Last Updated on September 27, 2016 at 2:47 pm

Whenever there is a discussion on stocks versus fixed income, someone or the other would say, ‘volatility is short-term but growth is long-term. One can expect the markets to always rise over the long-term. So buy and hold’.

To this, someone or the other would respond, ‘have you not heard of the Nikkei 225’? Stop being so optimistic about stocks. What stops the same from happening in India?’

During one such discussion (I don’t remember the details) in the facebook group, Asan Ideas for Wealth, the group owner, Ashal Jauhari, remarked, ‘I would like to see how a SIP in the Nikkei 225 would have fared’. So here goes.

Japan is one strange country. If you keep the money in a bank, you would get no returns!? The current interest rate hovers around zero. That is the banks have a zero interest rate policy.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

This is more or less in line with the inflation movement

Notice the extended periods of negative inflation or deflation (thanks to Ramesh Mangal for pointing this out in a different context).

Both these point to an economic recession. The Wikipedia article on deflation, lists the reasons for deflation in Japan, which includes a stock and real estate price bubbles in 1989.

What ails Japan? is a fine, easy-to-understand article about the whole situation.

According to tradingeconomics, “The Nikkei 225 Stock Average Index is a major stock market index which tracks the performance of 225 top rated companies listed in the First Section of the Tokyo Stock Exchange. The Nikkei 225 has a base value of 176.21 as of May 16, 1949”

source: tradingeconomics.com

Notice that the index has not recovered from the peak of 1989 and is currently close to its 1986 value! Downward-sloping oscillations from 1989 to 2003 and then a more flattened sideways movement.

Would the SIP work under such circumstances? Let us find out.

Yahoo Finance lists Nikkei from Jan. 1984. An ongoing monthly SIP of 1000 Yen started in Jan. 1984 would be worth 3,82,130 Yen on 10th June 2014 corresponding to a total investment of 3,66,000 Yen.

A CAGR of 0.28%.

Here is how the investment would have evolved.

That does not paint a pretty picture does it?

Now let us look at how the CAGR varies for monthly SIPs started in January from 1984 (30 year Sip) to 2014 (6 month SIP!).

The CAGR and the year in which it was started are plotted in red (right axis and top horizontal axis). The evolution of the Nikkei is plotted in blue.

For SIP durations of 10Y and more the CAGR is 5% or less. Only recently has the returns sharply picked up. Would it stay that way or will history repeat itself is anybody’s guess.

Here is a curious piece of statistic that I cannot resist sharing at the cost of flogging a dead horse. I could get hold of monthly MSCI Japan data from the MSCI website.

“The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market. With 320 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Japan” – MSCI.com

Here is how an ongoing monthly SIP started on 31st Dec. 1969 would have evolved

That looks better doesn’t?

Unfortunately, the CAGR is 2.94% !!

So what? What is the point of this post? Let us first head back home and then try(!) to answer this question.

Sensex

Here is how the CAGR varies for monthly SIPs stared in April from 1979 (34 year Sip) to 2008 (5 year SIP!).

- The Sensex has been plotted on a logarithmic scale (blue; left axis) to display the features conveniently.

- The red curve represents the CAGR from the start year (red upper horizontal axis) to 3rd July 2014. Notice there is very little spread in returns. That is returns of a 34 year SIP is high and not very different from a 10-year SIP. This, unlike the situation in Japan, is indeed very comforting.

- Notice the region indicated by the black line. After the Harshad Mehta scandal, compounded by liberalization(?) and unstable governments among others (I am not aware of), the Sensex moved sideways from Mar 1992 to Dec 2002. Thus like Japan, India has had a ‘lost decade’ as well.

- A monthly SIP of Rs. 1000 between Mar. 1992 to Dec. 15 2002 would have resulted in a loss. Total investment: Rs. 85,000. Value: Rs. 82,778. CAGR: 0% (that is Excel politely telling you that returns cannot be calculated when the net cash flow (value – investment) is negative!). See more about limitations of XIRR here.

- A monthly SIP of Rs. 1000 between Mar. 1992 to Dec. 15 2003. Total investment: Rs. 94,000. Value: Rs. 1,47,303. CAGR: 7.6%. Post-tax CAGR ~ 6.8%. Prior to 2004-05, there was no distinction between long-term capital gains from equity and debt. Thanks to Sundaram Anathakrishan for clarifying this. Thus, the SIP would have barely managed to beat a 10-year FD started in 1992.

- Although the Sensex moved sideways, was it all doom and gloom for the Indian stock investor ? That is, did every stock investor suffer? I can’t comment on this.

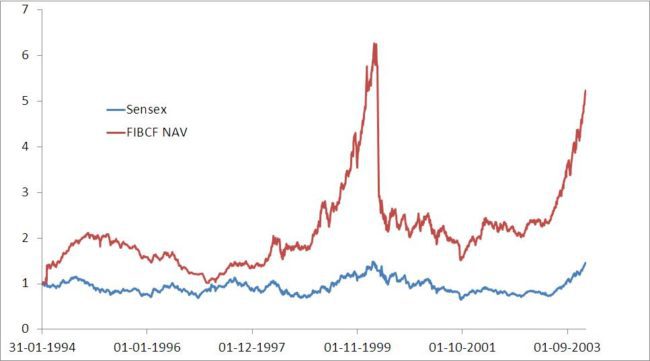

- The old racehorse Franklin India Blue Chip did not exactly do well in this period and was highly volatile.

- Monthly SIP from 7th Jan. 1994 to 7th Jan. 2002; CAGR = 2.6% (pre-tax!)

- Monthly SIP from 7th Jan. 1994 to 7th Jan. 2003; CAGR = 5.4%

- When the sideways period ended, monthly SIP from 7th Jan. 1994 to 7th Jan. 2004. CAGR = 19.96%

At the cost of stating what is obvious by now, SIPs do not work in a sideways market.

Averaging implies the presence of both ‘good’ and ‘bad’. If there is only ‘bad’, the average cannot be ‘good’!!

So what is the point of this post anyway?

When HDFC Equity and Top 200 hit a rough patch not too long ago, it was not gloom and doom for the entire industry. Yes, the market was moving nowhere but many funds, Quantum Long Term Equity, ICIC Focussed Blue Chip, ICIC Pru Dynamic etc. flourished.

Therefore, the investor had a choice to shift to other funds.

What if there was no choice? What if the entire market moves sideways?

Is this possible? Why not?

Did this happen in Japan? Did no Japanese stock investor make a killing during the last 15-20 years? I do not know.

All I do know is, that we can also have a real estate asset bubble like Japan did. This could well spill over to stocks. We could also have a prolonged sideways market.

Even the eternal optimist cannot hold on to his stocks or funds and sustain a sideways market or a recession forever.

The point is equity investing is done with a certain optimism. Even a die-hard pessimist like me, holds on to this optimism.

However, when the shit hits the fan, optimism is the first out of the door.

Let us look at the ‘Investment in MSCI Japan’ graph again.

What can you infer from this?

To blindly repose faith in the ‘buy and hold’ strategy will have to be called hindsight bias!

Buy-and hold will work only if the optimism rings true.

I do not think one should invest with bare unprotected optimism.

To protect the fruit of growth and compounding is the single most important task in the accumulation phase once investing begins.

The uncertainty of future market movement is the best reason to focus on goal-based investing:

- How long will my corpus support me now if I quit my job.

- How long will my corpus support me if I retire as intended

- If my net portfolio CAGR in line with my expectations?

- If it is too high, can I quit while I am ahead and shift to less volatile instrument?

These are the kind of focussed questions that lead to better decision and lower losses.

Should one also adopt tactical asset allocation strategies in-line with goal-based investing?

A look again at the MSCI Japan graph and my answer would be yes.

Easier said than done though! Thankfully not impossible.

What do you think?

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)