~~~~~

There are many stock screeners available online like the ones from Google Finance, Reuters, Equity master and paid services from Bloomberg as well. Out of them all, www.screener.in is one of the best and the one that I personally use and recommend because of its salient features.

But why to use it in the first place?

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Okay, to understand that let me give you an example.

You got a “tip” from a very good investor. He is very bullish about the stock. Now you wanted to know about the company. What will you do?

Following are the steps!!

1) Open Moneycontrol.com and type the company’s name.

2) Check the company’s current market price.

3) Click on 3 months, 6 months, 1 year, 2 years to know how the company is doing from past few quarters.

4) Quickly check EPS, PE, Dividend yield, Price to Book etc.

5) Get an idea of the company’s performance (without even knowing what are the products & services that the company offers).

But Krishna, What is wrong in doing so?

Nothing wrong in it but you will be “Biased”. Being in so called “Bull Market”, this can be dangerous to our portfolio. Every stock will make new heights these days. Hence, your mind takes the shortcut to process this least available information to say whether this company is doing great, good, bad or ugly. You start your analysis with a biased mode. We are not sure why that stock went up/down. Is it because of any sectorial momentum, Tailwind or Headwind? No idea, but we will start thinking that the stock price has went up, so something good happened/going to happen to the company (Shortcut processing of information).

Recently I watched a movie called “Drishyam”. The tagline of the movies goes something like this “Visuals can be deceiving”.

This particular tagline with a small change can be aptly suited for markets. “Stock Prices can be deceiving”!!!

But, also at the same time, we do not have enough time on earth to go through Annual reports of each and every company to understand the financial health of it. (Remember in olden days, Ben Graham, Peter Lynch, Buffett and many other legends actually did so)

This is where Stock Screeners comes into picture to serve the purpose.

Stock Screeners gives the fundamental view of the company (not in-depth information) which will be very useful and enough to get an initial idea of its health condition.

As already said I prefer using www.screener.in and now let’s try to understand the functionalities of it.

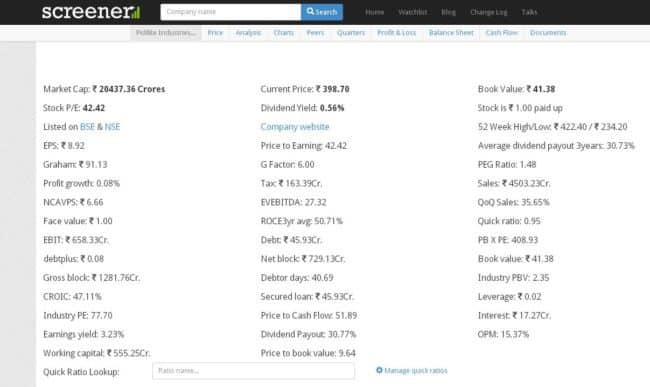

This is my stock screener page and I am taking example of one of India’s most consistent compounder, “Pidilite Industries”!!!

(Please do register to access all the functionalities and type which ratios you want to have in your page under “Manage Quick Ratios” section)

1) From this screen shot, I can get the following info. (In order to understand a stock more than just looking at the price, you need to know about the terms stated in the above screen shot)

a) Market Capitalization: Market capitalization is calculated by multiplying a company’s shares outstanding by the current market price of one share. This is used to tell us the size of the company, what are the future prospects of the company to grow further at a good rate.

I highly recommend you to please go through the videos of 2 min each for better understanding for these terms. Fun Learning!!!

http://www.investopedia.com/video/play/market-cap/?rp=i

b) Book Value per Share: This gives the per share value of a company by calculating total assets minus intangible assets and liabilities.

http://www.investopedia.com/video/play/book-value/

c) Price to Book Value: This is an important ratio to consider if the company is trading at expensive levels or not. This is mainly used for NBFC’s to compare the stock prices among its peers.

http://www.investopedia.com/video/play/price-to-book-ratio/

d) Price to Earnings ratio: This is one of the most important ratios to consider. Leaving the technical terms aside, this gives the “Confidence of the Investors on the Company”. High PE says, Investors are expecting the company to generate above average earnings for the longer period of times. Sometimes this confidence turns in “Over confidence” & if it happens welcome to the Bull Market.

Just to give you an example, during the time of Reliance Power IPO, the oversubscription of this went viral and people are ready to pay 5000 (Five thousand) PE for this company. This kind of ratios is highly unsustainable. If you ask me what PE is cheap and what PE is costly. These are mostly considered by Relative valuations and preferably from same sectors. (Read more about Reliance IPO here)

e) Dividend Yield: This is calculated by ratio between Annual Dividend per share to the current market price.

http://www.investopedia.com/video/play/understanding-dividend-yields/

f) Earnings per Share: The portion of a company’s profit allocated to each outstanding share of common stock. Very important metrics to look for.

http://www.investopedia.com/video/play/earnings-per-share/

Profitability Indicator Ratios: ROE & ROCE

g) Return On Equity: Another major ratio to look for. It tells how much profit a company generates with the money shareholders have invested. If explained properly, ROE alone can be a separate post.

http://www.investopedia.com/video/play/return-on-equity/

h) Return on Capital Employed: A financial ratio that measures a company’s profitability and the efficiency with which its capital is employed

ROCE = Earnings before Interest and Tax (EBIT) / Capital Employed

i) Piotroski score: This is an interesting number to know the fundamentals of a company. I have already written an article for the same: What is the Piotroski Score of Your Stock ?

j) Price to Free Cash Flow: A valuation metric that compares a company’s market price to its level of annual free cash flow. This is similar to the valuation measure of price-to-cash flow but uses the stricter measure of free cash flow, which reduces operating cash flow by capital expenditures.

http://www.investopedia.com/video/play/understanding-free-cash-flow/

There are much more ratios that this Screener provides, but as I told you, for the initial analysis of a company, these is good enough to start.

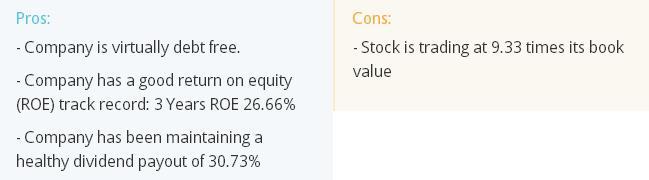

2) Later, it provides an amazing screen which states the Pros and Cons of the company.

3) In this screen, it provides the information of Individual stock performance vis-a-vis Index along with the shareholding pattern.

Only one small issue is, here we will not know if any of the promoter holdings have been pledged or not. This is critical information in terms of analyzing a company. Promoter pledging is not a good sign while analyzing the current condition of the company.

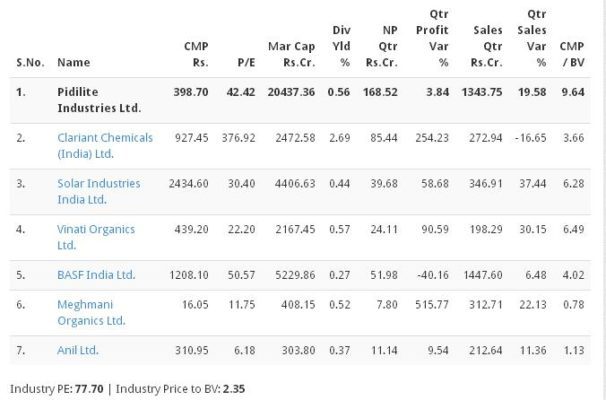

Peer Comparison:

4) Relative Valuation is very important for any company. This screen allows us to understand the financials of the company with respect to its peers.

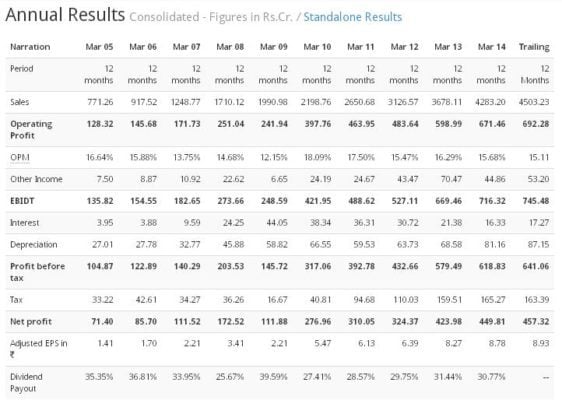

Financials (Income statement: Standalone & Consolidate):

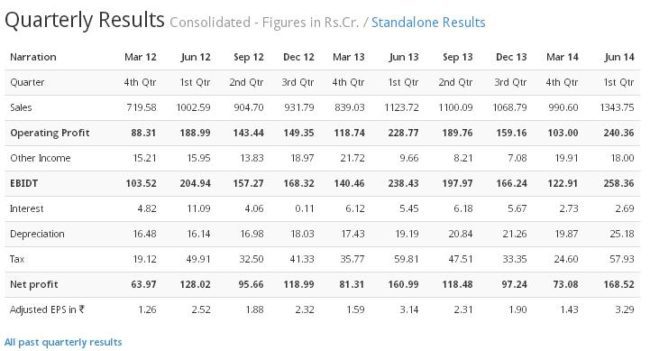

5) As already discussed above, this particular section gives us the first glance of the company’s financials on Quarterly & Annual basis for both Standalone and Consolidated.

As you can see below that some of the terms below are in “BOLD” which states the importance of it. Let’s have a quick understanding of them:

Operating Profit: The profit earned from a firm’s normal core business operations. This value does not include any profit earned from the firm’s investments (such as earnings from firms in which the company has partial interest) and the effects of interest and taxes.

http://www.investopedia.com/video/play/operating-profit/

EBIDTA: EBITDA is essentially net income with interest, taxes, depreciation, and amortization added back to it, and can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

http://www.investopedia.com/video/play/earnings-before-interest-taxes-depreciation-and-amortization-ebitda/

Profit Before Tax: As the name suggests, it is a profitability measure that looks at a company’s profits before the company has to pay corporate income tax.

Net Income: This is Very Very critical number to look for in the company’s Income statement. Net income is calculated by taking revenues and adjusting for the cost of doing business, depreciation, interest, taxes and other expenses. The measure is also used to calculate earnings per share.

http://www.investopedia.com/video/play/net-income/

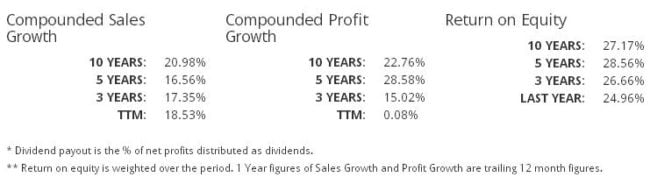

6) The other screen gives the compounded growth of Sales, Profits and ROE over 3,5,10 and TTM periods of time.

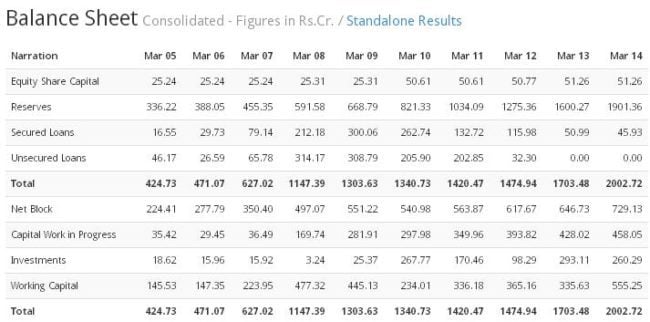

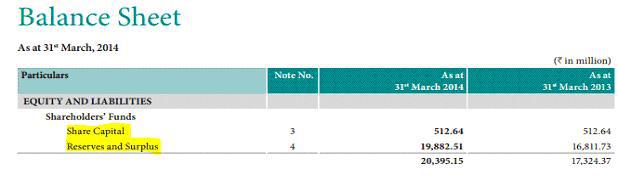

7) Financials (Balance sheet: Standalone & Consolidate):

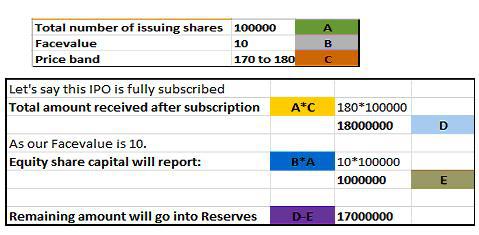

Let me take a moment and try to explain what is first 2 rows (Equity Share capital & Reserves) of any balance sheet tell us.

Example: Let’s say company ABC came up with an IPO and wanted to raise 10 crore rupees. It shares are prices at a band of 170-180 rupees with a Face value of 10 each. Total number of issuing shares is 1 Lac.

Working Capital: A measure of both a company’s efficiency and its short-term financial health.

Formula: Working capital = Current Assets – Current Liabilities

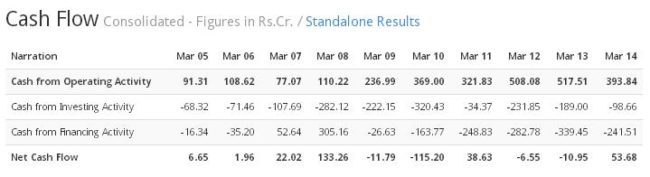

8) Cash Flow statement: Even though Cash flow statements are the critical ones to check where and how the money is flowing in & out. This gives info of Cash Flow from Operations (CFO), Cash Flow from Investments (CFI) & Cash flow from Financing (CFF)

Cash Flow from Operations: The amount of cash generated by a company’s normal business operations. Operating cash flow is important because it indicates whether a company is able to generate sufficient positive cash flow to maintain and grow its operations, or whether it may require external financing.

http://www.investopedia.com/video/play/operating-cash-flow-ocf/

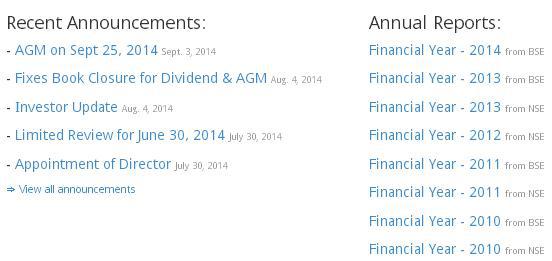

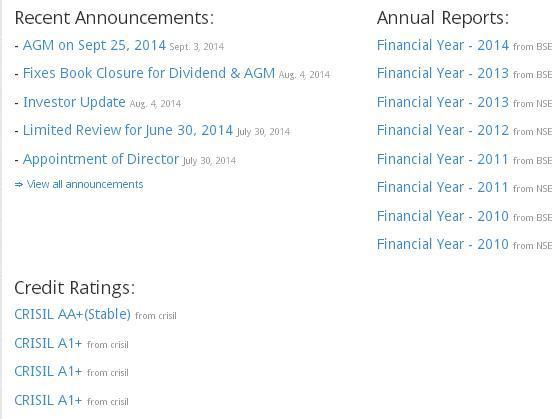

9) Recent Announcements, Annual reports & Credit Ratings:

This section gives the information on recent activities like AGM, Corporate actions like Dividends, Splits. It also provides us with the latest information of Annual reports and credit ratings for the Debentures or Bonds issued by the company.

Also, another great feature of this is, this allows us to export all the above information into an Excel sheet. It takes all the data from www.bseindia.com.

You can also customize many things and create your own stock wish list.

Go & Explore the amazing stuff available at www.screener.in

Also, if you care to, you can try out the Freefincal Excel Stock Screener

Happy Learning & Investing 🙂

~~~~~~~~~~~~

Do join me in thanking Krishna for a comprehensive review of a stock screener.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)