Last Updated on December 29, 2021 at 6:05 pm

Here are some financial lessons from our childhood stories! This is a guest article by Srivatsan, who would only like to be referred to as a “long-time reader” of freefincal! He has written several articles here before and is responsible for adding the Earnings power box feature to our stock analyser. His previous articles are listed below.

- We spotted a “Multi-beggar” stock 3 years back – You can, too!

- Forget Buffettisms/Mungerisms: try these 2000-year-old personal finance tips!

- Ten Amazing Similarities between Poker, Stock Markets and Life

- It’s Earnings That Count: Forget the next Infy; Can you identify the next Satyam?

- PMC Bank Fraud: Lessons from Sanjay Gulati’s story

- Automated Earnings Power Stock Analysis With Screener.in data

- Want financial success? Budget time & energy before money!

- Are you a DIY investor? Be careful what you read and how you apply the stuff.

- If BJP loses Lok Sabha Election 2019, will the stock market crash?

Childhood Stories; Adulthood insights!

On a cold rainy day, with nothing to read, I picked up my old Aesop/Panchatantra stories collection. I realized some of the stories are etched in our memories and have instant recall even if we had read them way back in class one. This is my (lame) attempt to go beyond “what is the moral of the story” and see whether I could draw some parallels/insights connecting to financial aspects from our lives.

Let’s start with the one I consider the most successful time tested template for storytelling and Rajinikanth movies ☺. Any guesses? [Note: As the stories are well known, I am not rehashing them for the sake of brevity]

Hare and the Tortoise

Every time I read this, I could glean multiple insights. Apart from the “slow and steady wins the race”, “pride /hubris/laziness” morals, here are my takes:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

- The obvious analogy here is hare represents equity and tortoise represents debt, and their respective nature represents the returns and volatility. Let’s explore further

- Before even the terms “fooled by randomness and black swan events” were coined, this story is a shining example. Let’s face it. If the race happened 1000 times, the hare would win 999 times, hands down. What makes the story memorable is the fact that the tortoise won. As the saying goes, “History is driven by surprising events; Forecasting is driven by predictable events”.

- If you are a tortoise, decide whether you even want to run this race in the first place? Barring a miracle, the odds are heavily loaded against you. How many of us are running the rat race, hedonistic treadmill or the race we are ill-suited for?

- If you are a hare, again, decide whether you even want to run this race in the first place? If you win, who cares? You beat a tortoise, and you were expected to win anyway. However, if you end up losing – your name will be etched forever in annals of history for all the wrong reasons. For the hare, it is the “fat tail risk”. While the probability of hare’s failure is miniscule, the impact of hare losing the race has now spanned 2000 years! Same extension to our financial investments.

- Hare can afford to sleep; A Tortoise cannot. Tortoise simply doesn’t have the Margin of safety. Every single step it makes seemingly takes enormous effort. Tortoise, to win the race, has to make this effort every time continuously without any breaks. Tortoise needs to do this relentlessly till it crosses the finish line – Only then it can rest. You can easily relate this to the plight of daily wage earners, migrant workers during the lockdown.

- Tortoise personifies the sustained, disciplined, relentless effort that is required for our health, personal financial freedom and career development [Refer story 4 about bamboo tree growth]. On the flip side, if you are a hare, you need to capitalize on your head start. You can afford to sleep, but even then, you need to really scramble to the finish line despite your head start and speed. You can relate this to people earning high incomes waking up late get a rude shock when presented with retirement numbers

- Your parent’s career vs yours – Tortoise represents the careers of the previous generation. Work at the same seat, same floor, same building, same company, and same location for 40 years plus retire with a pension, pf and gratuity. NOT YOU. You are a dynamic, result-oriented professional with x years of rich, diverse global experience. Hare represents the career reality of this generation. You want rapid growth, big salary hikes every year, job hop every 3-5 years, take a break to figure out yourself, get laid off in between or switch career directions, start a business etc.

- Tortoise is inflation; Hare is your income/corpus growth – Tortoise is like inflation given it is slowly steadily, relentlessly moving and eroding your wealth 8% at a time. You don’t see its effect unless it is too late. Just like equity returns, our career growth/salary is lumpy. No one gets a 15% raise Y-o-Y every year.

- Let’s say you were frustrated with a job with paltry raises, and you jumped at a 25% hike offer after 3 years. Is that a good deal? Do the math. 3 yrs inflation at 8% will make what cost earlier at 100 now cost ~125. Your 25% jump barely kept pace with inflation, leave alone lifestyle creep!

- Do not let the tortoise (inflation) overtake the hare (your corpus) when you reach the finish line (retirement)

The Goose that Laid the Golden Eggs

The instantaneous parallel I could draw is to Dividend investing and capital preservation.

- Goose is your dividend-yielding stock; golden eggs are your dividends. In the long run, the golden eggs compound to be far more valuable than the rare goose itself. Once you find that golden goose (stock), do not kill it (by selling due to panic, greed, ignorance).

- More importantly, this is a lesson in Capital Preservation. Many of us lose sight of this fact by obsessing excessively over returns. This fact is succinctly reiterated in Thirukkural:463.

ஆக்கம் கருதி முதலிழக்கும் செய்வினை ஊக்கார் அறிவுடையார்

Losing the capital in pursuit of profit is not a task the wise will undertake.

A smart businessperson will not bet the bank if there is a severe threat to the capital, even if there are promises of significant gains in the future. Read more: Forget Buffettisms/Mungerisms: try these 2000-year-old personal finance tips!

The Fox and the Grapes

How many times have we seen people who have lost money in stock market proclaim that it is a gamble, scam and rigged etc.? This is what behavioural psychologists call forming ad hoc hypothesis and rationalization (I cannot reach the grapes 🡪 the grapes must be sour 🡪 [ad hoc hypothesis] 🡪Hence I will not eat it [rationalization])

Bamboo tree growth

- The obvious analogy is a multi-bagger stock;

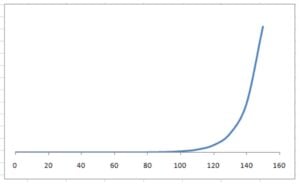

- The second obvious analogy is that this is how compounding works. Take the famous example of Rs 100 p.a invested at 10% in FD for 150 years – the bulk of the returns at a rapid pace comes after year 100! Note the almost flat slope in early years!

- For Buffett bhakts – this is precisely why Warren Buffett didn’t even become a billionaire until he was 50 years old. In fact, 99% of Warren Buffett’s net worth was earned after his 50th birthday.

A deeper insight I could draw is that life is highly non-linear. It is definitely not the straight line; step by step, upward progression, we are conditioned to think from our school and college education. There would/could be years of latency before that explosive exponential growth.

The critical thing is to keep nurturing during the so-called dormant phase. Be it health or career development – Keep persisting and doing things in a sustained disciplined manner day-in and day-out. The results may not be immediately apparent in year 1, 2 or even 5. But those so-called “atomic habits” compound – even 1% a day makes a huge difference!

The Bald Man with Two Mistresses

This is my favourite one, and I could draw several connected insights.

- Things people do to you are driven by their own self-interests and not for your benefit.

- It is impossible to please everybody. Trying to satisfy everyone because you want to be perceived as “nice” will be detrimental to you. Do not say “yes” when you want to say “no”.

- This story also resonates with the modern-day quote on marriage, “Men Marry Women with the Hope They Will Never Change. Women Marry Men with the Hope They Will Change; Both are disappointed.”

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)