Last Updated on December 29, 2021 at 5:51 pm

In this article, let us find out if it is worth buying IDFC Bank shares. Concerns are being raised over of the fate of Indian Private banking space esp. banks apart from ‘Too big to fail’ list of the names. Recently, few Indian Private banking names like Lakshmi Vilas Bank, PMC Bank and Yes Bank have been in the news which hasn’t gone down well with shareholders.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) ITC Dividend Analysis (3) Stock Analysis: Is Reliance Industries Ltd Worth Buying? (4) Stock analysis: Is Tata Consumer Products share worth a buy?

IDFC First Bank stock price hasn’t done much ever since the bank was launched, and investors have been through an endless wait to see the light at the end of the tunnel. A big chunk of IDFC First Bank stock investors know the bank through the parent company known as IDFC Limited, and they received shares when the parent company acquired banking license in July 2015 and launched an operational bank in November 2015 and ultimately demerged the banking entity shares.

Before we could read a conclusion, we need to look at the data points:

1. IDFC Limited acquired banking license in July 2015 and launched an operational bank in November 2015.

2. IDFC Bank shared got listed on the exchanges after the demerger from the parent entity, and the listing price was 72/- on NSE.

3. In January 2018, Erstwhile IDFC Bank and Erstwhile Capital First announced a merger. Shareholders of Erstwhile Capital First were to be issued 13.9 shares of the merged entity for every 1 share of Erstwhile Capital First. Thus, IDFC FIRST Bank was founded as a new entity by the merger of Erstwhile IDFC Bank and Erstwhile Capital First on December 18 2018.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

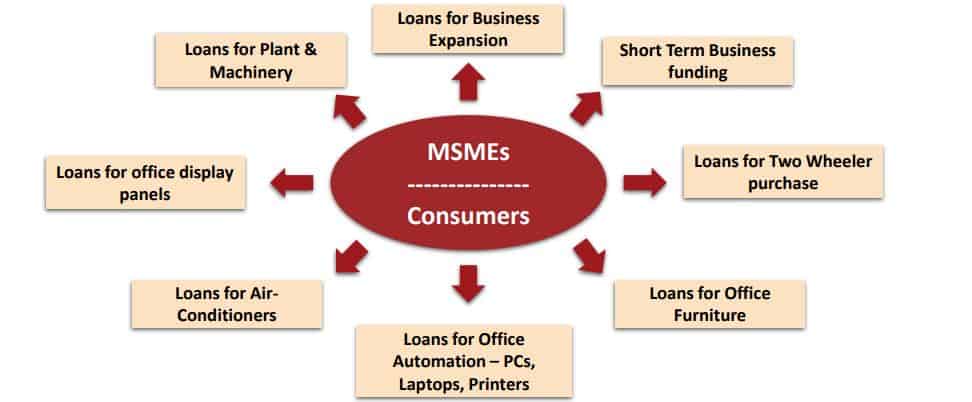

From a pure business point of view, what started as an institutional provider of finance and advisory services for infrastructure projects as well as asset management and investment banking has gained ground on the retail financial oriented institution (by acquiring retail banking license and merging with non-bank financial institution providing debt financing to small entrepreneurs, MSMEs (Micro, Small and Medium Enterprises) and Indian consumers). Now, let’s dig into data to analyze the situation.

Capital first [Before merger] was NBFC [Non-banking finance company] engaged in business with SMEs and Retail segments. As visible, the target segment of the NBFC was primarily the customers who are out of reach of the banking industry due to operational reasons.

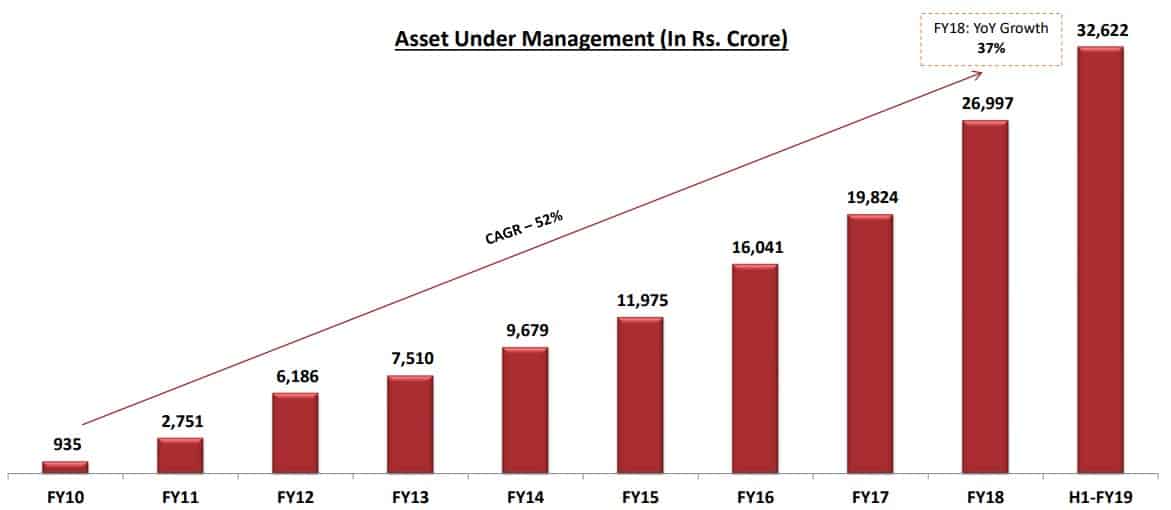

Now, let’s take a look at the AUM growth in the portfolio of the company Capital first till the merger was announced.

The company grew AUM at a healthy growth rate of 52% in the past decade before the merger with IDFC Bank was announced.

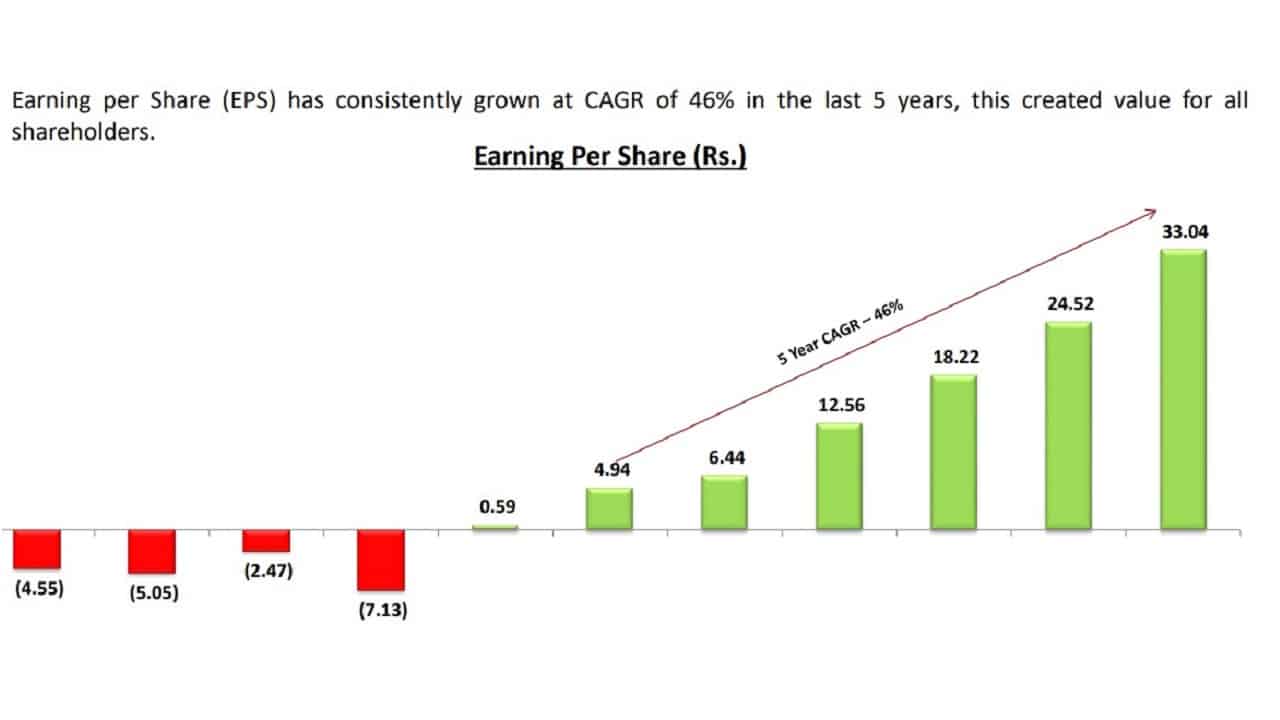

The upcycle in the business also reflected in the books of the Capital First NBFC, earnings of the company grew at a healthy rate of 46% in the past 5 years [before merger].

The company announced a merger with IDFC Bank and the Shareholders of Erstwhile Capital First were issued 13.9 shares of the merged entity for every 1 share of Erstwhile Capital First. Thus, IDFC FIRST Bank was founded as a new entity by the merger of Erstwhile IDFC Bank and Erstwhile Capital First on December 18 2018.

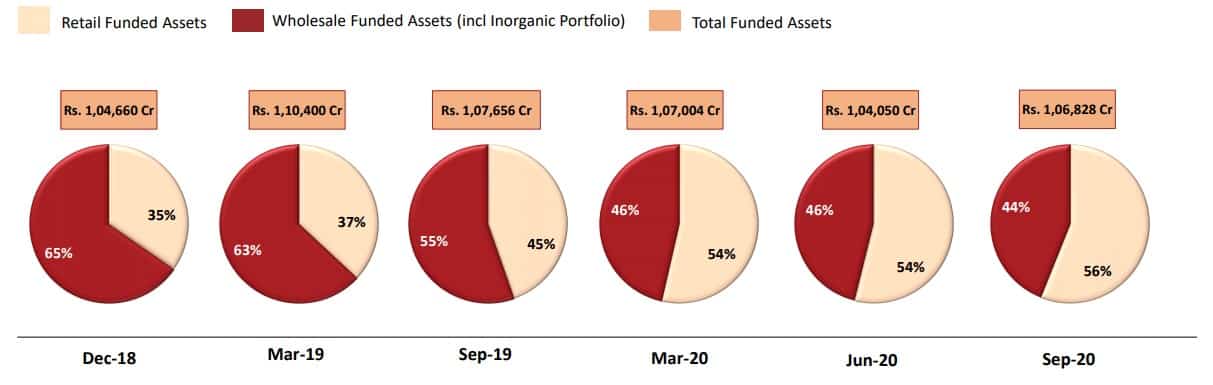

Before the merger with Capital First, the IDFC bank was an institutional heavy bank and minimal exposure in retail and SME space due to legacy it enjoyed in the past. Now, let us take a look at the performance of the books of the IDFC First bank and impact on its books after the merger was effective.

The Capital first NBFC brought in retail flavour to the books of the IDFC First Bank [combined entity] and diversified the portfolio of the bank from wholesale or institutional heavy portfolio to retail heavy portfolio. If you believe in the theory of the moving part, this was essential from the book’s point of view to diversify as well as reduce risk in the portfolio. As of Sep30, 2020, the retail contribution to overall Loan assets stands at 63%.

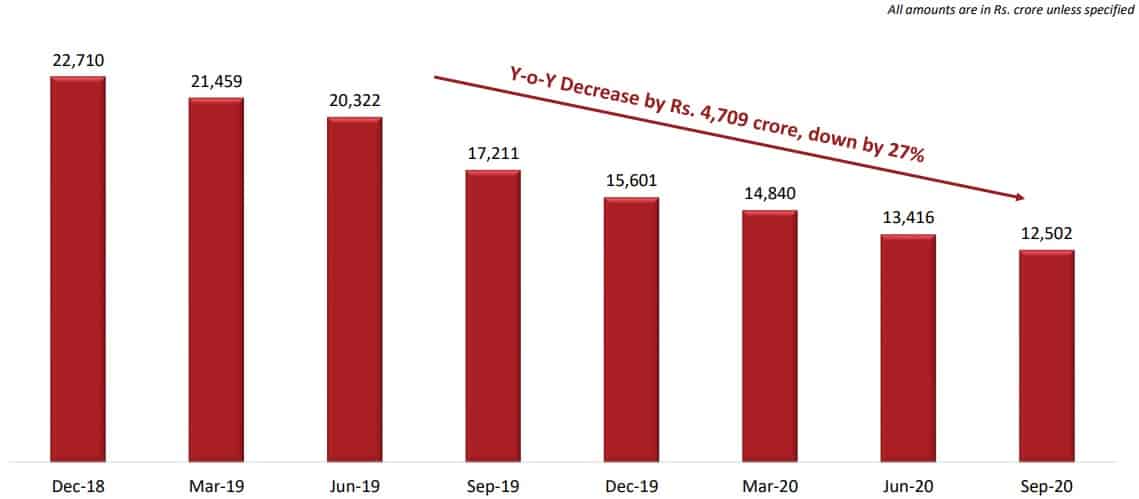

Another point of interest for investors would be to check on the year or year decrease of the Infrastructure loan book, which was one of the stated reasons for the merger with NBFC.

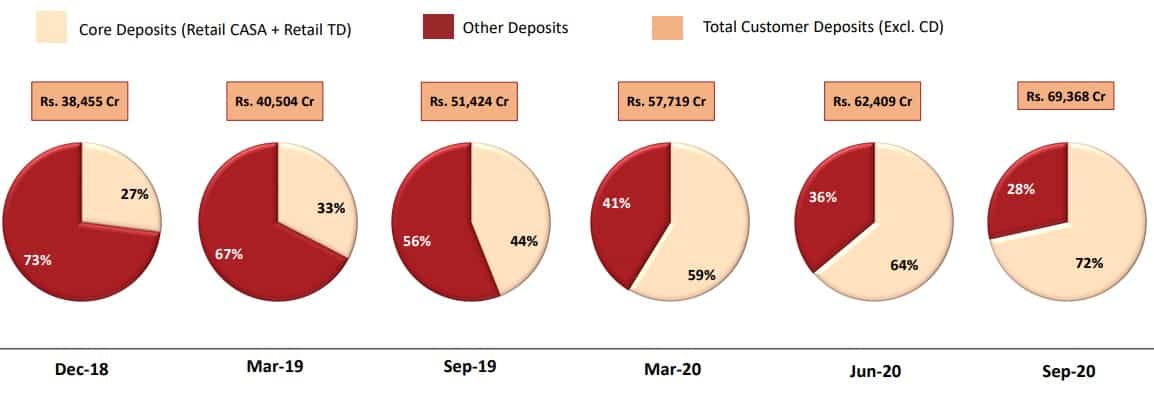

Category of Deposits

Moving on to the overall deposits and category of deposits view: “The Bank is focused for the realisation of the liabilities which is reflected in the growth in its Core Deposits. Such Deposits are sticky and sustainable in nature in comparison to institutional borrowings. Core Deposits (Retail CASA + Retail Term Deposits) as a % of Total Customer Deposits of the Bank as on Sept 30, 2020, were 72% as compared to 27% as on December 31, 2018 (merger quarter).”

This is what the bank has stated in the recent filings with the exchanges. As mentioned earlier, the bank’s focus is towards retail business than only being an institutional lending organization, which is also reflected in the progress towards ‘Retailisation’ as below.

The bank has been growing branch network to widen the reach and also utilizing the channels of e-KYC verification to reach end customers.

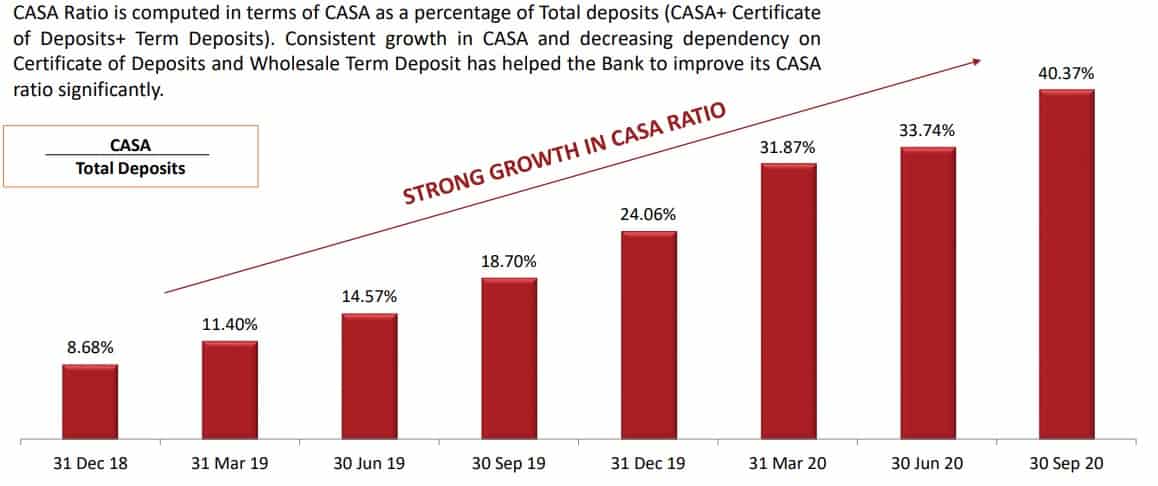

Casa Ratio

Let’s take a look at the key ratio which the investor community focuses on to gauge the performance of the banking stocks, which is the CASA ratio. This is the ratio which provides any banking entity lower cost of funds to reduce the cost of lending, the reason being, banks usually do not give any interest on current accounts. Though this particular bank has been giving higher interest than competition on the savings, account in the past, but that has given an edge to widen the reach and build a customer base and attract accounts. Overall, the higher the CASA ratio, the lower the cost of the funds.

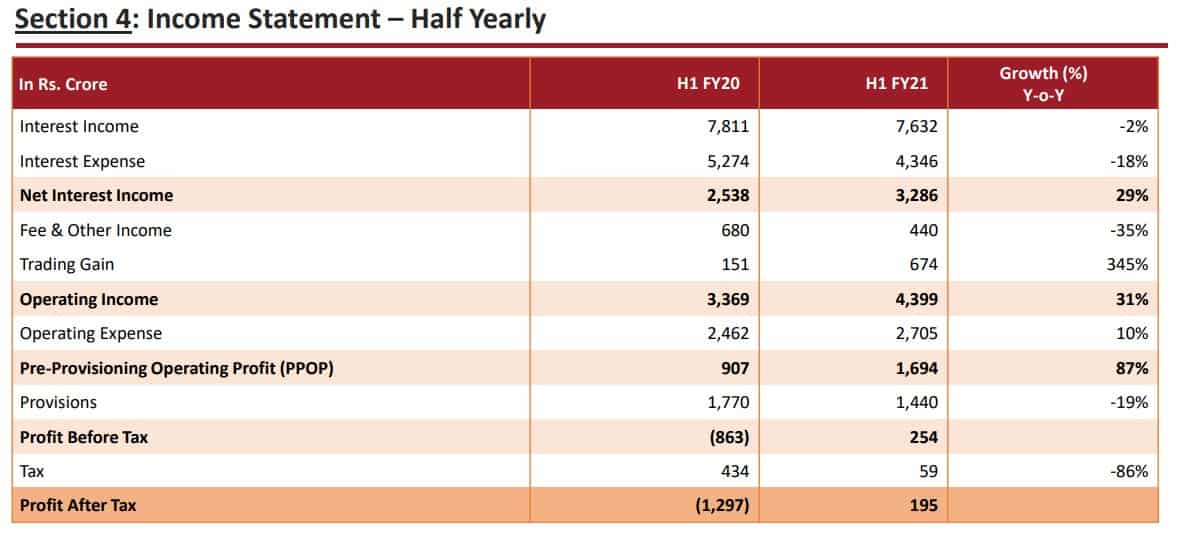

- The first and foremost important thing that should catch investor’s attention is the rise in [NII] Net Interest Income in YoY basis, and this is a crucial number from a banking point of view.

- The NII has gone up by 29% YoY basis when the interest income has fallen by 2%, and interest expense has also fallen by 18%. What this implies is: operational efficiency of the bank has improved.

- Operating income has risen by 31%, the main factor driving this is the growth in NII.

- Trading gains: the trading gains are visible in the H1 2021 though investors need not rely on this factor; as this remains an unpredictable factor for driving the profits of the bank.

- Another key important factor to note is PPOP: Pre-provisioning Operating Profit.

- Which implies good sign in terms of corporate governance that bank is highlighting the provisions. [Assets that have the potential to turn bad in future and banks have set aside already]

- Profits after tax: the bank has turned PAT positive from PAT negative in FY2021.

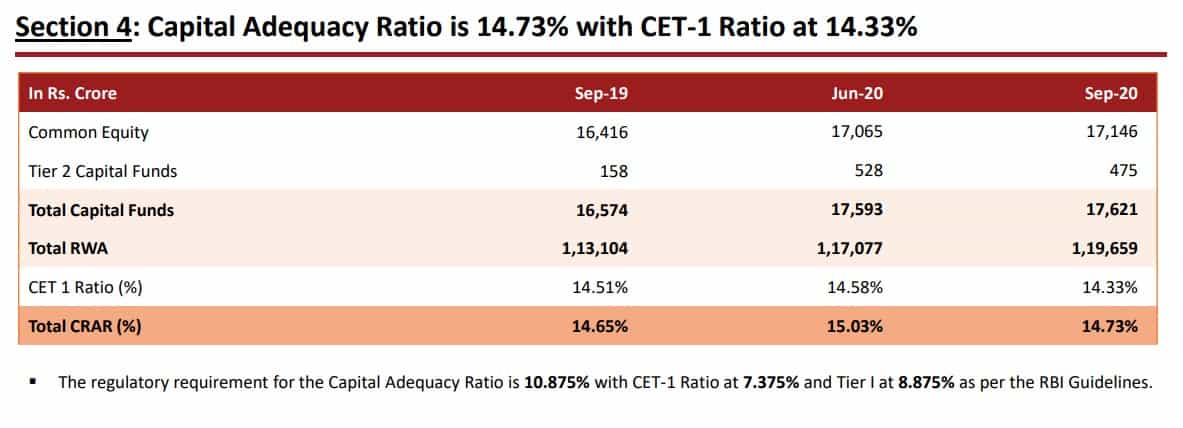

Capital Adequacy Ratio

Moving to another important which banking investors should focus on is Capital Adequacy Ratio.

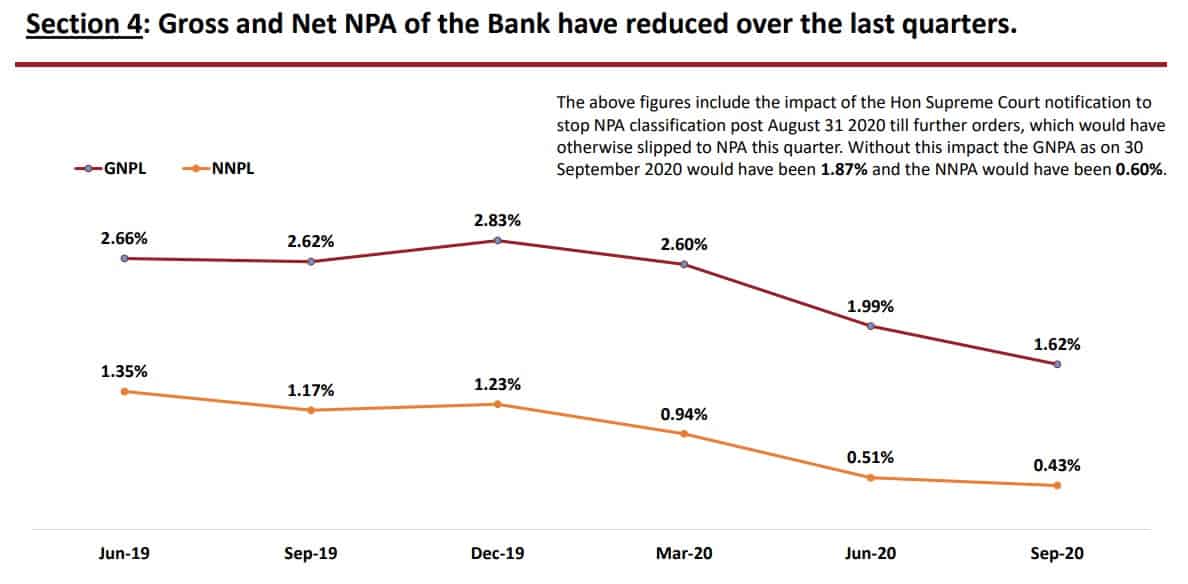

NPA: Non-Performing Assets

This is another key aspect which investors await anxiously every quarter and would want to know if there is any improvement in asset quality.

Visibly, the bank has been able to manage the NPA ratio both on the net, and gross fronts also imply improving asset quality.

Another news which should give a breather to the long-term investors is:

Bank said it carried Rs 1,622 crore of provision at end of June this year, which were done pro-actively in Q3FY20 against a large telecom exposure of Rs 3,244 crore, as there were adverse comments around the future of the company. After the verdict of the Supreme Court related to AGR dues, IDFC First Bank said, ‘Considering the positive outcome of AGR verdict and moratorium…fund raising plan, repayment record and the recent trades (by the telecom player), the bank has released 50 per cent provision out of Rs 1,622 crore held as of June 30, 2020.

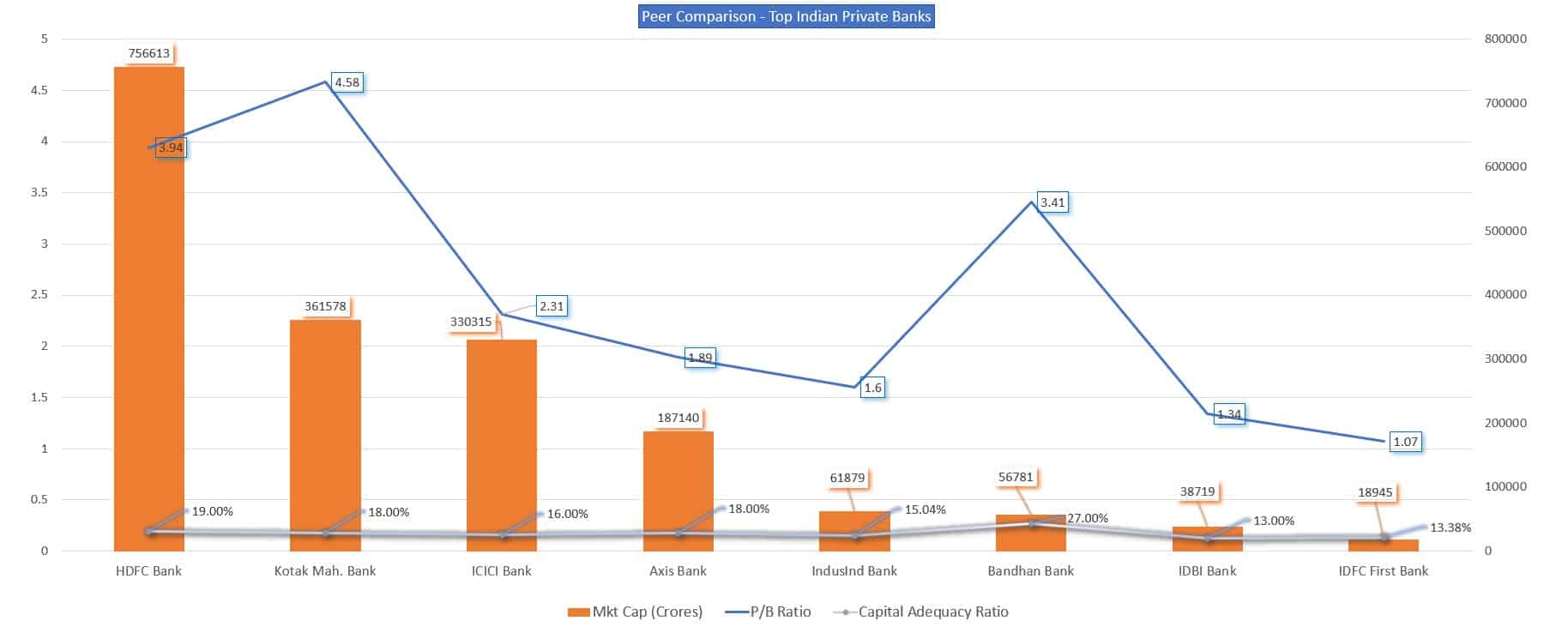

Now, we will take a look at a comparison of IDFC First Bank across Indian Private Banking space and see how it fairs on certain key aspects. The Key performance indicators used to compare the Indian Private Banks below are:

- Market Capitalization By definition – Market capitalization refers to how much a company is worth as determined by the stock market.

- P/B Ratio By definition – This ratio compares the market value or market capitalization with the book value.

- CAR – Capital Adequacy Ratio By definition – The capital adequacy ratio weighs up a bank’s capital against its risk. The calculation is shown as a percentage of a bank’s risk-weighted credit exposures. This ratio ensures banks have enough capital to cover potential losses, which protects them from insolvency.

We have compiled data to compare the Indian private banking space on these key ratios.

- As visible from the graph, the IDFC First bank stands 8th in terms of market capitalization if compared with other Indian private banks.

- The P/B Ratio as derived from the market cap of the banks continues to slide towards the bottom and reflects the valuations given by the investors to the banks.

- Capital adequacy ratio of the IDFC First bank still stands comparable to the peers despite low valuations given by the market to the bank.

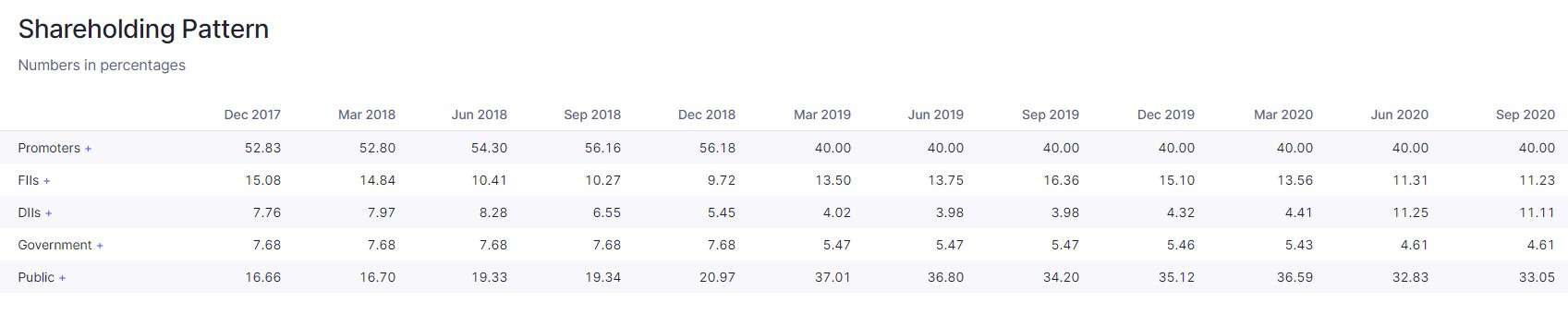

Shareholding Pattern

The institutional shareholding needs to be looked upon from 2 perspectives, 1 being the pre-merger and the other one being post-merger.

In the post-merger shareholding pattern, the share of institutional investors hasn’t dropped significantly domestic institutional investors, e.g. domestic Mutual funds, domestic insurance companies/ETFs have raised their stake in the bank. This should give a breather to the retail shareholders holding this share.

Let us now summarize:

- Given the fundamental and operational analysis of the bank, no alarming signs are appearing both on Asset quality as well as Quarterly earnings reports.

- Bank has been able to diversify books both on lending and deposit side towards the retail segment from being an institutional heavy bank, which is as per the management strategy.

- Merger with Capital First to be incremental in nature for the bank, given the operational metrics on which the NBFC was operating before the merger.

- Bank has been able to set aside pre-provisions to avoid late surprises and turn PAT positive despite COVID-19 impact seen across the board.

If you are long term investor holding the share, then you might want to give the bank more time to show results as the banking industry as a whole has faced headwinds due to balance sheet cleanups, and impact of COVID-19 provisions.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)