Last Updated on December 28, 2021 at 6:34 pm

As readers may be aware, fee-only India (FOI) is an organisation to help investors with their money management and fee-only advisors with knowledge sharing and support in their journey. Our first meeting and launch were on Sep. 2017. Out second meeting was organised by Piyush Khatri (Shahasta Financial Consultants) and held at his office on 25th March. FOI is also an idea conceived by Piyush. Both Ashal and I attended the meeting. Here is a report.

Who is a fee-only advisor?

A professional who reviews your money situations tells you where you stand, understand your future needs and goals and help you work out a plan for the same and recommends commission-free products for the same is a fee-only advisor or fee-only planner. Such advisors are registered with SEBI as an investment advisor (SEBI RIAs).

FOI members are fiduciary in nature. That is they work for you and only for you. Everything that they do is for your benefit alone. It is unfortunate that many SEBI RIAs have tie-up with insurance and mutual fund distributors (sometimes a dad, mom, son, daughter, wife, the husband is the sales guy). So they are not pure fee-only planners. Investors need to careful. Do not get misled by “SEBI registered investment advisor”. That means nothing if they get commissions “on the side”.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

What is more, there are organisations and associations which train such advisors on how to exploit regulation wordings and still earn commissions. Investors/clients/advisees need to be wary of advisors from such training schools. And advisors who have the self-confidence that they can make a good living from client fees alone and be working for the client alone, should “get out” of such associations and come be a part of FOI. We have the expertise of many advisors who have suffered alone and made it big. They will guide towards a position of respect and wealth.

Who can be part of fee-only India?

1: Has to be registered with SEBI as an investment advisor. Registration as an “individual” is preferred. If you have a “corporate registration” then they should not have any link up with any mutual fund or insurance selling agencies – directly or indirectly.

2: Should not suggest any products that result in commissions to them

3: Should preferably charge a flat fee and not as a percentage of AUM. Any client with a small bit of common sense will not stay long if they see their fees grow with the AUM.

4: Must be willing to work with the client and educate them on money matters.

5: Should be approved as “suitable” by senior FOI members (advisors). Suitable as in, someone who has the temperament and drive to work as a pure fee-only advisor.

The participants of the second fee-only India meet

From left to right (Standing): Sudheer Variar*, Brijesh Vappala*, Chandan Singh Padiyar, Piyush Khatri, Melvin Joseph, Nagarjuna*, Avinash Lutharia*. Sitting (left to right): Aniksha Lanjewar*, Swapnil Kendhe, Ashal Jauhari, Pattu (yours truly), Vikram Krishnamoorthy.

* Sudheer (Bangalore) and Avinash (Bangalore) are at different stages of obtaining SEBI registration and are just about to begin their practice. Brijesh (Palakkad) got his registration in Oct 2017 and has begun. Nagarjuna is Piyush’s colleague. Anshika is Swapnil’s colleague and better-half.

Member websites: Melvin Joseph (Mumbai): finvin; Chandan Singh Padiyar (Pune): Padiyars.com; Piyush Khatri (Hyderabad): Sahastha.com; Swapnil Kendhe (Nagpur): vivektaru; Vikram Krishnamoorthy (Coimbatore): Insightful; Two members: Shilpa Wagh (Mumbai): Waghfinancials and Sukhvinder Sidhu (Karnal, near NCR): Finlifecare.com. could not attend due to personal reasons. Ashal of course, runs FB group, Asan Ideas for Wealth

Want help with your money management? Get into touch with one of the planners listed above. Location does not matter. See: Here is why you can safely consult a fee-only advisor living in another city Please note that neither Ashal nor I get any kind of compensation for this.

Fee-only advisor journey

Check out some inspiring stories:

Fee-only Advisor Journey: Melvin Joseph’s determined struggle to the top

Fee-only Advisor Journey: Shilpa Wagh’s “money personality” lessons

Fee-only Advisor Journey: Sukhvinder Sidhu’s unwavering principles

Fee-only advisor journey: Swapnil Kendhe’s successful transition into a SEBI RIA

So what was discussed at the 2nd FOI meet?

Every participant shared their journey. How they came to become or wanted to become fee-only advisors. Melvin talked about his journey, the mistakes he made, his struggles and how he managed to go from a couple of years of losses to profit. In other words, from survival to living to thriving. Vikram talked about his approach to dealing with clients, how to manage time effectively, how to be productive, how to track and analyze time and effort spent with each client and how he keeps expenses at a minimum.

Swapnil spoke about how he uses Google sheets to keep track of the action items suggested to clients and how his wife and colleague helps with the implementation for local clients. Chandan talked about staying relevant in the time of big data and AI. Brijesh gave his take on handling demanding clients with easy access to knowledge/information. Ashal spoke of his role in connecting advisees with advisors as per their expectations and mindset. Piyush talked his experience in handling clients and the weird situations he has faced. I as usual spoke about the importance of visibility and building organic leads.

Visibility has two components: Passive visibility a clear website which explains the service beyond any doubt as Vikram pointed out. This will ensure better conversion of lead. Active visibility: Regularly writing topical content that showcases our competence. Today this need not be a blog. An intelligent set of tweets will do the job.

Avinash discussed his return assumptions while arriving at a corpus. And that is as far as my memory takes me. Forgive me if I am forgetting something. Thank you Piyush and Nagarjuna for the excellent arrangements that included excellent Hyderabadi biryani.

What does it take to be a successful fee-only advisor?

I think anyone who cannot sell a financial product or anyone sick of selling products can consider fee-only advisor as a career. Melvin, Vikram and Piyush took a few years to become established. As pointed out by Piyush, they worked in isolation not knowing whether their next move is right or wrong. The next generation of fee-only advisors need not go through that suffering. This is the main aim of fee-only India.

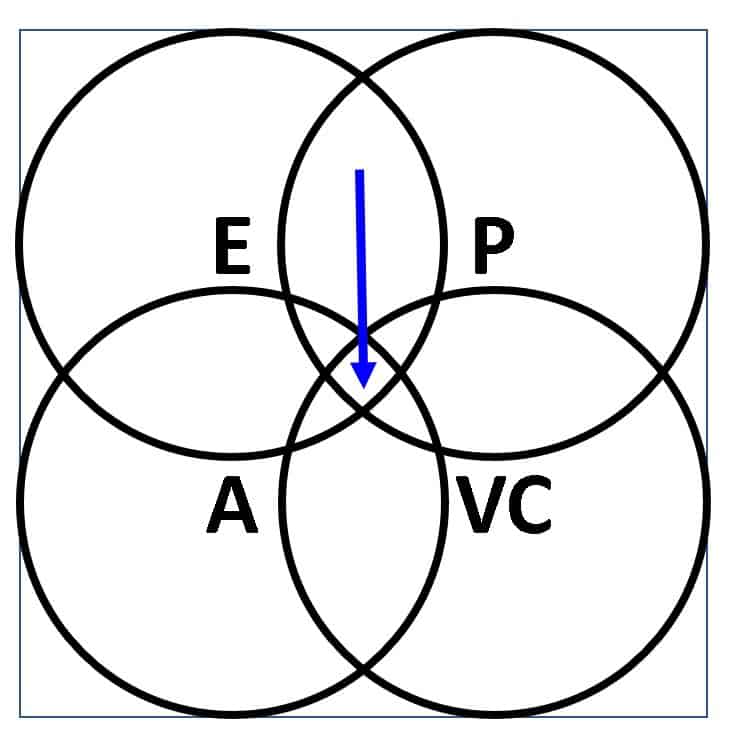

If you do not want to sell products, have the clients best interest in mind (ethical-E); have the passion (P) to work with clients and help them with their goals and money management, recognise the need to run an affordable (A) business (affordable for the client and affordable for you), recognise the need to systematically showcase your competence (via blogs, in social media etc) that is build visible competence (VC), then you can begin your journey to the intersection of E,P,A and VC as shown below.

From my experience, successful fee-only advisors start from being passionate and ethical and work towards the centre. This is what the members of FOI have achieved. Their income is built on the trust of their clients. As Swapnil said, anyone with competance and commitment can become a successful fee-only planner. Clients are willing to pay for good sincere advice. You just need to know how to find them. It will not be easy. The above Venn diagram is three dimensional. The centre is a peak. More like the top from inception. Your goal is to get there. Many have. Come be a part of fee-only India either as a client or as an advisor. Get in touch with one of the planners listed above for guidance.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)