Last Updated on October 8, 2023 at 5:18 pm

Many investors worry that they would lose the benefit of compounding or growth if they switch mutual funds. A discussion on why is not true as part of the freefincal Q/A. As mentioned last week, I will respond to reader queries each Saturday. I was supposed to make a video response, but I don’t quite feel up to it. So I thought I will respond in text. You can use the form below to enter your questions for next week.

Debt fund for retirement

There are so many varieties of debt funds in the market. Which debt funds are appropriate for debt portion of retirement goal? Should we stick to only ultra short term funds only? – Eswar.

I would recommend sticking to EPF, PPF or NPS (pure debt allocation) for the debt component of a retirement portfolio. This si the natural choice for a salaried individual. A debt mutual fund can be added a few years later as the portfolio gets big

Ultra short-term funds can be used for any duration and is a good choice for those who want to minimise volatility. Income funds that hold corporate bonds can also be considered (if comfortable). The key is to keep return expectations.

NRE vs NRO account

Could you please explain the merits and demerits of investing in direct mutual fund through NRE A/c Vs NRO A/c Vs Normal Savings A/c. Which A/c is better to use to benefit from any taxation perspective or any other benefits. – Arun

I sought the help of SEBI registered fee-only planner Melvin Joseph (part of my list) and he has the following to say:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

An NRI is not supposed to keep a normal savings account, because he has to convert that account into NRO, on his becoming an NRI. So the option for NRI is to invest through NRE account or NRO account. In the case of investment through NRO account, he cannot repatriate the amount on redemption. Investments made through NRE account can be repatriated. Even though the tax rates are same for resident & NRIs, there will be TDS for NRE investors. If the person is planning for children education abroad and want the amount to be repatriated in future, invest through NRE account. Otherwise, both are same.

Excel Data Download

Data downloading from web to MS excel like MF NAV -Rajan

NAV data from AMFI is obtained via Excel using a url of this form:

http://portal.amfiindia.com/NavHistoryReport_Rpt_Po.aspx?rpt=1&frmdate=3-Apr-2006&todate=13-Jan-2017&mf=22&scm=119598

Notice the from date is 3rd April 2006 and To-date 13th Jan 2017.

The AMC code is 22 (mf=22) and the scheme code is 119598.

So we will have to change the structure of this url according to the choice of fund and from and to dates.

No programming skills are necessary. I just let Excel record a macro, use the code and change it the way I like. To make those changes, I simply Google, search in Excel forums until I have my answer 🙂

Here is a short video (no audio) explaining how to record the macro

Now over to titular questions:

Mutual Fund Reviews and Switching

SIP Portfolio review process, churning in and out really necessary? – Senthil.

Since long i have requested to you to provide detailed post on switching of funds after evaluating the funds. If v r in middle of Goal , how power of compounding effect there? How tax related efficent? Note: i have CAN and investing in direct funds but switching between fund house i guess not allowed too. I will be greatful to you if you consider my QUESTION IN your upcoming VIDEO Session. Thanks just an Example: i want to switch HT200 to MiraeA Large cap. – Jignesh.

To answer these two questions, let us first ask, “what is compounding?”.

Compounding is not the same as compound interest. At least not in the way it is used wrt equity!

Compound interest refers to interest for the amount invested in the first year and interest on the amount + 1st years interest in the second year and so on. That is interest on interest.

Compounding simply refers to any situation where there is no visible growth in the first few years, followed by spectacular growth later on. There are two ways this can happen:

interest on interest: like in fixed deposits

growth in value: of stocks.

Stocks, mutual funds or any tradable commodity does not offer interest and does not compound in the traditional sense.

However, in order to describe their growth rate and to compare with a fixed income instrument (that does compound), we use compounding formula.

This is essential to quantify the risk that we have taken. Read more: What is risk premium and why it is important

Here is an example of how to calculate the compounded growth rate with returns that are not the same year after year.

Does Switching affect compounding or growth?

NO. If we switch from one equity fund to another within the space of a few days, there will be no reduction in benefits. The returns will not decrease as many believe. It is just a transfer from one basket of stocks to another. As long as the switch is made between instruments of the same asset class, there will be no change in (future) risk or (past and future) reward.

Should we switch?

Well, we should always monitor our mutual fund investments, be it a SIP or lump sum. First, we need to decide the frequency of monitoring. Early on, once a year is enough. This means, that we do not worry about it in between.

Second, we need a review process.

Have a System!

Many investors do not have a system to review in place and get confused by what everyone else says

- Have a reasonable, preferably low return expectation

- Give the fund at least 3 years to beat the index

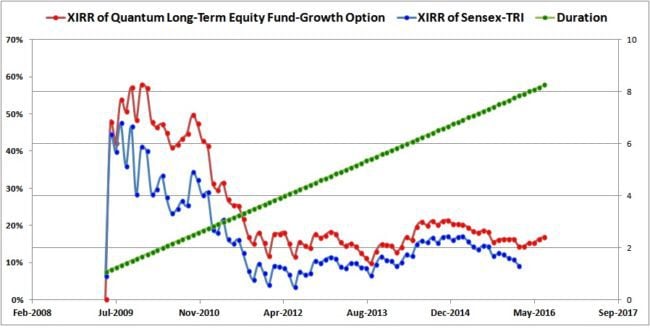

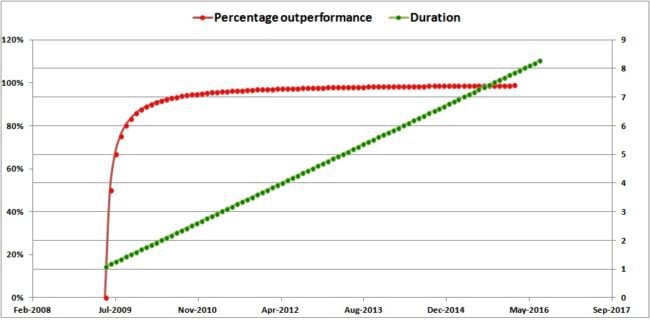

- Check out my XIRR SIP tracker. You can track month by month outperformance. Does not have to be a SIP investment.

- TheGrass is always greener: Wanting to invest in the top mutual fund all the time is plain immature.

- Regret does not help! If you decide to switch and after you make the switch, the old fund may do better than your new fund!

Ignore Star Ratings and Do not Compare Peers

Peer comparison is inevitable during fund selection. We want funds that have a reasonable record of consistent performance.

Mutual fund selection is different from mutual fund review. Peer comparison during a review is useless, even if done right!

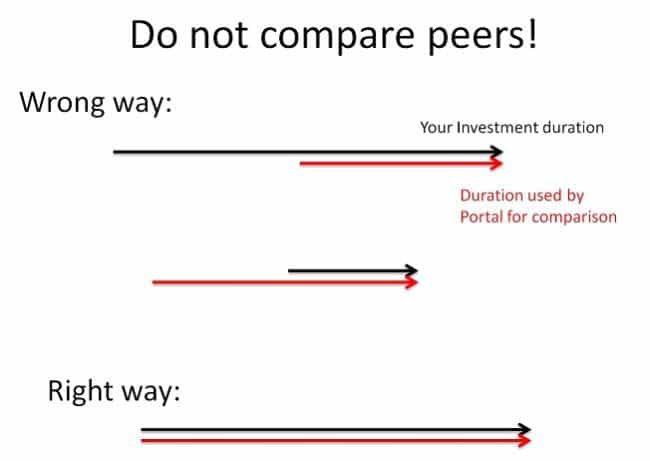

Peer comparison is typically done the wrong way. A fund portal publishes results for a different duration that the one in which we have held the fund.

For example, we may have held the fund for 5 years and the peer comparison is made for 3 years or vice versa. Either way is incorrect because unless the durations are the same, it is like blind men touching the elephant.

The right way to compare peers is to calculate performance for all funds in the category for the duration and for the same investment dates of your mutual fund. For what it is worth, I am making such a tool (but don’t intend to use it!).

I have written about ignoring star ratings earlier:

Here is why you should ignore mutual fund star ratings

Part II: Here is why you should ignore mutual fund star ratings

The simplest reason being:

Will you call yourself a bad English student, by looking at your Maths marks?

English (your fund performance), Math mark (star ratings). They are over different durations and therefore are different.

Now to answer the specific question:

Should I exit HDFC Top 200?

Well, I am an investor and here is a simple way to find out:

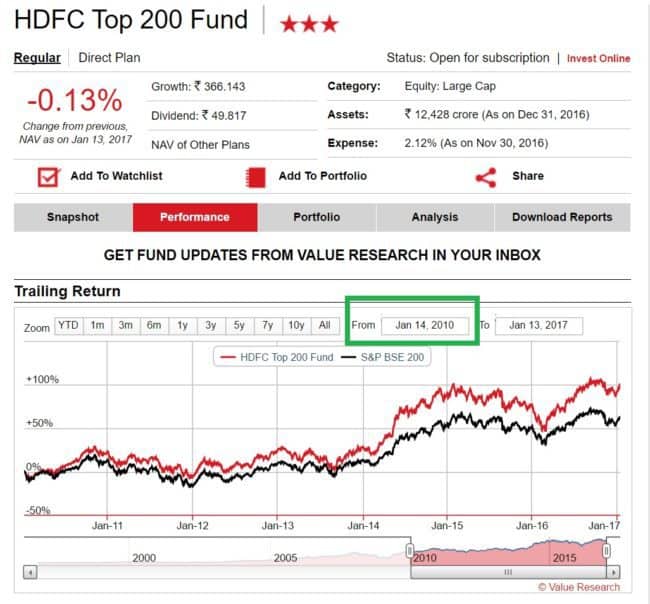

1: Go to Value Research T200 page

2: Click on performance tab

3: Set the from date (green box) to the date in which you started the investment

And see if that performance is acceptable for you. It is for me. My XIRR is 12.95%. I am happy with that. End of the review process. If that is one-star according to others, so be it. I have better things to do than switch funds at the drop of hat.

If this is not acceptable to you, switch. I would recommend a complete switch out, else the folio would get cluttered.

If the “loss” due to tax and exit load is important to you switch “gradually”. Else switch out in one shot and begin investments in the new fund.

Remember: A few months later, your new fund maybe in the same state as your old fund. At that point, if you do not have a consistent and reasonable review strategy in place ……

Questions for Next Week

Use this form to ask your generic questions. Will respond to them next week

DIY Investor Workshop in your city

Since Nov 2014, we have held investor workshops at Chennai (4 times, 5th this Jan 29th – few tickets left), Bangalore (6 times), New Delhi (twice), Mumbai (twice) and Pune (once). In 2017, we would arrange for the next Delhi and Pune events.

If you are interested in seeing this event in your city (other than the ones mentioned above), eg. Calcutta, Ahmedabad etc. please fill out this Google sheets form.

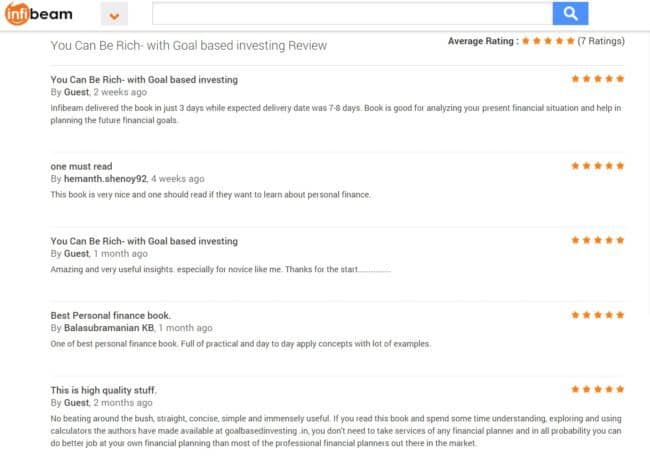

You Can Be Rich Too With Goal-Based Investing

If you are wondering if you should get my book with Subra(money.com), you can check out the book trailer

Or the book information page: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

Where to Buy

You can get it from:

Amazon.in Rs. 375 or Bookadda for Rs. 371/-. Or via Infibeam for just Rs. 307.

The book is also available on Kindle at Amazon.in (Rs. 244.30) or at Amazon.com ($3.36 or Rs. 244.30).

Also at, Google Play Store (Rs. 244.30)

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)