Last Updated on December 29, 2021 at 6:10 pm

The TER (total expense ratio) of the Tata Nifty Index Fund shot up from 0.05% to 0.15% on 5th April 2021. From 16th April UTI Nifty Index fund will charge a TER of 0.18% instead of 0.1%. From 15th April 2021, HDFC Nifty and Sensex Index funds will cost twice as much – from 0.1% to 0.2 %. All direct plan funds. This has shocked investors, and many would like to know if ETFs are the way forward instead of index funds. A discussion.

In the Asterix adventure, The Mansions of the Gods, the Romans build a residential complex right outside the Gaulish village. When the first Roman residents visit the village to buy fish, they are shocked to find how low the prices are compared to Rome. A few days later, all the new residents flock to the village for fish. The next day, the prices shoot up. Unhygienix, the fishmonger justifies the increase, “but it is still much lower than Rome!” (see snippet below).

Investors must understand that AMCs are not some idealistic loudmouth Bogleheads who worship low cost investing efficacy. All they care about is profit (whether their firm is listed or not). The only reason they would keep the TER low or lower than others is to invite the AUM. Once the AUM has increased enough, jack up the prices. It does not matter much if new AUM dries up; the existing investors will likely stay fearing tax. So the profit suddenly doubles. Also, see: AUM of 11 equity funds (6 are ETFs!) grew by more than 30% in Oct 2019.

We have been pointing out that SEBI has done nothing about this frequent expense ratio change via several examples. See a 48% increase in the expense ratio of the Birla Reg Savings Fund! Time for SEBI to act? And Why SEBI should stop frequent mutual fund expense ratio changes.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

I was just asked on Twitter if we have an MF screen based on the expense ratio. There is no use for this. We will look for the fund with the lowest TER and start investing, and after few months, the TER will double or triple or more.

Yes, these frequent expense ratio increases will hurt investor returns. You can play around with this tool: Impact of MF Expense Ratio Calculator. The increase is not permanent, though. Once the AUM inflow stops, the TER will drop again as bait. Rinse and repeat until SEBI does something. This mating dance will continue “within acceptable and permissible limits”.

The real “AMC risk” is in arbitrary variations of the expense ratio, not whether XYZ AMC will quit or sell. Any AMC can quit and go at any time. There is no risk in this. Investors will get their money back and will have to pay some tax. SEBI currently allows AMCs to reduce investors by 2X, 3X or more at will, regardless of whether it is an active or passive fund.

So the question to ask is, should we consider ETFs instead of index funds? There is no regular plan, direct plan business here. The TER of an ETF by construction will always be lower than an index fund. The fluctuations in TER is relatively lower. So why not consider ETFs?

Sounds tempting, but the real problem for most investors is the mode of transactions in an ETF. We have to buy and sell from other unitholders. See: How ETFs are different from Mutual Funds: A Beginner’s Guide. This can result in significant deviations of the unit price from the NAV, and most AMCs are not effective in employing a third party in reducing these deviations. See some examples here: Indian ETF Liquidity: Here is how you can select ETFs.

I have already demonstrated that the Lowest expenses do not mean the lowest tracking error! This applies to index funds or ETFs. Also, we have made detailed comparisons of ETFs and index funds.

- Nippon India ETF Nifty BeES vs UTI Nifty Index Fund: Which is better?

- SBI ETF Nifty 50 vs UTI Nifty Index Fund: Which is Better?

- ICICI Nifty Next 50 Index Fund vs Reliance ETF Junior BeEs

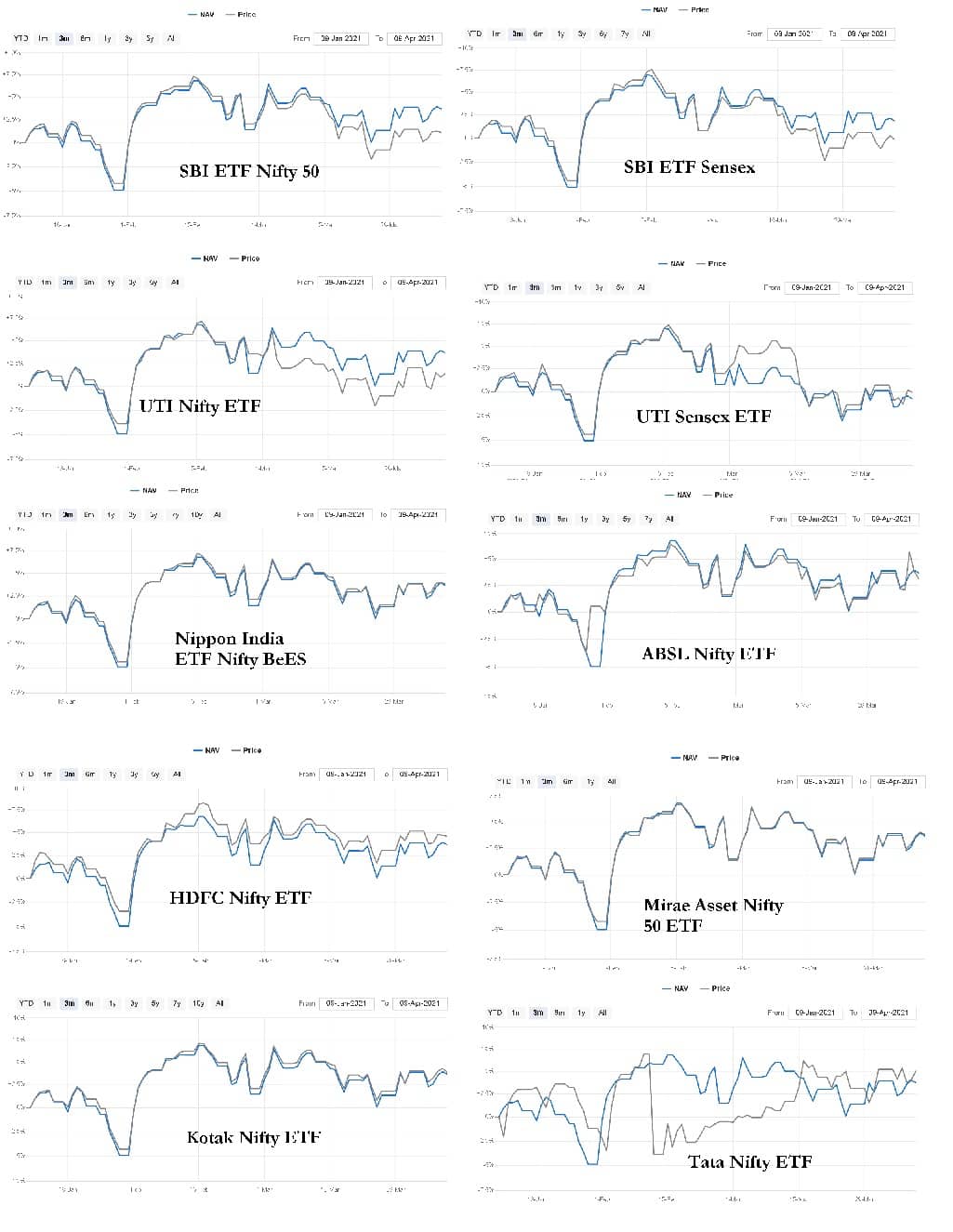

Here are some screenshots from ValueResearch of the last three-month difference between price and NAV of these ETFs (AUM and TER as of March 2021 also included)

- SBI ETF Nifty 50 ₹ 95,067 Cr 0.07%

- SBI ETF Sensex ₹ 42,466 Cr 0.07%

- UTI Nifty ETF ₹ 23,672 Cr 0.07%

- UTI Sensex ETF ₹ 13,141 Cr 0.07%

- ICICI Prudential Nifty ETF ₹ 2,220 Cr 0.05%

- ABSL Nifty ETF ₹ 334 Cr 0.05%

- HDFC Nifty 50 ETF ₹ 842 Cr 0.05%

- Mirae Asset Nifty 50 ETF ₹ 551 Cr 0.07%

- Kotak Nifty ETF Fund ₹ 1,161 Cr 0.012%

- Tata Nifty ETF ₹ 296 Cr 0.08%

- Nippon India ETF Sensex ₹ 34 Cr 0.07%

- ICICI Prudential Nifty ETF ₹ 2,220 Cr 0.05%

Very few AMCs manage or care about quickly correcting price-nav deviations. The Nifty ETFs from Nippon Indian, Mirae and Kotak stand out in this picture, but other durations like 6 months, 12 months etc., should be verified.

Price-nav deviation has nothing to do with AUM size or TER. It only depends on demand and supply fluctuations in the ETF and how efficient the appointed third party is in ironing them out.

Some people say, “but the price is lower than NAV, this is a good thing, is it not?”. A line from the movie Margin Call would help you, “I hope you remember our business is buying and selling?”. A price lower than NAV is good for the buyer, but who will sell?

The biggest risk of investing in ETFs is when the markets become turbulent, and there is some worldwide crisis. Then aberrations such as this would occur: Why SBI ETF Nifty 50 Price changed only by 0.2% when Nifty fell 7.6%. Also, see how much deviation is possible over the last year(recall the markets had just started recovering from the crash a year ago).

This has nothing to do with AUM size (see list above), just ETF activity. When an investor heard about the TER increase in HDFC and UTI index funds, his first instinct I am moving to Tata. Then someone burst his plans with the information of a 3X TER increase in the Tata Nifty fund! So searching for funds with the lowest TER is a futile exercise. The more people who do this search and pick low-cost funds, the sooner its TER will increase.

This same logic applies to ETFs too. The same guys are running these! Today, you can pick Nifty Bees, but that is susceptible to 2X TER shocks too. Sure, an ETF will always cost less than an index, but that does not mean more returns in your hands because of the nav-price deviations.

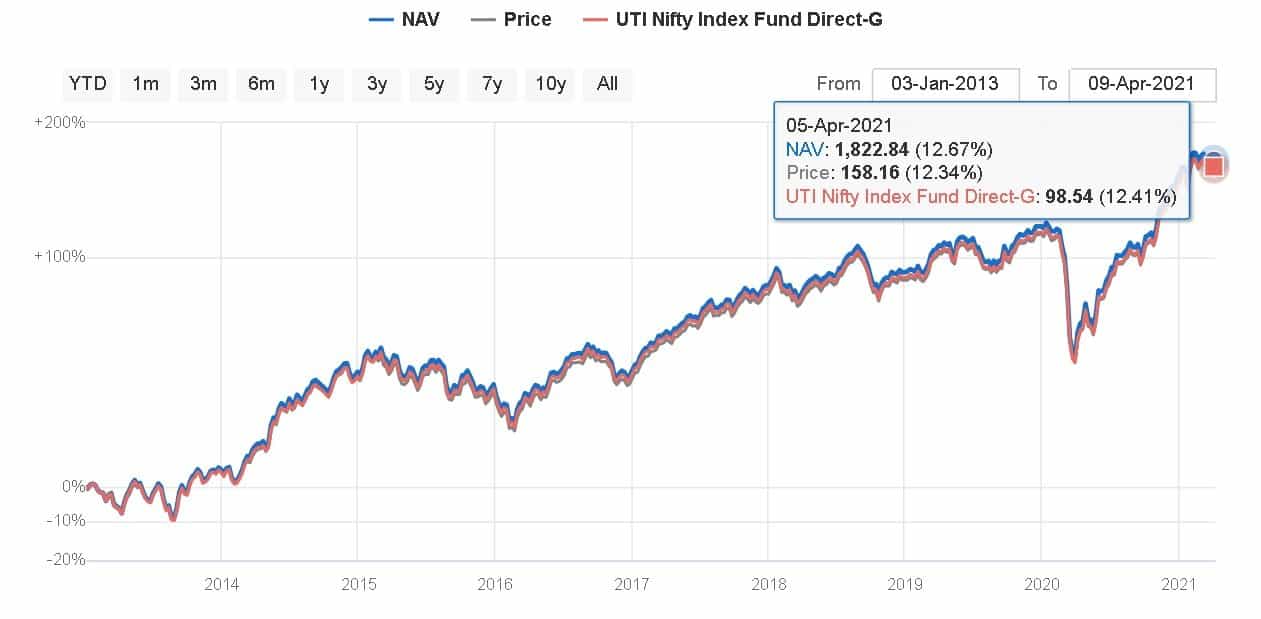

The increase in UTI NAV is less than the increase in Nifty Bees NAV because of lower TER. A common mistake investors make is to calculate tracking error and returns using ETF NAV. The typical investor has to buy units at the current price and sell at the current price, not at the current nav, and you see the impact of this above. The growth in the ETF price is less than that of the UTI NAV.

In summary, investors must stop making decisions based on the lowest TER or changes in TER. They have no control over this. We can know for sure that going from index funds to ETFs will come with a new set of problems and a new set of unknowns, particularly in turbulent situations. The grass is never greener. We recommend that index fund investors get used to these AMC gymnastics, stay put and not shift to ETFs. They might take a cue from Unhygienix, “but the TER is still lower than active funds; we have still made the smart choice here”.

This snippet from “The Mansions of the Gods”, remind you of anything? pic.twitter.com/7KKUQzJx5n

— M Pattabiraman (@pattufreefincal) April 11, 2021

Check out the new demo video of the robo advisory template!

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)