Last Updated on October 8, 2023 at 1:32 pm

Is early retirement in India possible? Can a 45-year-old with ‘enough’ saved up, hang up his boots and avoid a full-time job for the rest of his life?

In this post, I do a feasibility study considering three different scenarios for early retirement to determine the most practical approach.

Early retirement is a phrase that has become extremely popular in recent year thanks to successful blogs like

- Early Retirement Extreme

- Mr. Money Mustache

- Getrichslowly

- The Simple Dollar

and many more that have cropped up by inspiration.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Many Indians get inspired by these blogs and seek early retirement without understanding the implications of inflation levels in India and what it actually means to a retirement plan. Some even have designed retirement calculators ignoring post-retirement inflation!

No one seems to understand how fragile their plans look on paper. So this post is to debunk some popular notions on early retirement and to provide a reasonably practical solution.

Early retirement is an extremely common dream. You long to say good-bye to your tough corporate job, tell your evil boss to f%%% off, begin an entirely new phase in your life!

Almost everyone dreams it, but only a few people decide to do something about it. Will those few succeed? How practical is it to retire early in a country where inflation is close to double digits?

Let try and answer these questions in this post by taking the case Brainy Smurf. Regular readers may recall we considered Grouchy Smurfs retirement planning with fixed and recurring deposits.

Brainy Smurf is a nerd who loves numbers. He would like to meticulously plan his retirement before quitting his job. He is convinced that with a frugal lifestyle and intelligent investing, he will be able to retire early in India.

Brainy Smurf explaining to Papa Smurf about early retirement while inflation is preparing to strike! Photo Credit: Vik Nanda

Note: Although this post considers early retirement is meant for everyone. All of us should understand why it is crucial to plan for retirement as early as possible and invest as much as possible – preferably, as much as you spend!

This is a lengthy post where we consider different scenario cash flow charts with graphs. I would like the reader to observe the cash flow charts and make their observations.

If you are serious about early retirement, you will need to spend extra time with the charts.

Let us now run through Brainy Smurfs numbers and check see where he stands.

Age at retirement: 45

Years in retirement: 45! (He assumes he will live up to 90)

Monthly Expenses: 20,000 per month. This is much lower than most Indian households. When you reach the end of this post, recall this fact and figure out what would the situation if monthly expenses are higher than this!

Annual Expenses: 20,000 X 12 + 20,000 = 2,60,000. We add an extra months expenses to account for health insurance, and other annual expenses. We are going to use these inputs in three scenarios:

- The Income drawdown strategy (decreasing corpus)

- The constant withdrawal rate strategy (increasing corpus)

- Using a perpetuity (constant corpus)

- Accounting for the unexpected

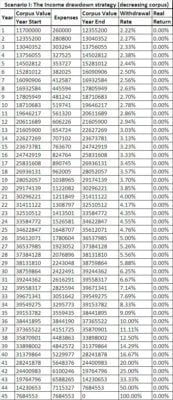

Scenario I: The Income drawdown strategy (decreasing corpus)

Inflation: 8%. Return expected on retirement corpus 8%. The real return is zero. That is our annual return is equal to the average rate of inflation. Using the “how much is required to retire?“ tool, we find that the corpus required is 1,17,00,000 or 117 Lakhs. Here is how the cash flow chart would pan out.

Notice how the corpus initially increases and then decreases when expenses become high due to inflation.

It becomes zero after 45 years. This is known as an income drawdown strategy. Brainy allows his corpus to grow at some rate (8% in this case) and withdraws from it each year to handle his expenses that increase each year with inflation (8% in this case).

The real rate of return =(1+return)/(1+inflation)-1 = 0%

Notice how the withdrawal rate = expenses/(corpus value @ year start), rapidly increases.

Myth: Withdrawal rate is a constant

Truth: Withdrawal rates are constant only if you plan for them to be so. In a drawdown strategy, the withdrawal rate cannot be constant even if inflation is assumed to be zero!

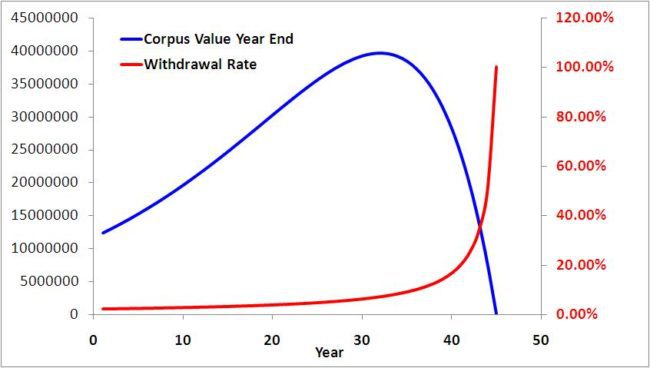

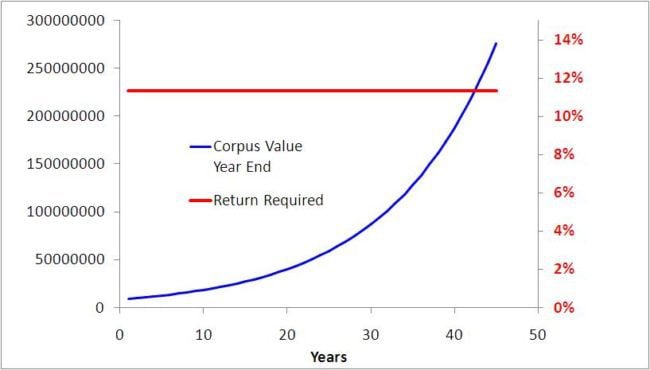

Scenario II: The constant withdrawal rate strategy (increasing corpus)

In this case, the percentage Brainy withdraws from a corpus at the start of each year is assumed to be a constant.

That is Brainy will need 2,60,000 in the first year of retirement. So assuming a withdrawal rate of 3%, he will need a corpus of 86.7 Lakhs to start with.

Notice this is considerably lower than the 117 Lakhs need in the drawdown strategy.

If inflation is assumed to be zero and for 3% withdrawal rate each year in retirement, brainy Smurf will only need a return of 3.1% on his corpus.

His corpus will not reduce in value and will remain 86.7 Lakhs after 45 years! Since inflation is zero, the real return = return = 3.1%

For an inflation of 3%, the return required = 6.2% and real return = 3.1% for each year in retirement to maintain the withdrawal rate constant at 3%

For an inflation of 8%, the return required = 11.34% and real return = 3.1% for each year in retirement to maintain the withdrawal rate constant at 3%

This is how the cash flow chart looks like

The top cell in the withdrawal rate column is green to signify that it is an input. This is how the corpus grows with time.

Lower the withdrawal rate, higher the initial corpus required lower the return.

For example, for a withdrawal rate of 5%, Brainy would need only 52 Lakhs to start with, but require an annual return of 13.7%

For a withdrawal rate of 1%, Brainy would need only 260 Lakhs to start with, and required an annual return of 5.3%. (Thanks to Satish for pointing out a mistake here)

So he needs to find an optimum withdrawal rate to keep the initial corpus and return required low.

However is this scenario practical? Can you manage a real return of 3.1% year after year for the kind of inflation that exists in India? Many of the early retirement fans seem to think it is not such a big deal!

Have to find out what they are smoking! One could argue that a real return need not be obtained each year in retirement, and it is some kind of average after a few years.

Point taken. However, we are talking the return for the entire corpus to grow. So even if we invest part of the corpus in equity and part in debt, how practical is to achieve an average real return of 3%? This would mean much of the corpus will have to be in equity.

So a couple of bad years and Brainy would be screwed.

They also talk of something called a safe withdrawal rate(SWR). This is the rate at which one can withdraw from a corpus taking into account volatility in its growth rate and inflation. All this talk of SWR is impractical in a high inflation rate scenario.

What one needs is a Safe rate of return. That is, before we actually retire, we should plan with a volatility-free return, that can be realistically achieved year after year in retirement.

After we retire, we should divide the corpus in different buckets and allow them to grow at different rates. Even then, the net portfolio return has to be realistic!

Resigning our job in the hope of achieving an unrealistic high net portfolio returns is madness.

Retirement math is simple. No matter when you retire, the math is the same. It is neither shocking simple, not alarmingly complex. You do not need concepts like SWR.

Prepare for the worst and pray for the best. To assume that withdrawal rate ( = SWR) will be constant in retirement, for high inflation scenarios is plain dumb in my opinion. I will leave you to be the judge.

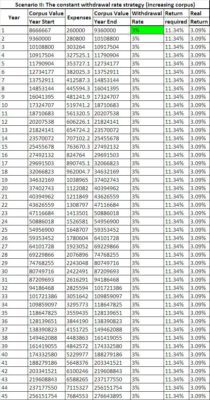

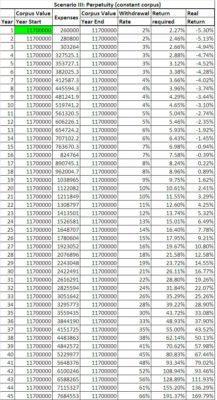

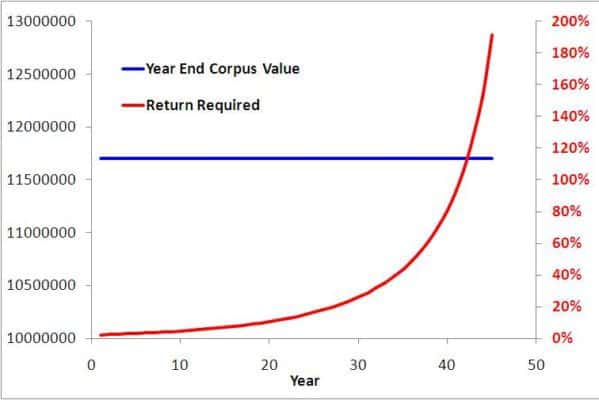

Scenario III: Perpetuity (constant corpus)

Perpetuity is nothing but an pension or annuity that is constant and forever. Such annuities are sold by insurance companies and last until the lifetime of the retiree.

If you want one to last forever (that is outlive you) your corpus will have to increase each year by the exact same amount that you withdraw.

Then the corpus will never diminish like it does in a drawdown strategy (scenario I), nor will it increase like the constant withdrawal rate strategy (scenario II).

When inflation is zero, scenarios II and III become identical.

Now with 8% inflation, if Brainy uses 117 Lakhs as the corpus required (same as scenario I), this how the cash flow chart pans out

The green cell indicates that corpus is an input in this case. Although the corpus is constant, notice the return required.

Notice the return required is low initially and the rapidly increases. Therefore, for nearly 20 years the real return is quite small and in fact negative for several years initially.

After that it is impractically large! So assuming again the idea of a perpetuity as it is defined will not work in a high inflation rate scenario.

Hey! Wait a minute, the return required for the first several years is too small. Why can’t Brainy assume a higher rate of return? He sure can!

Only that it will not become a perpetuity then.

For example. If the rate of return required is an achievable 8% (= inflation rate) for all 45 years, then you will simply reproduce scenario I. That is the corpus will reduce to zero.

If you take the rate of return is higher than the inflation for all years in retirement, you will reproduce scenario II: the corpus will increase. Again, the question of how practical this is, looms large.

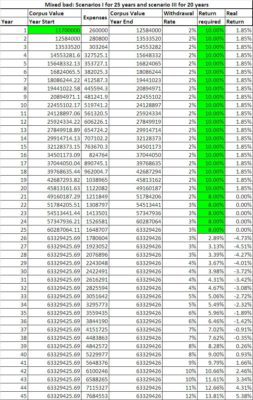

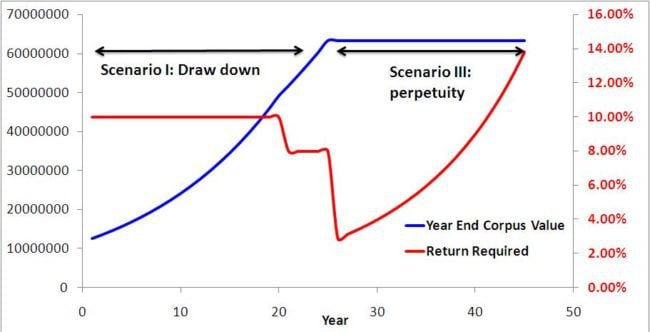

Mixed Bag Scenario

What if we combine Scenarios I and III? That is choose 10% as required return for first 20 years in retirement (real return 1.85%, still a tall order but barely manageable), 8% as required return for next years (real return is zero since inflation is 8%) and then plan for a perpetuity

. That is we choose scenario I for first 25 years in retirement and then switch to scenario III for the last 20 years. Here is the cash flow chart

The green cells as usual represent the variables. Notice that return required is now just about manageable for almost 41 years in retirement. That is a reasonably good achievement.

Notice how the scenarios are combined. We have used the fact that the corpus grows in the initial phase of scenario I and combined it with the constant corpus perpetuity in scenario 3.

The region in scenario I when the corpus starts to decrease has been avoided. This provides a reasonably manageable scenario. The starting corpus used is the same as in scenario I: 117 Lakhs.

Scenario IV: Accounting for the unexpected

Phew! If you have made it to this point, thank you very much!

Now, all of the above are scenarios on paper. Life does not work quite like that.

Trouble with the early retirement extreme folk (including Brainy) is that they think frugality and DIY can solve all problems of life. This is nonsense.

You may want to be frugal, but life may not allow you to do so. You may think you have your expenses in control when an unexpected recurring expense can wreck havoc on your plans.

Banking on frugality to defeat inflation is dumb. Yes, frugality will help you combat inflation but you will also have to take into the ups and downs of life. I can tell you with the full benefit of hindsight that a frugal lifestyle has helped me keep expenses in check. I cannot however assume that it will continue to remain the same.

I may buy only what I need, but that can change with time!

We have already discussed the trouble with banking on real returns after retirement.

So what does this mean for Brainy? What scenario should he choose?

Brainy should plan with a drawdown strategy – this is the standard used in all retirement plans. When it comes to implementation he should choose the bucket method which in some sense a variation of the mixed bad scenario discussed above and try to prolong the life of the corpus as much as possible without taking undue risks.

Bottomline: Do not hate your job too much! If you are not assuming realistic rates of return and inflation, you will not able to retire as early as you think.

Besides if you don’t know how to spend your time in retirement, why bother retiring? Your time would be better spent investing wisely and enriching your skill set.

Dear Brainy Smurfs, Get real!

Do not retire early if your corpus is lesser than that given by the drawdown strategy with reasonable inputs.

What do you think? Do you think it is possible to retire early in India?

What if the expenses were higher than that assumed here?

Download free e-book: E-book: How to retire early in India

=-=-=-=-=-=-=-=-=-=

You Can Be Rich Too With Goal Based Investing is now 30% OFF at at Flipkart . The Kindle edition(you can use the free app to read it). is available for only ₹90.74. The Google Play Store editionOpens in a new window (read on PC/Tab/mobile) is also available for the same price. Grab them before the offer ends!

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)