Last Updated on April 26, 2025 at 9:26 pm

In this article, SEBI registered fee-only advisor Swapnil Kendhe discusses if passive investing aka index investing is suitable over the next 20-30 years in India.

About the author: Swapnil is a SEBI Registered Investment Advisor and part of my fee-only financial planners’ list. You can learn more about him and his service via his website, Vivektaru. In the recently conducted survey of readers working with fee-only advisers, Swapnil has received excellent feedback from clients: Are clients happy with fee-only financial advisors: Survey Results. His story: Becoming a competent & capable financial advisor: My journey so far.

As a regular contributor here, he is a familiar name to regular readers. His approach to risk and returns are similar to mine, and I love the fact that he continually pushes himself to become better, as you see from his articles:

- Want to build an equity mutual fund portfolio? Try these simple steps!

- Basics of Debt Mutual Funds Explained for New Investors

- Three Key Mutual Fund Terms All Retail Investors Should Know

- Debt Mutual Fund Categories Explained For Retail Investors

- Are you a conservative investor? Here is how you can grow your money smartly.

- SEBI Registered Investment Adviser Application Process: a step-by-step guide

- Looking for a fee-only financial planner? Here is a list of questions to ask before you sign up

- Should Mutual Fund Distributors become SEBI Registered Investment Advisors?

- Everything you need to know about equity portfolio construction

- Should I pay a financial planner who only recommends index funds?

- Try these back-of-the-envelope financial planning calculations!

Indexing hinges on two important concepts:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

- The arithmetic of indexing and

- The efficient market hypothesis

I have covered the arithmetic of indexing in an earlier article. This article discusses the efficient market hypothesis and its relevance for investing in India over the next 20-30 years.

Please read my article ‘The arithmetic of indexing explained’ and William Sharpe’s article ‘The arithmetic of active management’ before proceeding with this article.

In 1970, Eugene Fama defined an efficient market as a market in which prices always “fully reflect” available information. At any given time, all known and relevant information is already reflected in stock prices. And new information is continually priced in virtually instantaneously. This simple concept is at the core of indexing.

A perfectly efficient market An efficient market is a model. Models are approximations, not reality. A perfectly efficient market doesn’t exist. It is an ideal state in which financial markets should operate.

In a perfectly efficient market, investors accurately pay a price for a security based on the discounted value of its expected future earnings and the riskiness of those earnings. They pay a higher price for a security with more predictable and higher expected future earnings and a lower price for a security with lower expected future earnings.

When new information arises that changes the expectation of future earnings, it quickly spreads and is incorporated into the prices of securities without a delay. Prices fully reflect all known information at any given time. Prices change only based on unexpected new information. There is no anomaly in the price of any security that an investor can exploit to earn a superior return.

Prices of securities in the future would reflect the information in the future. Since no investor can predict the information that would become available in the future, no investor can predict resulting price changes. Stock pickers or fund managers who try to predict future prices of securities cannot expect to do better than an uninformed investor buying a market portfolio even before the higher cost of active management unless they are lucky.

In a perfectly efficient market, buying and holding a total market index fund is the best thing for an investor to do. The investor doesn’t have to worry if he is paying the right price for any stock. Markets would come down when expectations of future earnings come down, but expected returns from the market at any given time are positive. An investor would never want to be out of such a market.

An inefficient market: In an inefficient market, all publicly available information is not reflected in the security prices. As a result, some securities are overpriced while others are underpriced. A skilled investor with better access to the information can easily spot anomalies in the market prices to generate excess return.

The arithmetic of indexing still works in inefficient markets. Before cost, half the actively managed money invested in the market would underperform the market-cap-weighted index portfolio. Post cost, a low-cost market-cap-weighted index fund would beat more than half the actively managed money. But a skilled investor can achieve a significantly higher return than the return of a market-cap-weighted index fund.

In such a market, it makes more sense to let a skilled fund manager actively manage your money instead of using a low-cost index fund.

The level of efficiency in Indian equity markets: Indian markets were certainly inefficient in the past. The information was not easily available. In 2020, in a conversation with Rajeev Thakkar, Prashant Jain said “When I started my career way back in the 90s, we used to spend a lot of time just collecting information. And you may find this unbelievable, but we used to actually go to these raddiwalas, and buy annual reports by the kg. Annual reports were not available in the early 90s, you had difficulty in obtaining hard copies of annual reports.” When information was hard to get even for fund managers, all the available information was unlikely to be fully reflected in the prices.

The ready availability of information is no longer a problem in India. Prashant Jain further says, “From that, we have come to the other extreme situation where so much information is available that just sorting out what is useful to you can be extremely time-consuming. India is an over-researched market….”

So one necessary condition for an efficient market, i.e. easy and ready availability of all the public information, is fulfilled in India today. The other condition is whether this information is fully and correctly reflected in the prices. If the information is not fully reflected in prices, a skilled investor can easily spot underpriced stocks relative to their fair price. Is that the case in India today?

Mutual fund managers, PMS managers and other professional investors are becoming important players in the Indian market. As informed and skilled investors play a bigger role in the market, they make the market efficient. In such markets, it is difficult to find underpriced securities relative to their fair price. You can spot companies with above-average future growth potential, but it is already reflected in the expensive stock valuations of these companies. Where companies are available for cheap valuations, there are reasons for those cheap valuations.

It is difficult to find underpriced good opportunities in Indian equity markets today; therefore, it is difficult to generate an above-average return without taking an above-average risk like investing heavily in smallcap stocks (riskier investments should demand higher expected return).

Cherry-picked past data with survivorship bias (eg. saying X fund has beat the index over 20Y) could be less relevant for our investment choices for the future.

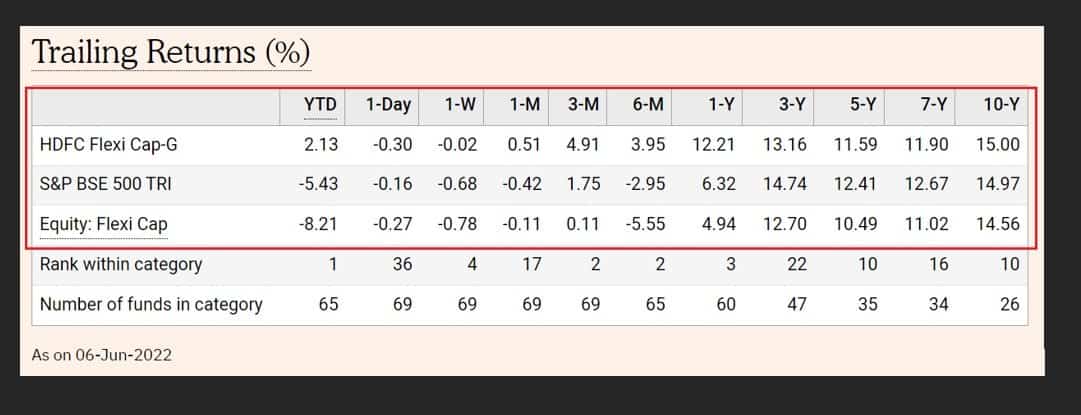

While such data is correct, a significant part of alpha was generated in the beginning when markets were far less efficient. It would be difficult for Prashant Jain to repeat the performance of the last 25 years. In fact, alpha has significantly shrunk for HDFC Flexicap Fund in the last 10 years.

Here is another interesting snippet from Prashant Jain’s conversation with Rajeev Thakkar.

Rajeev Thakkar: “Some third-party published data has been saying that for the industry in general, the alpha, especially in the large cap space, has been coming down, so is there a role for..bigger role for passive in the days to come in your opinion?”

Prashant Jain: “I think the time will tell. I think the alpha has been coming down because returns of the index in the last 3-5-10 years have been in single digits. And when you look at the fund costs, it is about 15 to 20% of those returns. So I think we have been in a period where the returns have been extremely low and therefore the disadvantage and the hurdle of cost is a significant one. I think the second point is that the last 2 years have been unique in the sense that 100% of the returns have come from 5 stocks. I don’t think there is a case to be made that in the future as well the 5 stocks would lead to 100% returns. I think as the market becomes more broad-based, the alpha should come back, but I would agree with you as mutual fund ownership of the stock markets keeps on increasing, generating alpha would become challenging. I believe that those with a value bias will still be able to generate alpha even though the waits may become..the periods may become longer.”

Prashant Jain is pointing towards increasing efficiency in Indian equity markets. As markets become more and more efficient, alpha starts shrinking.

There is no way to quantify the level of efficiency of markets. But we can get some idea about it from the level of underperformance of actively managed funds against the index.

67.61% of large-cap funds in India underperformed the S&P BSE 100 over the 10-year period ending in December 2021 based on absolute return. 82.26% of large-cap funds underperformed over the 5-year period. 56.06% and 58.14% Mid/Small Cap funds underperformed S&P BSE 400 MidSmallCap Index over the 10-year and 5-year periods, respectively. The SPIVA data is similar to what you would expect in a fairly efficient market.

In Oct 2017, SEBI published a circular that rationalized mutual fund scheme categorization in India. In this circular, SEBI defined large cap, mid cap and small cap companies as follows:

- Large Cap: 1st to 100th company in terms of full market capitalization

- Mid Cap: 101st to 250th company in terms of full market capitalization

- Small Cap: 251st company onwards in terms of full market capitalization.

SEBI defined large cap, mid cap and small cap schemes as follows:

- Large Cap Fund: Must invest a minimum of 80% of total assets in large cap companies.

- Mid Cap Fund: Must invest a minimum of 65% of total assets in mid cap companies

- Small Cap Fund: Must invest a minimum of 65% of total assets in small cap companies

The outperformance in some of the large cap funds could be because of their investments outside S&P BSE 100 companies. Remember, HDFC Top 100 was HDFC Top 200 before the rationalization of scheme categorisation. SPIVA combines Midcap and Smallcap funds in one category and compares their performance with S&P BSE 400 MidSmallCap Index. This may not give a correct picture.)

In the future, there will be funds that will beat the index over longer time horizons. But most of these funds would only marginally beat the index. This excess return would be lost to tax liability that arises when you keep tinkering with the portfolio or to the adviser fee. Only a tiny number of funds would beat the index with a significant margin over your investing lifetime. These funds would also go through periods of underperformance.

While they are underperforming, either you or your adviser would lose conviction in them and leave them for some other better-performing funds of that time. It is difficult to hold an underperforming fund because you never know if that underperformance would continue or if the fund would recover. The probability of picking these funds and then holding them over decades through their periods of underperformance would be no different from the probability of winning a lottery.

Indian markets are not as efficient as US markets but they are significantly more efficient today than they were 10, 15 or 20 years ago. They will only get more efficient going forward.

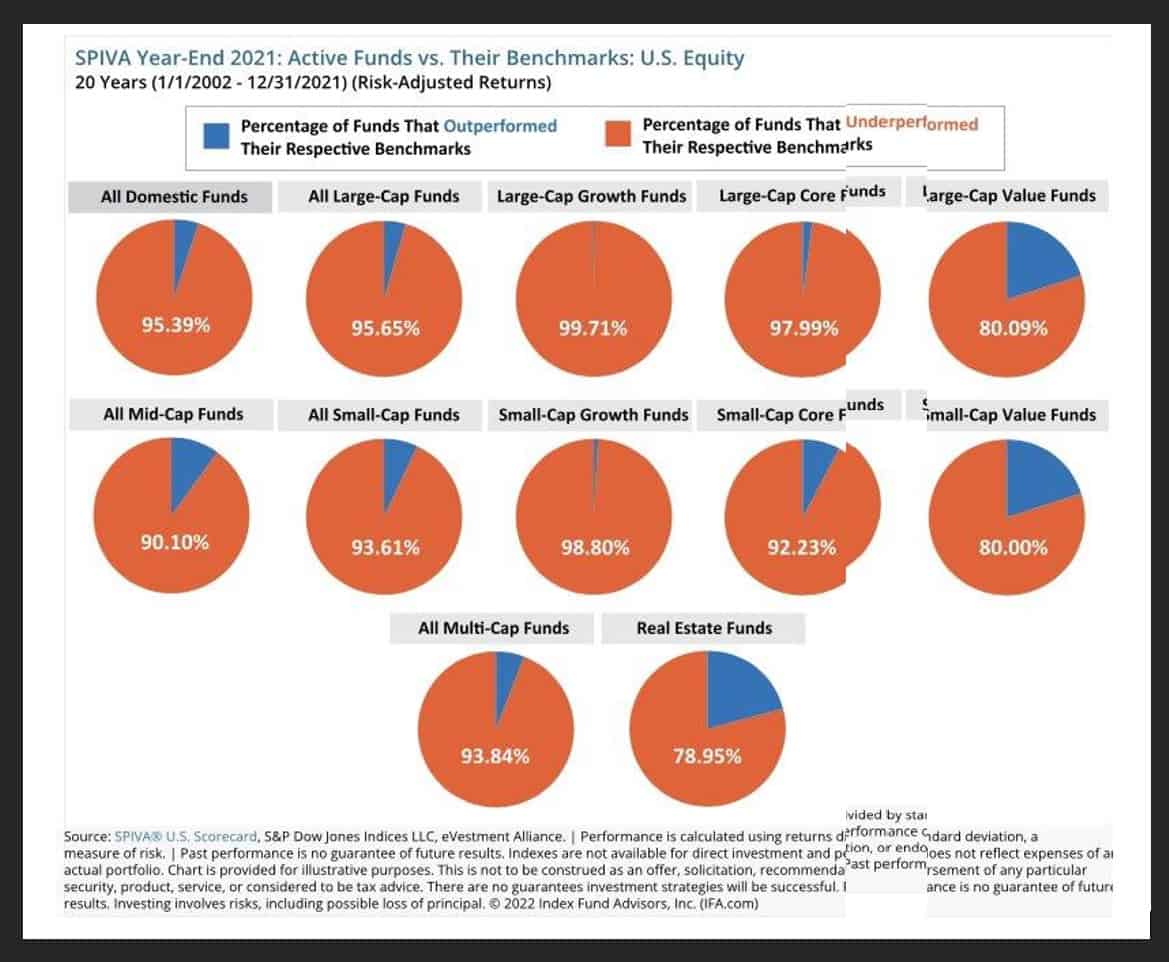

This is the 20-year SPIVA report for the US ending 2021. Considering that India is 20 years behind the US, this is likely to happen in India over the next 20-30 years. Would you want to bet on active management seeing this data?

Before you bet on actively managed funds, understand the impact negative compounding can make in the final corpus over longer time horizons.

Let’s say, you have 10 Lac that you want to invest in for the next 30 years. A simple option would be to put it in an index fund and capture market return. If the index fund generates a 12% annualized return, the final corpus after 30 years would be 2.99 crores.

The other option would be to invest this amount in a portfolio of actively managed funds. With active investing, there is always the risk of underperformance. If your actively managed portfolio underperforms the index portfolio by 1% and generates an 11% annualized return, the final corpus would be 2.29 crore. This is 24% lower than the corpus in an indexed portfolio. For 2% underperformance, the final corpus would be 1.74 crores, a 42% lower value. For 3% underperformance, you would have 56% lower corpus and for 4% underperformance, the corpus would be 66% lower.

Perhaps, your actively managed portfolio would beat the index and generate a 1% higher return, i.e. 13% return and get you a 3.91 crore corpus or 31% higher corpus. But the probability of that happening post-tax, expense and adviser fee over the next 30 years is slim.

Ending with a significantly lower corpus than what you could have accumulated with indexing would feel much worse than accumulating a higher corpus. You are going to get only one chance at it, and you would not be able to reverse the outcome.

The choice of investment strategy in Indian equity markets over the next 20-30 years should depend on your belief about the level of efficiency or inefficiency of Indian equity markets. If markets are inefficient, using actively managed funds managed by competent fund managers makes sense. But if markets are reasonably efficient and getting more and more efficient as the SPIVA data suggests, you need to rethink your strategy of using actively managed funds.

For a retail investor with no edge to exploit inefficiencies of the market, the better strategy is to use index funds; and protect himself from occasional excesses of markets with sensible asset allocation and rebalancing.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)