Last Updated on February 11, 2021 at 8:03 pm

This post showcases a presentation by Aparna C K to her office colleagues. I am delighted that she kindly consented to let me share this here. Regular readers may be aware that Aparna has written two guest posts for freefincal which became instant hits:

I have chosen to post the PowerPoint slides as individual .jpeg figures with the authors notes (mildly edited for public consumption) and relevant hyperlinks.

Author Note: Personal finance is more to do with you as a person than finance. It is not finance in the conventional sense. You must participate actively to get max return on your time invested. Let us find out what you guys expect from this.

Author Note: Not “making” money. What suits one person may not suit the other. Avoid copying others. Personal comes first rather than Finance, precisely because it is Personal.

Author Note: Not “making” money. What suits one person may not suit the other. Avoid copying others. Personal comes first rather than Finance, precisely because it is Personal.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Author Note:

What if your vehicle meets with an accident and goes for repair,

What if you die due to accident or illness?

What happens if you lose jobs?

Now you have income, but when it stops, how are you going to live

How are you going to finance your dreams/goals which are a few years away

Before really getting into deep waters, knowing one’s inclinations, attitudes is very important.

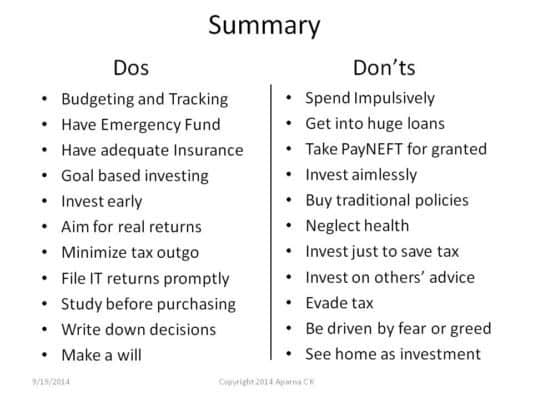

Author Note: When you already have so many genuine expenses, not spending on unnecessary things is very important. Not needed also applies to financial products.

Author Note: Once you start DIY, it is hard not to enjoy it. It is equally hard to trust someone else with our hard earned money. Only advantage with hiring someone to handle our finance is, they may help you to take balanced decision, but this may or may not happen. Many a times, they get interested only in their commission.

Link in the slide: What does it take to do your own financial planning?

Author Note:

One may not realize the importance if staying in parents house, parents still working

Check if you live within the budget.

Don’t purchase anything on a whim, without understanding. In finance, this results in loss of investible surplus, which is formally termed as an opportunity cost.

If you are already stuck with one, don’t try to avoid current loss, when you know further investments in bad products will only lead to more future losses.

-Credit card is not bad if you exploit all its advantages and do not get spoilt

If you get tempted to spend, transfer it to another account. Best to keep one more account other than salary account. Let the salary account be expenses account and the other one savings. As soon as you receive salary, transfer the surplus to savings

When I say cutdown, I am not saying lead an ascetic life. As I said earlier, evaluate needs and wants.

My own experience: I used to record my expenses right from my highschool days, as a result, once I started earning, I completely stopped it. I did it on and off after marriage, since December 2013, religiously doing it.

Link in the slide: Budgeting Gets Your Financial Act in Place

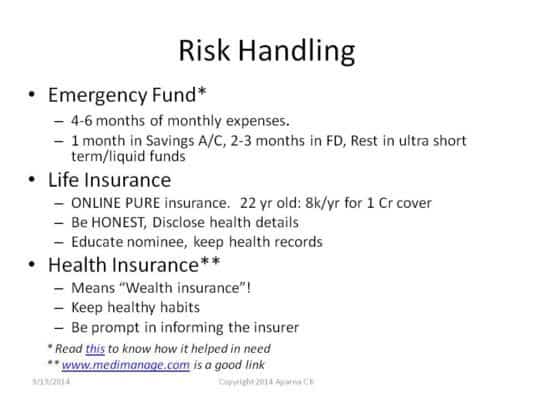

Author Note:

Touch it only for real emergencies-unforeseen events. Accident, house collapse, or forgetting wife’s birthday!

Business people may keep more emergency fund, like 12 month expenses.

On Life insurance: Go for it only if you have dependents/loans that too if your net worth is not sufficient to take care of them in your absence.

Term + PPF/ELSS is superior to Endowment/ULIPs.

Health insurance is a complicated product, be careful when you buy. Read exclusions, pre-existing illness cover, co-pay.

Related link: Handling financial emergencies

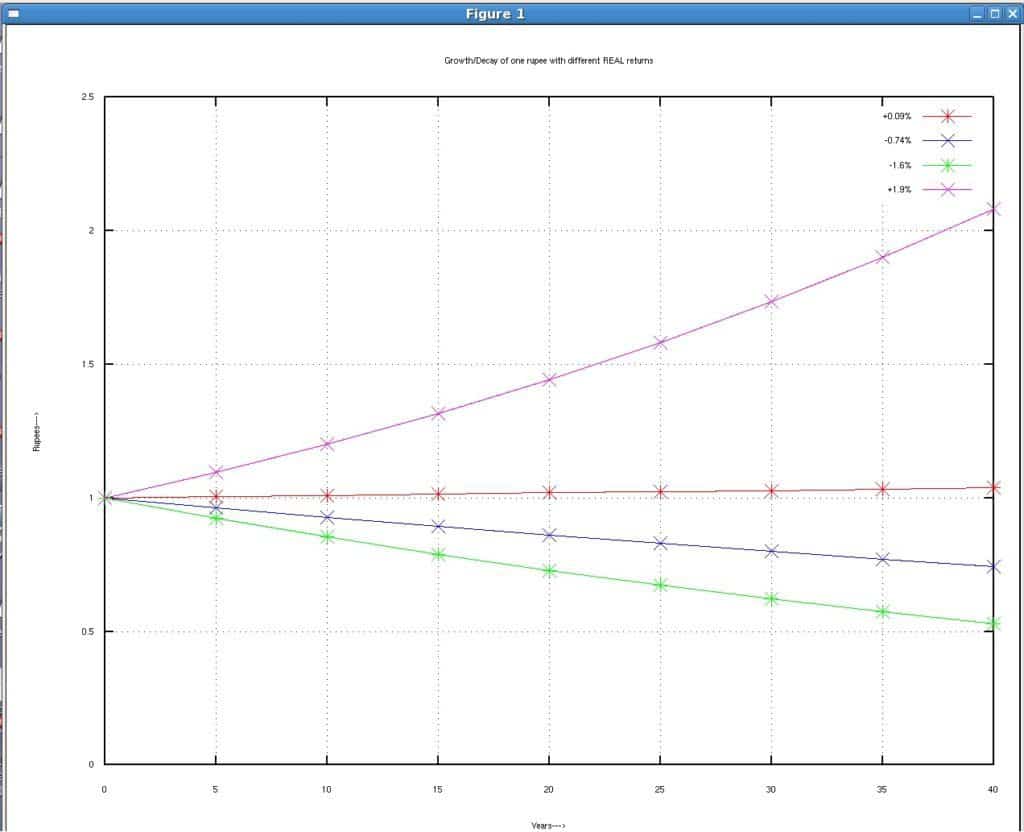

Author Note:

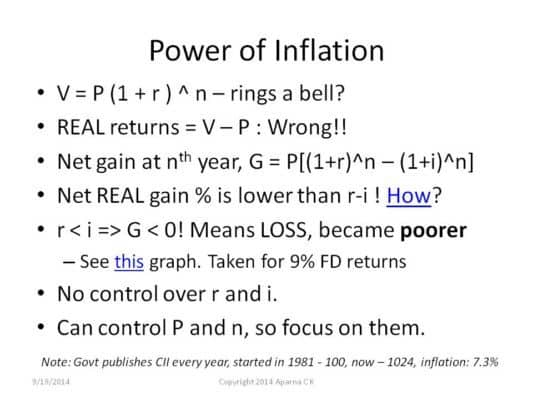

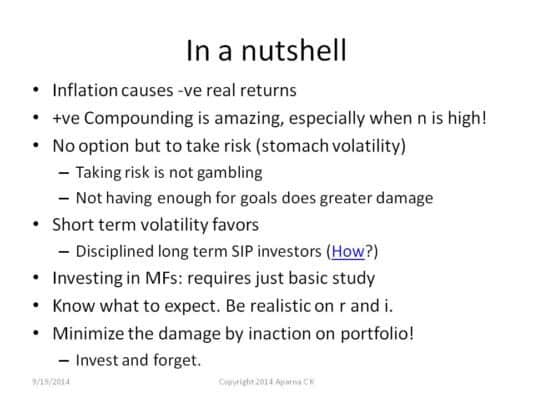

An example. 1000 rupees invested today. After a year get back 1100. But what costed 1000 rupee today costs 1090 next year. Still net gain is 10 rupee, but this 10 rupee next year is not the same as this year’s 10 rupee. It is only 10/1.09 = 9.1 rupee. So your real return is 9.1 rupee for 1000 rupee invested.

CII Started in 1981-82, at 100.

In 2014-15: 1024 => Over 33 years, 7.3% annualized inflation – At this rate, after 33 yrs, your 20k becomes 2L expenses.

Collect actual data from your parents. My own experience: When I started in 2002, with rented home, my expenses were 10k per month, but now it is not comparable. Lifestyle itself has totally changed.

FDs at 9%, after tax give 6.3%/7.2%/8.1% (Fixed Depreciation)

So, don’t be fooled by how banks present their interest rates. Would you really love to save money in FDs if banks all over put banners saying, “we give -1% real returns”.

It is just the way numbers are presented makes us not see the reality.

Link in the slide: Real return Calculator

Graph (click to enlarge)

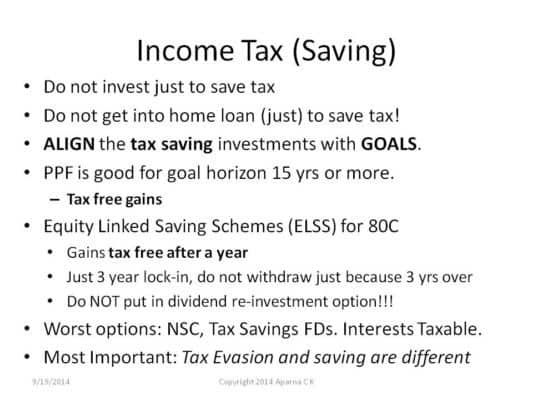

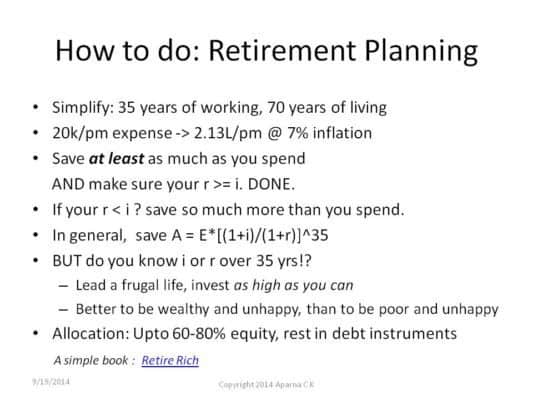

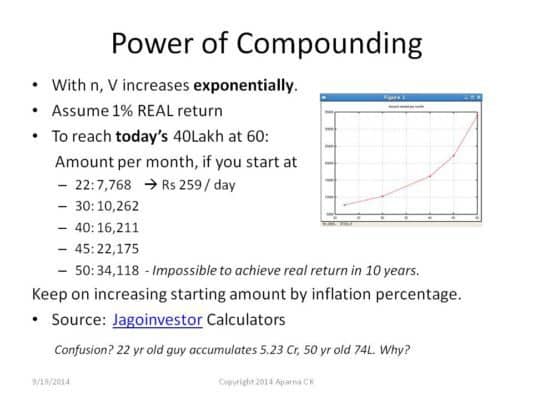

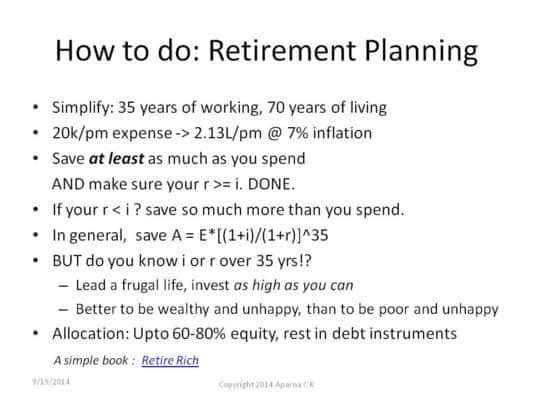

Author Note:

If you are 60 today and your monthly expenses are 11900, you can retire with a corpus of 40Lakh, provided, the returns from corpus matches inflation.

For 50 yr old, In 10 yr duration, due 40L gets inflated to 74L. For 22 yr old boy, in 38 yr duration, it gets inflated to 5.23Cr. This is the reason for the difference in the corpus needed.

Author Note:

Set your personal priorities first. If you do not like grand weddings, do not have one, worse, do not take a loan for it.

In general, do not plan for unnecessary expenses to please parents, relatives or friends. If your parents are ignorant and made mistakes, does not mean out of respect for them you must repeat them. Be logical.

Another point. Do all these activities ASAP, before marriage, otherwise you need to please one more person. (At the same time, be flexible, and accept if the other person has better suggestions) If you are in single ready to mingle state, it makes sense to talk about finances at some stage while dating. It can start indirectly initially and go deeper with a few more meets. Converging on a common finance philosophy becomes very important in marriage. Do you want to be fighting about money every day?

Own home in Bangalore, as of now does not make any financial sense. Renting is far sensible than buying. That is a different analysis by itself. We can take it up later.

People are uncomfortable with huge cash, for the fear of spending them. Due to lack of familiarity with other avenues, they get into EMIs. This should be avoided.

Link in the slide: So you want to buy a house?

Author Note:

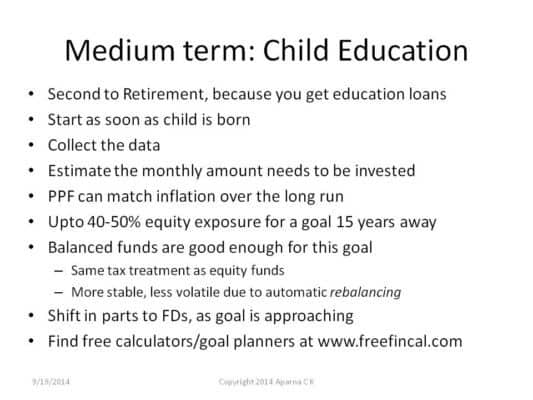

Short term : Buying a bike/car, house renovation, Big amounts of charity for a cause you believe in

Medium term: Child education, down payment for home/land for future home

Long term: Retirement

Link in the slide: Four-part Series on Goal-based investing

There are some more lesser known advantages of PPF apart from Govt backing

It can be extended by 5-year blocks, after maturity, for n number of times. There are some fine rules to be adhered to.

At any time after crossing 7 yrs, you can withdraw half the balance 4 yrs ago. But go for it only for matter of life and death

PPF balance is safe, lenders can not claim it.

Fact about PPF: Interest rates are volatile. Till 2002 it was around 11%!

On tax evasion

TDS is not same as paying tax. Bank cuts at nominal rate of 10%, but you need to pay as per tax bracket.

Also the 10k exemption is only on SB interest, not on FDs and RDs. To be paid on accrual basis

If you do not pay tax and get caught, you may be fined 3 times the hidden income.

Scrutiny is random.

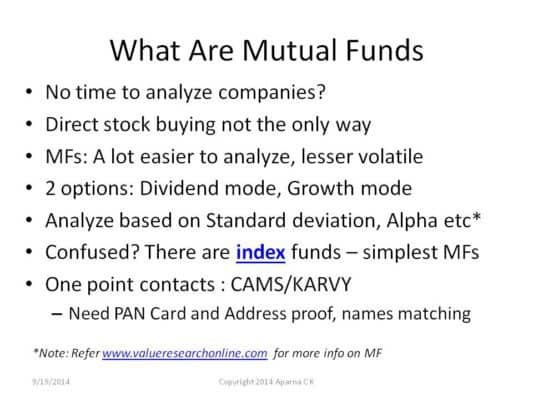

Debt mutual funds: These could be superior to FDs especially for 20 and 30% bracket people, for short and medium term goals, due to indexation benefit after 3 years.

Index funds: Do not choose blindly still. See AUM, expense ratio and tracking error. Buy it from reputed fund house.

Important point: SIP: Any time is a good time to start. Rupee cost averaging works independent of start and end points.

Some numbers. Consider 1000 rupee SIP.

Buy 100 units at 10 rupee

Next month, say it falls to 9.5 rupee. Investment value has fallen to 950 rupees., But you get 105.26 units. Now your investment chart reads as 1950

Say next month it fell to 8 rupee. You get 125 units for 1000 rupees and your cost value 3000, investment value now reads as 2642. Do not panic. Wait patiently.

Consider next month, increasing to 11 rupee, due to some factors. You get 90.9 units, your cost value is 4000, but the investment worth is 4631. You can either cry you got 90.9 units, or celebrate you gained 632 overall due to jump.

Do not redeem. Let the SIPs continue.

Link in the slide: Reddit IndiaInvestments

Author Note:

Once invested, focus on learning basics. Read books/blogs written by qualified people (not necessarily finance people).

My list of Personal finance teachers (names not important): An old wise CA, Computer Sc Engineer turned financial planner, Physics Prof in IITM, Chemical Engineer, Doctor and all the active folks in an FB closed group called “Asan Ideas For Wealth” whom I’ve never met in my life and might not meet. For motivated people inspiration can come from anywhere, just have the willingness to learn. To be financially intelligent, you do not need to have a degree in finance.

Do not listen to TV channels or read newspapers on market movements. Rebalance, not profit booking. Periodically move back and forth based on asset allocation ratio.

With active funds, one needs to evaluate its performance wrt benchmark index, not as absolute performance. That is not necessary in the case of index funds.

Related link: What you need to know before starting a mutual fund SIP

Do not link happiness and money. Also, frugal doesn’t mean miser. Clearly distinguish between needs and desires. Miser compromises on needs, frugal controls his desires, but spends on needs.

When you do not know what it means to be in financial stress, it is hard to guess what will happen if you do not have enough in the retirement.

This is just accumulation phase. During retirement, one can treat blocks of 5 yrs as a separate goal and keep aside money from the total corpus.

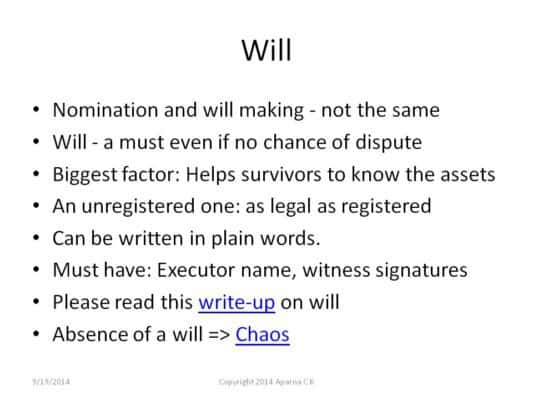

Related info: FB group Asan Ideas for Wealth can download a sample will from the files section.

Read more: Few things I learned after Mithun

Please share your views on this presentation and any questions that you have in the comments section. If you found it useful, do share it with fellow young earners.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)