Last Updated on January 6, 2022 at 7:56 am

Here is why you should stay away from Motilal Oswal Nasdaq 100 fund Of fund (MOFN100FOF) that will invest in Motilal Oswal Nasdaq 100 ETF (MOFN100). The NFO for this fund of fund is open between 9-22 Nov 2018 and it will subsequently operate as an open-ended fund. However, say no to it if your distributor or bank RM suggests it to you. Not because it is an NFO. Not because of Nasdaq 100, but because it is unlikely to make a difference in your portfolio. Allow me to explain.

What is a fund of fund?

A mutual fund invests in other mutual funds or exchange-traded funds are called fund of funds. All fund of funds in India are taxed liked debt mutual funds unless they invest in Indian ETFs. So Motilal Oswal Nasdaq 100 fund Of fund is a debt mutual fund from a tax point of view. So gains from units less than or equal to 3 years old at the time of redemption will be taxed as per slab. Gains from older units will be taxed at 20% with cess after inflating the purchase price using the cost inflation index (aka indexation).

What is the Nasdaq 100?

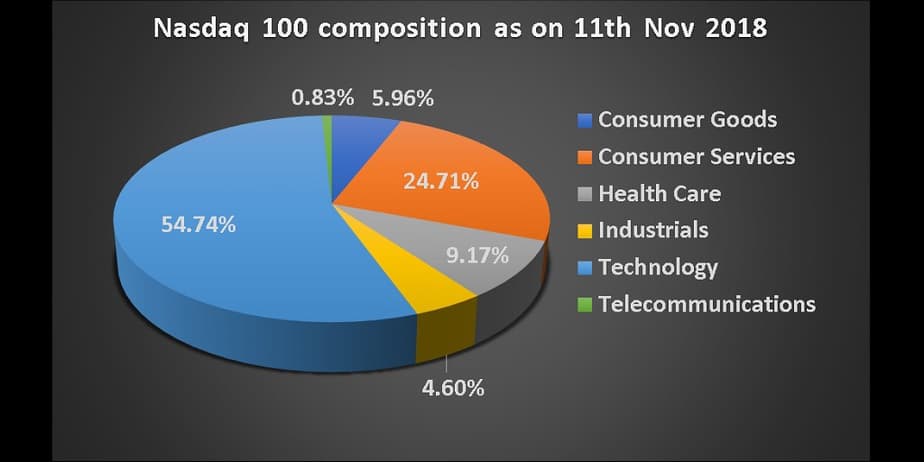

Nasdaq is the second largest stock exchange in the world in terms of market cap (next to the New York stock exchange). The Nasdaq-100 Index launched in Jan 1985 has 103 of the largest (in terms of market cap) domestic and international companies excluding financial companies and investment firms listed on the Nasdaq exchange. Because of this, the index is dominated by technology giants. This is the current sector-wise composition. (this link will also give you the full list of stocks)

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

There are two reasons why the Nasdaq 100 looks promising from an Indian point of view: (1) diversification across international stocks (available in a single index) and (2) the presence of giants like Apple, Microsoft, Facebook, Amazon, Adobe, Intel, Starbucks, Paypal. It is a list of whos-who!

10-year rolling return performance of the Nasdaq 100 (adjusted for dividends and splits)

If you want to look at past performance, don’t just look at one data point and assumption this is great for you. These are 2306 10-year rolling returns calculated from 13th Jan 1999 to 9th Nov 2018. Source: Yahoo Finance

Notice that after the 2008 crash, returns quickly climbed to around 10% and stayed there for an incredible four-year period with a small uptick recently. We will discuss what this means below. Note: these returns are for the US investor (before expenses and taxes, still a well above their inflation). The Indian investors will have to factor in FOREX growth rates as well. We will do this below.

What do we know about Motilal Oswal Nasdaq 100 ETF?

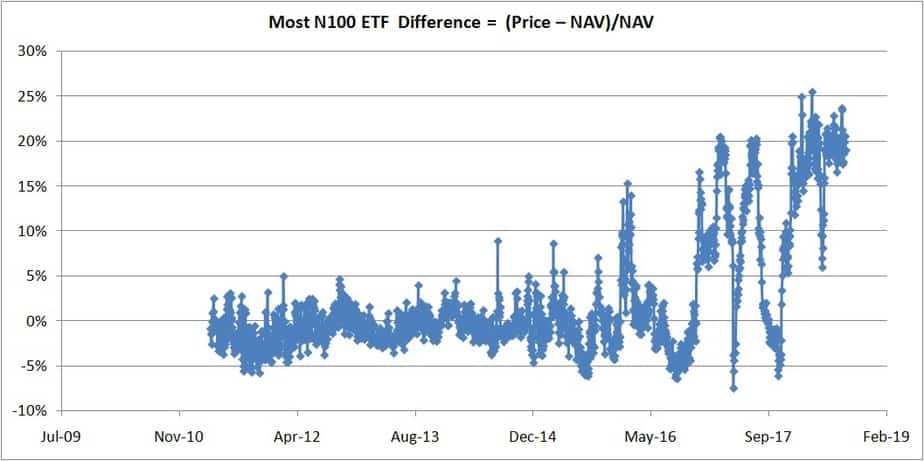

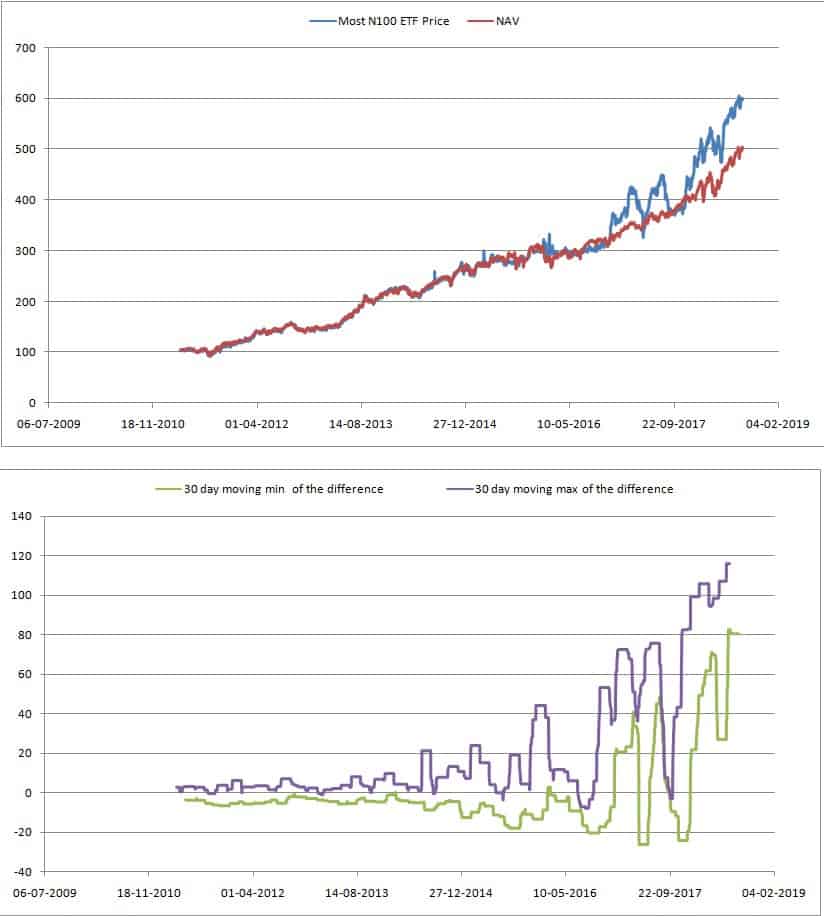

This was started in March 2011 but only has about 94 crores and 4,912 folios only (no commissions means no sales) and even poor liquidity Source: MOFN100FOF scheme document (page 24). This has one of (if not the) worse nav to price difference for an ETF in India. If ETFs are new to you, you can read more about them here: How ETFs are different from Mutual Funds: A Beginner’s Guide and Interested in ETFs? Here is how you can select ETFs by checking how easy it is to buy/sell them

You can see the NAV and price of the ETF plotted below along with the 30-day moving minimum and max of the difference between price and NAV.

Have a look at the atrocious Price-nav percentage difference.

Have a look at the atrocious Price-nav percentage difference.

This means that if you are holding these ETF units, you will not easily find a buyer as the price is much higher than the NAV. There is a high demand for buying these ETF units. but at least for now, not many sellers.

Will the introduction of this FOF create better liquidity in the ETF? The fund manager of the FOF will buy ETF units directly from the fund manager of the N100 ETF or from the stock exchange (secondary market). Unless the FOF sees regular investments and redemptions which are routed through the secondary market, the ETF liquidity is unlikely to improve.

Motilal Oswal Nasdaq 100 Fund of Fund: Advantages

In an ETF, the retail investor can typically only sell with other investors. The AMC will buy these units if there are no other taker, but these will take a few days. This lack of liquidity is minimized (not eliminated) in a fund of fund. We can buy and sell any amount with the AMC and it is their headache to create the units and buy them back upon (when we sell). Liquidity is not a problem for Nasdaq 100 stocks and as long as they have a proper international broker, it should not be an issue. Well, that is about the only advantage.

MOFN100FOF: Disadvantages

- The fund of fund will have a NAV that tracks the price of the N100 ETF. Since there is a huge disparity between the price and nav of the ETF, this will also lead to a disparity in the returns of the fund of fund and lead to significant tracking error. This one reason al0ne should be enough to avoid Motilal Oswal Nasdaq 100 fund of fund

- The ETF will hold 5% cash to handle redemption pressures. So will the fund of fund. So this makes 10% cash in total and that much less exposure in the NASDAQ 100. This cash holding will also result in a distinct and constant tracking error (difference in returns between the index and the fund of fund)

- MOFN100 (ETF) has a ~ 0.5% expense ratio. The fund of fund will have an additional ~ 0.1% expense ratio (for the direct plan. The regular plan will have higher (~ 0.5%)

- The fund of fund will be taxed as a debt fund as mentioned above. Since this should be a long-term investment, one can expect (as per current laws that can change for the worse) to pay about 15-17% effective tax post indexation on the gains (if any!)

- The US market may appear nice and stable, but it if falls, it falls big (see the 10Y returns around 2009 above). The current fluctuations add an additional layer of volatility in the returns. So the usual nonsense like “invest for the long-term” etc will not work here (or anywhere else).

You can get details about the FOF from the AMC site

US INR Exchange rate history and how it will impact investments in the Nasdaq 100

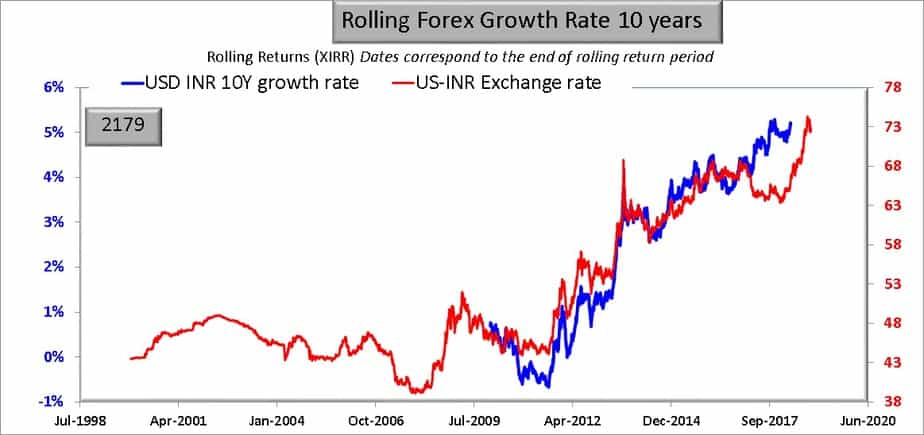

If you look at the price of gold vs time or the USD-INR exchange rate with time, it appears as if the growth rate is “huge”. In reality, it is not so.

Now let see how this forex growth rate will enhance returns from NASDAQ 100. Let us assume that the 10Y return expectation from the NASDAQ is 8% (accounting for expense ratio, but not tax) assuming we do not see huge crashes. If there a 40% crash, you will get next to nothing. after 10 years. We shall also assume that the USD-INR rate grows year on year at a rate of 4%.

Suppose you buy NASDAQ units for Rs. 10,000. and one USD is Rs. 70. So you will be buying units for ~ $ 148.8. This amount grows at an 8% CAGR for ten years to $ 308.4. Meanwhile, the exchange rate has now become Rs. 103.6 per USD (at 4% CAGR). So after 10 years, you will have

= 103.6 x 308.4 = 31957.4 INR. This corresponds to a CAGR of 12.32% (a little more than 8% + 4%). If you remove about 16% tax (LTCG at 20% with indexation will be lower than 20% flat), then CAGR is about 10.4%.

Why avoid Motilal Oswal Nasdaq 100 Fund of Fund?

So, the index is wonderful, the forex rate is favourable, the FOF minimises the risks associated with the ETF (although it is exposed to its illiquidity), but then why are you saying avoid it? Yeah, yeah I agree with all of this, but what most people fail to understand is the importance of asset allocation in the portfolio. Allow me to explain with an example.

In 1997 when I started my PhD and started using computers, the brand new WIN’95 machine in my lab had a storage issue. So I was asked to remove files and create some disk space. So I listed all the files in C: and started removing one by one. After an hour so, my supervisor came by and was surprised to find that I was still at it. He then realised that I was focussing on kilobyte sized files and not the large ones. So he taught me a lesson that I never forgot: focus on stuff that creates the most impact. Don’t spend time worrying about peanuts. Well, he meant, arrange the files by size and delete the largest ones that were not useful and be done with it. The same applies to our investment portfolio as well.

Sure, the Motilal Oswal Nasdaq 100 fund Of fund is a good way to invest in the NASDAQ 100 (which in of itself is a fantastic index). However, how much are you going to invest? How much of your portfolio will have exposure to this fund? I am willing to wager that for most people interested in this it will be not more than 5%, rarely 10%.

Just because it is a good investment, will you allocate 20%/30%/40% of your portfolio to this index and face the prospect of huge crashes and extended sideways movements? (why do you think the 10Y returns are so poor prior to 2011?). At 5% or so, what great difference will it make to your portfolio?

Yes, yes “diversification with international stocks” is a good thing (for lower volatility, not higher returns), but this implies significant exposure. Take a balanced fund or aggressive hybrid fund for example. It has 25-30% bond exposure at all times with periodic rebalancing to deliver equity fund like return at lower risk. Most investors are unlikely to have this kind of exposure in MOFN100FOF and even if they do, how many will rebalance each year and pay tax on gains as per slab because risk management is important? Most investors have a flawed, “let us keep investing and hope it will work in the long -term approach”.

Stop spending time searching for kilobyte sized files like me. Focus on the key players with a minimalist portfolio. If you actually, truly understand the purpose of diversification and lower volatility in your portfolio, use a fund like PPFAS Long Term Value Fund. If you hold enough of it, (min 30% upwards), then you will end up getting a small exposure to international stocks. Of course, it will not be as diversified as Nasdaq 100 and dependent on fund manager risk. It is not a perfect solution but will provide lower volatility (which is what diversification is all about) and favourable taxation (this fund will hold 65% minimum Indian equity at all times).

In summary, having a “small exposure” to Motilal Oswal Nasdaq 100 fund Of fund (as “experts” will now ask you to consider as they need to sell) will not help you in any way – not in terms of returns, not in terms of risk and not in terms of diversification. You will be left with a cluttered kichdi of a portfolio. If you disagree, at the very least, do not start a SIP “for the long-term” in this as it will be a tax nightmare!

Note: Video version of this post will be available today evening. Subscribe to the freefincal youtube channel (press the bell icon to receive notifications)

update: this is the video

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)