Last Updated on October 8, 2023 at 1:45 pm

Axis Dynamic Equity Fund is yet another dynamic equity fund that proposes to tactically change its asset allocation to reduce risk (with no guarantee that the backtesting will work in the future). When Anish Mohan sent me the funds KIM*, his description piqued my interest to look deeper. Here is a description of its strategy. a backtest followed by a discussion.

Announcement: Travel to Europe at 40-50% lower air fares!!

Pranav Surya just posted in AIFW that “Oman Air + Lufthansa are running a fantastic promotion for cities to travel from Delhi”. If you want to avail such huge discounts (eg. Delhi to Berlin only Rs. 23K) , follow the steps pointed out in our new book: GameChanger (Rs. 199 hardcover; Rs. 99 Kindle). Additional tips are available in the Travel Training Kit (Rs. 199)

- KIM = Key information Memorandum. SID = Scheme Infomation Document. The KIM contains the essentials about the fund. The SID tells you all possible risks and legal wording to safeguard the AMC. Looking for a book to learn about mutual funds, just download the SID of any fund and read it end to end.

Announcement: Venkatesh Jambulingam has been kind enough to translate few of my posts in Tamil. Please support his work by sharing it. Latest posts:

How to review a mutual fund portfolio (Tamil) (English version is here)

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Minimalist portfolio ideas for young earners (Tamil) (English version is here)

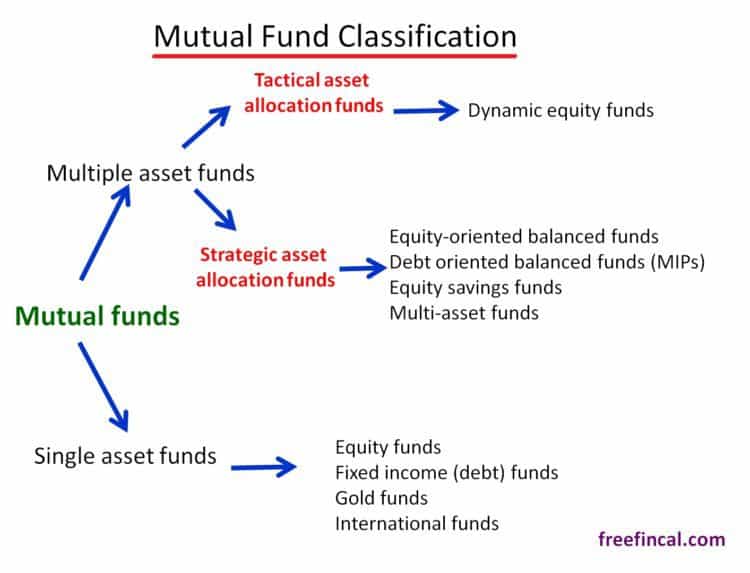

First, it is important to “place” the fund. I would recommend reading this classification post: Dynamic Mutual Funds vs Balanced Mutual Funds. Here is a picture from the post.

Strategic asset allocation is trying to keep the asset allocation fixed at all times (rebalanced every month or so). Tactical asset allocation refers to (in this context), reducing equity exposure when markets are “overheated” and increasing it when they “cool” down.

I had earlier done an investment strategy analysis of Investment Strategy Analysis: IDFC Dynamic Equity Fund when it was an NFO. And now, I see it not exactly doing well. This fund uses 200 days daily moving average + Nifty PE to tactically asset allocate.

Then came a fund from Motilal Oswal, which led to this: Do not invest in dynamic equity funds if you wish to chase returns

Earlier I had also studied the performance of Dynamic Asset Allocation Mutual Funds.

The only reason I decided to backtest Axis Dynamic Equity funds strategy is that it was complex – amusingly so. So when you backtest, it is fun and you learn a thing or two. This post is NOT an advertisement for the fund. In fact, I am quite clear that one should not invest in this or any other such fund even before I started. Yeah, call me prejudiced, but my portfolio hates clutter and it thanks me.

Take a deep breath and read on.

None of the below numbers and rules are justified in the SID and supposed to be a “proprietary in-house quantitative approach”. This means, “we won’t tell you what it exactly is other than rosy results”. So I will not take it too seriously.

Every 40 business days, the fund

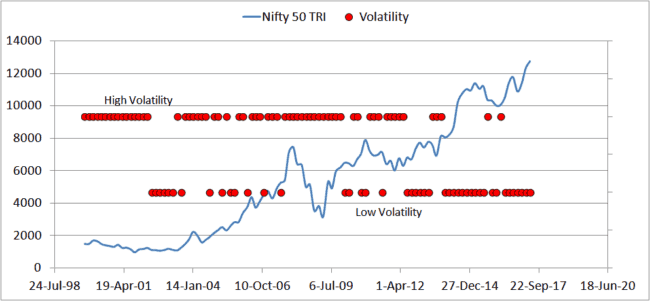

Step 1: Check the trailing 30-day standard deviation of Nifty 50 daily returns.

If this is > 17% define it as a time of high volatility

<= 17% is a time of low volatility

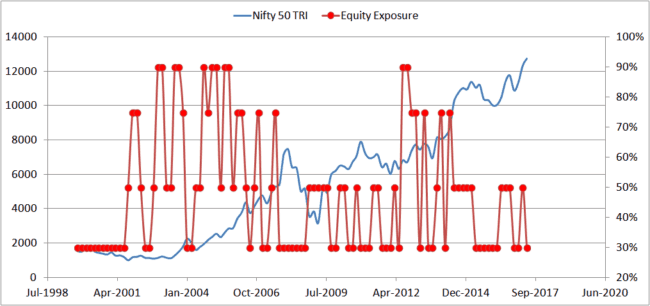

Each red dot represents the volatility reading every 40 days. Obviously, there is no clear demarcation. It swings back and forth!

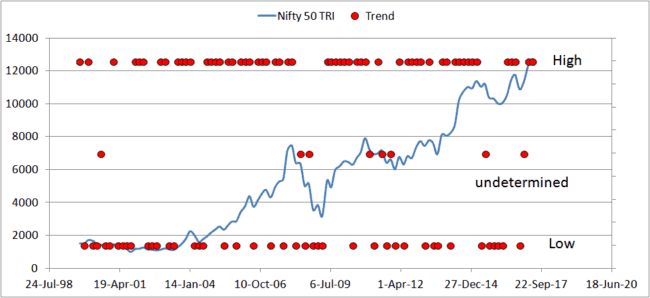

Step 2: Then it would calculate two quantities of the Nifty 50:

Diff = 90-day daily moving average – 15-day-daily-moving-average

Rate = rate of change of the 90-day moving average

If Diff < 0 AND Rate > 0% —-> period of high (market) trend

If Diff >0 AND Rate <= 0%

OR

If Diff <=0 AND Rate > 1% —-> period of Mid trend

If Diff >=0 AND Rate <= 1% —-> period of Low trend

Do I here you go “what the ****”. Hang on. There is more!

I could not find a mid-trend. Eight observations had no specified trend.

I could not find a mid-trend. Eight observations had no specified trend.

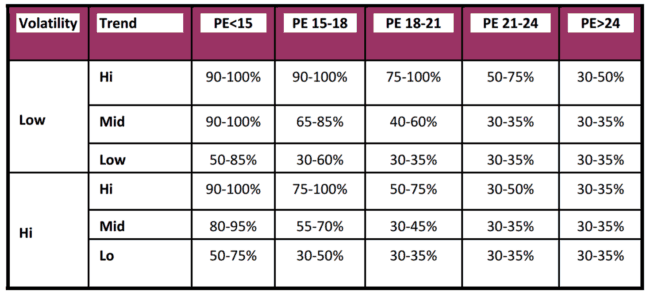

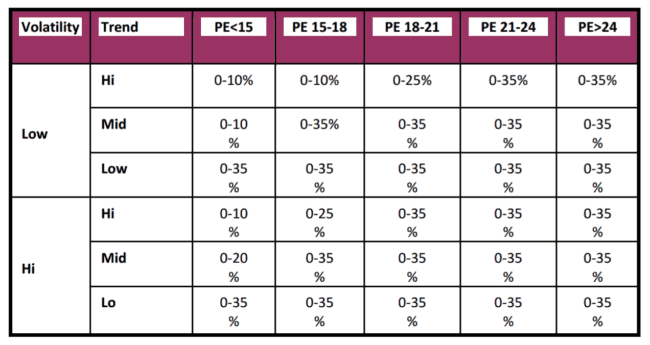

Step 3: Once volatility and trend are determined, it allocated direct stocks (both Indian and International) according to this matrix. Here PE is the Nifty trailing PE

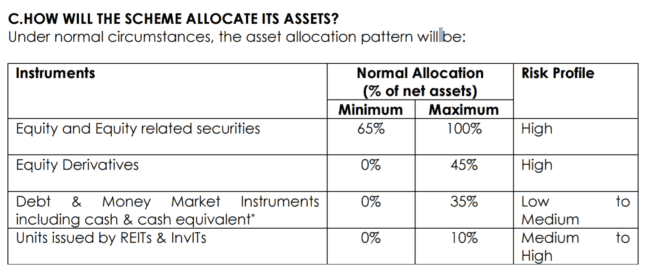

Then it would fix the fixed income asset allocation as per this

The difference between direct equity exposure and fixed income (short-term bonds including money market and some REITs) will be covered by arbitrage.

The difference between direct equity exposure and fixed income (short-term bonds including money market and some REITs) will be covered by arbitrage.

Therefore, the fill will remain an equity fund at all times from the tax point of view.

Step 4: Once the asset allocation is determined (this is known as a top-down approach), the stocks will be actively chosen (aka bottom-up approach).

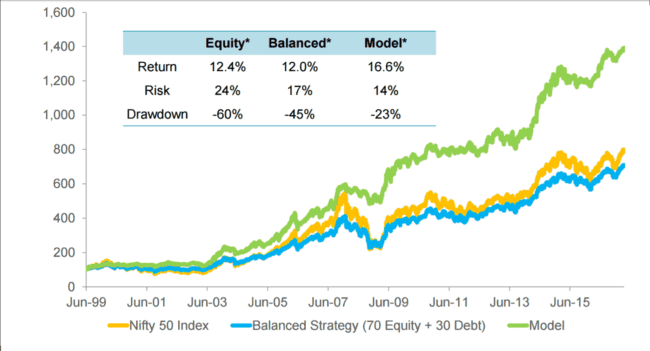

The AMC obviously did a back-test for a nice presentation slide. Mutual funds can only be sold with outperformance. No one will buy a fund that claims to reduce risk at the cost of returns (although it would be a smart choice)

Source: Axis Dynamic Fund Presentation

This is the SID: Axis Dynamic Fund Scheme Information Document

This is the KIM

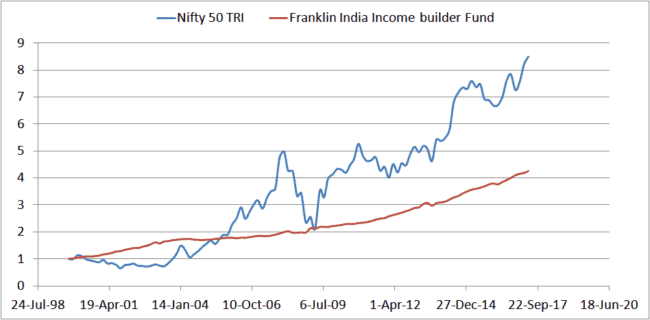

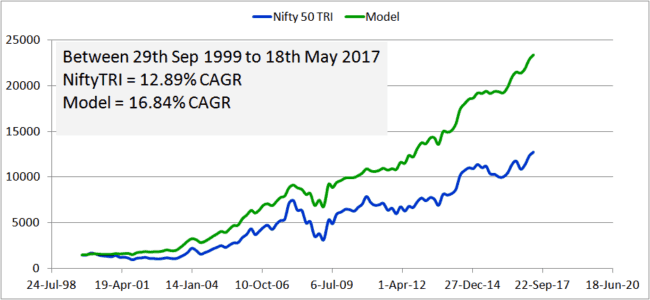

I ran this backtest without considering any arbitrage position. I tool Nifty 50 TRI as the equity universe and Franklin India Income Builder Fund as the fixed income universe. It is an arbitrary choice and I just did inky pinky. Debt mutual funds irritatingly change colour from time to time. So I have no idea what kind of bonds this fund help from July 1999 onwards.

I only used the equity allocation matrix and the rest was in the debt fund. So this is what I got. It is not identical, but the resemblance is good enough.

Discussion

I know what you are thinking. Are such complexities necessary? No, they are not!

Have a look at the direct equity allocation after every 40 days. It is not exact, but close enough in my opinion. I have chosen the lower equity percentage in the matrix.

First of all, the fund wants to change equity allocation so much to reduce risk and not beat the Nifty. And considering that definition of “high PE” and “low PE” keep changing after each business day, I doubt if it will replicate the above outperformance in future.

I was curious if an individual investor can try this kind of risk reduction. However such dramatic changes in asset allocation every 40 days is a bit too much. The fund can do it as it will not have to pay tax or exit load. It will have to pay brokerage though.

After all this gymnastics, the fund wants to benchmark itself against Crisil Balanced Fund Index! I interpret this as a lack of confidence on the part of the AMC to be able to beat (higher absolute returns) the Nifty price index (forget TRI) in future.

No, thank you. I will take my chances with a simple equity-oriented balanced fund and live with whatever risk reduction a strategic asset allocation offers me.

Thanks to Anish for sending me the funds KIM.

Ask Questions with this form

And I will respond to them in the coming weekend. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

GameChanger– Forget Startups, Join Corporate & Live The Rich Life You want

My second book, Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want, co-authored with Pranav Surya is now available at Amazon as paperback (₹ 199) and Kindle (free in unlimited or ₹ 99 – you could read with their free app on PC/tablet/mobile, no kindle necessary).

It is a book that tells you how to travel anywhere on a budget and specific investment advice for young earners.

The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download)

You can Be Rich Too with Goal-Based Investing

My first book with PV Subramanyam helps you ask the risk questions about money, seek simple solutions and find your own personalised answers with nine online calculator modules.

The book is available at:

Amazon Hardcover Rs. 271. 32% OFF

Infibeam Now just Rs. 270 32% OFF. If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Flipkart Rs. 279. 30% off

Kindle at Amazon.in (Rs.271) Read with free app

Google PlayRs. 271 Read on your PC/Tablet/Mobile

Now in Hindi!

Order the Hindi version via this link

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)