Last Updated on September 15, 2024 at 7:56 pm

UTI Nifty200 Momentum 30 Index Fund is an open-ended fund that will track the Nifty200 Momentum 30 index. The new fund offer is from Feb 18th to March 4th 2021. In this review, we discuss what interested investors should be aware of; who should invest in this fund and who should avoid.

What is momentum investing? Investing in stocks that have moved up considerably over the past 6-12 months hoping that the trend will continue (for a short period) is known as momentum investing. Relevant data and links for the Indian and US markets are available here: Momentum Stock Investing in India: Does it work?.

The Nifty200 Momentum 30 index will pick 30 stocks with the highest “momentum score” from the Nifty 200 (Nifty 50 + Nifty Next 50 + 100 stocks from Nifty Midcap 150). The normalised momentum score is a combination of 6-month and 12-month momentum.

Momentum ratio is return divided by the standard deviation. A 6-month momentum ratio is a six-month return divided by the standard deviation of daily returns over the last year. A 12-month momentum ratio is 12-month return divided by the standard deviation of daily returns over the previous year. More details about the index construction are available in our earlier review: Nifty200 Momentum 30 Index: A new strategy index from the NSE.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

UTI Nifty200 Momentum 30 Index Fund hopes to capitalise on the interest and buzz related to momentum investing. The AMC will be hoping for at least Rs one thousand crores of AUM in the NFO period (most of it via the regular plan). If this fund does well, we can expect a string of similar NFOs.

UTI Nifty200 Momentum 30 Index Fund: Pros and Cons

Pros: Many investors also seem to be excited about this launch. All the more reason it is imperative we understand the risks associated with momentum investing. By its very nature, momentum investing would involve frequent changes in the stock portfolio.

Suppose an investor creates a DIY momentum portfolio or invests via an automated basket offered by a broker or third-party (for example, smallcase). The tax and brokerage fee associated with the churn will have to be paid investor.

If a momentum mutual fund manager shuffles the portfolio, the investors do not pay tax (at least not yet!), plus the labour/effort associated with DIY momentum investing is outsourced.

Thus UTI Nifty200 Momentum 30 Index Fund also has a 5% cap on individual stock weight, reducing concentration risk. However, it is subject to sectoral risk (more weight to one sector).

Cons: The primary risk is, as we shall show below, is the fund’s inability to beat the Nifty or Nifty Next 50 over a few years! Particularly when the market is recovering from a crash; when the market is range-bound or governed by just a few stocks.

Readers may be aware of an idea known as volatility bunching discussed earlier: Timing the market will work but not the way we imagined! A large market up movement will follow a large down movement and vice-versa. Also “momentum stocks” may suffer more if there is a market-wide crash. In other words, momentum can be a double-edged sword. Stocks that race upward could lose momentum just as fast.

The higher risk comes in two ways: (1) even when the strategy “works” the prices fluctuations will be higher than the “market” (Sensex or Nifty) and (2) when it does not work.

We have already established that the S&P 500 Momentum Index has not impressed when compared with S & P 500: Momentum Stock Investing: Does it work? The data for the Nifty200 Momentum 30 Index may look impressive today but “over the long term” (as hopeful investors and advisors like to put it), the strategy may underperform the Nifty/Sensex.

As discussed earlier, such strategies suffer from ‘construction risk’. For example, the choice of 6 and 12-month windows for calculating momentum scores could simply be the ones that gave the best past performance. This need not work in future. See Data Mining in Index Construction: Why Investors need to be cautious.

UTI Nifty200 Momentum 30 Index Fund is likely to be about five times more expensive than a Nifty or Sensex index fund with higher tracking errors (it can pick from stocks from Nifty Next 50 and almost 70% of the Nifty Midcap 150 stock universe). Therefore the margin of outperformance that you see below would have been lower.

Who should invest in UTI Nifty200 Momentum 30 Index Fund?

Before we look at the underlying index’s performance, let us consider who should invest in this index fund. Momentum is a fascinating strategy for many investors. If we stop and think about it for a moment, investing in an ‘ordinary’ Sensex or Nifty or Nifty Next 50 index fund is also momentum investing. The weights in these indices changes with its market capitalisation, which in turn depends on price.

Therefore if you have just started investing in a combination of Nifty and Nifty Next 50 index funds, there is no need for you to include UTI Nifty200 Momentum 30 Index Fund in your portfolio.

If you feel the need to experiment and taste the adventure of momentum, you can consider a “small exposure” to this fund (as “advisors” who wish to remain diplomatic with all AMCs would say). In any case, the risk and reward would also be “small”.

If you are already a DIY momentum investor and would like to outsource the job of portfolio construction in a low-cost tax-efficient manner, then you can consider investing in this new fund. Before deciding, you can backtest your transactions with the momentum index like I benchmark my stock portfolio with the Nifty. It would be safe to consider a low volatile blue-chip portfolio as the core and the momentum investment as a satellite. See, for example, My Stock Portfolio Feb 2021.

If you are already investing in a momentum PMS portfolio or via an automated momentum-basket like smallcase, we recommend switching the investments to this fund. Again, you can benchmark your returns with this index before deciding. At the very least you will save on tax. Do be sure to check the graphs below to appreciate what to expect. Let us now dig deeper.

Nifty200 Momentum 30 TRI vs Nifty Next 50 TRI vs Nifty 50 TRI

Our previous review of this momentum index has already established little difference between Nifty 50 TRI and Nifty 200 TRI. It should be intuitively clear to the reader that a momentum index would be more volatile and potentially more rewarding than the Nifty 50.

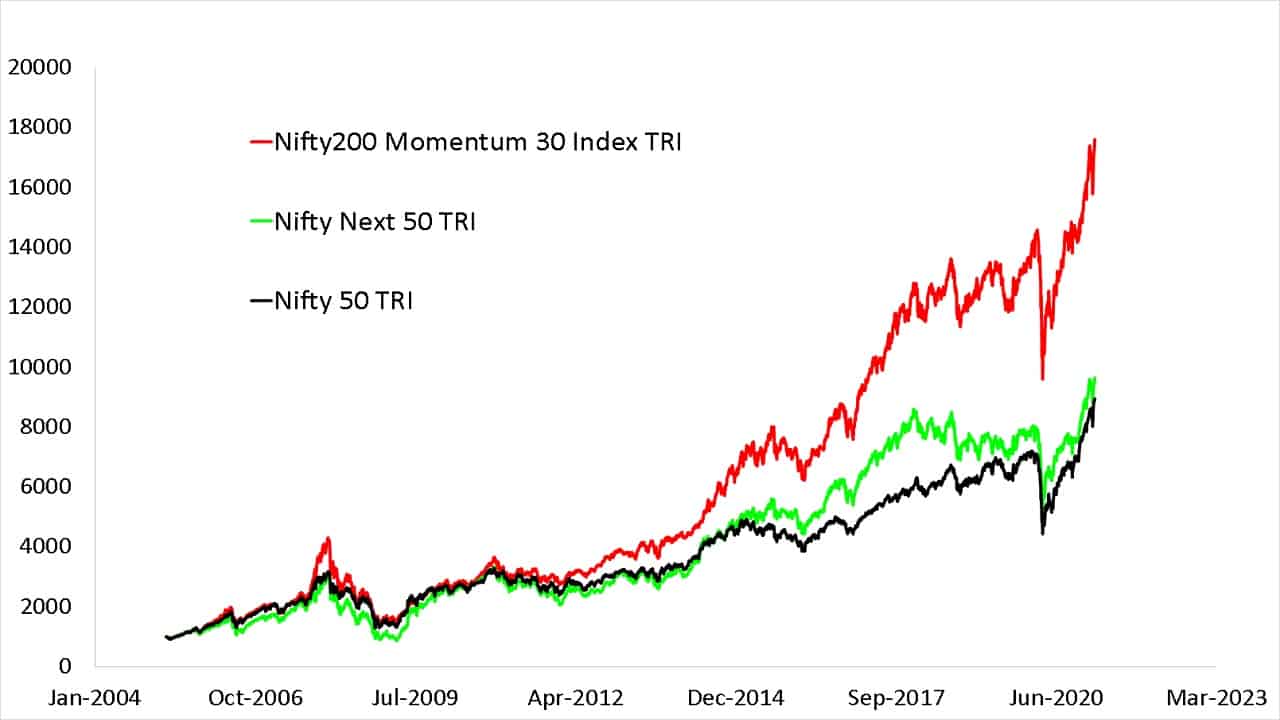

So we shall include a volatile index – Nifty Next 50 TRI in our analysis to help the reader access the momentum index. The since inception evolution is impressive for the momentum index, this corresponds to just one return data point (1st April 2015 to Feb 12th 2021). Do not make the mistake of getting carried away by such graphs. As we shall see below, most of this outperformance stems from one time-window!

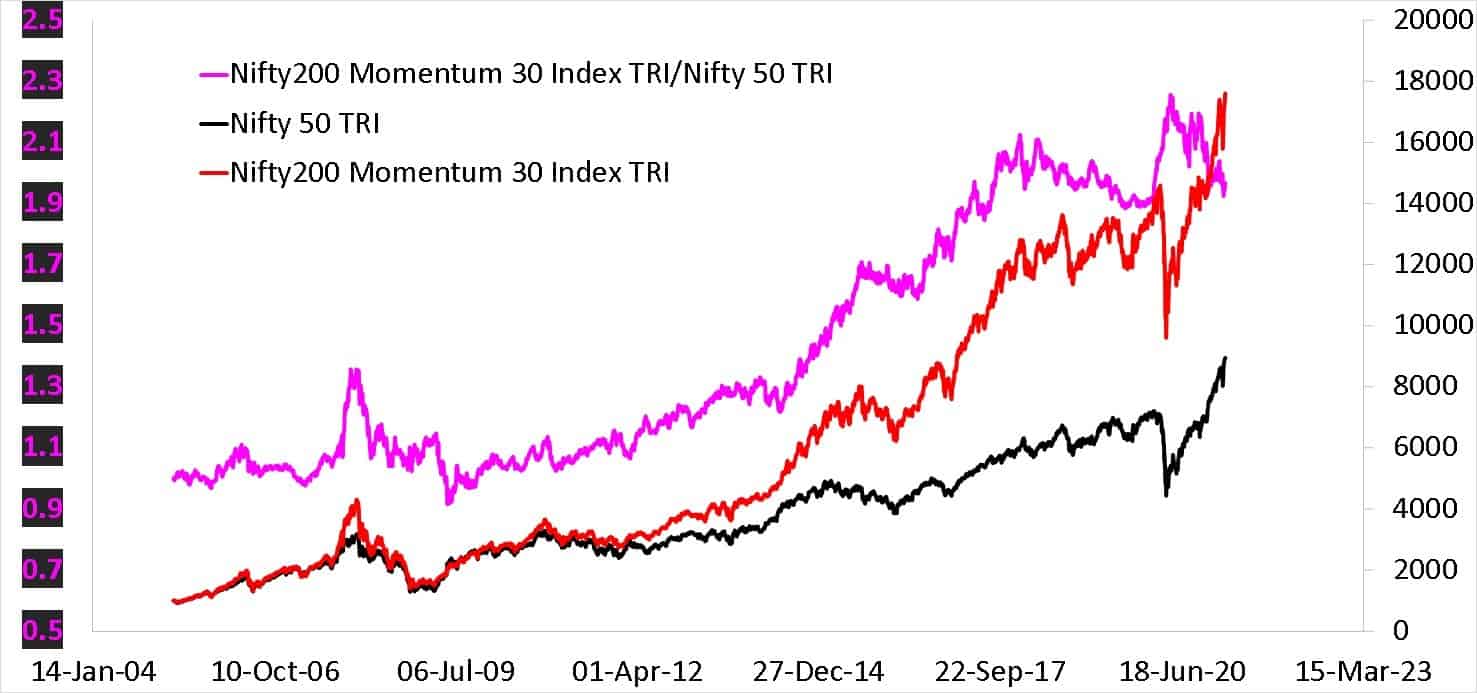

Next, we shall consider the relative index movement: Nifty200 momentum 30 index TRI divided by Nifty 50 TRI (pink line, left axis) compared with the Nifty 50 TRI. If the ratio increases, then the momentum index has increased more than the Nifty or fallen less than the Nifty.

If the ratio decreases, the momentum index has moved up less than the Nifty or fallen more than the Nifty. When the momentum index outperforms (uptrend in the ratio), and underperforms (downtrend in the ratio), can be easily seen below.

An investor in UTI Nifty200 Momentum 30 Index Fund should appreciate that periods of momentum outperformance will be followed by underperformance. There can also be long periods (years) of the momentum index following the market (failing to beat it). So whether our investment in a momentum index “beats” the market or not depends on the sequence of returns risk, aka timing luck.

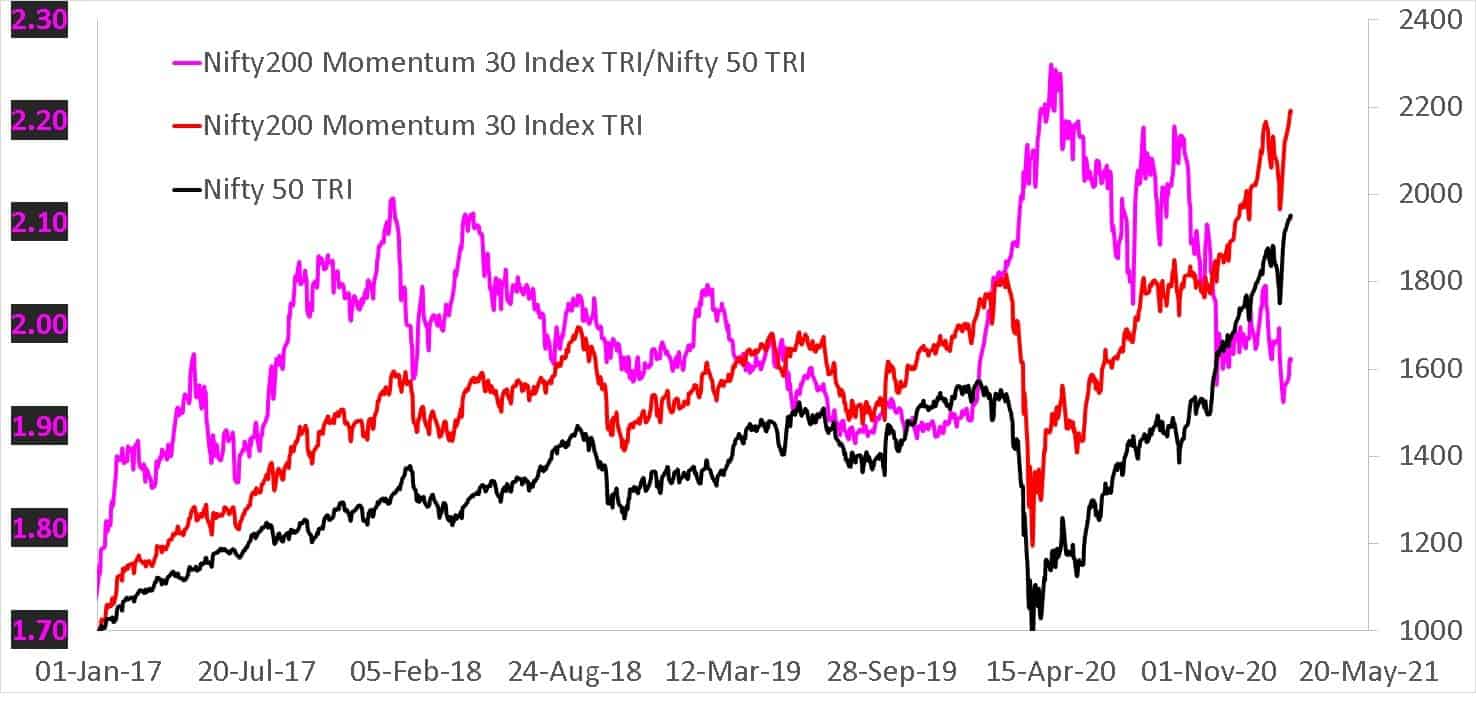

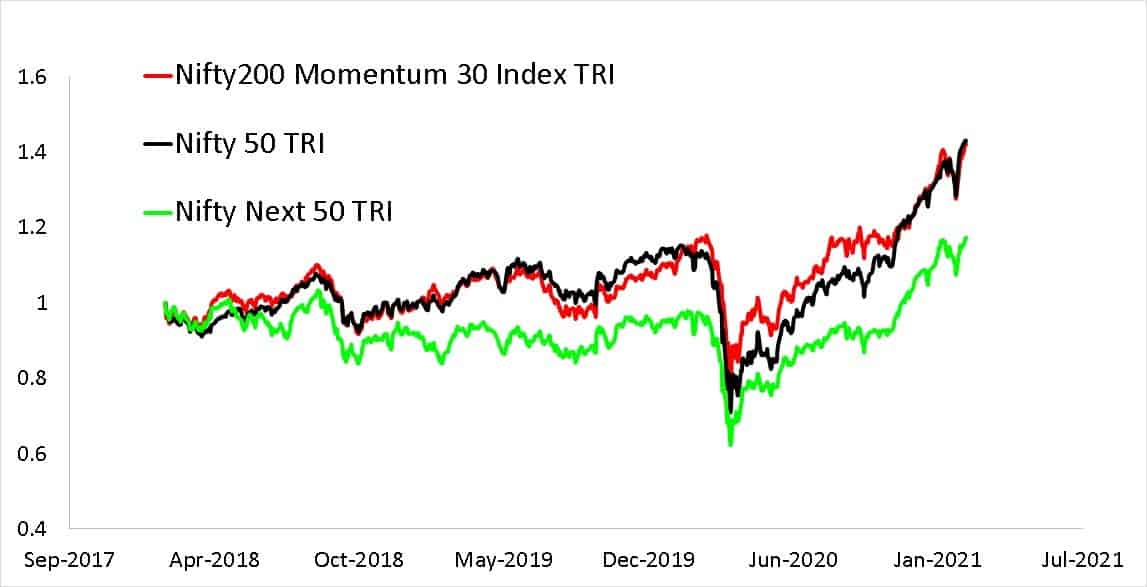

The behaviour from Jan 2017 is most interesting. From the latter part of 2017 up until the March 2020 crash, the Nifty was moving up only because of a few stocks (see more here: Nifty 50 equal-weight index surges past Nifty 50 due to market rally).

According to the UTI Nifty200 Momentum 30 Index Fund fund prospectus

It helps in constructing a portfolio that systematically add relatively performing stocks and remove relatively non-performing stocks, based on pre-defined criteria, without individuals’ intervention.

Notice during this period the relative price (momentum index by Nifty) is falling. It zoomed up during the crash because the two-year imbalance among Index stocks was destroyed and fell since!

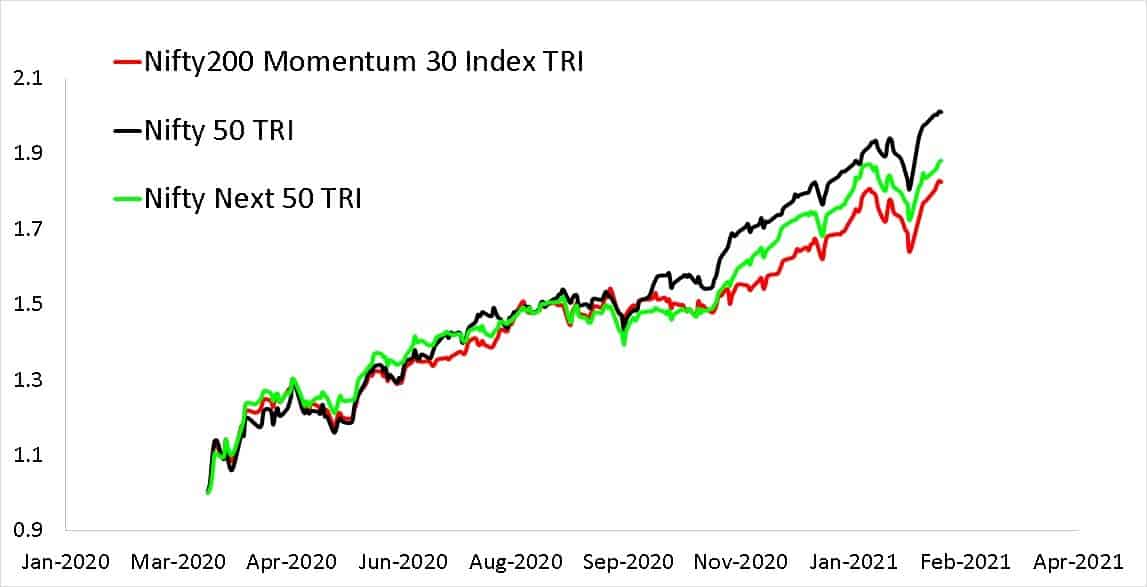

As pointed out by Ragesh in FB group, Asan Ideas for Wealth, the NIfty has doubled between March 23rd 2020 (crash bottom) and Feb 15th 2021. During this period, the momentum index has underperformed both the Nifty and Nifty Next 50.

The point is, this pre-defined criterion with which the momentum index is built may not always work even when the market itself has significant upward momentum. The 5% weight capping for the momentum index versus no such capping for the NIfty maybe the reason. The momentum index has failed to beat the Nifty ever since the market imbalance became prominent. That is about 3Y of underperformance (taking fees and tracking error will make it worse).

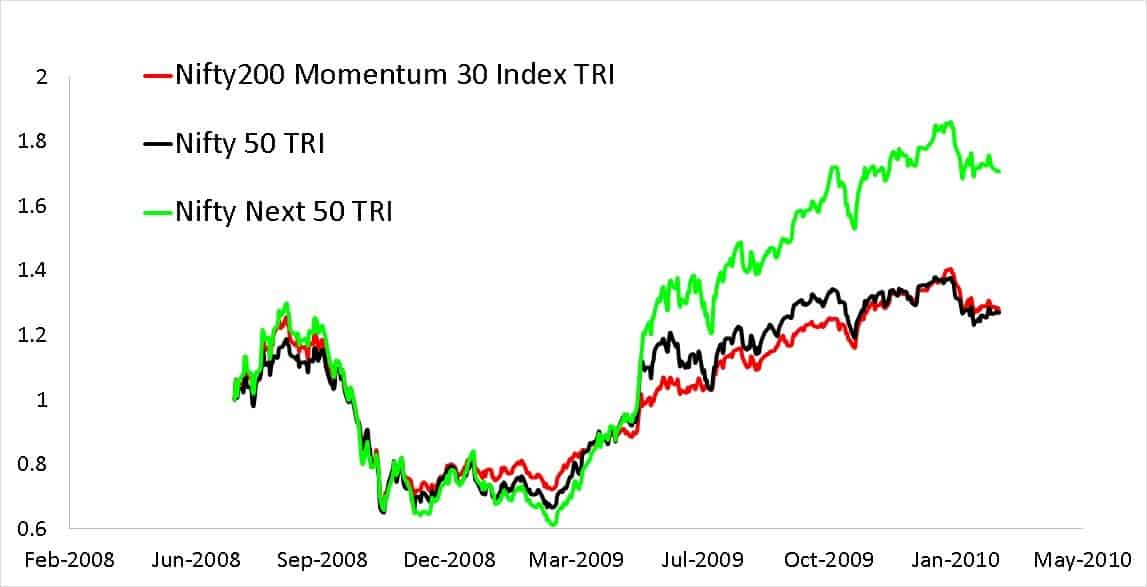

Another instance when the momentum index failed was during the recovery post-2008. Again, the momentum index could not beat the Nifty for about 3.5Y from before to after the 2008 crash (shown up to Jan 2010).

I am not saying the momentum index “should have” outperformed during the above-mention periods, but only trying to point out that an investor in this NFO should not expect the fund to beat Nifty every time the “market” zooms up.

A different way of constructing the momentum portfolio or more frequent churning may improve performance in certain time periods but not in others. Tax incidence if done elsewhere will also be higher. So there is always a price to pay.

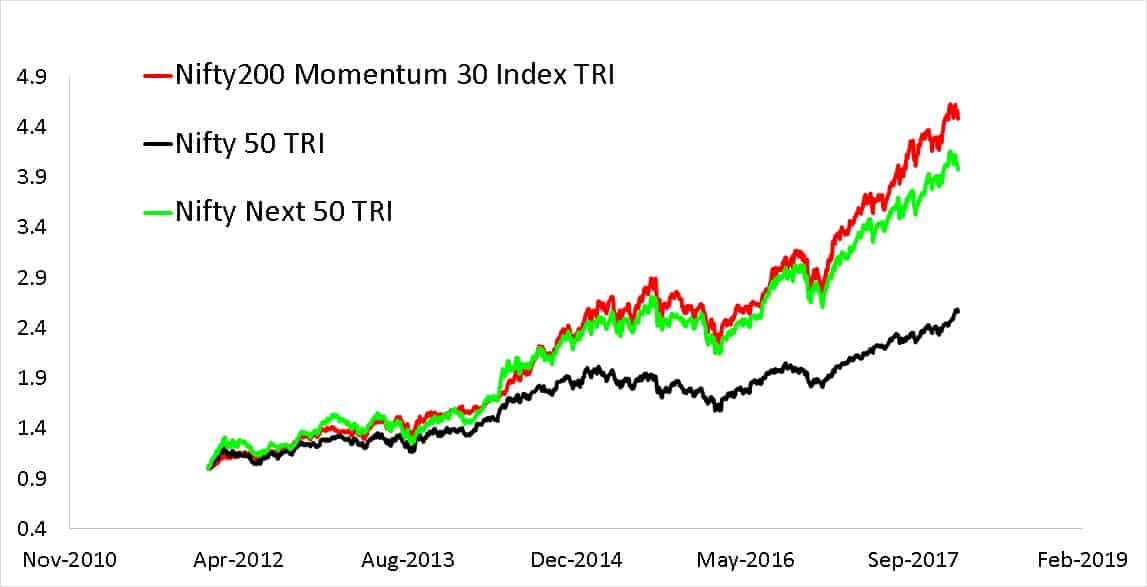

Almost the entire outperformance came from Jan 2012 to Jan 2018. Even here the Nifty Next 50 has fared well wrt to the momentum index.

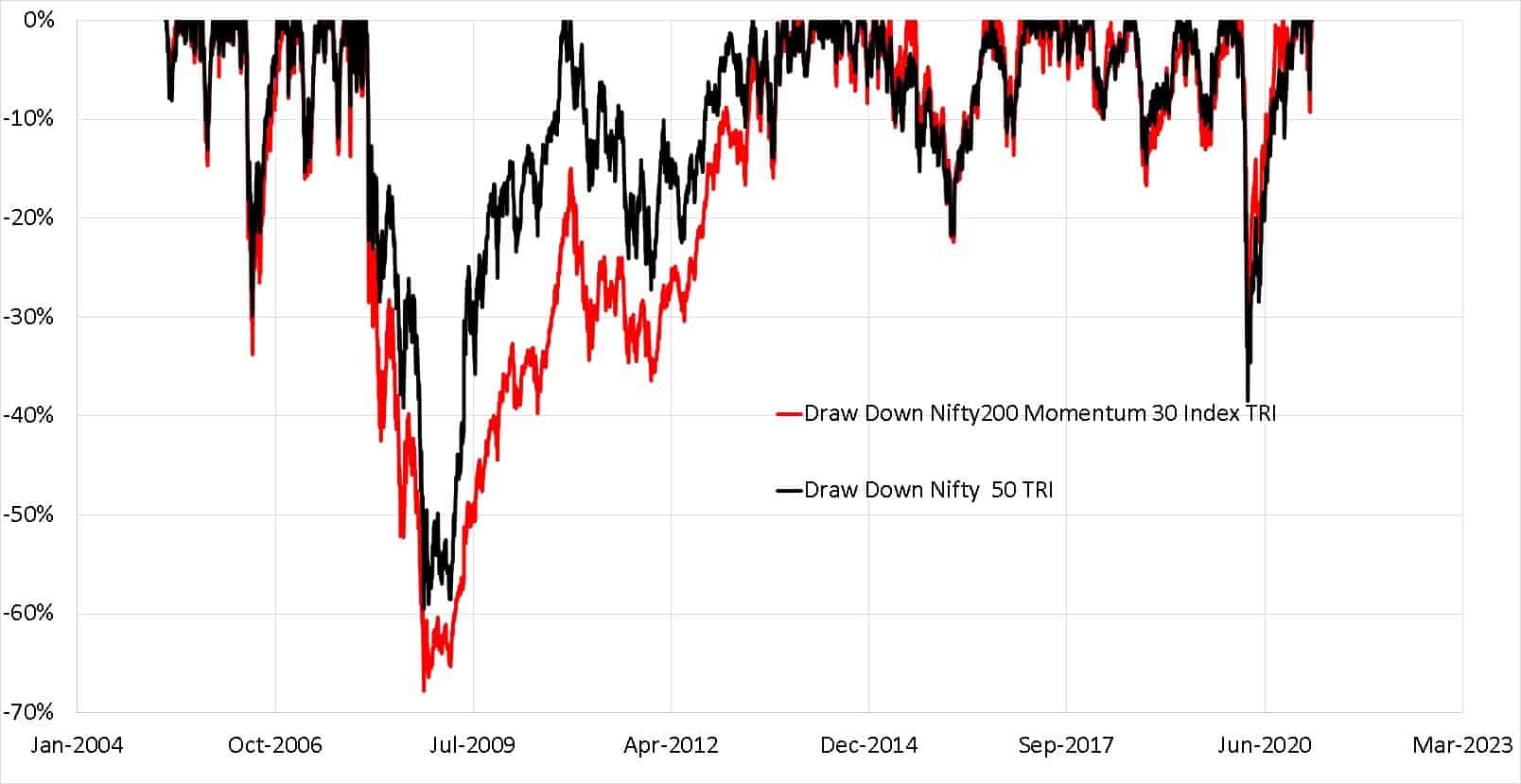

Shown below is the drawdown of the momentum index and Nifty 50. This represents the fall from an all-time high. The amount of time the index was underwater can also be seen. The momentum index fell more than the Nifty during the 2008 crash. During the 2020 crash, the NIfty fell more because it had a higher momentum!

Notice the momentum was underwater for longer during a rangebound market (2008-2012). The momentum index does not seem to react quickly enough when the market falls and recovers fast like it did in 2008 and 2020.

When compared with Nifty Next 50, the momentum index has seen similar falls.

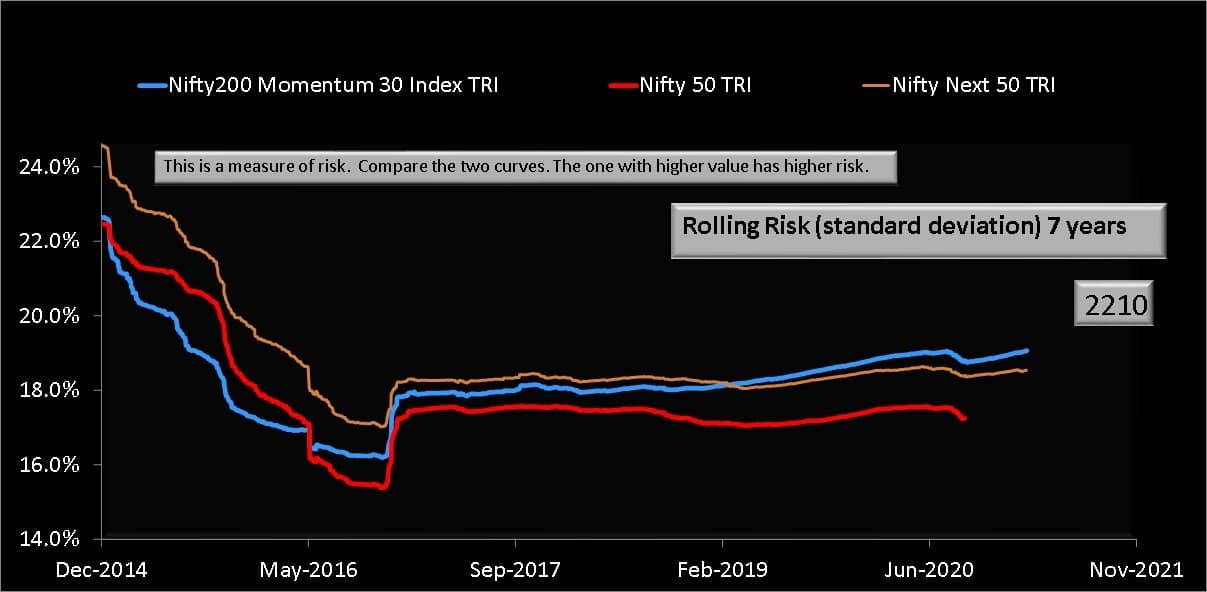

In terms of daily volatility (measured by the standard deviation) the momentum index is comparable to Nifty Next 50 (and sometimes to the Nifty!). Shown below is the rolling standard deviation over seven years.

Next, we consider five-year rolling returns. The NIfty 200 Momentum 30 index has fared reasonably well but does not consistently beat the Nifty or Nifty Next 50.

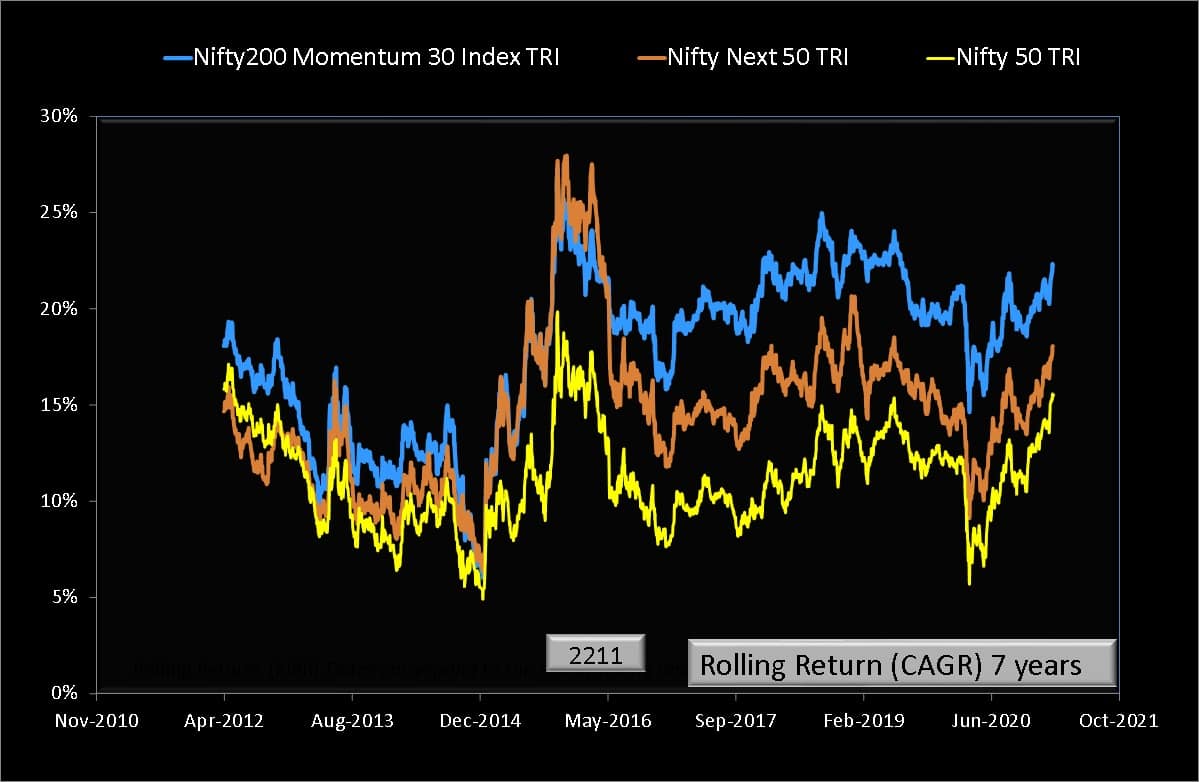

The seven-year returns look better but notice the time window in the x-axis shrinking. These are 7Y returns ending April 2012 to Feb 2021 – about a decade.

The ten-year rolling return data is even better, but the time window has shrunk further. Meaning, there is not enough history to consider “long term” performance of the momentum index.

Is it worth investing in the UTI Nifty200 Momentum 30 Index Fund?

Before we conclude a trivia related to the S& P 500 Momentum index: An investment made ten years ago on 31st Jan 2011 in the S&P 500 Momentum Index TR would have beat the S&P 500 TR 12th Feb 2021. However, for the first 6.7 years, momentum failed to beat the S&P 500.

Momentum investing is not a bed of roses. It is not some “proactive strategy” that will regularly beat the market. This offering from UTI is just another fancy thematic index fund that is likely to disappoint investors assuming they are getting something ‘special’.

- I am an active MF investor, can I buy this fund? You can, but if you already hold a few funds, this fund will not help you much. Most investors are incapable of analysing individual mutual fund contributions to their portfolios. So we recommend that you avoid the clutter.

- I already hold Nifty 50 and Nifty Next 50, can I buy this fund? As we have shown above, one should expect long periods of mediocre performance. You already have Nifty Next 50 capable of this. Why add one more?

- I invest only in Nifty 50 (or Sensex), can I buy this fund? Yes, if you wish to treat it as an expensive replacement for Nifty Next 50. However, beware of too much exposure.

In summary, we recommend investors not get enticed by the “momentum strategy” without appreciating the risks, particularly the cost and time underperforming the market. Giving this fund a miss will not harm your portfolio in any way.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)