Last Updated on April 26, 2025 at 9:25 pm

Build an equity mutual fund portfolio with these simple steps explained by SEBI Registered Investment Advisor Swapnil Kendhe.

Swapnil earlier discussed equity portfolio construction for retail investors with a listing of options available and the pros and cons of each. He also talked about why mutual funds make sense and discussed the problems a typical investor faces when it comes to mutual fund selection. In this article, he goes to offer solutions. If you have not read part one, please do (link above) and then come back to this.

Swapnil is a SEBI Registered Investment Advisor and part of my list of fee-only financial planners. You can learn more about him and his service via his website Vivektaru. In the recently conducted survey of readers working with fee-only advisers, Swapnil has received excellent feedback from clients: Are clients happy with fee-only financial advisors: Survey Results.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

As a regular contributor here, he is a familiar name to regular readers. His approach to risk and returns are similar to mine, and I love the fact that he continually pushes himself to become better as you see from his articles:

- Becoming a competent & capable financial advisor: My journey so far

- Are you a conservative investor? Here is how you can grow your money smartly

- SEBI Registered Investment Adviser Application Process: step by step guide

- Looking for a fee-only financial planner? Here is a list of questions to ask before you sign up

- Should Mutual Fund Distributors become SEBI Registered Investment Advisors?

- Everything you need to know about equity portfolio construction

- Basics of Debt Mutual Funds Explained for New Investors

- Three Key Mutual Fund Terms All Retail Investors Should Know

- Debt Mutual Fund Categories Explained For Retail Investors

What is the solution if we cannot spot future mutual fund outperformers?

There are no reliable tools or strategies that can help us select, in advance, funds that will outperform peers and benchmark based on past performance. Even if there are, retail investors and most advisers with their limited resources and understanding of investing cannot use them successfully. What is the solution then?

The solution could be simple. If we cannot find the best performing funds of the future, the focus should be on finding competent fund managers with a proven track record across market cycles. It requires at least ten years of data to draw any inference about the skills of the fund manager. This means avoiding relatively inexperienced fund managers irrespective of their superior short-term performance. We would miss future stars of the fund management industry, but since there is a risk of ending up with lucky fools in the search for future stars, we should not try to do that.

This search would mostly lead us to fund managers managing funds in older and established AMCs. These fund managers are unlikely to deliver the highest return majorly because of the significant assets they manage, which restricts some options for generating a higher return. But we can have some surety that competent fund managers are managing our investments, which reduces the probability of serious underperformance. These fund managers are also likely to have better support infrastructure and qualified teams working with them. Finding three or four competent fund managers and letting them manage the money is all retail investors should aim for.

Fund review

Conventionally, fund performance is compared with the category average return and the benchmark return. If fund beats both, it is continued; and if it underperforms, it is changed with a better performing fund. This looks sensible thing to do. The only problem, this approach doesn’t work.

All fund managers have a style of their own. One fund manager could have value investing bias while another has a bias for a growth style of investing. Market’s behaviour doesn’t match any style consistently every year. Value style fund managers who invest with a margin of safety and detest investing at expensive stock valuations underperform when the entire market disregards investment fundamentals in a bull market. Similarly, growth style fund managers underperform in bear markets. All fund managers go through a period of underperformance.

It is irrational to expect fund managers to beat benchmark and peers consistently every year; because no fund manager can do that. It is not a fund manager’s job either. His job is to generate a good return over the long term, not to beat benchmark and peers every year. As a rule of thumb, one should never invest with a fund manager whom he cannot give at least five years to perform. Over shorter periods, it is luck more than skill which determines the fund manager’s performance.

It is wrong to change funds after a short period of underperformance. When you have a quality fund manager with a proven track record managing your money, stick with him during the period of underperformance.

When should I change the fund?

If the style of fund management changes (e.g. a multicap fund changes to a largecap or midcap fund), I would change the fund. If I am investing in a fund because I trust the fund manager and fund manager leaves the job, I may want to change the fund if I am not as comfortable with the new fund manager. But if the new fund manager has a long enough track record of good performance, I would continue with the fund.

The toughest decision is when a fund, managed by a competent fund manager, goes through a period of underperformance. Advisers are highly likely to change such funds because if they don’t, clients could think of them as not doing their job well. But the fund we leave can very well recover, and the new fund we choose may start underperforming. Likewise, an underperforming fund can continue to underperform in the future.

I have not yet arrived at any satisfactory solution to this problem. We had chosen the old fund because of its superior past performance, and then it underperformed. Why won’t the same thing happen with the new fund?

If fund selection and review were easy and straightforward, no adviser or mature investor would have felt the need to use index funds. Let us discuss index funds before discussing portfolio construction.

Index Funds

“The best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of professionals.” -Warren Buffett

(In establishing a trust for his wife’s estate, Warren Buffett directed that 90 per cent of its assets be invested in a low-cost S&P 500 Index fund.)

An index fund is a fund that holds all the stocks in the underlying index to mimic the overall performance of that index. At present, Nifty50 and Nifty Next50 are two best index fund options available for investors in India. These funds mimic the portfolio of the Nifty and Nifty Next50 Index, respectively.

Most investors and many advisers believe that it is easy to beat index fund returns. In reality, most fund managers do not beat index fund returns both over short and long periods.

Why most fund managers cannot beat index fund returns?

To understand this, we must understand how indices are constructed. Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two biggest stock exchanges in India. There are approximately 4500 listed companies on BSE and around 1600 listed companies on NSE. Most big companies are listed on both stock exchanges. Sensex is the stock market index of BSE, while Nifty is that of NSE.

Let us try to understand how the Nifty index is constructed. Index construction is a little more complex than discussed below, but we want to understand the concept of index construction, not the details.

The top 100 companies based on full market capitalisation listed on NSE are called Nifty100. Full market capitalisation is the current price of stock multiplied by the total number of stocks of the company. Or in simple words, it is the amount an investor needs to spend if he wants to purchase 100% ownership of the company.

Nifty50 index represents the top 50 companies from Nifty100 based on free-float market capitalisation. Free float market capitalisation is the market capitalisation calculated after excluding shares held by promoters and strategic investors.

Nifty Next50 Index represents 50 companies from Nifty100 after excluding the Nifty50 companies. Likewise, Sensex represents the top 30 companies listed on BSE by free-float market capitalisation.

The weight of each stock in the index depends on its free-float market capitalisation. Higher the free-float market capitalisation of the company, higher its allocation in the index. At present, HDFC Bank is the biggest company in India by free-float market capitalisation; therefore, its weight is highest in both Nifty and Sensex. If the free-float market capitalisation of another Nifty business is 1/10th of HDFC Bank, its weight in Nifty would be 1/10th of HDFC Bank’s weight.

Since the weight of each stock in the index depends on its free-float market capitalisation, which depends on the stock price, when the stock price of any company goes up, its weight in the index goes up. Likewise, weight of any business whose stock price goes down also automatically comes down. If any company is no longer in the top 50 companies by free-float market capitalisation, it is replaced by another successful company. In any calendar year, a maximum of five businesses can be replaced. These changes in the index are done semi-annually.

Nifty50 index value is calculated using the following formula:

Nifty50 Index Value = (Current total free-float market capitalisation of Nifty50 companies/total free-float market capitalisation of Nifty50 companies on Nov 03, 1995) * 1000

Though the Nifty50 index fund mimics the portfolio of the Nifty50 index, the returns from the index fund are higher than that of the Nifty50 index return. This happens because the dividend index fund scheme receives is reinvested in the portfolio. Nifty50 value doesn’t reflect the effect of dividend reinvestment.

Index funds benefit from price discovery by the collective wisdom of the market. It is tough to outguess the market and generate a higher return.

Another big reason most actively managed funds underperform index funds is their higher expenses. Actively managed funds charge significantly higher expense compared to index funds (the expense ratio of HDFC Equity Fund-Direct Plan is 1.27% per annum as against 0.1% expense of HDFC Index Fund Nifty 50 Plan-Direct Plan).

There are additional expenses that mutual fund schemes incur like the brokerage paid on purchase and sale of stocks, which are not included in the expense ratio of the scheme (This expense gets hidden during NAV calculation. Suppose a fund manager sells a stock for ₹100 and pays ₹0.05 as the brokerage, it is assumed that the stock was sold for ₹99.95 during NAV calculation). These expenses are higher for actively managed mutual funds because of higher portfolio turnover compared to index funds. This could add an expense of as high as 0.5% for actively managed mutual funds compared to index funds.

This means that to generate the return equal to the index fund, the fund manager must generate a return 1.5% to 2% higher than that of the index fund. This requires a high level of skills as an investor and/or a lot of luck. Few fund managers do this consistently over a long time. Historically, index funds have beaten over 80% of the fund managers in developed markets like the US. The same phenomenon has started happening in India.

Indexing is a simple rule-based investing that puts stock investing on autopilot and removes the need for picking right stocks or fund managers. It is a time-tested strategy that eliminates the risk of a serious underperformance of the equity portfolio.

Ideally, the index fund should hold all the listed companies in proportion to their free-float market capitalisation. As long as cheaper index fund options are not available in India that holds midcap and smallcap stocks, we will have to use Nifty50 and Nifty Next50 index funds. Since Nifty50 companies form over 75% of the free-float market capitalisation of Nifty100, the allocation of Nifty50 and Nifty Next50 could be 75:25 in the portfolio.

Foreign equity allocation

Investors across the world invest most of their money in their home country. But the home country may not be the best place in the world to invest in.

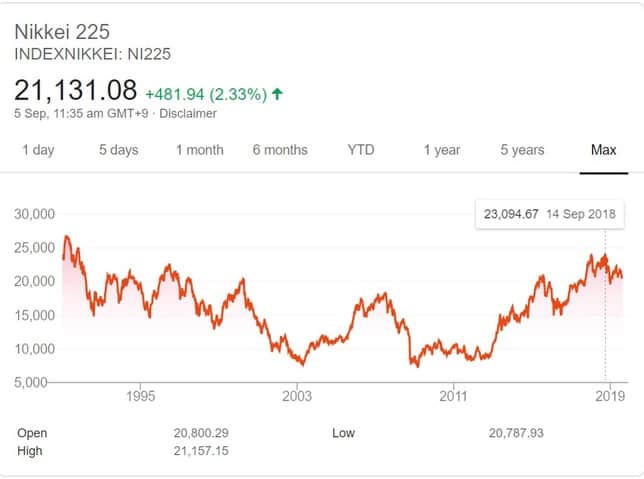

At the end of 1989 in Japan, over the past ten years, equity markets generated an annual average return of over 21%. Japan was a booming economy, and most Japanese would have considered it a dumb idea to invest outside Japan. Here is what happened in Japan since then.

Japanese markets didn’t generate any return for three decades. If this happened in Japan, we have no reason to believe that something like this cannot happen in India. Therefore, it is prudent to keep a third of the equity portfolio in mutual funds that invest in foreign stocks.

For foreign equity allocation, the ideal option would a fund like Vanguard Global Stock Index Fund that holds the biggest companies in developed countries in the proportion of their free-float market capitalisation. Since this option is not available for Indian investors, we can allocate up to 20% of the total equity portfolio in funds like Motilal Oswal Nasdaq 100 Fund of Fund. For taxation, these funds are treated like debt mutual funds; but that is fine since we diversify the portfolio to reduce risk not to increase the return.

Equity portfolio construction

In theory, retail investors should only use index funds. A portfolio of Nifty50 and Nifty Next50 index fund with 75:25 allocation is all they need for Indian equity allocation.

But following any investment strategy requires a conviction in it, and most retail investors lack conviction in the index fund investing. At present, the popular narrative is favourable for index funds; but a bull market outside the top 100 stocks will be enough to change it in favour of actively managed funds. This change in the narrative will make it difficult for most retail investors to stick with index funds.

A better approach, therefore, is to take the middle path. Invest half the Indian equity investment in index funds (Nifty50 and Nifty Next50 with 75:25 allocation) and the remaining equally in 3 to 4 multicap funds managed by fund managers with a proven track record of over ten years. Up to 20% of the equity portfolio can be kept in foreign equity index funds.

It is difficult to beat the returns generated by this simple portfolio. Half the portfolio will follow the time-tested rule-based investing that beats most fund managers; the other half will be managed by the top brains in equity mutual funds in India.

Most investors equate simplicity with incompetence and mediocrity, but simplicity trumps drama in investing.

###

If you find the article useful, do share it. If you wish to work with Swapnil, you can contact him via Vivektaru.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)