Last Updated on January 1, 2024 at 10:04 am

In this edition of “reader story”, Ravi Kiran describes his experience of procuring a home loan from LIC Housing Finance (LICHFL) and then transferring it to SBI, thereby saving over Rs. 12 Lakh in interest.

UPDATE: MD and CEO of MF Utility, V Ramesh will be joining Ashal and me at the PUNE DIY Investor meet on 26th Feb. Registration link below.

-=-=-

Dear freefincal readers, I am Ravi Kiran, working as School Asst. in Education Dept. Govt. Of Andhra Pradesh…. Would like to share my experience of Housing Loan Process…

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

2013 February

My wife also works in the same Dept. like me and we had a decent income also a pay revision was due to us. So I wanted to have a home of my own. I searched and sorted out a ready-made house. As I had no surplus funds and time to construct a house on my own I preferred a ready-made house. I made an agreement with the seller for ‘ X ‘ amount and approached one of the branches of SBI in my town to have 22 lacs of housing loan. The rest of the amount was obtained via personal loans from relatives.

The manager at first enquired me about my background, accounts, assets liabilities and finally told me to fulfil the following requirements.

- Form 16 for 2 years

- Latest 3 months salary slips

- PAN card, Address Proof

- Legal opinion from Two lawyers from SBI panel

- An Engineer’s Valuation from SBI Panel.

- 5% franking for mortgage statements i.e., 10000/-

- 500/- Stamping charges for agreement with SBI.

I approached the panel engineer, paid his fee of Rs. 2500/- and got a valuation for Rs 28,00,000/-

One fine day my wife and I approached the bank manager and submitted all the documents, valuations, legal opinion.

THE DRAMA BEGAN HERE.

The branch had a limit of 20,00,000/- for home loans. So the manager had no authority to sanction my loan. He tried to compel me to take 20 lacs only. As I had already had personal hand loans, and not in a position to get any money from anyone else, I requested him to pursue and sanction 22 lacs as the loan. I had a decent salary to pay the EMI even for 30 lacs. He postponed and wasted 30 days of valuable time in the name of processing the application with authorities. Meanwhile, the agreement time had approached. One fine day he told me that he had forwarded the application to the regional business office (RBO) so it was not in his hands to sanction the loan. The RBO officials of my city valued the house for just 10 lacs and finalised the loan amount as 8 lacs….where the market value was nearly 30+.

I could neither take the loan nor go anywhere as the time was short to register the house. So I asked them to give the 20 lakhs which they offer at first. But the inefficient manager, who was unable to compel the authorities to sanction the loan for a salaried couple who were with SBI for the past 9 years, who could pay the EMI easily, simply said: “ As RBO once rejected your proposal, I can’t do anything except giving 8 lakhs proposed by RBO”. I was blank.

I paid nearly 20000/- for lawyer and engineer and stamping and all of that could go waste.

2013 APRIL

I approached LICHFL. They agreed to sanction the loan. Took 30000/- for various expenses. Sanctioned the loan of 22,00,000/- at 10.95% fixed for 10 years, which I opted myself, as floating rate of interest was very high after first 2 years.

2016 October.

By this time I had paid more than 40 EMIs @ 21098/-. I paid 1150/- to LICHFL and got the interest rate reduced to 9.85%. As the RBI cut the rates now and then housing loan interest rates slashed to a multi-year low. Again LICHFL asked me to pay another 1150/- to bring down the rate to 9%.

2016 December

Our P.M. announced demonetization and all the banks were flooded with cash flows, SBI interest rate became very attractive for me. Meanwhile, during these three years, I followed freefincal calculators and AIFW FB group and learnt a lot about Financial Management. So I was waiting for the opportunity to move to SBI MAXGAIN.

Migration from LICHFL to SBI MAXGAIN

At the end of December 2016 my Outstanding balance in LICHFL was around 20,00,000/- by January 10th of 2017, it was 19,90,000/-. I received several phone calls from various money lending institutions offering Personal Loans, car loans, credit cards etc., post demonetization. I also heard that SBI was also advertising for customers to sanction loans. So I just wanted to give a try.

First I tried to figure out how much I could save by shifting from LICHFL to SBI post all the expenses. Punched the numbers in calculators available in freefincal, switchme.in and in some other websites to figure out the savings and notional cash at the end of the tenure… It was around 12 lakhs. I took a decision to move.

-=-=-=-

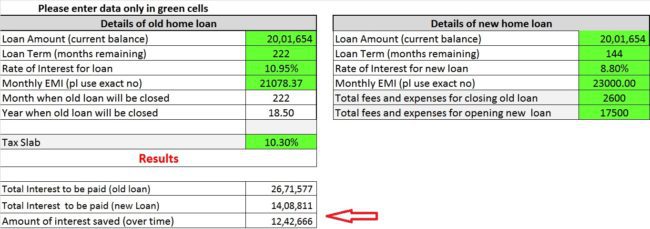

Author note: Here is an illustration of the savings from reduced interest outgo. This savings is not immediate but over time.

You can use this home loan transfer calculator if switching like Ravi: From one tenure/EMI to another tenure/EMI.

If you either keep the EMI the same or the tenure the same, you can get more insights like, how soon the loan can be closed if the interest savings can be used to pre-pay or the corpus that you can generate if the savings are invested with this sheet: Home Loan Transfer Calculator: Base Rate To MCLR Switch. Now back to Ravi.

-=-=-=-

Contacted the SBI Branch Manager for taking over. The present manager wanted the following:

- Outstanding Balance statement from LICHFL Original

- Last one-year payment statement Original

- List of documents Original

- Registration Papers Xerox copy was given to LICHFL and other documents supporting the previous owners of the said plot/ property

- House approval plan Xerox given to LICHFL

- House tax and water tax receipts or notices

- Form 16 for 3 years

- Salary slips for the last 3 months

- Adhar, PAN, Cancelled Cheques, 2 Photographs

- Legal Opinion and Engineer’s valuation

25.01.2017

At first, I contacted the Engineer for present valuation of my home and explained how I lost money in 2013 with SBI and why am I moving to SBI again. I showed the 2013 valuation Original ( glad I didn’t tear it) to him.He was sympathetic and assured that he could do his best and help me shift.

He immediately sent his assistant to take the measurements of my home and some photographs of me in the home…

In the evening I contacted the Lawyer for Legal Opinion and explained the same. He felt very sorry for what had happened and he also assured to help for the takeover. Collected the Original 2013 legal opinion and Registered deed Xerox of LICHFL, house tax receipts.

26.01.2017

I got the valuation report from the Engineer for 3500/- and he asked me to come for any help in this issue. He also assured me to recommend to another branch if I was unable to make it.

28.01.207

By the evening I got the Legal Opinion from the Lawyer. He didn’t charge me anything except for the ECs as I lost money in 2013 and he introduced me to another branch in the city and requested them to treat my loan as his personal housing loan. I will always be grateful to him.

30.01.2017

Went to the bank and filled the application form, given cheques and other relevant documents. They checked our CIBIL scores and satisfied. An assistant of the field officer visited my home and completed KYC. The manager told us to visit the branch the next day.

The following documents were given for takeover.

- Engineer’s valuation with approved plan

- Lawyer’s legal opinion with House tax receipts and ECS

- Form 16s and Salary Slips

- 6 cheques

- Franking on mortgage papers of 0.5% of Loan amount i.e. 10000/-

- 500/- stamping on agreement papers with SBI…

31.01.2017

Went to the bank in the afternoon. Got some agreement papers to be stamped for Rs. 500/- and handed over to them. 10000/- Franking been done on mortgage form and handed over to them. By the evening they gave me a cheque of Rs. 20,00,000/- in favour of LICHFL. I was astonished. The sincere effort I never expected from SBI Staff. I am very much thankful to the Panel Lawyer, who introduced me to these wonderful people. I said a heart felt thanks to them and took leave and didn’t take the cheque as it was a Tuesday. I requested them to give it the next day i.e. on Sree Panchami, a Wednesday.

01.02.2017

Went to bank around 11.00 am. I felt as though they were eagerly waiting for me as I was honest in my words, praising their sincerity and dedication to SBI. Taken the cheque and given to LICHFL. A balance of 1654/- was paid in cash. Closed the account. Took the Account Closure Intimation letter and Receipts and given to SBI. I was also given RINN RAKSHA insurance policy premium as the loan.

Migration expenses are as follows.

- Lawyer 00

- Engineer 00

- Stamps 00

- Franking 00

My new EMI commences from 05.02.2017 which is @ 8.80% with SBI for 12 years tenure against 9.85% of 19 years tenure in LICHFL.

-=-=-=-

Ravi is a classic example of a contended investor. You got to admire a guy who says, “we are earning enough”. 🙂

Other Reader Stories

Reader Story: Are you sure you can be a DIY investor?

Reader Story: Arise, Awake and DIY!

Reader Story: A Force Awakens!

Pune Investor Workshop Feb 26th, 2017

The second Pune workshop will be held on Feb 26th, 2017. V Ramesh, MD and CEO of MF Utility will be joining Ashal and me. You can register for this via this link

You Can Be Rich Too With Goal-Based Investing

A very concise and practical read. No nonsense advice to personal finance.

The best book ever on Financial Freedom Planning. Go get it now!

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 346 13% OFF

Kindle at Amazon.in (Rs. 244.30)

Google Play Store (Rs. 244.30)

Infibeam Now just Rs. 307 use love10 to get additional 10% OFF.

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

Also Available At

Bookadda Rs. 371. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)