Last Updated on February 19, 2022 at 4:56 pm

It is common knowledge that the Japanese stock market (often represented by the Nikkei 225) has been underwater since December 1989. That is, it kept falling (excluding minor recoveries) for about 23 years until later 2012. Since then it has seen a recovery. Many investors have asked us, “can this happen to the Indian stock market too?” A discussion.

In the 1980s Japanese housing market and stock market witnessed a bubble. With the full benefit of hindsight, there are treatises (see references below) on how the Central Bank of Japan got it wrong while handling the crisis.

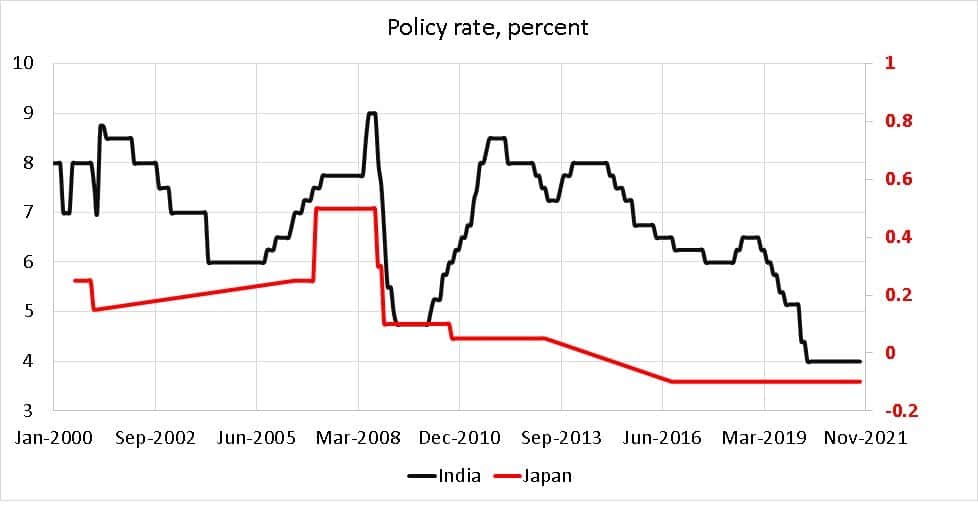

The bubble burst when the central bank decreased the money supply in the economy to control prices. That is, they removed money from the banks (eg. by selling bonds). This increased interest rates because there is not much money around. Then the bank sharply decreased interest rates (see image below). The rate kept falling and so did the inflation rate.

The Japanese refused to spend or invest because there was no incentive to invest and no incentive to spend. Readers may recall we had recently discussed this in FAQ: How inflation affects our ability to manage money.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Falling prices meant the Japanese thought they could wait a bit longer before spending to get even lower prices. This means consumption dropped and the demand dropped. This means the supply also must fall as there is no incentive for manufacturers to work. This is referred to as a liquidity trap.

Typically, lower interest rates would mean businesses will be eager to borrow. However Japanese banks had lost heavily on real estate investments when the bubble burst in 1989 and they were also nursing loan losses. So to stay afloat, they were refused to lend. This led to a credit crunch affecting both the supply of goods and their demand.

When people stay away from the stock market – spooked by the 1989 crash and falling inflation, when businesses are not increasing their profits (as demand has fallen), there is no way a stock market will move up!

The most important aspect that investors should keep in mind is that the return we get from an asset class is not independent of what happens with the rest of the economy.

The supply vs demand for goods and services, the inflation rate, the money supply, the interest rate, the rate of population growth (among others) decide future returns. This is why many analysts talk about real return (inflation-adjusted return) instead of a bare return.

Just because the equity market kept falling south, the Japanese did not suffer. They were living in a well-developed country by 1990 (remarkable considering the devastation during WWII). They have access to excellent public resources and infrastructure.

When it came to money management, things were easy. Inflation was nearly zero. There was no need for them to invest in equity! Interest rates were nearly zero so they kept the money under the mattress. Banks were reluctant to offer credit cards and the people did not need them. They happily spent cash.

The Japanese population also hit a peak and has since been falling! This means the demand for goods and services also keep falling or at the very least stay constant. This in turn keeps inflation low. Recall from our FAQ linked above that if there is a healthy demand and the rate of supply just falls below, a small health inflation rate ensures that the goods are not sold out.

There is no point in talking about poor Japanese equity returns without appreciating the context and circumstances in which they occurred.

Can this happen in India? As a possibility, yes of course it can. As a probability? Let us find out by comparing some common economic indicators of Japan and India. All graphs below are from the (paid) economic data aggregator theglobaleconomy.com.

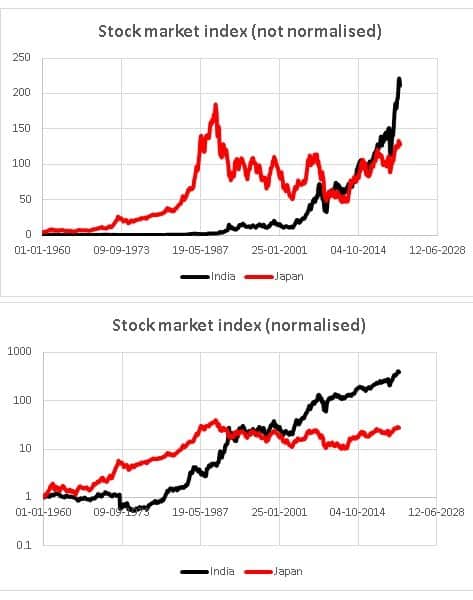

Stock market

The extent of Japan’s prolonged economic stagnation is best seen in its stock market. Since returns are uncertain, some amusing situations arise (reflecting the Nikkei 225 recently recovery): Nifty SIP provides 2% real return over 15 years but underperforms Japanese equity by 50%

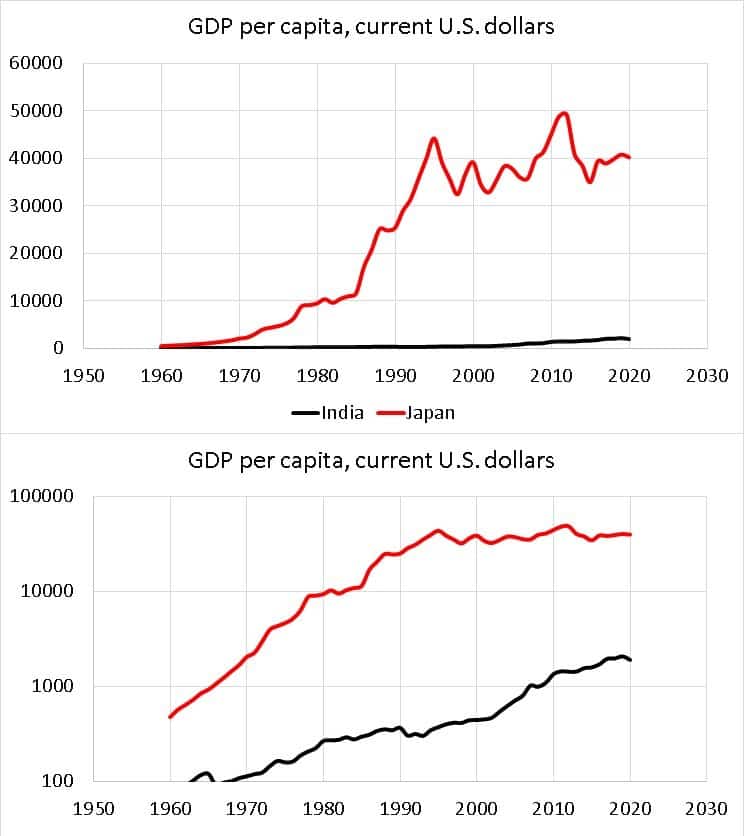

Gross Domestic Product (GDP) per capita

According to globaleconomy.com, “GDP per capita is gross domestic product divided by midyear population. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources. Data are in current U.S. dollars.”

Notice the difference in GDP per capita levels between India and Japan in 1990 at the start of their stagnation. The Japanese GDP has been range-bound since then in line with the overall stock market movement.

Even today the per capita Indian GDP is well below that of Japan. This means that there is a lot of scope for India to improve its GDP. Indian GDP can be expected to move up for the next 3-5 decades and this should reflect in our stock market. Global warming and climate change are bigger threats to our existence than losing money in a persistently falling stock market!

Can India fall into a middle-income trap and will this affect the stock market?

A middle-income trap occurs when economic growth fuelled by cheap labour and resources is not sustained when wages increase over time. The World Bank classifies India as a lower-middle-income country in terms of Gross National Income per capita ($1000 to $4000).

It transitioned from low-income to lower-middle-income in 2009. Currently, the value is 1920 USD (2020). The increase from 1000 USD to 2000 USD took about 11 years (2008 to 2019). We can expect the jump to upper-middle-income (> 4000) USD) to occur in the next 20-25 years. If this happens with a reasonable increase in GDP, we would have escaped stage I of the trap. Stage II is moving past USD 12000 and that is a long way away!

At the very least, we are about 25 years away from languishing in the middle-income trap. So we should expect reasonable stock market optimism and therefore growth during this time.

Whether this number reflect ground reality is arguable but this is not the place for it. It suffices if we agree that economic growth should be widespread. Everyone’s life should improve for the better. Otherwise only the rich would get richer and we fall into an income trap.

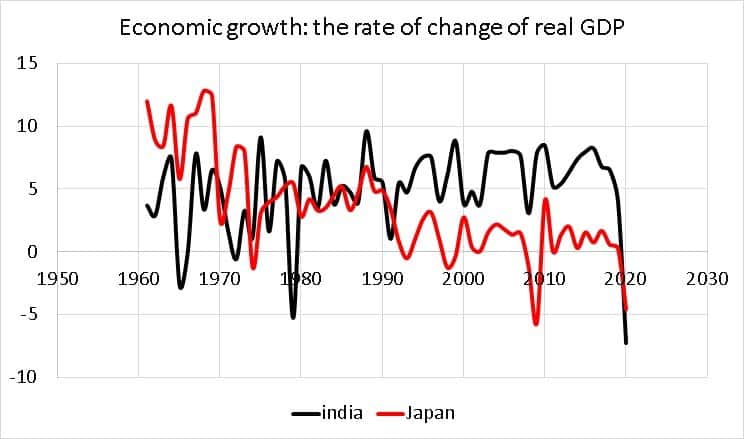

GDP Change

Excluding the consequence of the pandemic, the Indian GDP has been growing at a reasonable pace. The fall in the Japanese GDP growth rate is obvious.

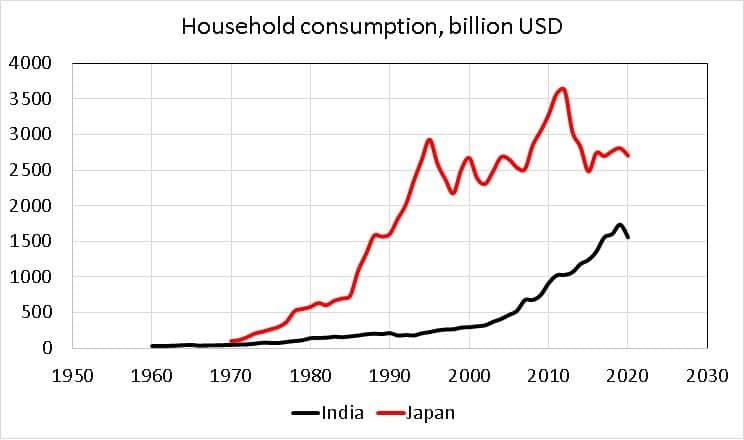

Household Consumption

According to globaleconomy.com, “Household final consumption expenditure (formerly private consumption) is the market value of all goods and services, including durable products (such as cars, washing machines, and home computers), purchased by households. It excludes purchases of dwellings but includes imputed rent for owner-occupied dwellings. It also includes payments and fees to governments to obtain permits and licenses. Here, household consumption expenditure includes the expenditures of nonprofit institutions serving households, even when reported separately by the country. Data are in current U.S. dollars.”

Japanese household consumption has mirrored its GDP. Without consumption, or without demand, businesses cannot profit and their stock prices cannot move up. Again there is significant room for improvement in the case of India. the only catch is, our economic growth should permeate to all social classes.

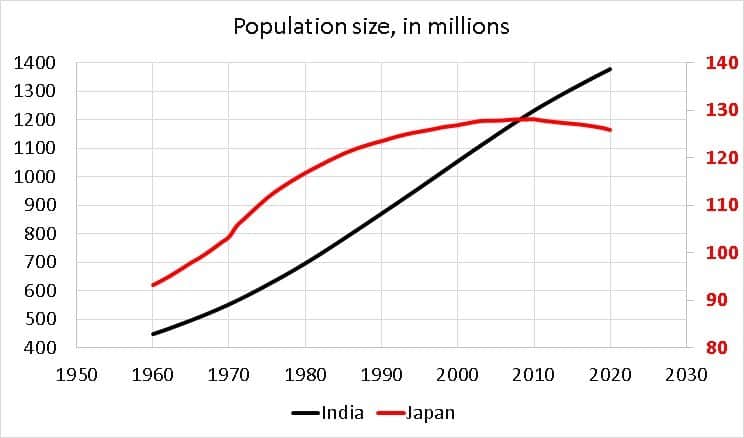

Population

Population plays a key role in driving demand. Our biggest evil is also our biggest strength. A growing population implies growing demand. Growing demand implies the supply of goods and services have to keep up. A health inflation rate keeps supplies from running out. Companies have the incentive to produce more, borrow more and profit higher than the rate of borrowing. This drives the stock market at a rate greater than inflation.

The Japanese population has saturated or has declined over the years. This means that the rate of supply can easily match up to the rate of demand without the need for inflation to intervene.

Our population rate implies that our stock market has enough potential to grow in the time to come.

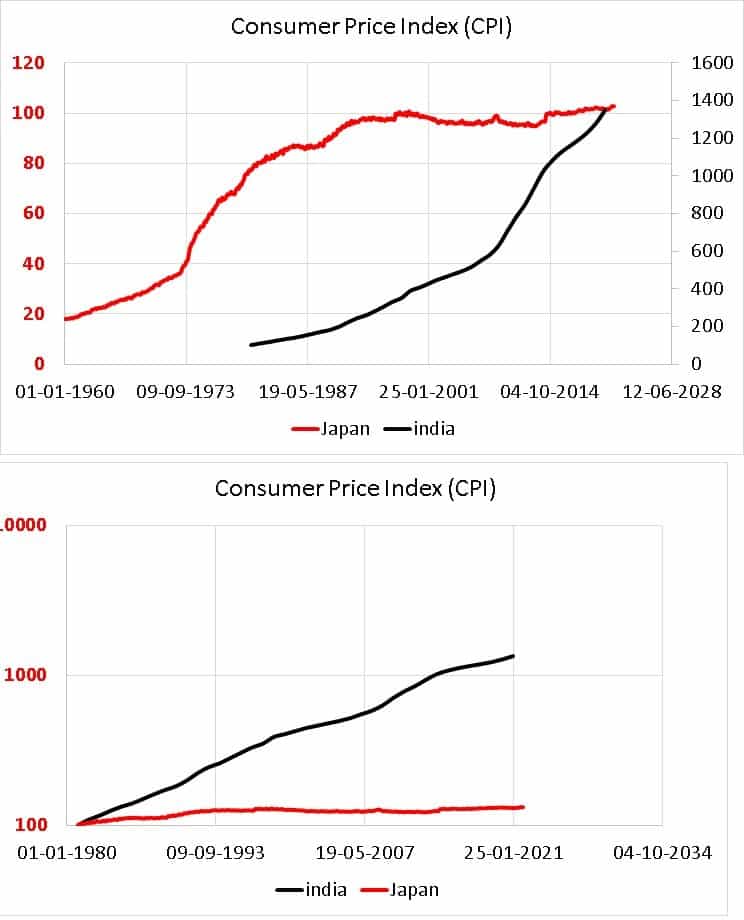

Inflation

As mentioned in the comprehensive inflation FAQ, inflation should neither be too high nor too low. The “Goldilocks zone” differs from country to country and also from time to time. For India, it is about 4-5% currently and we are getting there.

Consumer price index

The normalized plot shows different the Indian economy is different from the one in Japan.

Central Bank Policy Rate

Indian interest rates have gone down over the past decades (reflecting a drop in inflation). This means Indian stock market returns have also decreased – Ten-year Nifty SIP returns have reduced by almost 50%.

This is perfectly fine and healthy. As long as we have the right return expectations and review our assumptions each year, we will be able to beat inflation. See: Equity may beat inflation but that doesn’t mean you will!

In summary, the Indian economy is at a different place in its growth trajectory than the Japanese economy. Considering our population and area, we can safely expect our economy and therefore our stock market to improve in the next couple of decades.

So short answer to “Can the Indian stock market keep falling like the Japanese stock market?” is: A sustained equity downfall can happen in India as well but we are some distance away from it. There is no immediate fear of this happening. It must however be kept in mind that India does face the middle-income trap hurdle to cross after a couple of decades.

Equity investing is necessary only when there is healthy inflation and post-tax returns from fixed income do not beat inflation. When inflation hovers close to zero, there is no need to invest in equity or fixed income. Cash is king.

For the foreseeable future, Unlike the Japanese, Indians need to invest in equity and there is more than a reasonable chance that they will beat inflation over the long term (in other words generate a premium for the risk taken): Why should I invest in equity mutual funds when there is no guarantee of returns?

Investors must not fixate on X or Y return and appreciate that a return is relative to overall economic growth (or the lack thereof!)

References

- The Lost Decade: Lessons From Japan’s Real Estate Crisis

- The financial crisis in Japan during the 1990s: how the Bank of Japan responded

and the lessons learnt - Japanese asset price bubble.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)