Last Updated on December 18, 2021 at 10:33 pm

It is possible to build a beautifully diversified equity portfolio with only sector mutual funds. The data first published with this idea in April 2014 has now been updated.

Note: what is presented below is an investment idea presented with academic curiosity and not a recommendation to abandon your existing diversified mutual funds.

Investing for long-term financial goals has a singular purpose, obtain returns that are more than the average inflation after taxes. Typically, this is possible only by using instruments that are volatile like equity.

Volatility is a double-edged sword. It is necessary to combat a volatile enemy like inflation. However, too much of it can erode the benefits of compounding.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Investing is not about returns! It is about returns with low standard deviation. That is annual returns of a portfolio should not deviate too much from the ‘average’ return. If there are wild swings, each time there is a fall, most gains would be wiped out.

I can think of at least four ways to contain the erosion of gains due to volatility:

- Asset allocation Spread your investments across investments that vary in volatility, preferably among those poorly correlated with each other. The simplest form of diversification is between equity and debt, avoiding real estate, gold, art etc.

- Diversification The investments in each asset class must be well diversified. That is, equity investment should be spread across market cap, sectors and geography and debt investments across instruments that vary in credit risk and interest rate risk (learn how to choose debt funds here)

- Rebalancing Gains made in one asset class is shifted to another to ensure the asset allocation is not skewed in favour of one asset class. You can learn all about rebalancing and play with a simulator here.

- Decumulation The assets in the volatile instruments are gradually shifted to safer instruments a few years before the money is required for the intended expense.

While asset allocation (don’t put all eggs in the same basket) and decumulation (quit while you are ahead) represent simple common sense,

Diversification (hit a moving target with a pellet gun and not a rifle) and rebalancing (keep adjusting the centre of gravity if you balancing a stick on an end!) are less obvious but equally important.

Diversifying within each asset class is most crucial in containing portfolio volatility.

The idea is simple. You don’t know which stocks will work. So just buy stocks of each variety (market cap, type, sector, geography). In any given year some of these stocks will click and others won’t. So the gains in your folio will on an average increase steadily and will lower volatility compared to investing in select stocks.

Diversification is also a double-edged sword. It will equally suppress losses and returns! That is the price you pay for investing in a volatile asset. Diversification will not work if a person does not have the maturity to understand this.

Most DIY investors fail to diversify within asset classes – primarily equity. Diversification applies to debt as well but is not as crucial, since volatility is lower. Come to think of it, NPS is a half-decent way to diversify a debt folio!

It is difficult to build a truly diversified equity portfolio with … er … diversified equity funds! Many of us hold more than one large cap or one mid/smallcap funds. Down the line we accumulate more such funds and soon many of the funds in our equity folio will have the same set of stocks – use this tool to find out the overlap in equity portfolios.

The portfolios of diversified funds can significantly with time. Large-cap funds can increase small/midcap stock exposure beyond what we expected it to do and vice-versa. In fact some funds have even jumped categories in VR online!

So although we start out with fund with minimal overlap, this can change with time.

What is the simplest way to build an all-weather diversified equity folio? How can we ensure minimum overlap among stocks at any point in time but at the same time, minimising risk and therefore hope to obtain decent returns?

Can we find a turn-key solution to equity folio diversification? That is, once we find a method and implement it, the extent of diversification does not vary by much for the entire investment duration, with no intervention necessary by the investor.

I had earlier discussed a turn-key solution to asset allocation – The permanent portfolio. You hold 25% of equity, 25% of gold, 25% in long term bonds and 25% in short-term bonds and rebalance each year.

This has had excellent success in the US and other parts of the world. In the Indian context, tax could play spoil sport.

In this post (finally!) I discuss a turn-key solution to equity portfolio diversification: Use Sector Mutual Funds

This post is inspired by a thread in facebook group Asan Ideas for Wealth (AIFW).

A sector (equity) mutual fund is one which has a mandate to (primarily) invest in stocks of one particular sector – Health Care, Metal, Oil/Gas, fast moving consumer goods, information technology etc.

The idea behind the turn-key solution is simple. Buy different sector funds in equal proportions and contribute to them regularly. By doing so, you would have pretty much a guaranteed diversification of the equity portfolio at all times.

Okay! But what about performance?

To verify this Idea I have chosen one fund from each of the actively managed sector funds that are listed at VR online.

I have chosen funds that are 10 years old. So in each sector, I only had 2-3 funds to choose from. Among these ,I picked the ones that were most consistent as outlined in the step-by-step guide to selecting an equity mutual fund.

As always star ratings were ignored! The funds chosen were,

- UTI-infrastructure

- ICICI-Pru-technology

- SBI-Pharma

- ICICI-FMCG

- Reliance-banking

In the case of infrastructure funds, the one from UTI was the only 10-year-old fund.

NAV history from AMFI is available only from Apr 3rd 2006. So to automate the process, and determine net portfolio return*, I used the mf/financial goal tracker.

* To obtain the net portfolio return one take into account all past transactions to compute the average return with Excels XIRR

Two scenarios were considered

Scenario I

Ongoing SIPs of 1000 in each of the above funds from 3 Apr 2006.

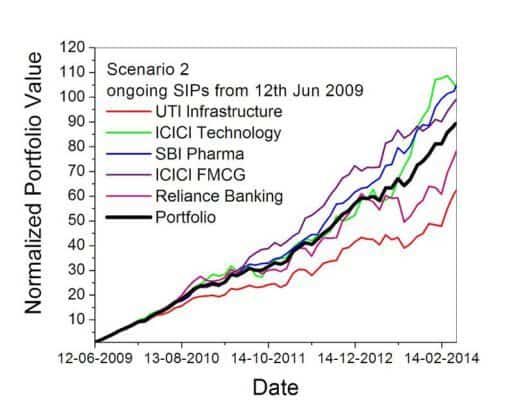

Scenario II

Ongoing SIPs of 1000 in each of the above funds from 12 Jun 2009.

After 12 Jun 2009, the recovery from the 2008 crash slowed down significantly. So I wanted to test the performance in slow growth conditions.

Let us now consider each of them

Scenario I Ongoing SIPs since 3 Apr 2006

The normalised portfolio values are shown below

Note: This is the normalised value of the funds and the portfolio. This is to illustrate the volatility in the same scale. The actual portfolio value will be the sum of the individual fund values.

There are two ways to interpret this graph:

- The person who constantly chases after returns is likely to think I should have invested in Pharma, FMCG or Technology sectors!

- The person who is concerned about building a diversified portfolio in the hope of reducing its volatility to ensure steady but not a spectacular growth will be delighted.

While the portfolio volatility is indeed considerably lower than individual constituents. This is because the folio dips only when all the funds respond alike. The portfolio growth neither resembles the worst performer (UTI-infra) nor the best performers. This is the hallmark of good diversification.

Notice the reasonable downside protection during 2008 and smooth recovery.

Returns (updated 12th July 2016):

Pretty good!

Returns (Apr 28 2014):

- UTI-infrastructure 1.74%. Total investment: 97,000; Current Value: 1,04,109

- ICICI-Pru-technology 18.26% Total investment: 97,000; Current Value: 2,06,670

- SBI-Pharma 18.65% Total investment: 97,000; Current Value: 2,10,107

- ICICI-FMCG 19.30% Total investment: 97,000; Current Value: 2,15,872

- Reliance-banking 16.15% Total investment: 97,000; Current Value: 1,89,222

- Portfolio 15.63% Total investment: 4,85,000; Current Value: 9,25,983

This is astounding because despite abysmal returns from the infra fund the net portfolio return is extremely decent for a 8 year period.

Scenario II Ongoing SIPs since 12 Jun 2009

The normalised portfolio values are shown below

Again notice the amazingly low volatility of the portfolio

Returns (updated 12th July 2016):

Again not bad at all!

Returns (Apr 28 2014):

- UTI-infrastructure 2.22% Total investment: 59,000; Current Value: 62,289

- ICICI-Pru-technology 23.44% Total investment: 59,000; Current Value: 1,03,332

- SBI-Pharma 23.99% Total investment: 59,000; Current Value: 1,04,654

- ICICI-FMCG 21.63% Total investment: 59,000; Current Value: 97,074

- Reliance-banking 11.57% Total investment: 59,000; Current Value: 7,079

- Portfolio 17.30% Total investment: 2,95,000; Current Value: 4,47,447

In this case, again infra sector disappoints. The banking fund has relatively underperformed. The net portfolio return is still an impressive 17.30%

Clearly, this method appears to be an effective way to diversify an equity portfolio.

Can we compare this with the method against the usual core-satellite diversification strategy? That is, use diversified large cap funds as core and diversified mid and small cap funds as the satellite of a portfolio.

Mr. Muthu Krishan at AIFW pointed out that Quantum Long Term Equity (see analysis here) a multi-cap fund has returned 15.5% from 2006.

So clearly, a folio well diversified across market caps delivers. However, we can only say this in hindsight. There is no way we can ensure diversification and decent returns before investing. We can only speak in hindsight about performance.

In this aspect the turn-key diversification strategy – picking different sector funds and contributing equally to them – scores. Simply by common sense. Of course, there is no guarantee that it will work. Since it is based on sound logic, combined with Rupee cost averaging, I am confident that it will.

Note: This strategy is not for getting better returns than any other strategy. The motive here is to reduce portfolio volatility, preserve gains and enhance downside protection. That such a motive will usually yield good returns is entirely incidental 🙂

I have not included any returns from diversified funds for comparison. The reason for this is hindsight bias. I can pick and choose funds which suit my argument. You can pick and choose funds which negate my argument.

Why bother? Let us agree on one thing. We can definitely get good returns with the core + satellite approach as well. However, we will have to take a chance on the competence of the fund manager and the extent of diversification

In the sector-based approach, if a sector is doing well or badly any sector fund should reflect that to a large extent. The reason for this is the portfolio has only one type of stocks (typically). So the fund managers role is less important here. Also in this approach we are guaranteed of diversification and therefore guaranteed of lower volatility.

Returns are not guaranteed, but I expect it to the comparable to the core + satellite approach if not better most of the time.

How to construct a portfolio with sector mutual funds?

The fund should be a hard-core sector fund. It should not be a sector-plus fund. That is, some funds invest in stocks outside a sector because such stocks can influence the sector. For example, some infrastructure funds invest in banking stocks.

In a sector-plus fund the fund manager plays a role. We would like to minimise his/her importance for effective diversification.

Low expense ratios would help, but this will be tough since most funds have low AUMs. Consistent performance and good risk-returns parameters as mentioned in the guide would obviously help. However, this should not vary too much among hard core sector funds.

Compare the performance of the fund with its sectoral index and not with Nifty or Sensex.

Reliance Banking practically mimics the CNX Bankex. So instead of this an ETF may be a better choice with respect to expense ratio but not with respect to liquidity! Bank ETFs have pathetic AUMs!

I had written about how these sectors are correlated with each other. I shall update the post and publish it tomorrow.

So what do you think about this method?

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)