Last Updated on October 1, 2023 at 5:43 pm

Stock momentum investing is a fascinating and counterintuitive concept like low-volatility stock investing. Momentum investing is essentially chasing stocks with good past performance! In this post, we find out if momentum investing in India works by analysing the S&P BSE Momentum Index. That is, we find out if the strategy can yield better returns than a market cap based index. We also compare momentum investing with low volatility investing to understand how they differ and which works better. This is the first in a series on momentum investing (something that I have always wanted to do). Let us start with the basics.

What is momentum investing?

At its very essence, momentum investing is spotting stocks that have delivered good returns (moved up = upward momentum) over the last few months and investing in them. When the stock price reverses direction, it is sold and replaced with another with upward momentum. There are of course various ways in which one can qualify the momentum and filer stocks. We will consider those in subsequent posts.

Why is it against logic (counterintuitive)?

If you see a gambler on a winning streak or a batsman hitting a 50 in every match in the T20 world cup, it is referred to as a hot hand. Since one cannot expect the gambler to keep winning all the time and the batsman to hit a 50 in the T20WC semi-final and final, this is referred to as a hot-hand fallacy. This is also true of mutual funds when people assume past performance will be repeated or when people believe that they do not have to plan for retirement as they will work until they die.

So if you look at the momentum strategy, it looks like another case of a hot-hand fallacy. Well yes and no. It is a hot-hand fallacy if you do not choose the time window right. It has been seen that momentum works for a 6-12 month period and not for durations lesser or longer! See references 7,8,9 in this wonderful alpha architect article by the Jack Vogel the author of Quantitative Momentum (co-author Wesley Gray).

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

In general, momentum investing is a high-risk, high -reward strategy with higher drawdowns (larger falls ) than market cap based index.

What is low volatility investing?

Since we will be comparing momentum vs low volatility investing, it is better to define that as well. In this case, we look at for stocks with low daily price up and down movement (volatility as measured by the standard deviation) in the last one year and invest in them. I have written about this extensively and the interested reader can consult:

- Low volatility stock investing: Does it work? Higher returns at lower risk?

- 30 Low Volatility Stocks from Nifty 100: Aug 2018

- Twenty Stocks With Consistently Low Price Volatility July 2018

- Picking Stocks With Low Volatility: A simple, but effective strategy?

Why is it counterintuitive?

Popular (does not mean right!) market analysis math is established around that idea that one should take higher risk to get a higher reward (return). Low volatility investing has shown without a doubt that one can get a higher return (than a market cap based index) at lower risk (than the same market cap index).

The connection between momentum and low volatility

I shall explore this quantitatively in the coming months but let me record my thoughts so that we can come back and check if was I right or wrong. In the above-mentioned article and book, they talk about momentum quality. That is, not just stocks that gave good returns in the past 6-12 months, but stocks that did so with a higher number of positive daily returns.

In other words, stocks that moved smoothly up are preferred to stocks that moved up but fluctuated in the middle. So in other words, high volatility momentum stocks are rejected and low volatility momentum stocks are preferred. This idea is also closely related to selecting stocks that trade close to their all-time highs. See this for a discussion: A list of stocks that have traded close to their “all-time” high

Low volatility per se does not mean high returns. A stock can keep heading south or trade flat with low volatility! Momentum per se does not mean smooth upward movement. So Momentum Quality essentially seems to imply choosing low volatility upward moving stocks. These are of course my thoughts without having studied or analysed anything about this. I am sure there should be a lot of material on this. After writing this, I found a more than 50% (current) overlap between momentum and low volatility India indices (see below)

Momentum Investing in India

S&P has a BSE Momentum Index with 30 stocks from S&P BSE LargeMidCap with the highest risk-adjusted price momentum. To calculate this, the price change (absolute return) over the last 12 months is computed. This is then divided by the daily volatility over the 12 months

So stocks with low volatility and/or high price change will have the highest risk-adjusted momentum value. The impact of outliers from this dataset (too high or too low momentum scores) is minimized by a process known as winsorization to compute the final momentum score. Thus the BSE momentum index combines momentum and low volatility in its stock selection. Let us now begin the comparison. We will also use BSE low volatility index (30 least volatile stocks in BSE Largemidcap index)

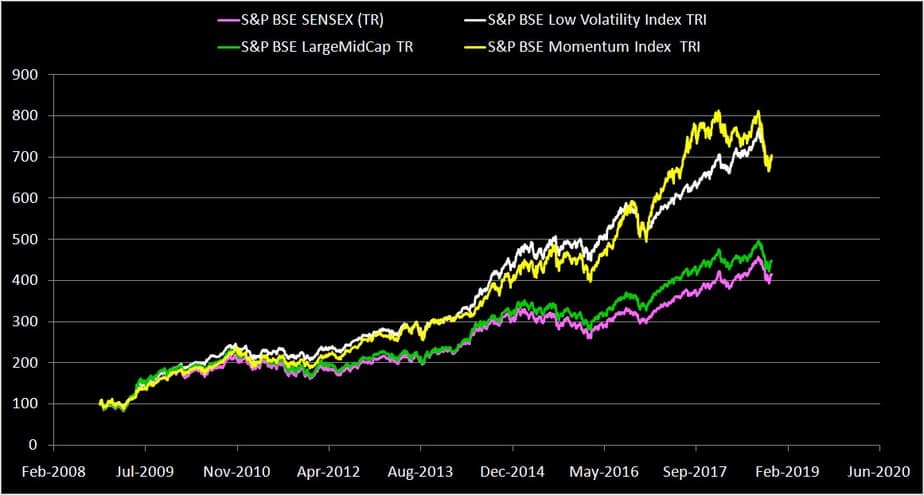

Noice how the momentum and low volatility indices pull away from Sensex and BSE large midcap. You can also visibly see that the drawdowns (fall from peak) is higher for the momentum index compared to the low volatility index.

BSE momentum index vs BSE LargeMidcap

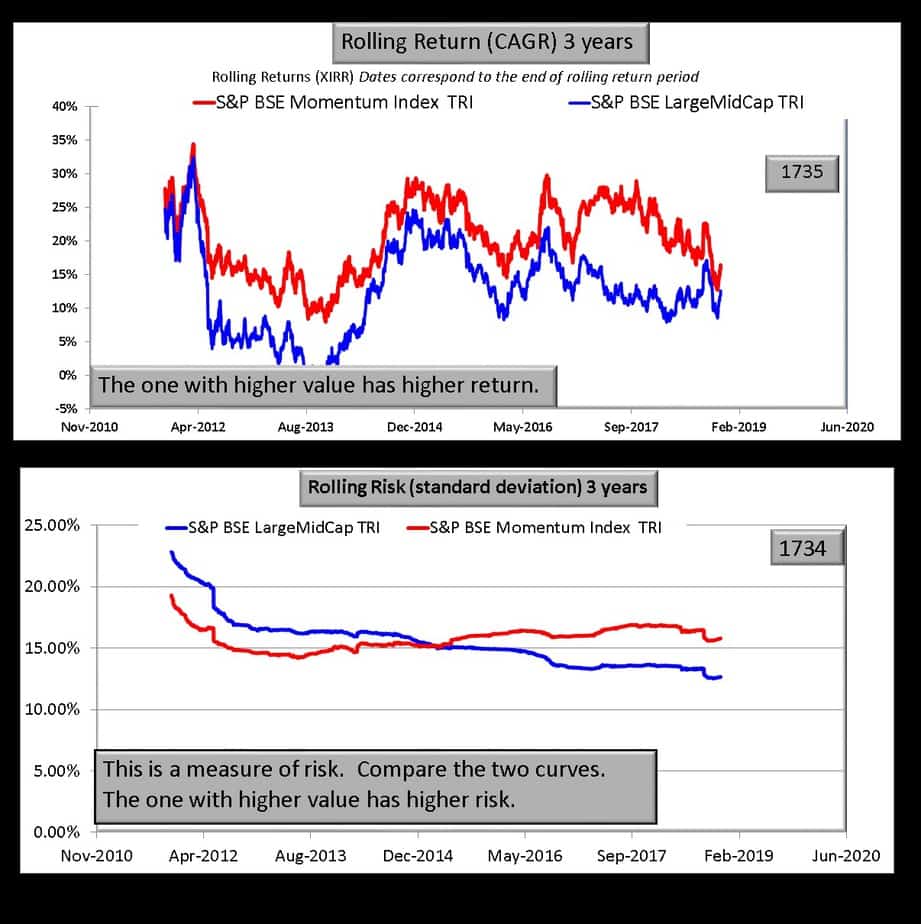

Three years

In all the graphs below, the top panel has the rolling returns. The no of return data points in each curve (red or blue) is denoted in the top right box (1735 below). The bottom panel is a measuring or rolling risk (standard deviation) Please spend some time on each graph to understand what they show.

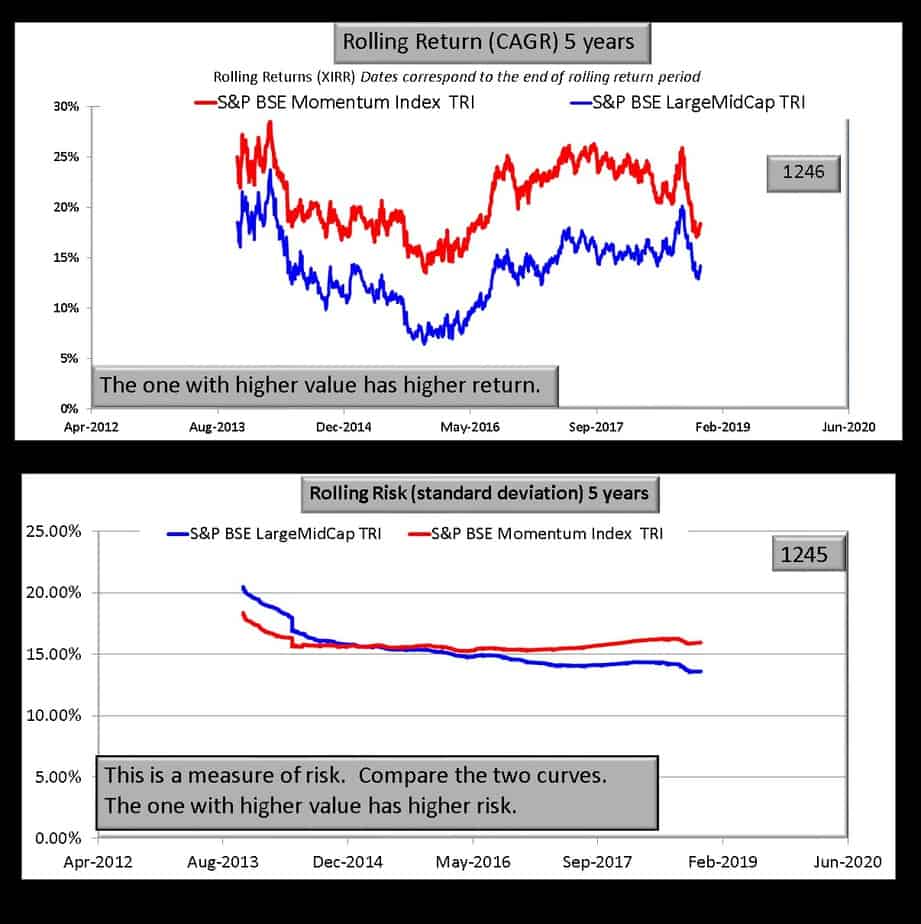

Five years

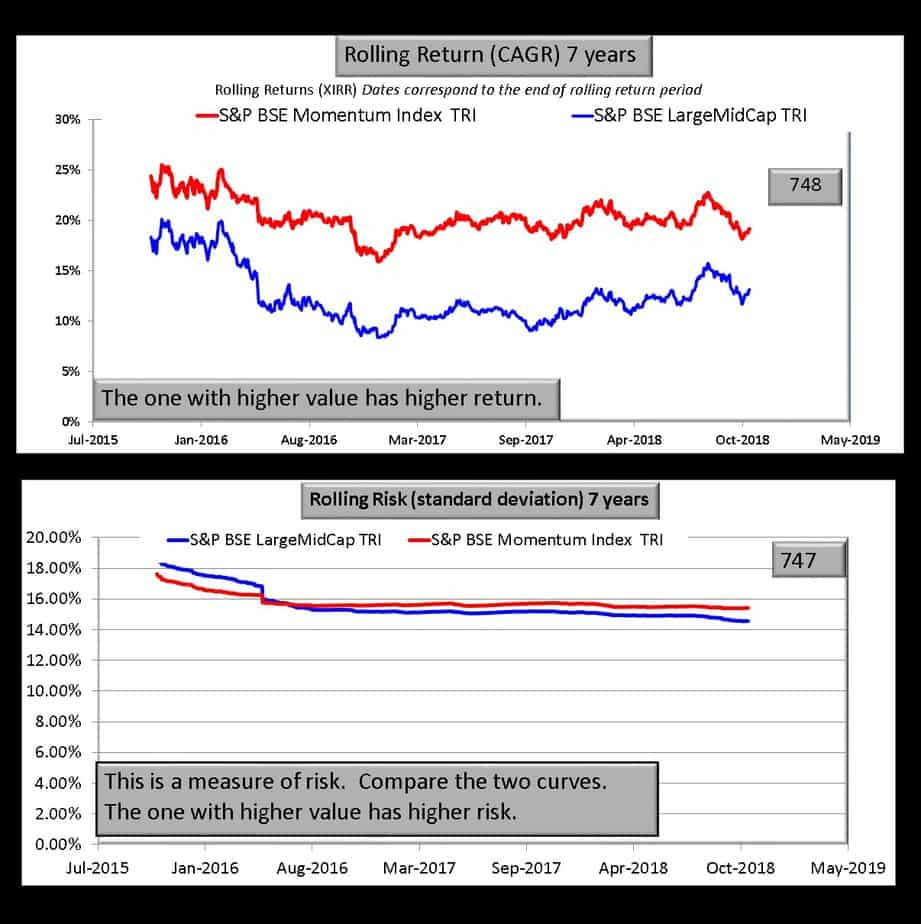

Seven years

Observations:

The BSE momentum index clearly outperforms its parent index BSE Large midcap. What I find amusing is that in terms of volatility, there is not much difference between the two. Only over 7 years do we see the momentum index have a bit more volatility. So the answer to the question, does momentum investing in India work? is a big YES! Technically, the momentum investing method used by the BSE works in India.

A real-life example of an individual portfolio following momentum can be found in Prashanth Krish’s blog (@Prashanth_Krish on twitter) portfolioyoga. This is benchmarked with the Nifty smallcap 100 and the stocks are selected on a similar strategy as outlined above. This strategy is not without disadvantages but will work for those who understand what they are getting themselves into.

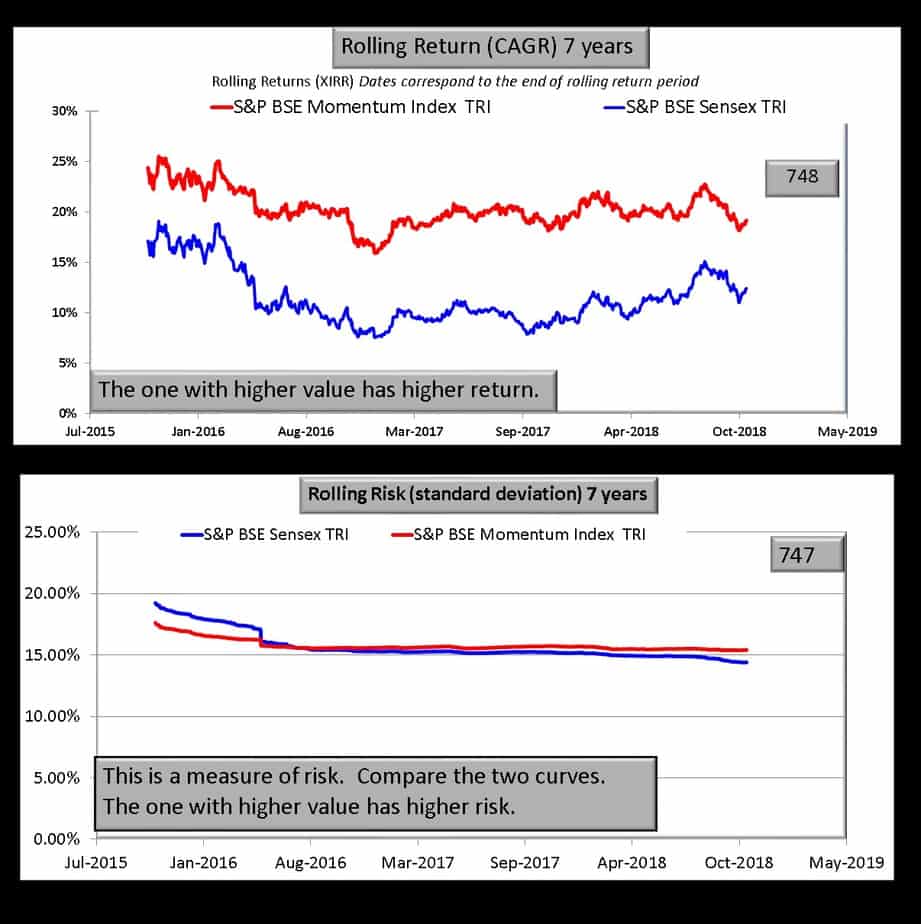

BSE momentum index vs BSE Sensex

Seven years

Observations:

The BSE momentum index has similar volatility wrt the Sensex but with much higher reward.

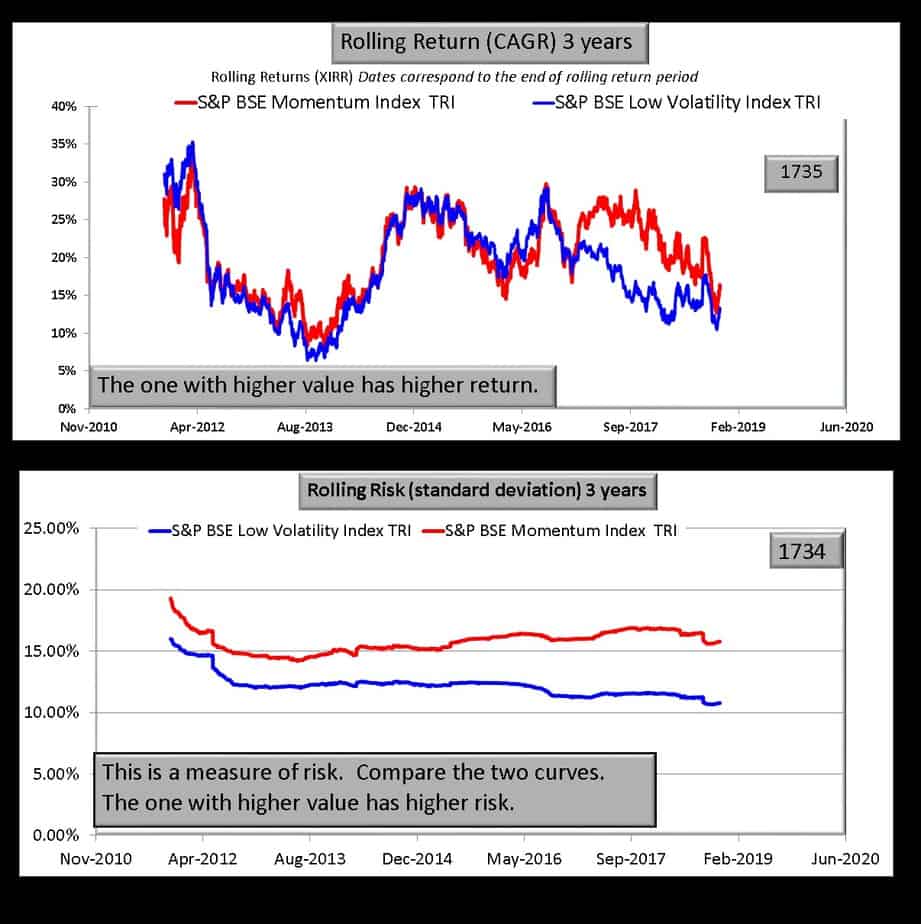

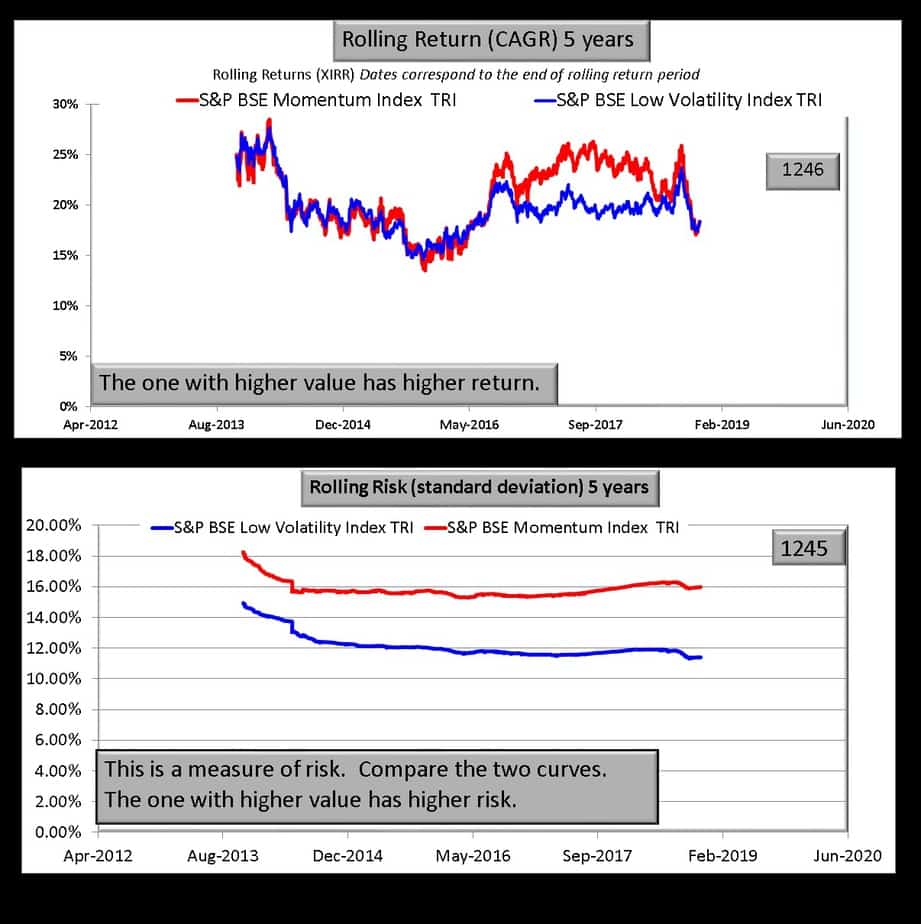

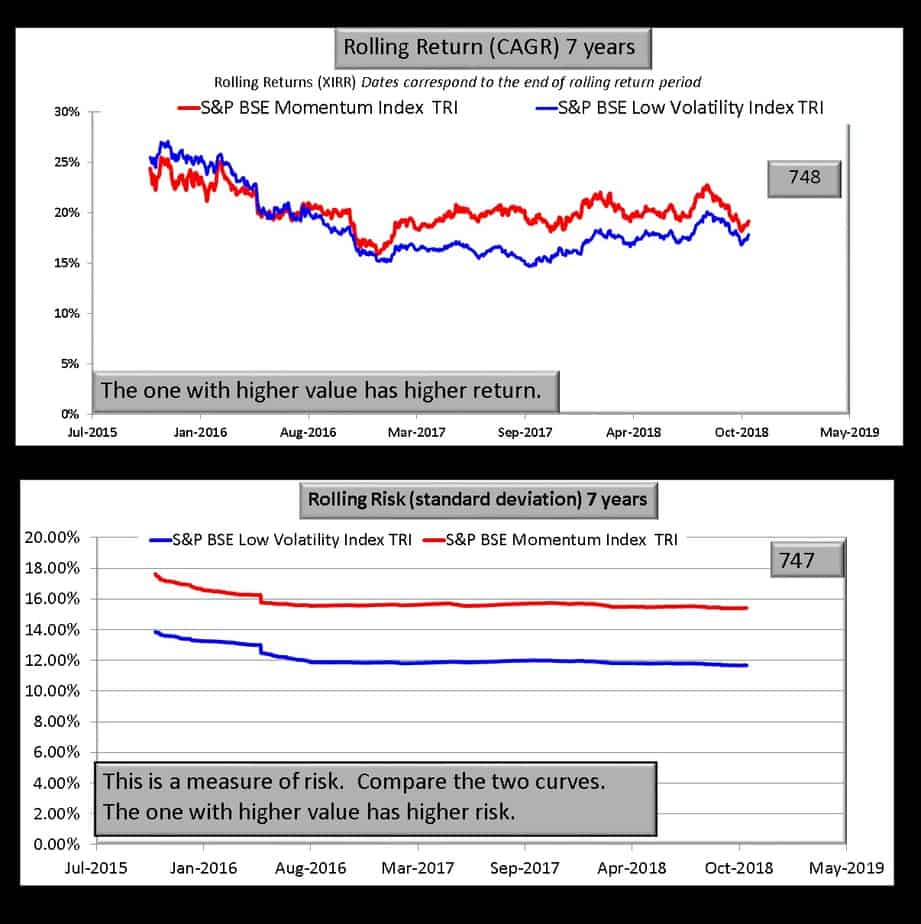

BSE momentum index vs BSE Low Volatility Index

Three years

Five years

Seven years

Observations:

The momentum index outperforms the volatility index “sometimes” but always has a higher risk. Therefore, in my opinion, this gives the low volatility method an edge

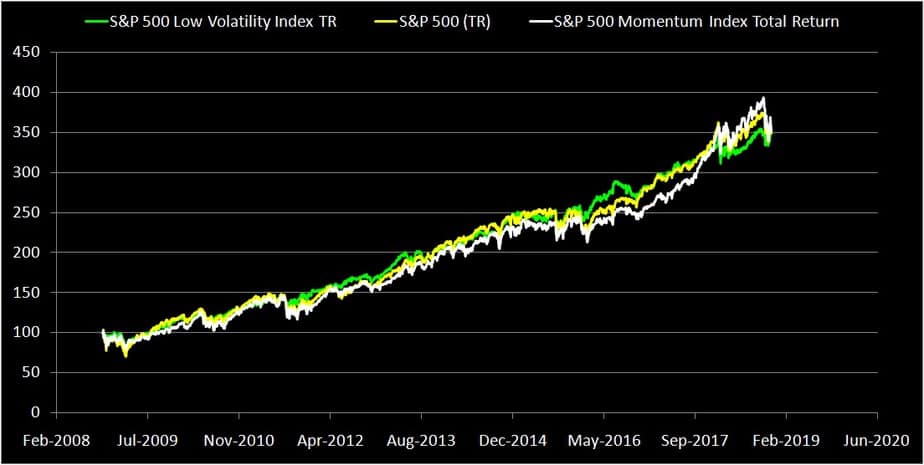

Momentum Investing in the USA

S & P 500 momentum index comprises of 100 stocks from the S&P 500 with the highest risk-adjusted momentum score computed as described above. We will compare this index with the S&P 500 and the S&P 500 Low volatility index (100 least volatile stocks in the S&P 500)

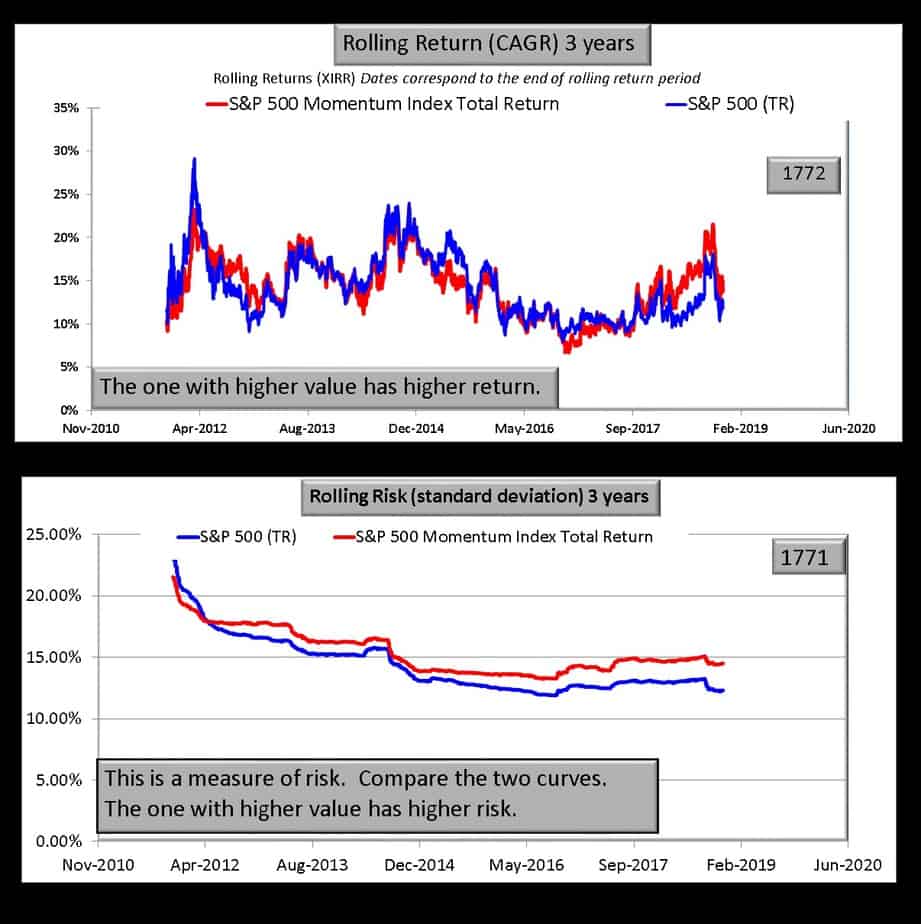

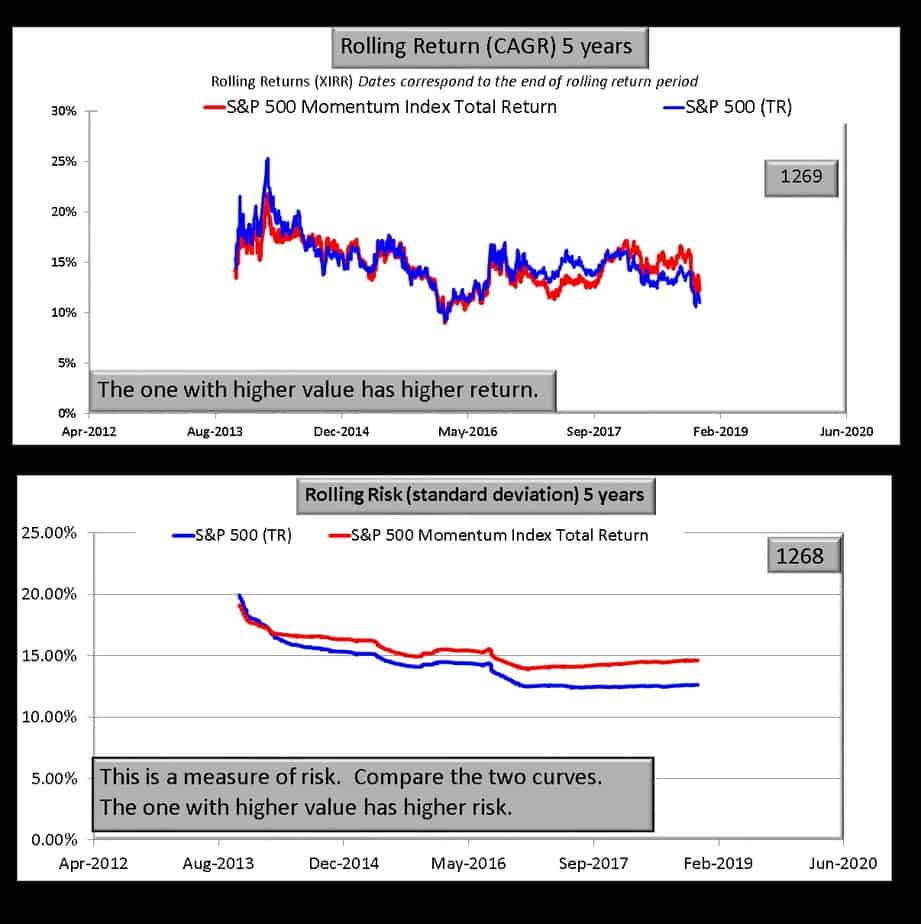

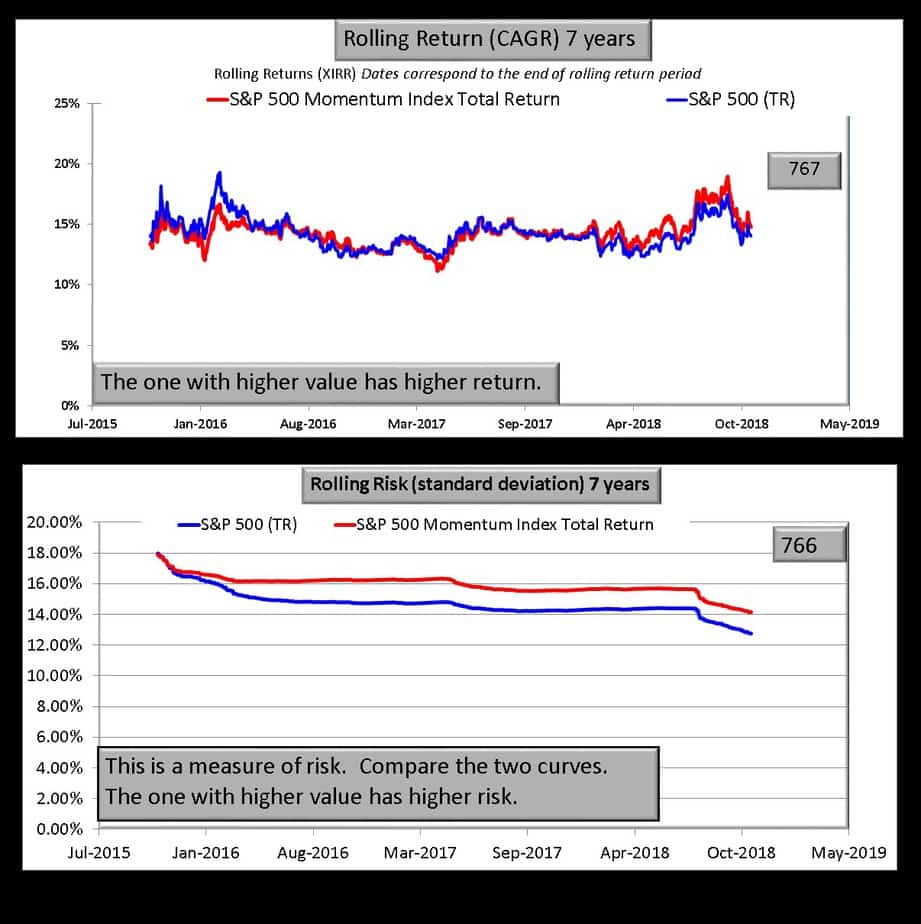

S&P 500 momentum index vs S&P 500

Three years

Five years

Seven years

Observations:

There is no compelling reason to choose S&P 500 momentum as it not rewarding compared to S&P 500 and is a bit more volatile.

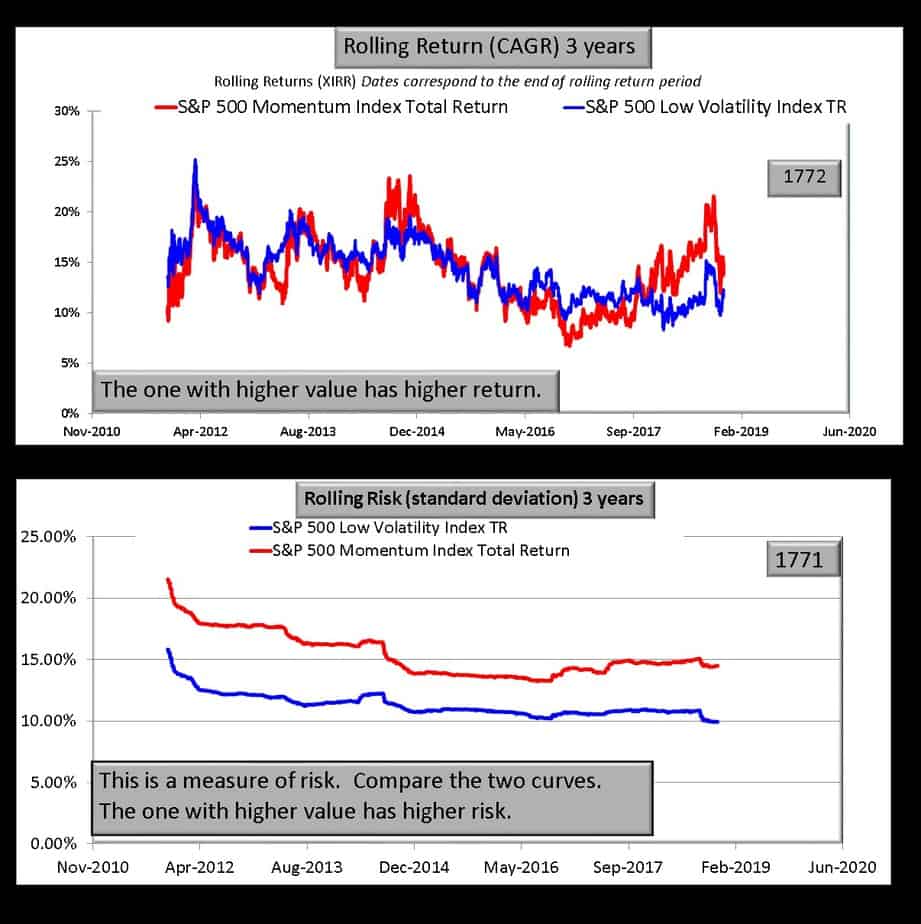

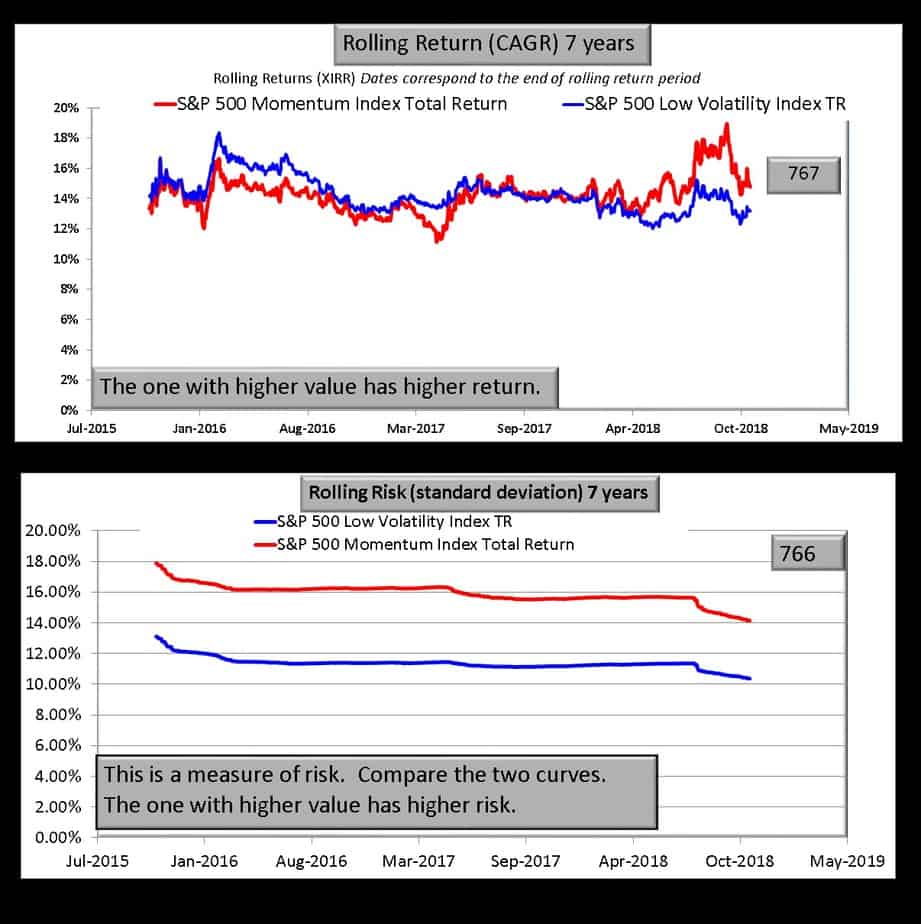

S&P 500 momentum index vs S& P 500 low volatility index

Three years

Five years

Seven years

Observations:

Again the S&P 500 momentum index (or to be specific the momentum investing method used by the S&P) does not seem to work in the USA. The low volatility index has much less volatility (although that too is not rewarding when compared to S& P 500. See Low volatility stock investing: Does it work? Higher returns at lower risk? )

S&P BSE Momentum Index and Low Volatility Index Constituents (Nov 2018)

S&P BSE Momentum Index | S&P BSE Low Volatility Index |

| Adani Ports and Special Economic Zone | Asian Paints Ltd |

| Asian Paints Ltd | Bajaj Auto Ltd |

| Axis Bank Ltd | Bosch Ltd |

| Bajaj Auto Ltd | Britannia Industries Ltd. |

| Bharti Airtel Ltd | Colgate-Palmolive India Ltd |

| Coal India Ltd | Dabur India Ltd |

| HDFC Bank Ltd | HDFC Bank Ltd |

| Hero MotoCorp Ltd | Hero MotoCorp Ltd |

| Hindustan Unilever Ltd | Hindustan Unilever Ltd |

| Housing Development Finance Corp | Housing Development Finance Corp |

| ICICI Bank Ltd | IndusInd Bank Ltd |

| IndusInd Bank Ltd | Infosys Ltd |

| Infosys Ltd | ITC Ltd |

| ITC Ltd | Kotak Mahindra Bank Ltd |

| Kotak Mahindra Bank Ltd | Larsen & Toubro Ltd |

| Larsen & Toubro Ltd | Mahindra & Mahindra Ltd |

| Mahindra & Mahindra Ltd | Marico Ltd |

| Maruti Suzuki India Ltd | Maruti Suzuki India Ltd |

| NTPC Ltd | MRF Ltd |

| Oil & Natural Gas Corp Ltd | Nestle India Ltd |

| Power Grid Corp of India Ltd | NTPC Ltd |

| Reliance Industries Ltd | Oracle Financial Services Software Ltd |

| State Bank of India | Pidilite Industries Ltd |

| Sun Pharmaceutical Industries Ltd | Power Grid Corp of India Ltd |

| Tata Consultancy Services Ltd | Rajesh Exports Ltd |

| Tata Motors Ltd | RBL Bank Ltd |

| Tata Motors Ltd DVR | Tata Consultancy Services Ltd |

| Tata Steel Ltd | UltraTech Cement Ltd |

| Vedanta Ltd | Wipro Ltd |

| Wipro Ltd | Zee Entertainment Enterprises Ltd |

| Yes Bank Ltd |

The overlapping stocks are shown in red. Currently, 17 stocks in the low volatility index are part of the momentum index. So that more than 50% overlap!

Summary

In conclusion, both smart-beta or alternate beta* strategies – momentum and low volatility – seem to work better for India (developing markets as we saw in the low volatility post linked just above?) and not for the USA (developed market?). In future posts, we will dig deeper into identifying momentum stocks with low volatility. * alternative beta refers to risks not covered in the original Capital Asset Pricing Model (CAPM)

Investors interested in momentum investing can the links and book mentioned above and track the stocks in the BSE momentum index or the BSE low volatility index and invest in a manner similar to the test Stock Portfolio Update November 2018 (Lazy Investing)

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)