Last Updated on May 19, 2025 at 12:45 pm

This post is a response to a question posed to me by a PhD student: Everyone seems to be predicting that price of Bitcoin will increase by a lot in the coming years and it will become popular. So should I buy some (accumulate) now?

To answer this, let us discuss the economics surrounding bitcoins or cryptocurrencies in general. This is my 4th Bitcoin post. Previous posts are:

Three Reasons to avoid Bitcoin or any other cryptocurrency

Bitcoin: Is it a Ponzi Scheme? A Pyramid Scheme? Or a Bubble?

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Investing in Cryptocoin vs Trading in Cryptocoin

So my stand ought to be obvious: Do not “invest” in a currency, “trade” if you must and know what you are doing. If you are bitten by the crypto bug use it to fund dreams (not serious goals) – buy that i10 or that DSLR you always wanted from the gains.

Please remember a 500% return need not mean a lot of money. If you want to make a lot of money, you must be willing to “put in” a lot of money. Investing in crypto without understanding the basics of asset allocation and how to calculate it is like walking on a wire without training and a safety harness.

If you are a Bitcoin/crypto lover, do me a favour: Share this and/or the above posts in a popular cryptocurrency Facebook/Whatsapp/Telegram group and point out how stupid I am. Thank you.

Reactions to bitcoins are extreme (reactions to everything seem to be that these days). Most of the haters do not understand the technology and call it a scam. To me, most of the lovers seem to be intoxicated with the returns. Hard to differentiate a brag from fact from holier-than-thou.

I owe it to myself and my training and of course to you, the reader to be neutral with regard to cryptocurrencies. Extreme pessimism and extreme optimism can only mean ignorance – of risk or underlying tech. Reactions to my previous Bitcoin posts have been along expected lines: “you don’t know what you are talking about”. I am too old and too tired to react to such nonsense. I am more than happy to learn and will be first to acknowledge that I am wrong, but I need facts, and explanative opinions.

To reiterate, this is a post about bitcoin economics.

Before I sat down to write this, I got a 100 g slab of Amul unsalted butter for Rs. 47 from my neighbourhood supermarket. If that establishment were to accept bitcoins today, I would have (if I had any) paid 0.00013129 Bitcoins.

Now fast forward 20 years from now and assume butter will still be available and that the Rupee will still be around (will it?). At a conservative 10% inflation, the 100 g slab would cost about Rs. 316. Since Bitcoin is the future, we must not ask stupid questions like, “will Bitcoin still be around (in its current form)” and must assume it will be around and popular. So the question now is, “how much will the butter cost in Bitcoin, 20Y from now?”

The method to calculate is obvious – we just need to know the then INR-bitcoin exchange rate.

Now, we should be able to afford 100 g of butter 20Y from now in INR and therefore should be able to afford it in Bitcoin too.

My point is, if we view Bitcoin as a currency then the answer to:

If Bitcoin becomes expensive and popular in future, should I buy some now?!

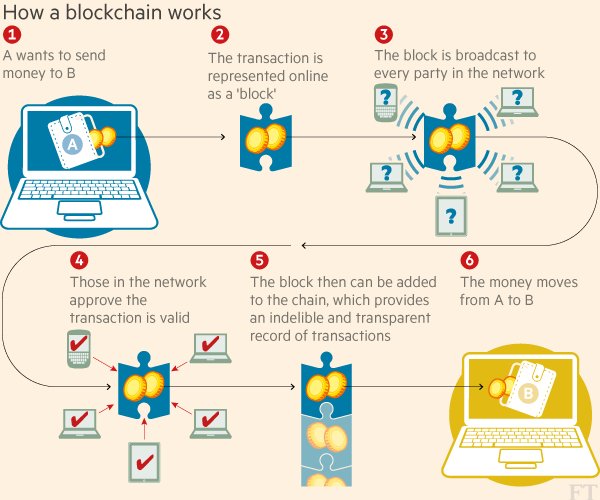

is NO – you don’t need to. Bitcoin is only a piece of code that three parties must agree as valid – you the buyer, supermarket the seller and the “miners” who will validate the transaction for a fee.

Seen as a currency, Bitcoin has no value other its face value. A Rs. 500 note is more worth than Rs. 500 (unless you hold antique notes).

If we view Bitcoin as an investment then the answer to:

If Bitcoin becomes expensive and popular in future, should I buy some now?!

Can only be speculation as the question itself is one of presumptive speculation (sorry Pankaj 🙂 ). Well to be fair, there is some intelligent guesswork involved behind projections that Bitcoin will soar in the future.

The nature of Bitcoin

To understand why, we must consider the nature of the currency. Bitcoin is a child of disgust. It was born as an alternative to government-controlled currencies which can be printed at will and which no longer have an underlying asset value (in gold). Gold was deemed too inconvenient under conditions of economic disasters because it would prevent governments to print more money.

The currencies we use every day are inflationary in nature. That is, as goods become more expensive, we can only buy lower and lower amounts with the same denomination. Such a price inflation (at low levels) is essential to keep the economy running. Without inflation, there will be no incentive to lend money and borrowing will become expensive as there is no time value of money at play (EMIs decrease in value due to inflation)

Under extreme economic conditions – eg. hyperinflation or hyperdeflation, governments can increase or decrease the quantum of currency being circulation to restore normality. Bitcoin is based on the idea that abrupt/manipulative changes in currency volume is harmful and should be eliminated.

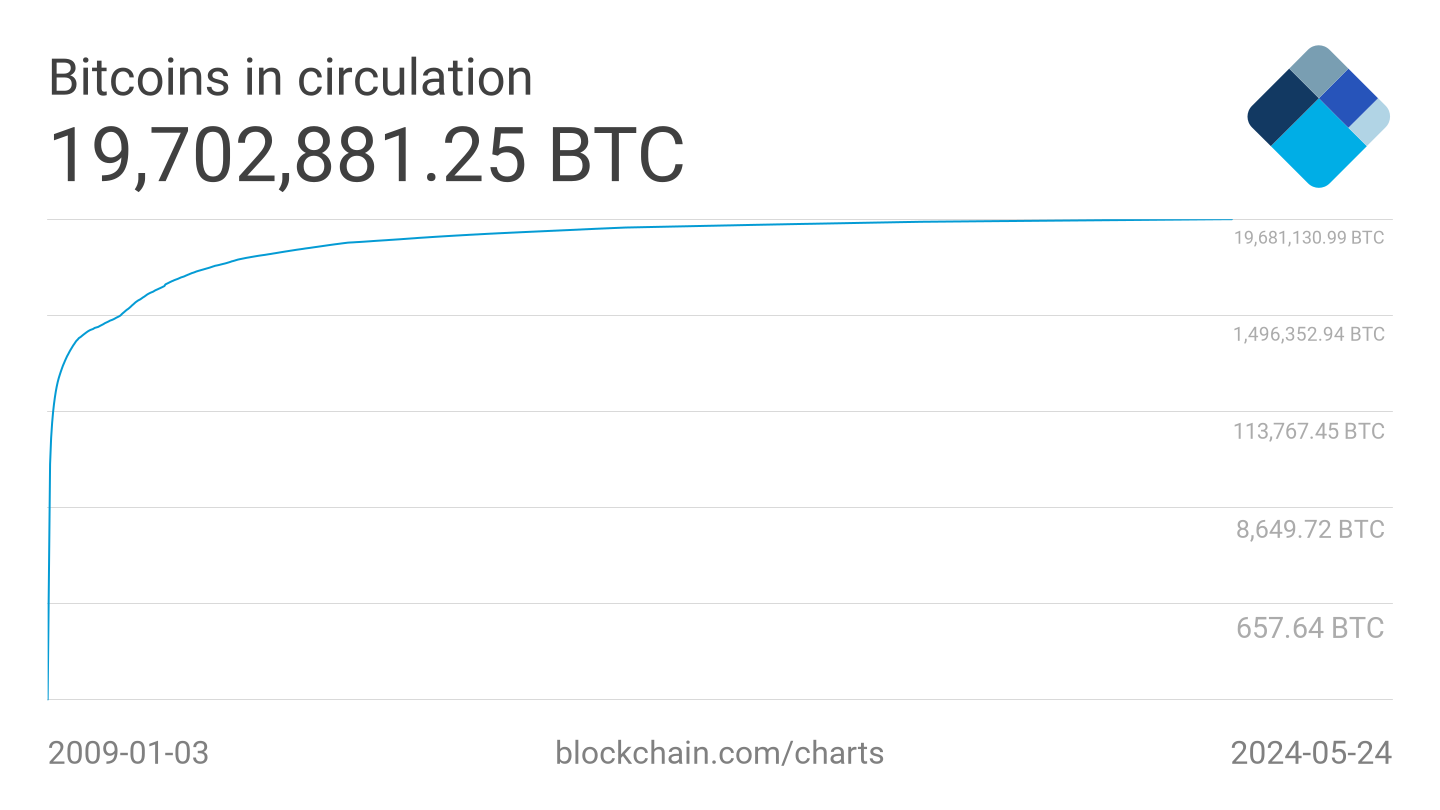

Therefore the number of total bitcoins that can be produced were limited to 21 million. This however meant an initial rapid increase in no of Bitcoins and decades of gradually slowing supply. Within a year of introduction 1 million Bitcoins were introduced!

Here is an interesting read on what happened to the Spanish economy due to a sudden influx of gold! Note that this does not apply to Bitcoin.

Why are Bitcoin investors confident?

The idea is if the total no of Bitcoins is limited, as demand increases, the Bitcoin value will increase. This is why Bitcoin investors sound so sure of themselves and welcome it with a chuckle each time a new party wants to transact in Bitcoin. As more people join the party, Bitcoin price is expected to soar.

So that it is it then? Should I drop everything and buy some bitcoin?

Hang on a bit.

A world with only Bitcoin

Imagine a world with Bitcoin as the only currency, our monthly salaries will not increase each year. Well, it need not increase as there is no inflation. The cost of goods will also remain the same. So will the cost of manufacture and profits.

With the same salary, we will be able to maintain our standard of living. Since the demand for goods will not drop, there will be an incentive for manufacturers to maintain production.

In order to maintain production, they will have to borrow capital. Since there is no inflation, the interest rate can be zero. The lender is also not deprived because there will always be people to give money to. As I mentioned before, it is a perfect form of communism. Everyone will live happily ever after.

If wars and human greed are thrown into the mix as possibilities, then this smooth cycle will get disrupted. How will a Bitcoin society handle that?

Is there a flaw in this picture? There could be, I am not an economist. If so, please correct me.

Even if flawed, there is one underlying assumption here which cannot be wrong: For people to be paid salaries, for them to purchase goods; for manufacturers to borrow and lenders to lend, there must be a free movement of Bitcoin. This is, of course, a necessary requirement of any currency.

A real currency: The situation in India

Now consider for a moment the situation here. According to an RBI press release dated Oct 11th, 2017, as on Oct 6th 2017, the currency with the public is 51.8% of the total reserve money.

The currency in circulation = currency with public + total deposits with RBI is 75.90% of the total reserve money. This is how liquid “real money” ought to be! See RBI definitions here

Would you believe that re-monetization abruptly removed about 86% of the currency in circulation as legal tender! Regardless of that being a failure or a success, we should be proud of each other, proud of the nation that we weathered that storm without panicking and revolting.

The trouble with Bitcoin

Bitcoin is an awesome idea and it will work in a world without human beings. Be it banks, corporations or the government or Bitcoin investors, there are Humans all round and they will muck up things one way or another.

According to Bitcoinprivacy.net,

There are 1,593 addresses with more than 1000.0 bitcoins, totalling 6,351,331 BTC, 38% of all existing bitcoins.

Two addresses have BTC >100,000

Another 116 addresses with BTC > 10,000

The remaining 882 addresses in the top 1000 had BTC >1,000

So clearly it is a case of few holding many. Is this a case of human beings exploiting a well defined algorithmic feature (limited coins => increase in demand = increase in price)? Or is a case of early miners holding most of the early coins knowing that their reward could drop and mining will become difficult in time?

While for a normal currency, regulation is centralized and holding is decentralized, for Bitcoin, as on date, regulation is decentralized and holding is fairly centralized.

A reasonable guess is that these guys expect the price to shoot up (and it has) as demand increases. So they are probably waiting to make a killing. Or they are Bitcoin idealists who prefer to transact only in a Bitcoin world. Or maybe they like the idea of buying drugs easily?! Your guess is as good as mine.

One thing is clear: Bitcoin was designed as a Peer-to-Peer Electronic Cash System. If you see Bitcoin forums, the “investors” argue that it is a commodity + currency and not a currency. I would like to think that the lure of returns has distorted the goal of bitcoin. After all, where there is a human, there is greed.

The biggest enemy of Bitcoin is not the Bitcoin hater, not the Bitcoin transactor, but the Bitcoin hoarder – make that hodler. HODLing is the new slang for hoarding.

For a currency to be successful, liquidity is essential – trillions of dollars are exchanged each day!

Bitcoin holding pattern cannot be so centralized if we want to buy regular stuff with it. How this holding pattern changes as the number of transactions increases will determine how successful Bitcoin works as a currency. As its value increases, new entrants will buy lesser and lesser units of Bitcoin (called Satoshis).

Then there is the thought of Wall Street wanting a piece of the Bitcoin pie, or in other words, large sums of a deflationary currency being purchased with an inflation currency make me quite uncomfortable. It feels like a trap!

Just before publication, I came to know of Aswath Damodaran’s viewpoint on Bitcoin:

The Bitcoin Boom: Asset, Currency, Commodity or Collectible? In this, he argues

bitcoin is not an asset, but a currency, and as such, you cannot value it or invest in it. You can only price it and trade it.

The Crypto Currency Debate: Future of Money or Speculative Hype?

Crypto currencies, with bitcoin and ether leading the pack, have succeeded in financial markets by attracting investors, and in the public discourse by garnering attention, but they have not succeeded (yet) as currencies.

Any resemblance to my viewpoints is purely coincidental and accidental!

There is one issue I would like to disagree upon: He says Bitcoin supporters think of it as a currency and detractors think of it as a collective. I think that the evidence suggests that many supporters think of Bitcoin as a collectible and as currency. That is, they perceive value in holding it.

My Stand

Just to reiterate, I strive to maintain a neutral stand as it the only way to learn more about fascinating blockchaining without bias.

Source: World Economic Forum: 5 questions about central banks and digital currency

I am not against Bitcoin. I think it is secure, solid technology and has the potential to revolutionalize the way we transact. There are better alternatives like Ethereum available too. I am not against Bitcoin trading either.

I am against Bitcoin hoarding: buy and holding as much as possible so that it can be sold when 1BTC = 1 Billion USD. That, I believe can (and has?) muck(ed) up a wonderful idea. There is still chance that some form of crytpo may turn out successful as a pure currency.

Which bring me to: If tomorrow, 1 BTC = 1 Billion USD and liquidity is reasonable, volatility will come down dramatically and therefore so will returns. You can still buy BTC. Just that 1 Satoshi will cost 10USD.

How will the miners behave?

I have always felt that there is something off about mining. There is always cost involved in every model. If the cost of inflationary currencies is manipulation by governments and banks, what is the cost of decentralization?

I will place my money on the cost of mining and validating transactions. Already there are articles about how unprofitable bitcoin mining is and then there is this: The electricity required for a single Bitcoin trade could power a house for a whole month.

It is my insignificant opinion that the cost of decentralization could well be the Achilles heel of decentralization. The incentive to ratify transactions should be money and not creating new money! When the supply dries up in one currency, the already rich miners could either call it a day or shift to a newer currency. The entry cost for new miners would then too high.

This control that miner can and do exert is a possible danger and couple with hoarding can prevent Bitcoin from ever realizing its true purpose (if ever there was one).

If a crytocoin enthusiast has bothered to read up to this point, your opinion please: the model of Ripple seems to be much better suited as a currency than as an investment. Ripple has a model in which some amount of coin is destroyed as a fee in each transaction. It is, however, a centralized currency and therefore trust will be lower.

Forget all this blah blah: should I invest?

Many readers may prefer to scroll right to this section. Well, if you are regret-monger and feel bad when your friends or contacts talk about the returns that they have made, buy some crypto for the sake of your health and peace of mind. If you are going to buy fractions of a cryptocoin (say BTC, ETH) it really means nothing to your wealth. If you are going to buy whole units of those (even gradually), then I hope you understand what you are doing and what you are getting into.

Hail Hydra!

I welcome criticism with an explanation of where and how I am wrong. Will not take blanket statements seriously.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)