Last Updated on October 8, 2023 at 1:36 pm

Here is a list of 15 different ways to invest in direct mutual funds and how to choose a direct plan portal. MF Utility (MFU) a transaction aggregation portal where one can invest in 26 AMCs, is the game changer for the evolution of such portals. At six portals in the list below use for transacting.

While as a development, I welcome it, I am not too sure if it is health for the user. There are one too many commission free intermediaries between the investor: the portal and MF Utility. If the aim is to just invest, this is a needless complication.

Also, the association of mutual funds is in talks to sell MFU. If and when this happens, MFU may not remain free and this will affect these direct portals too.

Update: CEO MF Utilities: “There is no plan to sell MF Utility”

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

So I will recommend avoiding any portal that operates via MF Utility. If you like their services, you can always pay for the advice and invest directly yourself.

Are you KYC compliant? In other words, does the AMC know your PAN no and address (with proof)?

If you are KYC compliant

The simplest way to invest in direct plans is

1 “directly” with AMCs. This is free and an account can be opened online. Don’t worry about managing “multiple accounts”. It is not a big deal.

The next simplest way is to use

2 CAMS online – desktop or app. Of course, you cannot invest in AMCs that use Karvy, Franklin Templeton and Sundaram. But you can always use CAMs and get an online account with non-CAMS AMC. This is free as they get compensation from the AMCs.

How about tracking? No biggie. Get the CAMS+KARVY+FTAMIL+SBFS consolidated account statement and upload it to any online tracker.

3 If a single portal is important to you get the free-for-now MF Utility.

Read more:

How To Apply Online For an MF Utility Account

MF Utility Portal User Guide: Updated Second Edition

If you are not KYC compliant

Decide on the fund to invest and go to either the fund office, CAMs or Karvy and submit your KYC documents in person. (Yes, that is one human interacting face to face with another. Won’t kill you).

Else, CAMS has an option to get an online KYC, so do some other AMCs (Eg. Birla, Quantum). Opt for PAN-based E-KYC instead of Aadhar based to avoid investment limits (50K per annum, per fund house).

Invezta also has PAN based e-KYC option.

Now for the other options.

Suggestions

(a) Opt for a portal which does not depend on MF utility. Ask this upfront as it is not always clear from the website.

(b) Pay a flat fee per month or per year. NOT per transaction. This fee will have two components: for investing and for Robo advisory.

(c) Do NOT pay a fee that is a percentage of your assets under management or amount that you invest.

What is Robo-advisory?

An algorithm (coded by the people who run the website) is used, after getting user inputs, to determine asset allocation for a particular financial goal, and/or suggest mutual funds.

This is suitable for a level-headed, mature investor who is looking for a shortlist of funds to invest, automated performance tracking and portfolio rebalancing triggers.

This is not suitable for an investor who wants to call up the advisor to know why the market crashed by 1% today or get opinions from random strangers at Asan Ideas for Wealth.

Personally, I would prefer Robo advisory only for tracking and rebalancing and not for fund selection.

The fund selection part is decent enough in these portals. It is the tracking that needs checking. So if you want to invest via one of these portals, ask for a test drive and find out if this is good enough for you. If the interface is basic that you can get via DIY tools like this, Google Spreadsheet for tracking progress to financial freedom, why bother? The features have to be unique not found in any other tracker.

Test the Robo portal first. Give some weird inputs. Say that your age 105 etc. and check how robust it is. If you are not impressed, stay away.

Btw, I am working on a Robo spreadsheet myself :). It is free, but I got to make sure it is SEBI-compliant though!

All of these portals provide Robo advisory to different levels. Unless I actually make an investment (not interested, happy with my direct AMC accounts), I cannot comment on that aspect.

Portals that depend on MF Utility

4. Unovest

Rs. 850 a year: 3 recommended portfolios to choose from and basic insights

Rs. 2000 a year: 3 accounts in a single login and 5 recommended portfolios with advanced insights

Rs. 3500 a year: 5 accounts in a single login and 10 recommended portfolios with advanced insights

5. Oro Wealth

The fee structure is a pain to decipher. Above one lakh, it is 0.1% of the transaction amount. Have a look:

https://orowealth.com/pricing

6. Piggy App: piggy.co.in This uses BSE Star platform (why?) in addition to MFU. I cannot find the fees!! And I will not consider a service where the fee is not explicit.

7. Bharosa club

Basic plan: SIP via MFU in certain funds (free)

Premium plan: Invest in any fund based on risk profiles + portfolio insights: Rs. 150 a month

Pro plan: Premium + portfolio migration assistance and SIP++ (market linked investments) Rs. 1000 a month (beta?)

8. Wealthtrust app

Basic plan (free): which allows you to search for “smart funds”

Premium plan: Rs. 99 a month, Paperless Account Opening; Complete Portfolio Management; Their suggestions.

Smart advisory: to be launched.

9. Wixifi.com “0.125% per quarter on your average quarterly balance”

Portals independent of MF Utility

10. Invetza.com Rs. 79 a month (948 a Y) for investing and basic tracking and Rs. 109 a month (1308 a Y) for personalised allocation and tracking. Invezta has a PAN based e-KYC option.

11. Kuvera.in At Rs 134 a month (1608 a year) (before taxes), this is a very good price too. Now it is free!!

12. clearfunds.com

“Flat-fee of Rs 199 each time you buy a mutual fund scheme, or set up a SIP” does not sound too appealing to me. If I do not set up a SIP and invest each month …!

13. upraise.in (need to confirm if this is not MFU dependent for sure)

This is a typical charge schedule:

“Transaction Fees: 0.15% of the total investment amount (inclusive of all taxes)

Upraise Advisory Fees: 0.60% of the total investment amount (inclusive of all taxes)” Sorry, that sounds expensive.

14. Update: Moneyfront.in is yet another portal. I need to check if this depends on Mf Utility or not. Fee is Rs. 1200 a year for resident Indians.

15: Update: Expowealth.in. offers two different plans Rs. 89/- per transaction or Rs. 129/- a month. Not sure if this depends on MF Utility.

16: Coin by Zerodha. Direct mutual funds in demat mode. Avoid!! Why? : Never Hold Mutual Fund Units in Demat Form!

Recommendations

If you do not want Robo advisory, choose CAMS/AMCS/MF Utility and track with free online trackers or my excel sheet

If you want Robo advisory and portfolio tracking and management services, then choose a non MFU portal with a flat fee per month or year. It is better if they have only 1/2 plans. Ask for a test drive and clearly understand the features.

If you already have funds, ask them if those can be tracked as well. If they cannot, then check if you can pay for advice and invest elsewhere. Portals that depend on MFU will not have any issues with handling past investments.

Whatever you choose, you can always get an account from the AMC, and find your units there. That is the mother ship.

Are there more? Have you used one of these portals?

Have I left out any direct fund portal? If you have used any of the above, please share your experience.

PUNE DIY Investor Meet Feb 26th, 2017

The second Pune DIY meet will be held on 26th Fb 2017. You can register via this link

You Can Be Rich Too With Goal-Based Investing

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 266. 33% OFF

Kindle at Amazon.in (Rs. 244.30)

Google Play Store (Rs. 244.30)

Now just Rs. 280 with additional 10% discount with code: Republic10 at Infibeam

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

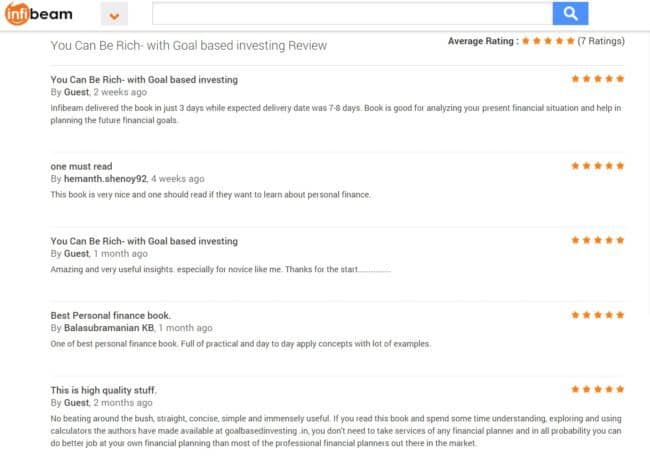

What Readers Say

Also Available At

Bookadda Rs. 371. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)