Last Updated on September 15, 2025 at 11:43 am

Version 3 of the freefincal excel stock screener now includes the Joel Greenblatt Magic Formula Screener. This quickly allows you to select quality companies available at attractive prices. The screening can be done index-wise. sector-wise and market-cap-wise. The financial data is obtained from Value Research and the multiple screens available have been created with the help of two young stock ninjas – Krishna Kishore and Indraneal Balasubramanian. This post is inspired by a comment from Anees Rao who participated in the PaisaVaisa podcasts on financial independence along with Anupam Gupta and myself

Before we begin, do check out SEBI registered fee-only advisor Avinash Luthria‘s article on Mint: Three financial risks to plan for before retiring

Joel Greenblatt, a hedge fund manager and Professor at Columbia University introduced the magic formula for choosing good companies at low prices using a combination of high earnings yield and high return on invested capital in his book Little Book that Beats the Market. The formula has been extensively tested by many and has come out trumps. This is one example of such a study. This is a simple guide to invest using the magic formula.

Note: The magic here will work only over the long term and every year. So please understand the pros and cons of the method used for screening. You will have to exclude financial and banking stocks. You must be ready to sell and buy new stocks.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

How does the Joel Greenblatt Magic Formula Screener work?

Step 1: Compute Earnings yield = EBIT / Enterprise value.

Here EBIT is Earnings before interest, tax (we use Earnings before interest, tax, depreciation and amortization EBITDA) and is a measure of a operating performance. The enterprise value (EV) is a modification of the market capitalization and is a measure of a companies value (including debt and cash). A high earnings yield represents an undervalued stock (performance exceeding perceived value). VR stock listing offers EV/EBITDA. So I have used the reciprocal.

Step 2: Compute Return on invested capital (ROCE). This tells you how efficiently the company is utilizing its capital and is defined as EBITDA/Capital employed. A high ROCE represents a quality business.

VR gives EV and EV/EBITDA in its stock listing. So this can be used to determine EBITDA. Capital employed can be defined as total assets minus current liabilities and this is the same as net worth. VR gives net worth. So this gives the ROCE.

Step3: Rank the companies as per earnings yield. Higher the yield, better the rank. So 1st rank corresponds to the company with the highest earnings yield.

Step 4: Rank the companies as per ROCE. Higher the ROCE, the higher the rank. So 1sr rank goes to the company with the highest ROCE.

Step 5: Add the two ranks and choose 30 stocks with the highest combined rank. The screener will do this at a click of a button.

Value Research suggests looking for companies with consistently high ROCE (>20% for past 5Y). In fact, it would be better to choose companies with consistently high combined magic formula rank. You can do both with the freefincal stock analyzer (but this will be one stock at a time)

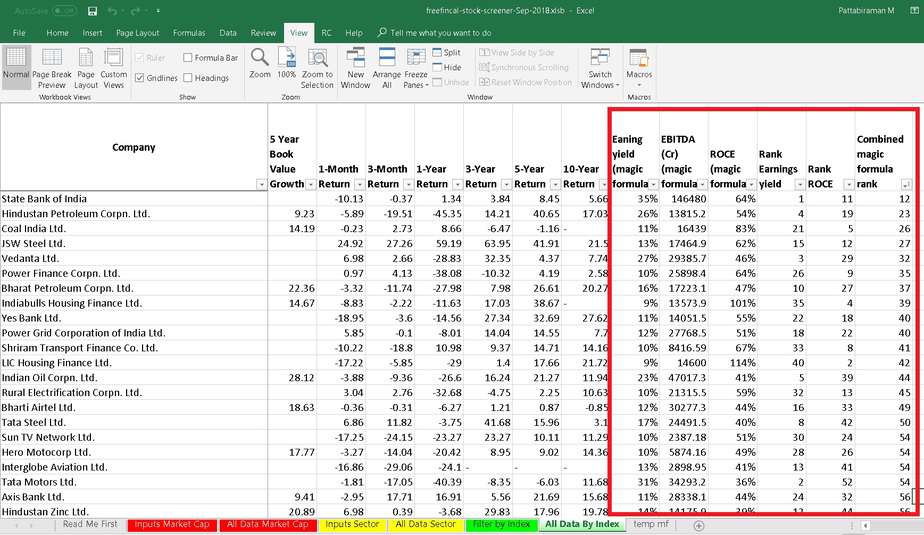

This is a screenshot. As you will notice, not many stocks have both high earnings yield and high ROCE.

Features of the freefincal stock screener

I have always wanted to build a stock screener and hence this sheet. I am well aware that they are pretty good online screeners available. What is being offered is a choice, and I am confident that the Excel screener will evolve into something at least useful to a small group of users, if not as a unique tool. I seek your help in evaluating this sheet and in making it better.

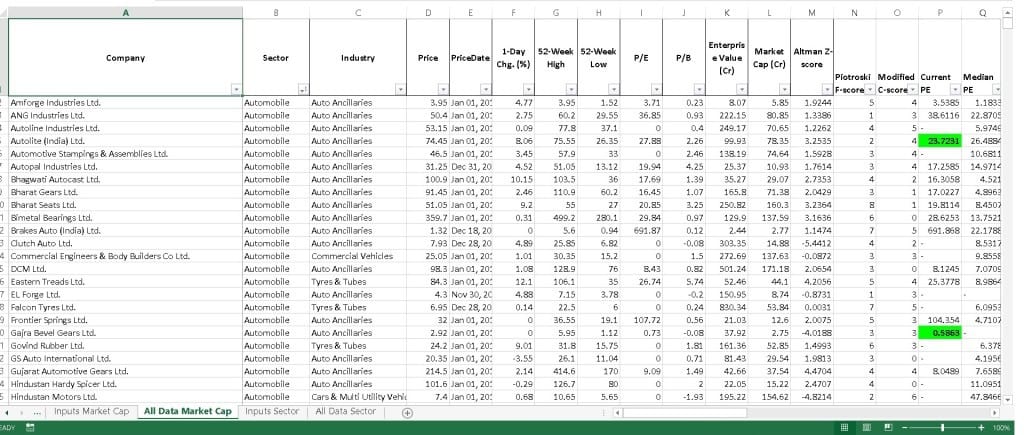

Those who are comfortable with using Excel’s data sort options can screen in several ways with this sheet.

For users who are not familiar with the sort options, several simple stock screens are incorporated after consultations with Krishna Kishore and Indraneal Balasubramanium – cognicrafter. Check out these:

Guest post by Krishna: A Guide to Understanding Stock Screeners

Guest post by Indraneal: How to Build a Stock Screener

They are my go-to guys when it comes to stock analysis. They are capable of simplifying valuation quite efficiently for a low-attention-span dummy like me.

Excel Stock Screener: How to use Video

This video may help build your own screens.

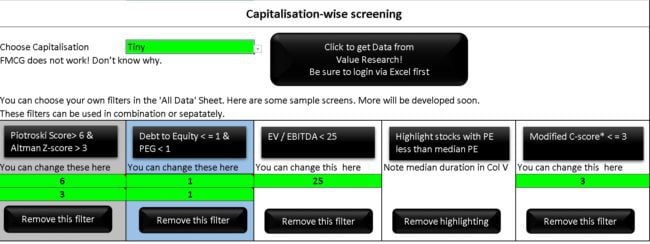

Capitalisation-wise stock screening

This is the screenshot of the cap-wise stock screener

In order to use the tool, one must first log in to Value Research via Excel. Necessary steps are given below.

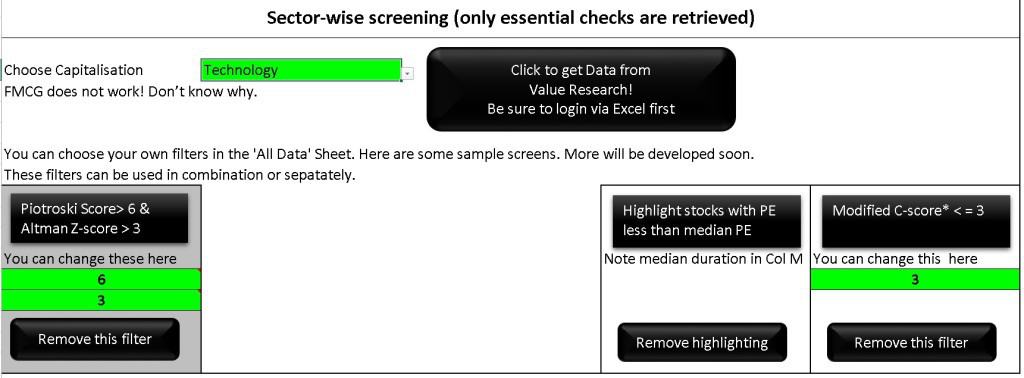

As you can see there are five sample screens which can be used independently or combined with each other. Other sort options can also be enabled from the datasheet.

The green cells refer to stocks with current PE lesser than median PE (5Y or 3Y -duration listed).

The following screens are available

Piotroski Score – Higher the score, better the strength of the company and confidence in its operation. VR article on the score.

Altman-Z Score – Higher the score, lower the probability of bankruptcy. This is how VR computes it

Modified C-Score – lower the score, lower the chance of accounting manipulation. This is how VR computes C-Score.

Debt to Equity – a measure of debt used by the company to operate. Lower is typically less risky. Less than one, preferred by many.

PEG – The PE ratio divided by annual EPS growth. Less than one could represent undervalued stock.

Enterprise Multiple EV/EBITDA – Compares EBITA, the earnings before interest, taxes, depreciation and amortization with EV, the enterprise value. Low values could mean undervaluation. However, ‘low’ is sector dependent.

Current PE less than Median PE – Median is the mid-point of a distribution of values (PEs in this case). Maybe used for solid companies (thanks Krishna).

Current PE more than Median PE – Maybe used for small companies which are expanding, provided other checks are in place.

Sector-wise stock screening

In this case, only essential checks are retrieved.

Index-wise screening

You can now select one of the 50 BSE/NSE indices and screen the stocks from within.

Joel Greenblatt Magic Formula Screener

In all of the above screens, the magic formula is implemented as a macro button. Once you click it , it will take you to the data with combined magic formula rank highlighted.

Download the freefincal Excel Stock Screener Sep 2018 Version 3 (with Joel Greenblatt Magic Formula Screener)

Also check out the individual stock analysis sheet with multiple valuation techniques: Automated Stock Analysis V9: Earnings Growth Estimation

Guest post by Krishna: A Guide to Understanding Stock Screeners

Guest post by Indraneal: How to Build a Stock Screener

Note: Please do the following to login to Value Research

- Open blank excel

- Select Data in the menu

- Click get external data and then from web

- A browser window will open and there will annoying script error messages. Dismiss them.

- Then Go to VR online in that window and go to the main page. There will annoying messages. Dismiss them.

- Click on login. If you are not able to do so. Stop the page from downloading and then click

- Login with your email (preferable) and click on remember me.

- Now you can exit the browser window and start using the screener. It should work fine now.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)