Last Updated on December 29, 2021 at 5:58 pm

If a stock has defied the COVID-19 and its impact on stock markets, it has to be Adani Green Energy Ltd. The stock of the company Adani Green Energy Ltd [AGEL] has given phenomenal returns ever since it became listed on the stock exchanges. In this stock analysis, we consider if Adani Green can be considered as a worthy long-term bet.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Should you sell ITC and book losses? (5) Stock analysis: Are Tata Consumer Products share worth a buy? (6) Stock Analysis IRCTC: Is it overvalued?

The company Adani Green Energy Ltd [AGEL] came into existence after the demerger from Adani Enterprises Ltd. wherein shareholders of Adani Enterprises Ltd [AEL] received 716 shares of Adani Green Energy Ltd for every 1000 shares of AEL. The company AGEL will be the renewable energy arm of the parent AEL going ahead. Source: Adani Green Energy to list today, to open at Rs28.9 per share

The stock of AGEL listed at the price of Rs 28.9/- per share during the month of June 2018 took the company’s market capitalization to Rs 4457 Crores. The stock currently trades at Rs 1030/- per share, and the company is valued at Rs 1.60 Lakh Crores.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Before we could analyze the stock of the company, we need to take a look at a lot of aspects:

- Power Sector in India

- Renewable Energy Market and it’s potential in India

- Fundamentals of the company AGEL

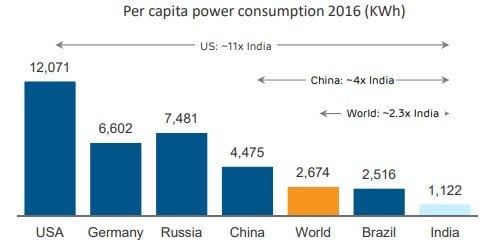

Per capita power consumption

Key observations:

- India stands at the lower end of the per capita power consumption rate as compared to the developed economies.

- The world average per capita power consumption rate is more than 2X of India’s per capita power consumption rate.

- BRICs nations [Brazil Russia China] also stand at higher per capita power consumption rate as compared to India

- Power consumption is also directly linked to

- Availability of power: 24/7 uninterrupted power supply even in the metro cities is still a distant dream.

- Power distribution is in need of reforms at a massive scale owing to:

- High Transmission & Distribution losses

- Political Interference

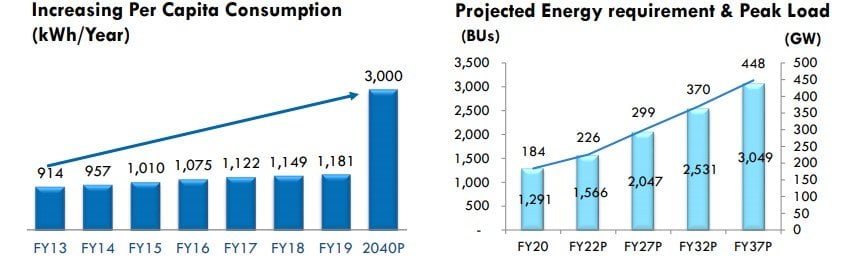

Power demand & consumption trends in India

Key Observations:

- Power requirement in India is poised to grow in line with the GDP growth of the country.

- India has low per capita power consumption which is expected to grow to 3000 kWh/Year by 2040

- Per capita power consumption and peak load demand are poised to grow at a healthy pace given.

- The overall growth in India’s economy

- Improved Availability of power

- Reduced Political interference and improvements in power distribution

- Rising income levels leading to higher discretionary spending

- Increased automation of the business segments, e.g. Agriculture, Textiles, Mining

- Electric vehicle technology adoption growing at a fast pace in India

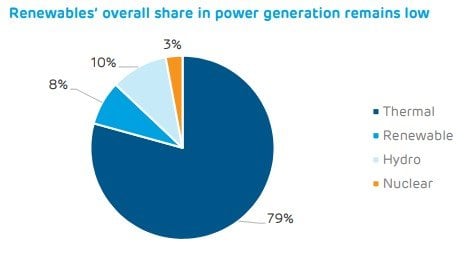

Renewable power sector in India

Key Observations:

- Non-renewables still occupy the lion’s share among all the sources of power generated in India.

- Out of the 79% contribution from the Thermal power, Coal has the major contribution; pegged at ~72% of all the power generated.

- Hydropower has faced several concerns on the Environmental front esp from NGOs working for the upliftment of tribal population, due to displacement of the original inhabitants from the basin areas to nearby high altitude places.

- Companies have also faced litigation due to demand for compensation by the displaced population. Source: Tehri dam oustees cry foul on compensation.

- Renewables including Wind, Solar, Bio-Power contribute only 8% to the power generation to date.

Note: Solar irradiation is the amount of electromagnetic radiation received from the sun per unit area (usually square meters).

Key Observations:

- India receives a fair amount of solar radiation throughout the year, putting the country at an advantage in terms of Solar Power potential.

- The roadmap laid out by the authorities and industry pegs Solar Power growth potential at 25% CAGR for the next 6 years, much higher than the wind power which is pegged at 8.5% CAGR.

- Solar Power has gained traction at the domestic and household level as well, Reason being:

- Favourable policy for installing Rooftop PV [photovoltaic] units for households

- Government subsidies encouraging conversion of barren lands to power generators

- Tech leader Google launched Sunroof to empower households.

- Source: How Project Sunroof Works

- Bengaluru’s Chinnaswamy Stadium: World’s first solar-powered cricket ground

- Thermal & Fossil energy companies turning towards Solar power generations as concerns rising on fossil fuel’s environmental damages

- Transportation sector turning to Solar power generation to turn sustainable/profitable:

- Technology leaders investing heavily into renewable sources of energy as carbon credits and sustainability take the front seat in the global corporate landscape.

- Apple now globally powered by 100 per cent renewable energy.

Source: Apple now globally powered by 100% renewable energy.

- “As per Infosys’ 11th Annual Sustainability Report, 43.7 per cent of the company’s electricity requirements — equating to more than 100 million units — is sourced from renewable sources.

Adani Green Energy’s renewable footprints

- 648 MW, Kamuthi, Tamil Nadu: One of the World’s Largest single location solar power projects were commissioned by the Adani Group at Kamuthi, in Tamil Nadu, with an investment of around INR 45.5 billion. It spans a vast area of 2,500 acres, equivalent to about 950 Olympic-sized football fields. Source: National Geographic Megastructures featuring Adani’s Solar Power Plant.

- The company commissioned 100 MW solar power plant in Punjab Source: Adani commissions 100 MW solar plant in Punjab.

- The company made announcements to set up the world’s largest solar power plant along with other investments in the state of Gujarat. Source: Adani Group to invest Rs 55,000 cr in Gujarat projects including the world’s largest solar park

- The Adani Group will also establish a solar cell and module manufacturing capacity of 2 GW by 2022 as a part of the contract from state-run Solar Energy Corp of India (SECI). Source: Adani Green to build 8 GW solar projects in India at the cost of $6 billion

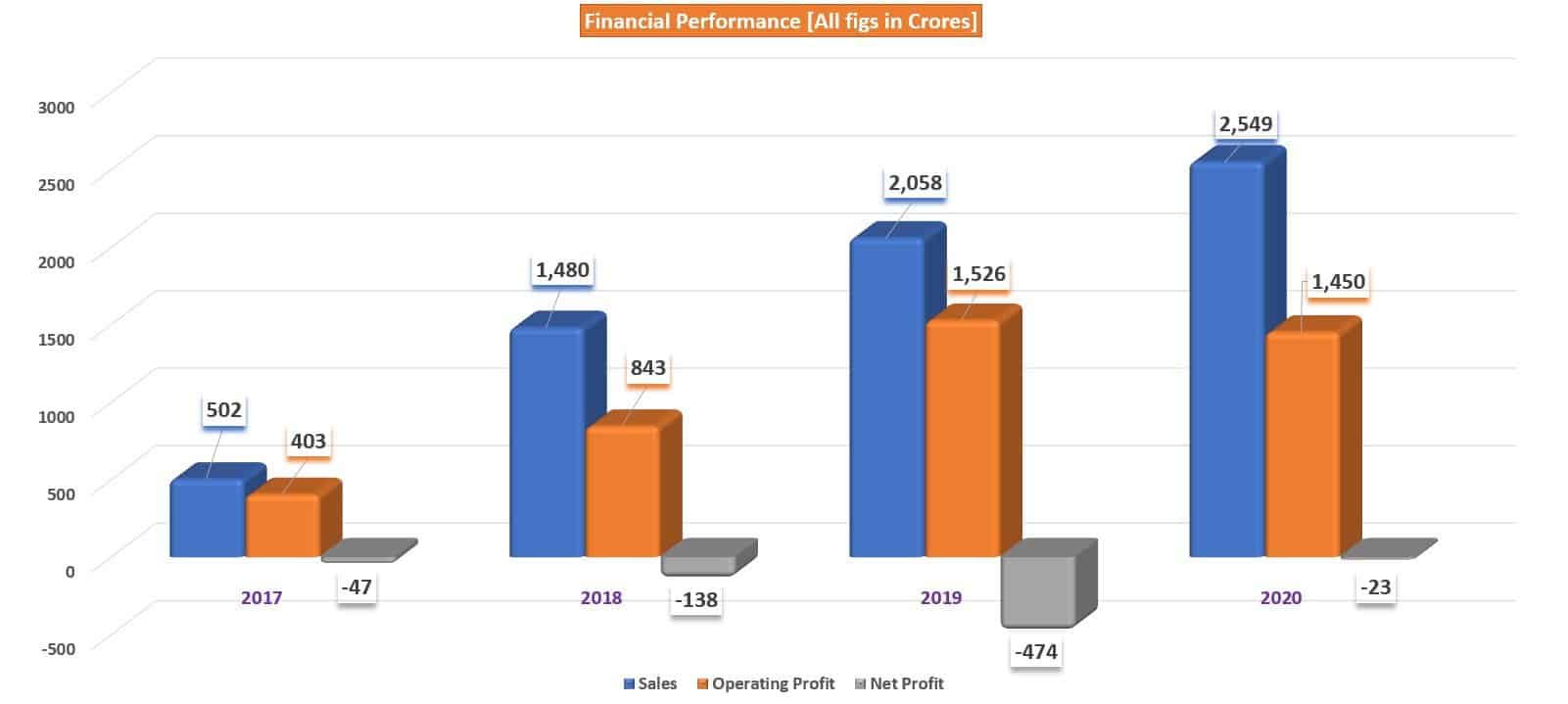

Adani Green Energy Ltd financials

Key Observations:

● The company has been able to grab some of the biggest contracts for installation and commissioning of renewable energy/power plants throughout the country, which is responsible for healthy growth in revenue figures.

● At the operational level, the company reports profits due to healthy growth figures in revenue terms

● However, the presence of debt and leverage in the balance sheet impacts the company’s net profits.

o “Interest and other borrowing costs increased to Rs 1,075 crore as compared to Rs 985 crore YoY.”

o “As on 31 March 2020, gross debt was at Rs 13,943 crore (excludes inter-corporate deposits and lease liability), and net debt was Rs 11,470 crore.” Source: Adani Green Energy FY20 results: Net loss narrows to Rs 68 crore; revenue up 23%

Key Observations:

- The Power Sector in India has gone through immense pain in the past were in some of the companies spent heavily to expand and build capacity, however unable to recover the majority of the spending, the balance sheets and ultimately stock price had to take all of that pain.

- AGEL is the most valued power producer of the country taking the valuation of the company beyond the sum total of valuations of power companies owned by the big corporate houses like Tatas and Reliance.

- A handful of power companies generate free cash flows in the country, making the power business a high entry barrier business due to:

- Capital intensive nature of the business

- Time to profit and survival during the expansion phase; both of these factors make it extremely tough for a company without a corporate house backing to remain viable in the business.

- High reliance on the import of solar panels faces regulatory risk.

- “About 90% of solar modules and panels used in Indian solar projects are imported from China and Malaysia.” Source: Delay in importing panels from China to hit solar projects in India

- Reliance Power: one of the star performers of the IPO market during 2008 is struggling to survive in the business after a decade, investors who lined up for the IPO can recall those days when the first time investors turned IPO applicants scrambled to fill applications and even prayed for allotments. Source: 10 years of Reliance Power listing: How Rs 10,000 turned Rs 1,600

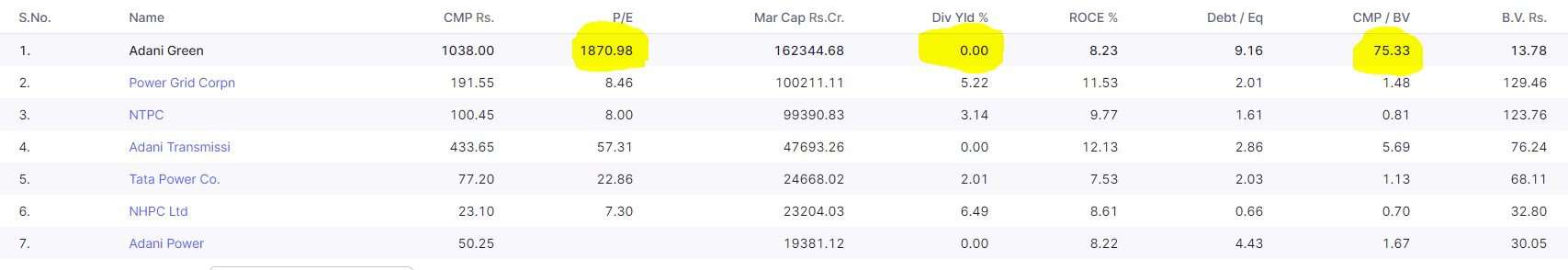

Valuations comparison of Power Companies

Key Observations:

- AGEL commands valuations north of Rs 1.5 Lakh crores at the stock exchanges, and this parameter makes it the most valued power company in India.

- Debt to equity ratio currently stands at 9.16, which is higher than even the biggest lenders and financial institutions listed in India.

- Note: The debt-to-equity (D/E) ratio is calculated by dividing a company’s total liabilities by its shareholder equity. The ratio is used to evaluate a company’s financial leverage.

- Higher debt to equity ratio also implies that the company would need to service the debt with future earnings for a considerable period of time and would leave little on the table for the minority shareholders in terms of dividend payouts.

- We would not like to believe that P/E is a good indicator of the valuation’s parameters for any corporate entity however 1 factor that should catch the attention of the investors is the P/B ratio which currently stands at 75. This parameter implies that most of the future earnings and growth potential of the company is already priced into the stock.

- Note: The P/B ratio measures the market’s valuation of a company relative to its book value.

Conclusion: Power sector has been through immense pain in the past decades in India for the reasons highlighted earlier in this post however the favourable policy environment and regulatory standards point towards better days ahead for the sector. Additionally, given the GDP growth and rise in discretionary spending in the country brings in cheer for the power sector as a whole. Favourable policy environment towards renewable sources of energy and rise in awareness and adoption of solar power could be an icing on the cake for the company Adani Green Energy Ltd.

From a fundamental perspective, the company appears to be on a strong footing. The company has bagged some of the biggest renewable power projects in the country and has started work on the commissioning power plants as well.

However, as an investor, one needs to also look at a host of other factors before taking any call on the stock of the company.

Given the valuation parameters, the stock of the company prices in most of the positive news mentioned above and also discounts the future earnings and the growth potential of the company and the sector both. Investors looking to make an entry into the power stocks to ride the growth of the power sector in India can take a look at its listed peers as well. There are better opportunities in the listed space which have a proven track record of execution of the projects, pay regular dividends and don’t have leveraged balance sheets.

Existing investors in the stock need to be watchful of the valuation parameters mentioned earlier in the post as most of the future earnings of the company would be first utilized to service the debt before any dividends are paid out in the hands of the shareholders.

We would like to believe that the cash flows as a valuation parameter take precedence over anything else esp EPS or Earnings, and the best indicator for cash flows is ‘Dividends’. Dividends are paid out in the hands of investors net of interests, debt, taxes and any other retained earnings.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)