Last Updated on September 4, 2018 at 10:19 am

In this post, let us compare two large cap funds from the same fund house. One a consistent performer with a terrific track record and the other a young superstar. The results will hopefully show how herd instincts among investors (and perhaps amcs and therefore(?) intermediaries too?) can obscure good funds from the same fund house.

The results shown below are derived with:

- Mutual Fund Risk and Return Analyzer: Fund A vs. Fund B

- Mutual Fund Risk and Return Analyse: Fund vs. Benchmark

Let us now list the salient features of both funds (Sources: VR online, thefundoo, fund SIDs, monthly reports)

ICICI Pru Focused Blue Chip Equity

Category: Large Cap

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Benchmark: CNX Nifty

Inception Date: 23rd May 2008

AUM: 5879.7 Crores (30th June 2014)

Investment Objective: To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd.

If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund Manager reserves the right to increase the number of companies to more than 20.

Indicative asset allocation:

Equity: 70% or more. Rest in debt or money market instruments

Portfolio:

Large cap: 88.5%

Mid-cap: 8.9%

Small-cap: 0.6%

Cash: 2%

Dominant Sectors:

Finance: 33.47%

Energy: 12.99%

IT: 13.79%

FMCG: 14.9%

ICICI Pru Top 100

Category: Large Cap

Benchmark: CNX Nifty

Inception Date: 9th July 1998

AUM: 666.56 Crores (30th June 2014)

Investment Objective: To generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities

(broader the mandate, the less verbose the objective!)

Indicative asset allocation:

Equity: 95% or more. Rest in debt or money market instruments

Portfolio:

Large cap: 79%

Mid-cap: 12.3%

Small-cap: 3.3%

Cash: 5.4%

Dominant Sectors:

Finance: 27.6%

Energy: 25.6%

IT: 15%

Portfolio overlap: Out of the 80% folio listed at VR online, there is an overlap of 52%. Which is significant.

Obtained with: Mutual Fund Portfolio Comparison Tool

Impression: There is reasonable similarity between the two funds (at the moment!). ICICI Top 100 is a bit more diversified than Focused Blue Chip equity.

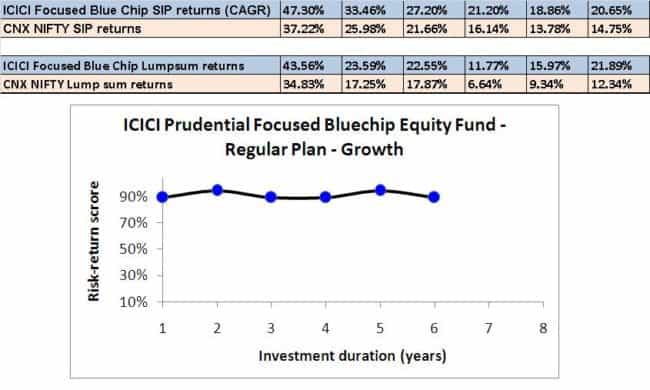

ICICI Pru Focused Blue Chip Equity vs. Nifty

The data and graph speak for themselves. Needless to say that the fund has done excellently well when compared with the Nifty

Ulcer index is a measure of downside protection and investor stress.

Since Focused Blue Chips ulcer index is lower than that of Nifty, investors would have been sitting pretty with this fund.

Created with Mutal Fund Risk and Return Analyzer

Read more: Mutual Fund analysis with the Ulcer index

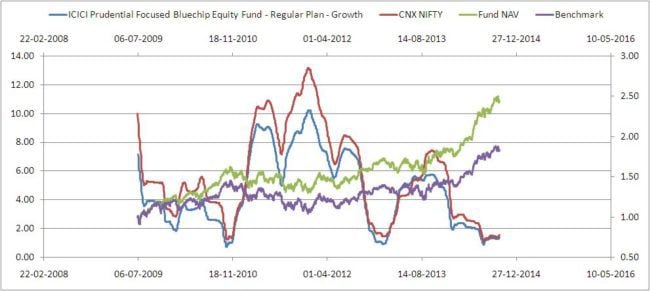

ICICI Pru Top 100 vs. Nifty

Top 100 has a longer history of consistent outperformance.

Again pretty decent when compared with the Nifty. However, not as much as Focused Blue Chip.

Created with Mutal Fund Risk and Return Analyzer

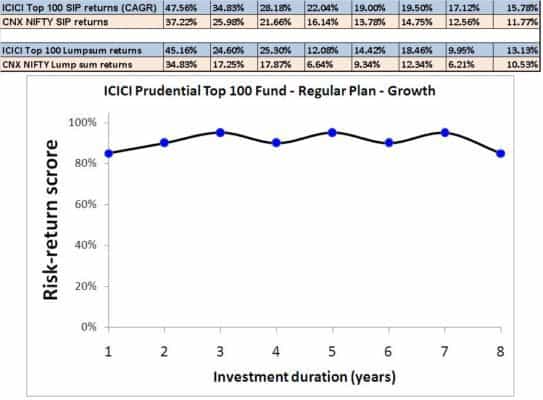

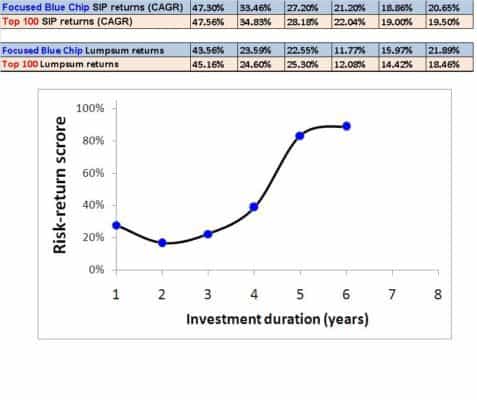

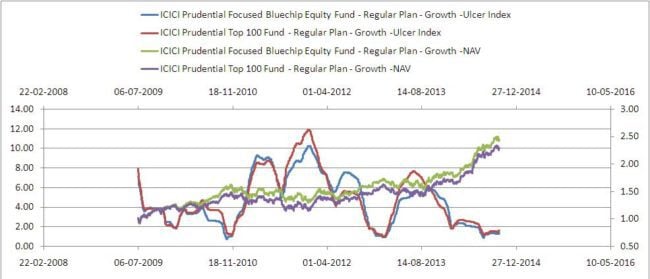

ICICI Pru Focused Blue Chip Equity vs. ICICI Pru Top 100

This Ulcer index comparison confirms that Focused Bluechip has better downside risk than Top 100. However,

A score of more than 50% means focused blue chip has done better than top 100. Created with Fund A vs. Fund B Risk and Return Analyzer

While there is not much difference in terms of returns, Top 100 has had better overall risk-adjusted performance than focussed blue chip for the last four years.

Is this because of its large AUM?

In Aug. 2009, Focused Blue Chip had 20 stocks in its folio (as per its original mandate) with an AUM of ~ 740 Crores and an annual churn ratio of 1.18 times.

In Aug. 2014, it has 50 stocks. It has to, because its AUM is now ~ 5879 Crores. Its churn ratio has dropped to 0.57 times. Read more about the impact of size on churn ratio here: Mutual Fund Size vs. Performance: a case study

My answer would be, yes.

ICICI Top 100 has a current AUM of ~ 666 Crores. Lower than what focused blue chip had 5 years ago?

The reason I wrote up this analysis is to pose the question why is this so?

In terms of performance, that is bare returns, there is not much difference between the two funds. In fact, Top 100 has a longer track record of consistency.

So why has this been pushed to the background? Who is responsible for this?

The AMC? The distributors? The investors? My guess is everyone.

The only difference between the two funds:

Focused blue chip began operations at the start of the 2008 financial crisis. Therefore, I think it appeared as a saviour to many since the established funds (incl. top 100) were struggling to cope with the crash.

While existing mutual fund investors flocked to focused blue chip equity, new investors saw it as a safe bet. One person said, ‘the fund would never fail’.

It is heartening that MorningStar analysts have given a ‘silver’ rating to Top 100 and a ‘neutral’ rating to focused blue chip, while VR online rates them both as 5* funds.

Silver: Fund with advantages that outweigh the disadvantages across the five pillars and with sufficient level of analyst conviction to warrant a positive rating.

Neutral: Fund that isn’t likely to deliver standout returns but also isn’t likely to significantly underperform, according to the analysts.

Now a few definitions for your perusal. Hopefully, they would clarify the first word in the title of the post.

Herd Behaviour

A group of animals fleeing from a predator shows the nature of herd behavior. In 1971, in the oft cited article “Geometry For The Selfish Herd,” evolutionary biologist W. D. Hamilton asserted that each individual group member reduces the danger to itself by moving as close as possible to the center of the fleeing group. Thus the herd appears as a unit in moving together, but its function emerges from the uncoordinated behavior of self-serving individuals. (wikipedia)

Herd Instinct

A mentality characterized by a lack of individual decision-making or thoughtfulness, causing people to think and act in the same way as the majority of those around them. In finance, a herd instinct would relate to instances in which individuals gravitate to the same or similar investments, based almost solely on the fact that many others are investing in those stocks. The fear of regret of missing out on a good investment is often a driving force behind herd instinct. (investopedia)

Information cascade

This occurs when a person observes the actions of others and then—despite possible contradictions in his/her own private information signals—engages in the same acts. A cascade develops, then, when people “abandon their own information in favor of inferences based on earlier people’s actions” (wikipedia).

Moral of the story: Never buy a fund because it is popular or even if a professional recommends it. Focus on your own portfolio. Do your own research. Ignore star ratings.

Note: Do not sell or stop investing in focused blue chip because of this post. Evaluate your needs and make informed choices. You know where to find the necessary tools 😉

~~~~~~~~~~~~~~~~~~~

Many years ago, my wife and I took an evening stroll around a temple tank. The moon was full and beautiful. We stopped to stare at it for a few minutes and took some pictures. Before we stopped to look at the moon, no one around us cared about it in the busy street. When they saw two people looking at something, they became curious and joined in. Soon there was a chain reaction! I am pretty sure behavioral scientists have a word for this phenomenon. Do share, if you know what it is.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)