Last Updated on September 27, 2023 at 5:27 pm

In this post, Niten Kapoor discusses how he selected a health insurance policy. In my previous article on health insurance, I had invited readers to compare policies as guest posts. Niten agreed to write about how he compared policies and selected one. This is part of Re-assemble – a series on the basics of money management aimed at young earner. Here is a brief summary of all Re-assemble posts.

₹e-Assemble: a recap of the steps

Many of you may be on vacation this week. Now would be a perfect time to work on these steps.

Step 1: Listing your goals dreams and nightmares

Step 1: Listing your goals dreams and nightmares

Step 2: Lay the Foundations to Get Rich creating an emergency fund

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Step 3: How to buy Term Life Insurance

Step 4: How to choose a suitable health insurance policy

* Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit

* Star Health Comprehensive Insurance vs Religare Care Comprehensive Insurance

* Building a health insurance comparison chart + Cigna TTK vs Royal Sundaram Health Policies

* How to buy a Super Top-up Health Insurance policy

* This post: an example of a selection.

* coming soon: how to build a medical corpus

Step 5: How to select a credit card for maximum benefit

Step 6: How to track monthly expenses and manage them efficiently

Step 7: How to close your loans and live debt-free

Step 8: Coming soon: choosing accident insurance

Step 9,10 etc. : Coming soon: Starting investing and portfolio management with examples from readers.

The coming year, I would like to post more reader stories – how they manage money, how they choose products. This is always an interesting read and it can inspire others to act. Here are some reader stories from the past:

Reader Story: Arise, Awake and DIY!

Reader Story: A Force Awakens!

Reader Story: Are you sure you can be a DIY investor?

I would urge true DIY investors to open up and share their money management styles here. Please contact me first – freefincal [at] gmail.com – discuss the outline and then write!

Now over to Niten.

Before I start with the post, I would like to thank Pattu Sir for giving an amateur like me the opportunity to write an article on his blog. This is my first blog post and I would request the readers to provide me feedback so that I can improve.

About Me – I am a software engineer, based out of Gurgaon, temporarily residing in the US for an assignment.

As with buying any product, selecting the right one and with good value for money, you need to understand the product. Similarly, you can buy the right Health Insurance plan if you know what parameters and features you are looking for in the product and understand the policy documents. The question is what should be my selection criteria? This varies from individual to individual and you need to identify what parameters are most important before finalizing the product.Below I am outlining some factors that I considered while selecting health insurance for myself.

After doing some research reading online articles and blogs, I got some basic knowledge about what a health insurance is and the need for the same. I had a pretty decent corporate coverage from my employer but still wanted a personal one in case I would switch jobs. You could refer to this article Should I buy personal health insurance if I have company health cover?

What are the parameters one should consider before buying health insurance

You can consider below parameters as a broader outline and add if any that are not in the listed while making the final selection.

- Individual or Family Floater – Decide which type of health insurance you want. Having an individual health insurance is beneficiary as each member has a separate cover to use. However, there is a cost factor associated, as the premium would be high for each individual. It is suggested that parents should be kept separate from your health policy as the premium would be decided on the basis of the parent’s age and not on yours.

- Co-Pay – This is the percentage amount you have to pay from your pocket when the claim is approved. So say for a co pay of 20%, for every 10,000 claim amount approved you need to pay 2000 out of your pocket. (Please note you still need to pay for non-covered items such as disposables from your pocket. This is irrespective of whether you have co-pay or not.)

- Room rent sub-limit – This is the limit that insurance companies impose for processing your claim. Remember that room rent limit is not only limited to rent of the room but also hospitals vary the cost of doctor charges, operation charges etc. based on this limit. So the cost of the same procedure will vary depending on the room you have rented. In NCR region, this is a big factor as big hospitals have higher rent, so your insurance may cover only the partial cost if the room rent limit exists. For other people, find out average room rents in your area to arrive at a figure that is comfortable.

- Availability of hospitals – You can get this by entering the zip code where you stay and see if your preferred hospitals are catered by the insurance plans. This makes the claim process fast and easy. One important factor, most of smaller towns in India are not equipped to handle complex medical cases. In such cases, patients are referred to nearby bigger towns for treatment. You can consider this for additional analysis to see what kind of insurance plan you need.

- Premium Amount – See the combination of the amount of coverage and features you want in the insurance plan to decide how much premium you can afford.

- Age till which coverage available – Though a long-term aspect, but people in late 40’s and 50’s can be impacted by this factor.

Finally, read the policy document before finalizing the product and do not rely on comparison portals to give the correct information. At the end of the article, I will highlight some of the carefully worded policy document terms which may spring a surprise while buying the policy or making a claim.

Some trivial or features that I ignored:-

- Dental coverage (more suited for western plans, in India still dental costs are not sky high)

- How the claim is processed (Third party or in-house)

- Maternity benefits, OPD, Eyeglasses coverage, Ambulance charges, vaccination expenses, alternative to allopathic treatments coverage – (All these are either one-time charges or the amount is not huge to impact your selection)

My Selection Criteria for health insurance

I read articles on freefincal multiple times to get knowledge. Also, Asan Ideas for Wealth group on Facebook would have regular discussions about health insurance plans. All this made the foundation for selecting the policy. I used coverfox.com for comparison as it does not asks for a mobile number.

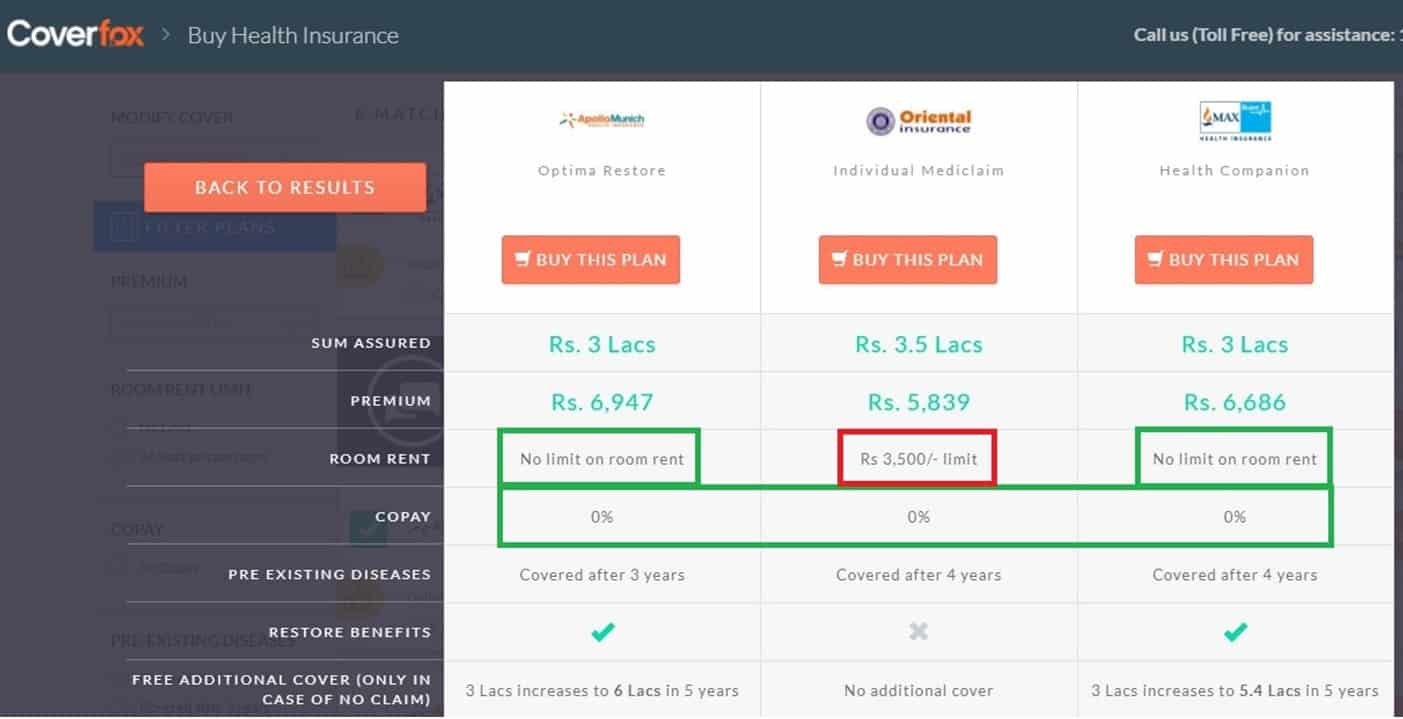

I was looking for an individual policy for myself. The premiums for PSU companies was less compared to private companies.The hospital coverage for Oriental was better in my area (32 hospitals v/s 23 by Max Bupa). However for me having an insurance plan without a co-pay and room-rent limit was of most importance.

Oriental Health insurance or for that matter PSU companies could not satisfy both these parameters.I then looked at other options such as Apollo, Religare and Max Bupa. Another parameter I looked at was how the premium is increasing with age? This is just an indicative thing (and the insurance company can change at any time), but I did not want to lock into a provider where the premium suddenly increases with a particular age limit.

In Apollo Munich Optima Restore benefit, the no claim bonus decreases if a claim has been made (from policy document highlighted in end). However, in Max Bupa, this would remain same. See: Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit.

So I ruled out Apollo Munich. Max Bupa Health Companion is what I decided. There are some benefits like AYUSH (non-allopathic treatments) that are covered under this policy. I do not require these and they make the plan expensive, but I had to compromise as I wanted to buy a plan and not wait for researching more products.

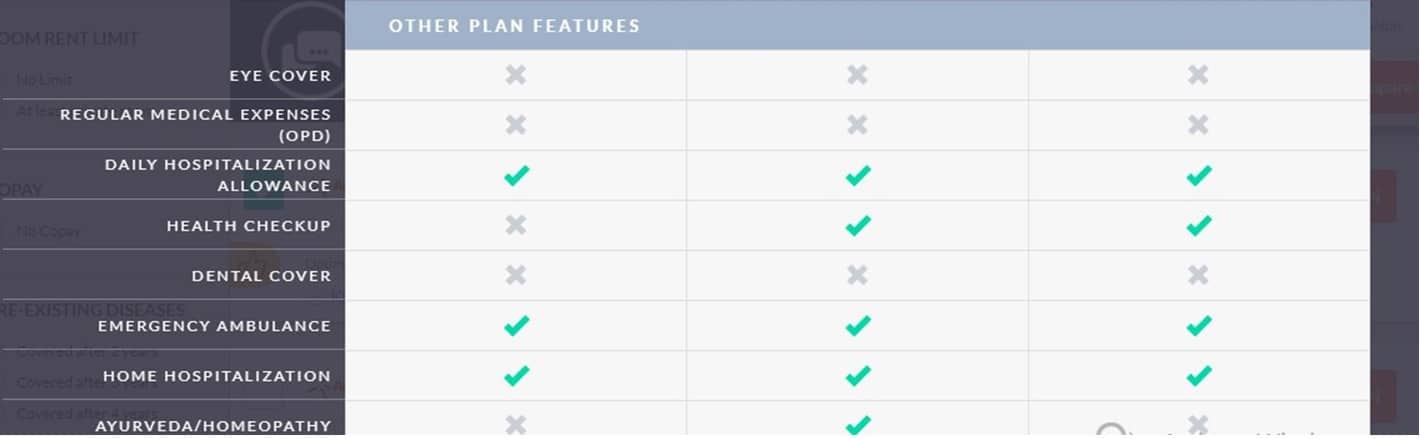

Below are screenshots of comparison of policies. The features that met my criteria are highlighted in green. This is just a sample comparison and you can compare 3 policies in parallel. A similar exercise was done for other policies.

Pattu’s note 1: Max Bupa also scores well in a comparison I did before: Building a health insurance comparison chart + Cigna TTK vs Royal Sundaram Health Policies Download the comparison file from this post and add policies you like to it.

Pattu’s note 2: I noticed that coverfox tells you the no of covered hospitals in your pin code. This could be useful for those in non-metros.

Common Myths – Below are some of the myths that are associated with buying health insurance which are just noises to confuse the customer.

- Having a Third Party to settle the claim. Everybody is in there to make money and the insurer will find a decent reason to reject a claim. So having an intermediary will not have much impact.

- Pre-existing disease coverage – Please note, it says if and only if you have any pre-existing disease, it will be covered after a cooling period of say, X Years. If you are healthy you should not worry. If you have any existing diseases, please declare before buying the policy.

- Not divulging complete information can help in getting a health policy approved – What good is an insurance when it cannot be used at the time of need? Similarly, declaring all existing diseases and lifestyle habits such as smoking while buying an insurance helps in getting a claim approved. The company may reject the claim due to misrepresentation of information.

- Health insurance will cover all the cost of hospitalization – Not all the costs are covered by the insurance. Apart from the limitations of different plans, some costs such as disposable like gloves, nebulizers etc. are not covered, they are to be paid on actual basis.

In summary, online comparison portals just help you in getting a shortlist of insurance policies. You need to read the policy documents to get a better understanding of the policy and finalize your choice.

Thank you very much, Niten.

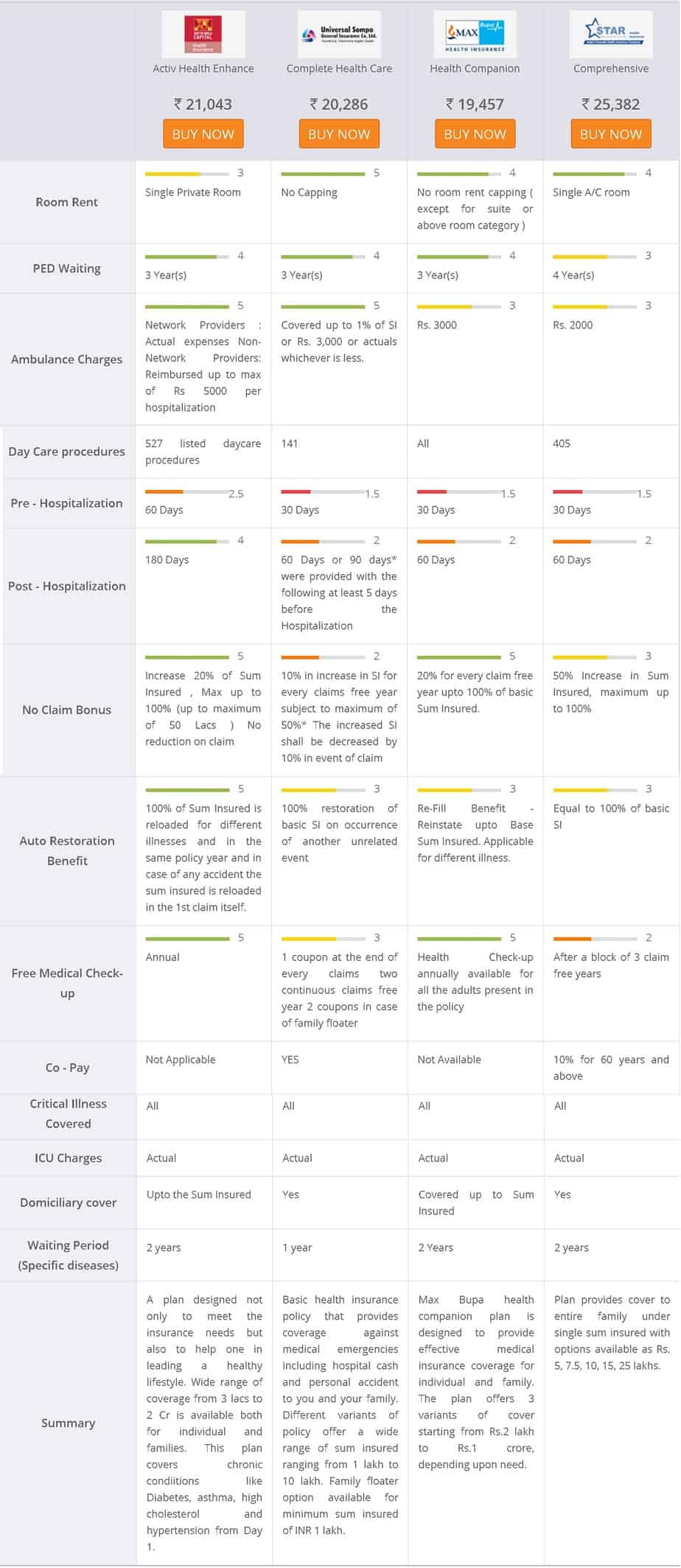

Pattu’s note 3: While reading Niten’s post, I looked at a few more policy comparison. I invite readers to comment on the following comparison from easypolicy.com

You can share below your opinions on the above table and also how you shortlisted your health insurance policy.

This holiday season do check out my books

| You Can Be Rich Too with Goal-Based Investing, my first book is now available at a 35% discount for Rs. 258. It comes with nine online calculators. Get it now. The kindle edition is only Rs. 199 |

| Gamechanger, my second book is now only Rs 199 (Kindle Rs. 99). Get it or gift it to a young earner |

| The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download) |

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)