Last Updated on December 29, 2021 at 12:07 pm

Jan 1st 2019 marks the sixth anniversary of introducing direct plan mutual funds (where no commissions are removed daily from invested value before publication of NAV). This is the returns and corpus lost to commissions by not switching from regular plans (where commissions are removed) to direct. Please show this to your friends who still believe someone else is paying the bank or “advisor”.

Note to mutual fund distributors: Please do not waste your time reading this article or getting worked up about it. This article or your getting angry about it will not make any difference to the direct plan AUM. If you react, it will only make the article popular and me more determined. Cheers!

I used to publish direct plan anniversary reports up to 2017 See: Direct Mutual Fund vs. Regular Mutual Fund: 2017 Performance Report but took a break in 2018. The current post is inspired by SEBI Registered investment advisor Avinash Luthria’s wonderful article in The Ken, Exorbitant annual fees and commissions to distributors are hurting Indian mutual fund investors. There is a solution, but don’t expect your local distributor to tell you about it (this requires payment to read, but free registration allows you to read a 200 word summary)

The commission structure in mutual funds is fraudulent in my opinion and the culprit is SEBI. They have let AMCs, and sales guy give the impression to the investor that commissions come from profits instead of the truth: AMC profit and commissions are different components of the total expense ratio. Every day, the AMC deducts three components from the current value of our investments in a regular plan: their profits, their expenses and commissions to be paid out. Repeat every day, whether or not you invest again, whether the market moves up or down.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

There is no transparency in commission calculation. Commission disclosure alone is not enough. Knowledge of how it is deducted is essential and no one, including the SEBI and the media is doing enough.

As I had argued in this Economic times’ article, trail commissions must be banned and replaced by an entry load. So if I invest Rs. 100, Rs. 98 gets invested and Rs. 2 is paid out as commissions. This is made clear to the investor right from the start. This is the right way to pay upfront commissions (AMCs can pay upfront trail commissions to distributors on SIPs and adjust it in their books later). Pigs might fly before this comes to pass.

There are two problems associated with mutual fund total expense ratios. We discussed one above. I associate the second with the profit component of the AMCs and this is hard to lay a finger on. Everyone will accept there is something fishy going on, but it is hard to prove anything. I for my part tried with help from a friend: Mutual Fund Expense Ratio: Direct Plan vs Regular Plan. One suspicion is that AMCs have been using the fungibility between expense ratio components for their and distributors benefit. This however was removed in 2018 and the gap between regular plan and direct plan widened for many schemes.

There is however a long way to go to ensure investors understand what they are paying for. As long as AMCs depend on sales guys for profit (as Avinash explains), that will never happen suddenly. The only hope is that we are moving in the right direction.

Return difference between regular plan and direct plan funds

Before we begin, let us answer the FAQ

Who should use regular plan mutual funds?

No one. It is 2019 folks, time to grow a brain.

Who should use direct plan mutual funds?

Everyone who wants to invest in a mutual fund.

But I will get lesser units in direct plans na?

Yes, so what? If you think lesser units means lesser corpus and lesser returns, your understanding of how mutual funds work is “lesser”. If you want numbers, wait for a post on this. Let me milk this topic dry!

But return difference is less in my fund na?

Your understanding of how small differences became huge with time is also “less”. If you use the six-year data presented below and extrapolate, it might help.

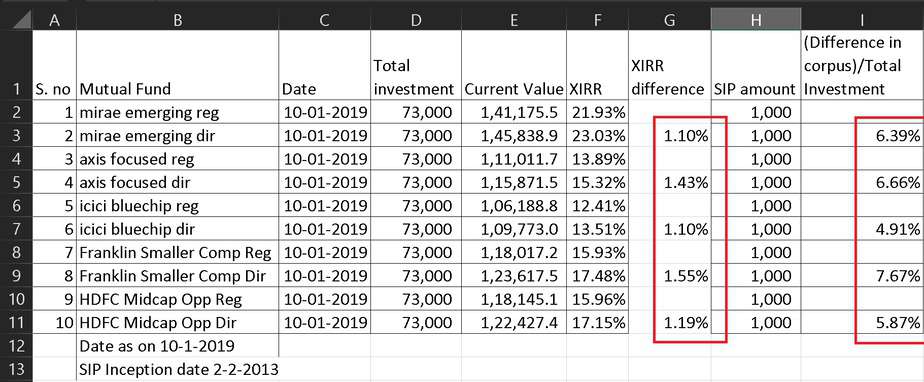

Corpus and return difference since inception of direct plans

Using the freefincal financial goal and mutual fund tracker, one can easily compute this:

I hope those numbers provide enough proof as to why you should switch. If you stay invested in a regular plan fund for 10Y. you will lose 10% of your investment to commissions. At least long-term capital gains tax on equity has a 1 lakh tax free threshold before the 10% tax on gains is applied. Please understand that this 10% (~ 1% a year) applies on the entire amount invested.

Want help in switching? Read: How to Invest in, or Switch to Direct Mutual Fund Plans

Current expense ratio difference between regular plan and direct plan (top 20)

Source: Value Research. The full data set of all the lists presented is available as an excel file below.

ER difference = TER (regular plan) – TER (direct plan)

| Fund | ER Difference % |

| IDFC Core Equity Fund – Direct Plan | 2.14 |

| Tata India Consumer Fund – Regular Plan | 1.68 |

| Mirae Asset Tax Saver Fund – Regular Plan | 1.68 |

| Axis Multicap Fund – Regular Plan | 1.66 |

| Tata Multicap Fund – Regular Plan | 1.48 |

| Axis Focused 25 Fund – Direct Plan | 1.47 |

| IDFC Multi Cap Fund – Direct Plan | 1.47 |

| HDFC Small Cap Fund – Regular Plan | 1.45 |

| Tata Large & Mid Cap Fund – Regular Plan | 1.43 |

| Invesco India Growth Opportunities Fund | 1.4 |

| Axis Bluechip Fund – Direct Plan | 1.4 |

| Mirae Asset Emerging Bluechip Fund – Regular Plan | 1.39 |

| Axis Midcap Fund – Direct Plan | 1.38 |

| HDFC Capital Builder Value Fund – Direct Plan | 1.35 |

| Kotak Emerging Equity Scheme Regular Plan | 1.34 |

| Franklin Build India Fund – Direct Plan | 1.34 |

| L&T Emerging Businesses Fund – Direct Plan | 1.31 |

| ICICI Prudential Pharma Healthcare And Diagnostics (P.H.D) Fund – Direct Plan | 1.28 |

| ICICI Prudential Manufacture in India Fund – Direct Plan | 1.28 |

| IDFC Focused Equity Fund – Direct Plan | 1.24 |

Three year SIP return difference (top 20) for equity funds

In what follows, the difference in return between regular plan and direct plan fund is presented using Value Research Tables.

3Y Difference = 3Y SIP Return (Direct Plan) – 3Y SIP Return (Regular Plan). Here 3Y = last three years.

| Fund | 3Y Difference % |

| Tata India Consumer Fund – Regular Plan | 2.07 |

| Invesco India Financial Services Fund – Direct Plan | 2.07 |

| Tata Digital India Fund – Regular Plan | 2.01 |

| Invesco India Mid Cap Fund – Direct Plan | 2 |

| Invesco India Largecap Fund – Direct Plan | 1.96 |

| Tata Banking and Financial Services Fund – Regular Plan | 1.96 |

| Invesco India Infrastructure Fund – Direct Plan | 1.94 |

| Tata Resources & Energy Fund – Regular Plan | 1.9 |

| Indiabulls Value Discovery Fund – Regular Plan | 1.89 |

| DHFL Pramerica Diversified Equity Fund – Regular Plan | 1.89 |

| DHFL Pramerica Long Term Equity Fund – Regular Plan | 1.87 |

| IDBI India Top 100 Equity Fund – Direct Plan | 1.86 |

| IDFC Focused Equity Fund – Regular Plan | 1.86 |

| Indiabulls Bluechip Fund – Direct Plan | 1.83 |

| Invesco India Multicap Fund – Direct Plan | 1.83 |

| BNP Paribas Multi Cap Fund – Direct Plan | 1.82 |

| Essel Large & Midcap Fund – Direct Plan | 1.82 |

| Invesco India Tax Plan – Direct Plan | 1.82 |

| IDBI Equity Advantage Fund – Regular Plan | 1.81 |

| Invesco India Growth Opportunities Fund – Direct Plan | 1.8 |

One year SIP return difference (top 20) for equity funds

1Y Difference = 1Y SIP Return (Direct Plan) – 1Y SIP Return (Regular Plan). Here 1Y = last one year.

| Fund | 1Y Difference % |

| IDBI Focused 30 Equity Fund – Regular Plan | 2.33 |

| IDBI Small Cap Fund – Regular Plan | 2.28 |

| Mahindra Mutual Fund Badhat Yojana – Regular Plan | 2.12 |

| Mahindra Mutual Fund Kar Bachat Yojana – Regular Plan | 1.96 |

| Tata India Pharma & HealthCare Fund – Regular Plan | 1.86 |

| DHFL Pramerica Diversified Equity Fund – Regular Plan | 1.82 |

| DHFL Pramerica Long Term Equity Fund – Regular Plan | 1.81 |

| IDBI Midcap Fund – Regular Plan | 1.77 |

| Invesco India Financial Services Fund – Direct Plan | 1.75 |

| IDBI India Top 100 Equity Fund – Direct Plan | 1.74 |

| Invesco India Mid Cap Fund – Direct Plan | 1.71 |

| Essel Long Term Advantage Fund – Direct Plan | 1.7 |

| Axis Multicap Fund – Regular Plan | 1.69 |

| Invesco India Largecap Fund – Direct Plan | 1.69 |

| Tata Digital India Fund – Regular Plan | 1.68 |

| Tata Banking and Financial Services Fund – Regular Plan | 1.65 |

| Essel Large & Midcap Fund – Direct Plan | 1.65 |

| DHFL Pramerica Global Equity Opportunities Fund – Direct Plan | 1.64 |

| Tata India Consumer Fund – Regular Plan | 1.6 |

| IDBI Equity Advantage Fund – Regular Plan | 1.57 |

Five year SIP return difference (top 20) for equity funds

5Y Difference = 5Y SIP Return (Direct Plan) – 5Y SIP Return (Regular Plan). Here 5Y = last five years.

| Fund | 5Y Difference |

| Invesco India Mid Cap Fund – Direct Plan | 2.09 |

| Invesco India Financial Services Fund – Direct Plan | 2.08 |

| Invesco India Infrastructure Fund – Direct Plan | 1.99 |

| Invesco India Largecap Fund – Direct Plan | 1.96 |

| Invesco India Multicap Fund – Direct Plan | 1.92 |

| Indiabulls Bluechip Fund – Direct Plan | 1.89 |

| Invesco India Growth Opportunities Fund – Direct Plan | 1.89 |

| Invesco India Tax Plan – Direct Plan | 1.88 |

| BNP Paribas Multi Cap Fund – Direct Plan | 1.86 |

| Invesco India PSU Equity Fund – Direct Plan | 1.85 |

| Kotak Infrastructure and Economic Reform Fund – Standard Plan – Direct Plan | 1.82 |

| Invesco India Contra Fund – Direct Plan | 1.79 |

| IDFC Focused Equity Fund – Regular Plan | 1.78 |

| BNP Paribas Midcap Fund – Direct Plan | 1.77 |

| IDFC Core Equity Fund – Regular Plan | 1.74 |

| IDFC Infrastructure Fund – Regular Plan | 1.73 |

| Tata Large Cap Fund – Regular Plan | 1.71 |

| Kotak India EQ Contra Fund – Regular Plan | 1.68 |

| DHFL Pramerica Large Cap Fund – Direct Plan | 1.67 |

| Tata Large & Mid Cap Fund – Regular Plan | 1.62 |

Three year SIP return difference (top 20) for aggressive hybrid funds

3Y Difference = 3Y SIP Return (Direct Plan) – 3Y SIP Return (Regular Plan). Here 4Y = last three years.

| Fund | 3Y Difference |

| Mirae Asset Hybrid Equity Fund – Regular Plan | 1.93 |

| Baroda Hybrid Equity Fund – Direct Plan | 1.58 |

| Reliance Equity Hybrid Fund – Direct Plan | 1.55 |

| Sundaram Equity Hybrid Fund – Regular Plan | 1.53 |

| Kotak Equity Hybrid Fund – Regular Plan | 1.48 |

| LIC MF Equity Hybrid Fund – Direct Plan | 1.48 |

| Tata Hybrid Equity Fund – Regular Plan | 1.48 |

| DHFL Pramerica Hybrid Equity Fund – Direct Plan | 1.47 |

| Franklin India Equity Hybrid Fund – Direct Plan | 1.46 |

| Canara Robeco Equity Hybrid Fund – Regular Plan | 1.44 |

| ICICI Prudential Equity & Debt Fund – Direct Plan | 1.44 |

| Tata Retirement Savings Fund – Moderate Plan – Regular Plan | 1.35 |

| Principal Hybrid Equity Fund – Direct Plan | 1.33 |

| Aditya Birla Sun Life Equity Hybrid ’95 Fund – Direct Plan | 1.29 |

| LIC MF Unit Linked Insurance – Direct Plan | 1.29 |

| DSP Equity & Bond Fund – Direct Plan | 1.19 |

| L&T Hybrid Equity Fund – Direct Plan | 1.15 |

| HDFC Children’s Gift Fund – Direct Plan | 1.13 |

| SBI Equity Hybrid Fund – Direct Plan | 1.12 |

| ICICI Prudential Child Care Fund – Gift Plan – Direct Plan | 0.93 |

One year SIP return difference (top 20) for

aggressive hybrid funds

1Y Difference = 1Y SIP Return (Direct Plan) – 1Y SIP Return (Regular Plan). Here 1Y = last one year.

| Fund | 1Y Difference |

| IDBI Hybrid Equity Fund – Regular Plan | 1.81 |

| HDFC Retirement Savings Fund – Hybrid Equity Plan – Regular Plan | 1.61 |

| Sundaram Equity Hybrid Fund – Regular Plan | 1.61 |

| Mirae Asset Hybrid Equity Fund – Regular Plan | 1.58 |

| BNP Paribas Substantial Equity Hybrid Fund – Regular Plan | 1.56 |

| Tata Hybrid Equity Fund – Regular Plan | 1.52 |

| IDFC Hybrid Equity Fund – Regular Plan | 1.49 |

| LIC MF Equity Hybrid Fund – Direct Plan | 1.31 |

| Canara Robeco Equity Hybrid Fund – Regular Plan | 1.29 |

| Baroda Hybrid Equity Fund – Direct Plan | 1.26 |

| Tata Retirement Savings Fund – Moderate Plan – Regular Plan | 1.25 |

| DHFL Pramerica Hybrid Equity Fund – Direct Plan | 1.23 |

| LIC MF Unit Linked Insurance – Direct Plan | 1.18 |

| Franklin India Equity Hybrid Fund – Direct Plan | 1.17 |

| Kotak Equity Hybrid Fund – Regular Plan | 1.14 |

| Reliance Equity Hybrid Fund – Direct Plan | 1.11 |

| ICICI Prudential Equity & Debt Fund – Direct Plan | 1.09 |

| HDFC Children’s Gift Fund – Direct Plan | 1.06 |

| DSP Equity & Bond Fund – Direct Plan | 1 |

| HDFC Hybrid Equity Fund – Direct Plan | 0.99 |

Five year SIP return difference (top 20) for aggressive hybrid funds

5Y Difference = 5Y SIP Return (Direct Plan) – 5Y SIP Return (Regular Plan). Here 5Y = last five years.

| Fund | 5Y Difference |

| Kotak Equity Hybrid Fund – Regular Plan | 1.55 |

| Baroda Hybrid Equity Fund – Direct Plan | 1.51 |

| Franklin India Equity Hybrid Fund – Direct Plan | 1.49 |

| Reliance Equity Hybrid Fund – Direct Plan | 1.49 |

| DHFL Pramerica Hybrid Equity Fund – Direct Plan | 1.48 |

| Tata Retirement Savings Fund – Moderate Plan – Regular Plan | 1.45 |

| ICICI Prudential Equity & Debt Fund – Direct Plan | 1.44 |

| Aditya Birla Sun Life Equity Hybrid ’95 Fund – Direct Plan | 1.32 |

| Canara Robeco Equity Hybrid Fund – Regular Plan | 1.28 |

| LIC MF Equity Hybrid Fund – Direct Plan | 1.27 |

| Principal Hybrid Equity Fund – Direct Plan | 1.22 |

| Tata Hybrid Equity Fund – Regular Plan | 1.2 |

| L&T Hybrid Equity Fund – Direct Plan | 1.2 |

| SBI Equity Hybrid Fund – Direct Plan | 1.19 |

| Sundaram Equity Hybrid Fund – Regular Plan | 1.17 |

| LIC MF Unit Linked Insurance – Direct Plan | 1.14 |

| DSP Equity & Bond Fund – Direct Plan | 1.14 |

| HDFC Children’s Gift Fund – Direct Plan | 1.05 |

| ICICI Prudential Child Care Fund – Gift Plan – Direct Plan | 0.94 |

| HDFC Hybrid Equity Fund – Direct Plan | 0.81 |

Download the full data set: 298 equity funds and 66 aggressive hybrid funds

Did you scroll down this far down? Then show me proof you did! Comment below or tweet to @freefcal what is (22x 10) +2 = ?

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)