Last Updated on December 28, 2021 at 6:33 pm

If you are someone who desires early retirement or you just want to save up enough to ensure income for a few years while you get your startup off the ground, then you probably should have come across* terms like frugality, FIRE, safe withdrawal rate = 4%, savings rate etc. These are some of the lingo tossed about in the so-called financial independence and early retirement (FIRE) forums and communities. Useful as these groups are, I discuss why you should not take their enthusiasm about frugality too seriously else you may risk exhausting your retirement corpus quicker than expected.

* If you have not, good for you. Don’t. You can start off with a clean slate. Planning for early retirement is not different than normal retirement. The math is the same. The assumptions are the same. In fact, contrary to what people think, early retirement requires conservative assumptions than normal retirement.

Don’t get me wrong. These groups are useful when it comes to clarifying and defining your ideas of minimalism, increasing your savings, tips on saving money and use of your available resources efficiently. However, when it comes to handling risk after retirement, many people here seem to think if they spend less (being frugal), they can “manage”.

This is like certified financial planners saying they know everything about money management because they have passed a course or like parents who have just started home-schooling feeling superior to others who send their kids to school.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Before we begin, here are some resources that may be of use to young earners who wish to quit their salaried jobs as soon as possible:

Frugality: The Cornerstone of Personal Finance ==> My early experiences

Misconceptions about frugality==> It is not spending less, but (organically) wanting less.

Download free E-book: How to retire early in India ==> This is meant as a complete guide.

Is it possible to retire early in India? ==> Different types of withdrawal strategies are discussed. Pity if you talk about risk, budding FIRE seekers read it as “it is not possible to retire early in India”. Nothing further from the truth! More than possible.

Frugality and me

I am a frugal person by nature. This does not mean I cut back on my needs on purpose. I just have fewer needs, to begin with. As an example: I reluctantly purchased my first mobile in 2006 (because my late father was bed-ridden and wanted to reach me at any time). Since then, I have changed my mobile twice and over the past 12 years spent a total of about Rs. 4500 on them. Nokia 1110 —> Nokia 105 —> Samsung Guru (better voice clarity, but not so great interface). As you may have guessed most of the money went into Nokia 1110.

I have not deprived myself of an iPhone or Samsung Galaxy. Just never felt the need for them. If I wanted to use internet on a mobile, I use Chrome dev tools and change the device (mainly for testing freefincal) in the browser.

Today I hear about people changing their smartphones once in two years because they have to and less than that because they want to. Nothing wrong that. Money is there to be spent. But if you are going to keep doing that, early retirement will not be so early. There is no free lunch. You can’t have everything.

You MUST plan for normal retirement early in life and start investing asap. You need not plan for early retirement.

The best part and the only reason we could become financially independent within a decade of earning is that my wife is intrinsically frugal too. Even today, she would come and ask, “I need to use the debit card, do we have money in the bank?” for amounts as small* as Rs. 500 or Rs. 1000. My point is, that is her idea of a “big purchase”.

* Should be the case with most people reading this

So make no mistake, we are big fans of frugality because that is our inherent nature. Either you are born with it or embrace it wholeheartedly later on. There is no in-between here.

A frugal existence is necessary for early retirement (unless you earn a super huge salary)

Two reasons:

1: It allows you to invest more. Today I manage to invest 60-70% of monthly income towards all our goals. A few years ago, it was a bit more. You can invest more, not just before saying goodbye to your regular job, but afterwards too.

2: It allows you to withdraw less. When you wish to draw an income from your corpus, a frugal existence goes a long way!

As a corollary: if you were frugal just to become financially free, you cannot change spending habits later on and start splurging! This is similar to a low-carb, high-fat diet. Once you are on it, you cannot change, else the weight loss will be nullified.

A frugal existence is not sufficient for early retirement (unless you are super rich)

Remember that phrase, “necessary, but not sufficient” from your math textbook? That is what I am talking about.

Again three reasons, but this time not as simple to understand.

1: Unexpected recurring expenses. If you have a one-time expected expense now and then you can use your corpus or your emergency fund to handle it. If you have unexpected or unanticipated expenses that recur (say monthly), you will start withdrawing more and more from your corpus after quitting your regular job and risk running out of money sooner. Those below 30 may not appreciate it as much as older readers would do.

This is the reason I started a poll on Facebook Asan Ideas for Wealth: When did you first start thinking about FIRE? Fire-seekers in their 30s are likely to be a bit more balanced in their views while planning for retirement than those in their 20s.

You may want to be frugal and keep your expenses lower. But remember that life must let you be frugal. Many young earners seeking FIRE (financial independent and early retirement) fail to understand this. They think they can generate a nice fat 3-4% return above inflation and be as frugal as possible.

2: Lower reward, not just from equity but also fixed income in future. That is lower than what you project after early retirement now. See: Should I expect lower returns from equity in future?

This might reduce inflation from your present expenses, but it would be pretty brave to assume an real inflation of lower than 6% in India for the next 10-15Y at least. The good part is, disappointing returns will prevent you from retiring early! Better that risks pan out before you retire!

3: Sequence of returns risk. This is the most important reason and in combination with unexpected expenses can wreck havoc.

What is a sequence of returns risk?

As recently shown in Sensex Charts 35 year returns analysis: stock market returns vs risk distribution, even after 25 years, Sensex in the past has returned single-digit returns. That is, the return sequence over such 25-year periods was quite poor.

Want an actual example? Watch this:

How is this a risk in early retirement? Well, this is a risk for any goal.

Consider the most popular thumb rule used by budding early retirees:

If my current annual expense is X then a corpus of 30X will last me for 30 years.

For example, a monthly expense of Rs. 30,000 or annual expenditure of Rs. 3.6L will need a corpus of 108 lakhs).

That is I take the 108L and invest it in a portfolio that should give me say a return of R% year on year. I keep withdrawing money for expenses. This expense can increase year after year at an inflation rate of R%.`

Say you invest the corpus in a portfolio of stocks and bonds that gives you a net post-tax return of 8% year on year. Your corpus will last for 30 years if the inflation in your expenses is 8%.

That is the real return (excess return above inflation) = zero. In other words,

a corpus of 30 times annual expenses will last for 30 years with zero real return

The problem is that this 30X thumb rule holds good for 0% return and 0% inflation; 4% return and 4% inflation and 8% return and 8% inflation. What is the difference? The risk necessary to achieve 8% net portfolio return after tax is higher than 0% or 4%!

This means as you expect higher and higher returns from your corpus in the withdrawal stage, you subject the plan to both

(a) unexpected recurring expense risk and (b) sequence of returns risk.

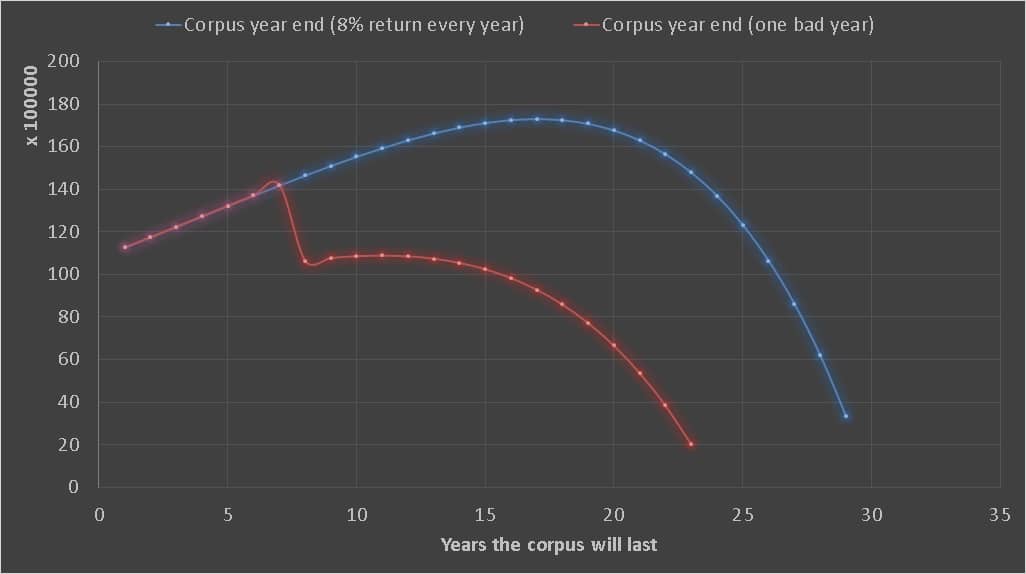

Suppose your 60-70% stock portfolio encounters a -40% stock market crash. This means for one year alone (say 8th), the net portfolio return is about -21%. Even if the net return is 8% for all other years, the corpus will only last for 23years. Seven years worth of corpus destroyed by one terrible year. If the -21% return had occurred in the very first year, 8 years worth of corpus would have been destroyed. This is known as sequence of returns risk. Will post more realistic examples soon

It is perhaps ironic that people who claim to be frugal in life are not frugal when it comes to return expecations! I have seen articles with 4% real returns!

What early FIRE seekers must recognise is, ten years after retirement, your portfolio return could be 12%. Great achievement, but if it includes even one negative return year, you will run out of money sooner than expected.

Consider this: If each year your portfolio return is 8%, then CAGR after 30Y is also 8% (obviously!).

Suppose you get 8% for first 7 years, -21% in the 8th year and then 10% in the remaining 22 years, the effective CAGR is 8.3%. A bit more than what you had in mind when you first calculated. You will still run out of money in 26 years. Four years earlier than expected because of a poor sequence of returns. A clear case of operation, successful, but the patient is dead.

FIRE seekers would do well if they understand that the return projections in a calculation are year on year returns and single bad year can derail their efforts. Please don’t tell me, you will somehow escape those bad years. That is plain stupid.

You cannot get single-digit returns from equity after 20-25 years without having a few negative return years. During those years, you cannot stop withdrawing from your portfolio! If the first few years after quitting your job, returns are poor, it can destroy your plans once and for all. You can play this game and see for yourself: The Retirement Bucket Strategy Simulator

How to handle a sequence of returns risk in early retirement?

1: Do not aim for real returns! That is portfolio return higher than inflation. This means simply too much risk. Yeah, it also means, you will have either postpone FIRE or have a side income afterwards.

2: Work with -2% real return or at best 0% real return but also work more with debt or bonds. I designed the robo advisory template to cough up higher debt allocation if one retires earlier! This is completely opposite to what you might read in early retirement blogs. Better to be safe than sorry. I would recommend a 40-50% equity allocation for early retirement, not more. If you cannot retire early with 40-50% equity, you are not ready to retire early, period. You cannot cope sequence of returns risk.

3: You must be able to generate inflation-protected income for at least the first 15 years of retirement. This is my “thumb rule”. I cannot back this with backtesting though (I soon will). Those 15 years gives you some time to recover from bad returns. This also means you have to tactically and aggressively manage the portfolio. That is, say, you expect 10% return on equity and one year you get 15%, you book profits to debt and protect that extra sum.

If you do this right, you can live off debt for 15Y at any given time -in the 1st year of retirement or 10th year. This should be the ultimate goal of a good bucket strategy. Try the simulator linked above. You will get some nice insights on how to handle this.

4: Set up an annuity ladder If possible, guarantee some income all your life with an annuity. Suppose your initial expenses are about 4 lakhs a year, buy an annuity to cover say, at least half your expenses immediately upon retirement. After 10Y or so, buy another annuity at a higher rate (because you are older), and hopefully lower taxes. Rinse and repeat. This annuity ladder will give you peace of mind. Of course, this means you need a good corpus to start with and more tax outgo.

5: Do something you love and earn a little money off that. This way you do will not withdraw for the first few years and do not need an annuity ladder for say 10-15 years. This gives you time to let the corpus grow untouched. Do not take on more risk though!

Advisor risk in early retirement

Not many financial advisors understand and appreciate sequence of returns risk and may ask a client to take on too much equity after retirement. This can be disastrous. Never ever get post-retirement planning advice from commission based (aka fee-based) advisors. Even if you get advice from a fee-only planner, double-check and understand the pros and cons yourself.

FIRE = DIY

To conclude,

Frugality is necessary, but not sufficient for FIRE. Know-how of managing “sequence of returns risk” is essential and possibly even sufficient for sustained FIRE

Download free E-book: How to retire early in India

What is your financial freedom strategy? How do you plan to handle a sequence of returns risk?

You can also tweet your response to @freefincal

Do share this with FIRE communities. I would be curious to know how they react!

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)