Last Updated on October 1, 2023 at 9:22 pm

One sector and market that has always attracted the attention of both investors and customers is the Telecom market, and rightly so the market has gone from a transformation in the past 2 decades in terms of technology, customer reach, telecom service providers, services and whatnot.

The question that investors often ask is whether there is any juice left in the Indian telecom space and if it is still worth owning a telecom stock after an exit of even global telecom behemoths from the Indian telecom market.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Should you sell ITC and book losses? (5) Stock analysis: Are Tata Consumer Products share worth a buy?

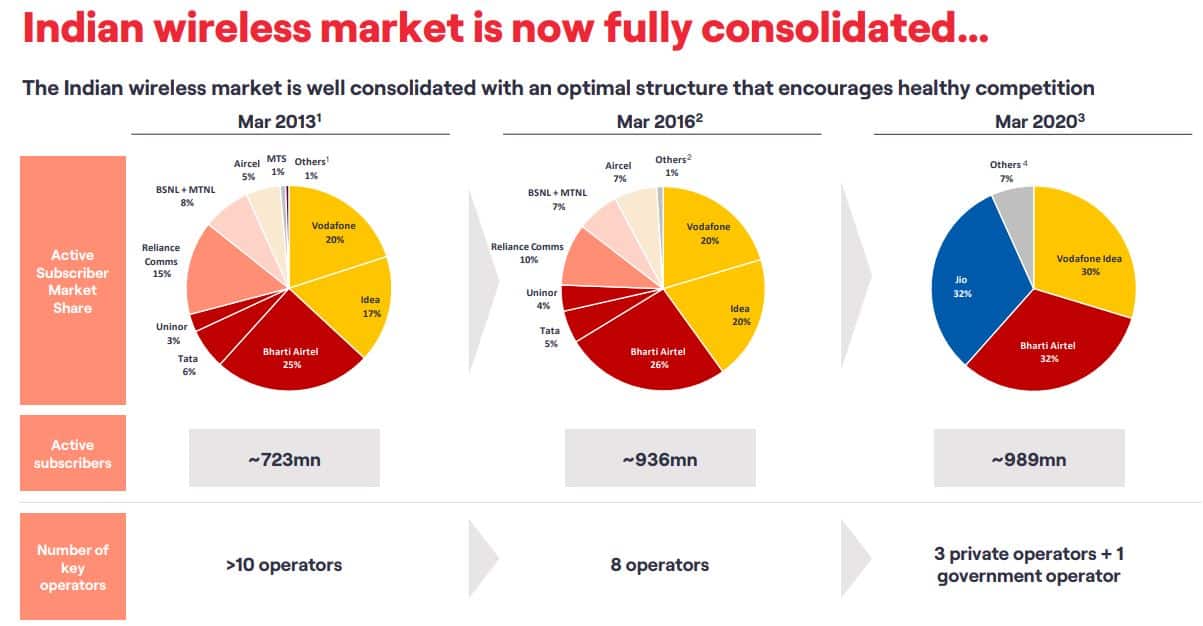

Before we could answer the question, we need to dig into data to analyze the situation. Let’s take a look at the Indian telecom market first. This is how the Indian telecom market has evolved over the past decade.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Key Observations:

- The market has not only seen the exit of some of the leading business houses like Tatas but also has seen consolidation into the hands of a few key players.

Notice the impact of fierce competition on the leading global players in the Indian Telecom market.

- Tata Indicom

- During 2009 → “We have been adding 2 lakh customers on a gross basis per month in the region,” said Sanjiv Sinha, regional head of the eastern region. Source: Tata Indicom to maintain 11% market share in the east

- During 2018 → Tata Indicom Shuts Down in Delhi: Can Users Port From CDMA to GSM?

- Telenor Group

- During 2009 → Uninor services launched in India

- During 2013 → Uninor shuts telecom operations in Mumbai from midnight today.

- Tata Docomo

- Once eyed as the most lucrative growth market in the world has now turned sour for even the big business houses which had to either shut the shop or surrender licenses, which of course came at a huge price itself. [Reason: Upfront Spectrum costs for 10-15 years to paid through cut-throat competitive auctions even before the cash starts flowing in]

- The consolidation of the telecom market happened at the time when the number of subscribers kept growing consistently, which itself is a case study for management students.

- The catalyst of this consolidation was the entry of newest player into the ‘game,’ i.e. Reliance Jio which offered 4G data rates at one of the cheapest price bands in the world and completely changed the way data was consumed by the subscribers.

- Vodafone and Idea chose to merge the business and balance sheets to save the backend/infrastructure costs and to become more efficient by cross-utilization of the spectrum.

- PSU companies [BSNL & MTNL] could not survive the onslaught as well and chose to merge the business to efficiently utilize the priciest part of the story, i.e. Spectrum.

- Fast-forwarding to FY21: if you are a telecom service user, then you are saved with the effort to choose from a variety of service providers.

- Investors are left with even fewer choices:

- Bharti Airtel [the only surviving company which started operations in 1996]

- Listed as Bharti Airtel Ltd.

- VodafoneIdea [Merged entity after Vodafone acquired Hutchison Telecom’s 67% stake in Hutchison-Essar]

- Listed as Vodafone Idea Ltd

- Jio [Company owned by Conglomerate Reliance Industries Ltd]

- RIL planning listing of Jio Platforms

- Source: Mukesh Ambani Prepping Overseas IPO For Jio.

- BSNL [Stated owned Telecom company]

- Unlisted

- Bharti Airtel [the only surviving company which started operations in 1996]

Bharti Airtel: Financial Performance

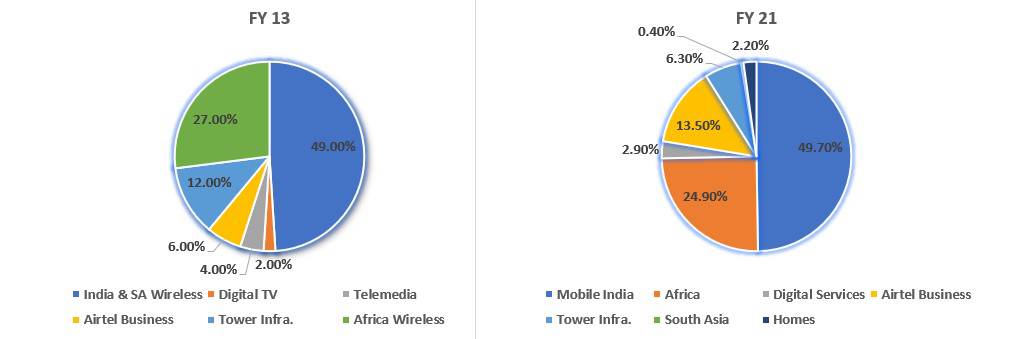

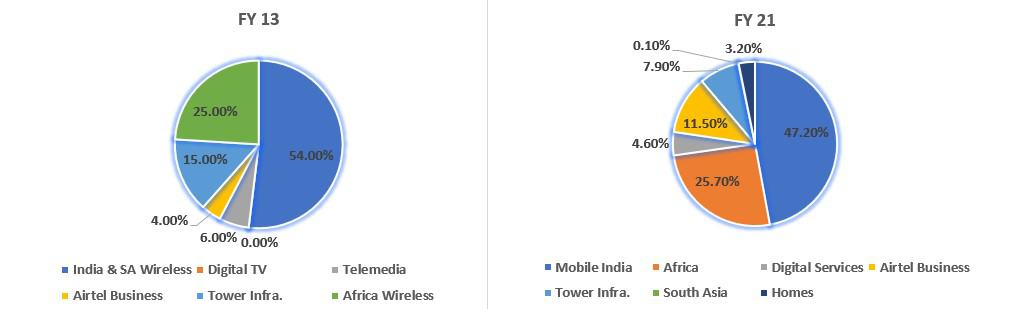

Moving on: let us analyze the company in focus, i.e. Bharti Airtel Ltd: The company is engaged in the following businesses:

- Mobile Services

- Digital TV

- Tower Infrastructure

- Airtel Business

- Home

- Payments Bank

Digital Assets: Airtel Xstream, Wynk Music

Key observations:

- The company has been able to fairly diversify the revenue and income streams by entering newer geographies as well as new business segments.

- African business of the company now commands a 25.7% share in the EBIDTA, and this business segment has been a turnaround story for the company from being a loss-making entity into growth and profit-making market.

- Company’s EBIDTA has also diversified into several new business segments, and all the investments made by the company, e.g. Airtel Business, Tower Infra have started contributing positively into the balance sheet.

- The South Asia business of the company which was earlier reported jointly with Indian operations has grown, and the company has started capturing significant market share in 2 geographies of Bangladesh and Sri Lanka, thus making the company a seamless telecom service provider in South Asia.

Key Observations:

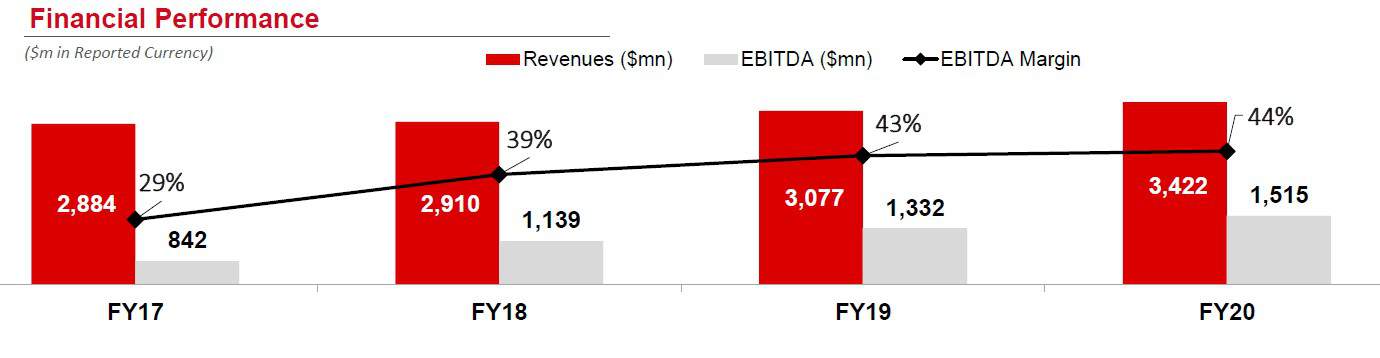

- The company has been showing consistency in growth in revenue terms as well as EBIDTA terms over the past years.

- EBDITA margins have been showing growth as well, which is a healthy sign originating from the fact that the company has been able to improve efficiency and contain costs.

- Margins of the company are higher than margins currently shown by its peers; the main reason behind this factor is the grip of the company in the corporate segment.

- The corporate segment comprises of the premium [Postpaid and Value-Added Services] customers who provide higher margins [Profits] without added costs vis a vis its prepaid customers.

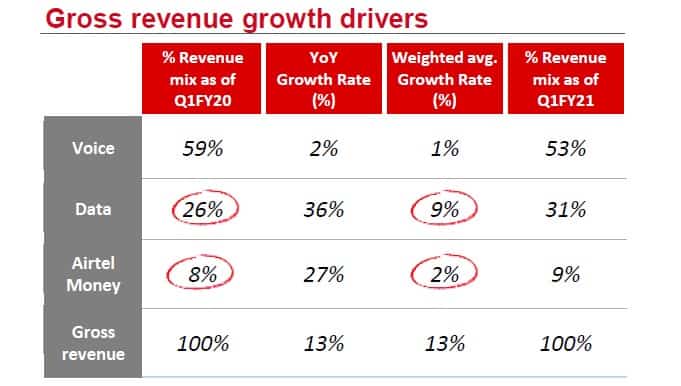

Key Observations:

- Revenue contribution from the Voice segment has been consistently eaten away by the growth of the data segment.

- Management is looking forward to shutting down the 3G network segment completely and moving the customer base from the 3G network to the 4G network.

- Due to the significant presence of the 2G network segment [wider reach] than the 4G network, it would still take time before the voice segment revenue mix is moved to the data segment.

![ARPU Trend [Average Revenue per User]](https://freefincal.com/wp-content/uploads/2020/12/ARPU-Trend-Average-Revenue-per-User.jpg)

- The ARPU has been stabilising over the past few years and the days of consistent decline in ARPU due to ongoing price war triggered by new entrant Jio appears to be the thing of the past.

- Company has taken a conscious call to raise the price tags of the various data packs and plans over the past quarters, which has led to the growth of ARPU.

- ARPU rose to ₹162 in the September quarter, from ₹128 a year ago, and ₹157 in the June quarter, the company is keen to take it beyond 200 levels.

- The ongoing WFH [Work from Home] situation in metropolitan areas has significantly boosted demand for faster data plans, thus improving margins and profitability for the telecom companies.

Key Observations:

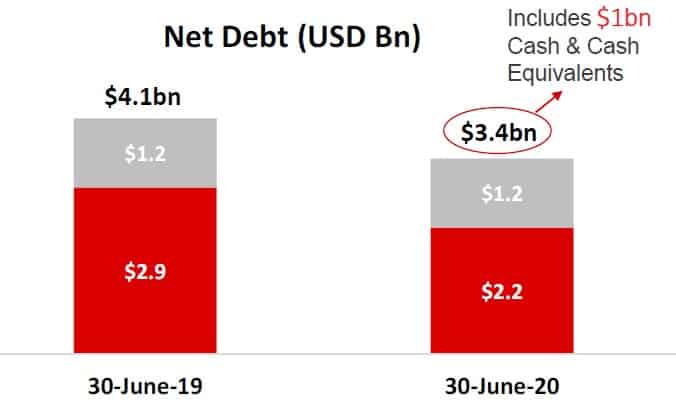

- The company has a strong focus on reducing corporate debt and deleveraging of the balance sheet.

- The company is also consolidating the business along with keeping the focus on the reduction of the overall debt.

What lies ahead for investors

- AGR dues continue to haunt the telecom companies, ultimately impacting cash flows of the company.

- As 4G business segment consolidates, the telecom companies need to upgrade the spectrum by bidding for the upcoming pricey 5G spectrum auctions, in short CAPEX will remain high to remain viable in the business.

- Internet giants of the global landscape are also making an entry in the telecom market passively by providing WiFi hotspots at popular locations, thus eating away business of the telecom companies.

Looking Ahead

Telecom is a high entry barrier business.

Reasons:

- High Spectrum charges and upfront costs to acquire licenses.

- National Presence with wider reach is a preferred choice for customers.

- Strong backbone infrastructure to sustain traffic and reduce costs.

- Companies with End-to-End service offering are only poised to make profits.

- The Indian telecom market is slowly turning to become a duopoly market where few key players drive the prices of the services offered.

- The big business houses of the country have already left the telecom market or shut their shop. They are unlikely to try their luck at any given point in time soon, which makes the survival of the current operators easier.

- The company faces challenges from the entry of the Jio and its platform business, mainly due to the price wars triggered by the competition.

- Despite the challenges faced on the financial front, overall debt and high costs in spectrum auctions, the company has been able to maintain profitability over the past years.

- The ARPU growth trend is a healthy sign from a profitability perspective signalling the fact that days of offering cheaper rates to remain in business are over.

- Reduced mobility of the customers improves the viability of the telecom business as companies [Customers] are willing to spend on telecom infra to have an online presence.

- Reduction in the overall debt of the company is a positive sign for the investors.

- The stock of the company trades at 2.5 Lakh Crore valuations which is significantly lower than the nearest competitor Jio. Source: Jio Platforms valuation to jump to $110 bn by FY22, propelled by sharp mobile ARPU growth: BofA Securities

In summary, Investors looking to make an entry into the telecom market of the country can have a look at the stock of the Bharti Airtel Ltd which offers a better value proposition compared to its listed peers. The company offers lower debt on the balance sheet as compared to its peers. Also, it has diversified its revenue and profit streams by investing in other related businesses and expanded across geographies.

Existing investors of Bharti Airtel Ltd stock can expect the stock to reward shareholders in tune with the growth in the telecom market as well as the earnings growth of the market leaders.

The company is one of few survivors of the fierce battle played out between the telecom players in the Indian Telecom market. The company has not only reaped the benefits of the growth of the telecom market but also is a partner to the development of the market as its one of the pioneers in the industry to bring the culture of the mobile telephony to the end consumer.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)