Last Updated on October 30, 2023 at 2:52 pm

Follow these simple steps to learn how to close your loans and live debt-free. This week in ₹e-assemble, we shall discuss one of the most important money management problems for young earners – handling debt. You will be surprised as to how many people in their 20s and 30s nurse huge credit card debts, personal loan EMI and car loan EMI. In addition, many also have an education loan or later a home loan or dream of owning a home ‘soon’.

This is a basic article meant for young earners. If you do not have a problem with debt, please do consider sharing this with those who do. There is more to personal finance than investing. Living in debt can be a horrible and demeaning experience. So it is essential to be free of at least credit card debt and personal loan debt before one can think of having/clearing a car loan and a home loan. The basic principles of how to close your loans and live debt-free are essentially the same for all kinds of loans, so we shall start with how an education loan/home loan/car loan differs from a personal loan/credit card debt.

Before we do a quick note: ₹e-assemble (Re-assemble) is a series of basic steps on money management aimed at young earners.

₹e-Assemble: a recap of the steps

Many of you may be on vacation this month or in the last week of Dec. Now would be a perfect time to work on these steps.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Step 1: Listing your goals dreams and nightmares

Step 1: Listing your goals dreams and nightmares

Step 2: Lay the Foundations to Get Rich creating an emergency fund

Step 3: How to buy Term Life Insurance

Step 4: How to choose a suitable health insurance policy

* Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit

* Star Health Comprehensive Insurance vs Religare Care Comprehensive Insurance

* Building a health insurance comparison chart + Cigna TTK vs Royal Sundaram Health Policies

* Shall continue discussing other aspects of health insurance

Step 5: How to select a credit card for maximum benefit

Step 6: How to track monthly expenses and manage them efficiently

Step 7: This post: how to close your loans and live debt-free

Step 8: Coming soon: choosing accident insurance

Step 9,10 etc. : Coming soon: Starting investing and portfolio management with examples from readers.

I am delighted with the response to ₹e-assemble. However please keep in mind that it is for DIY money managers. So I can only talk about how to compare health insurances policies and how to choose a policy. Asking me to compare more products or asking me which policy to buy sort of beats the purpose. I do not enjoy answering such questions.

The main difference between a home/car loan vs personal loan & credit card debt

Young earners buy a car either because they want one intrinsically or due to peer pressure and at times due to pressure from parents. The same is true of a home (with pressure from relatives often more important). Whatever be the reason, at some basic checks about the property or vehicle would be done. So I would not call these as hasty purchases even if emotions play a big part.

The same logic applies to an education loan. It is a loan for an essential need. Read more: Paying off Education Loan in India

Many people simply have a spending problem and/or do not understand how credit cards work (read the basics here: How to select a credit card for maximum benefit). So they end paying just the minimum balance and soon stare at a mountain of dues to pay that just keeps getting bigger with time due to the high daily interest. I know a guy who kept withdrawing money using a credit card and then transferred it to another card assuming the (lower) teaser interest rate is the final one – both big no-nos. So it is often a debt incurred from ignorance and recklessness.

If you have credit card debt, STOP USING YOUR CARD!! Every purchase you make after you have dues will also be subject to high daily interest.

Personal loans (from banks, relatives, credit cards) are often due to circumstances and emotions or recklessness. I know many young people with huge money problems because their parents or siblings need it urgently. So if they cannot get one from relatives, they borrow from banks or credit cards. If my brother-in-law had not given me an interest-free, no questions asked loan, I would not have managed my (late) fathers illness Remember that movie dialogue where the mother tells the son, “what use are my mangal sutra and jewels when your father is on his deathbed? Sell them” (or some such variant), my mother actually said that to me and I felt gutted.

A couple of years later I and two other cousins were handling the hospital expenses of my (late) uncle who was a bachelor. As he became comatose we could not access his money. Things came to such a head that I asked my banker cousin if she could apply for a personal loan. The very next day, I took my uncle’s bank branch manager to the hospital to get his thumb impression on a cheque. Within 30 minutes of this, he passed away due to a cardiac arrest. To be frank, I heaved a sigh of relief.

My point is, we should not be dismissive of people who take personal loans. They often have personal issues and at that time cannot sit and worry about processing fees, pre-payment fees, part-payment fees for a personal loan. They just want the money. So the circumstances surrounding these loans are different.

There is also another important technical difference. The interest rates on a home loan are lower than that of a car loan, which is, in turn, lower than that of a personal loan (bank/card). Why is this so? For this, you need to understand one of the most important concepts in finance: What is risk premium and why it is important

In a loan, you want a lump sum money from an institution and in return, offer to pay an equated monthly instalment = part principal (less initially) + part interest (more initially). Why should the institution trust you? Even if you have a high CIBIL score, past performance is not a guarantee of future repayment! If you ask the bank for only a lakh or two, it will take its chances with you. But if you ask it for 10 Lakh or 20 Lakh, it will offer you a choice:

Either pay higher interest rate or lower rate by pledging an asset. The latter is known as a secured loan. The asset will be liquidated (sold) by the bank to make good its losses if you default on payments (fail to pay EMI regularly). This is risk premium at play. When the bank takes a risk by offering an unsecured loan, you pay the premium (higher rate). If you offer an asset as pledge then the rate is lower.

Home loans are always secured loans and hence have a lower rate. Car loans can be secured or unsecured. Even if secured since the car is a depreciating asset, the rate is higher than that of a home loan. Personal loans up to a limit are unsecured and have the highest rates. These are all examples of risk premium at play.

The logic and math behind lending and investing are the same. Check this out: Understanding Loan EMI Calculation as a Monthly SIP Investment!

With this out of the way, let us consider how to close your loans and live debt-free step by step.

How to close your loans and live debt-free – A: Slow down and make a list

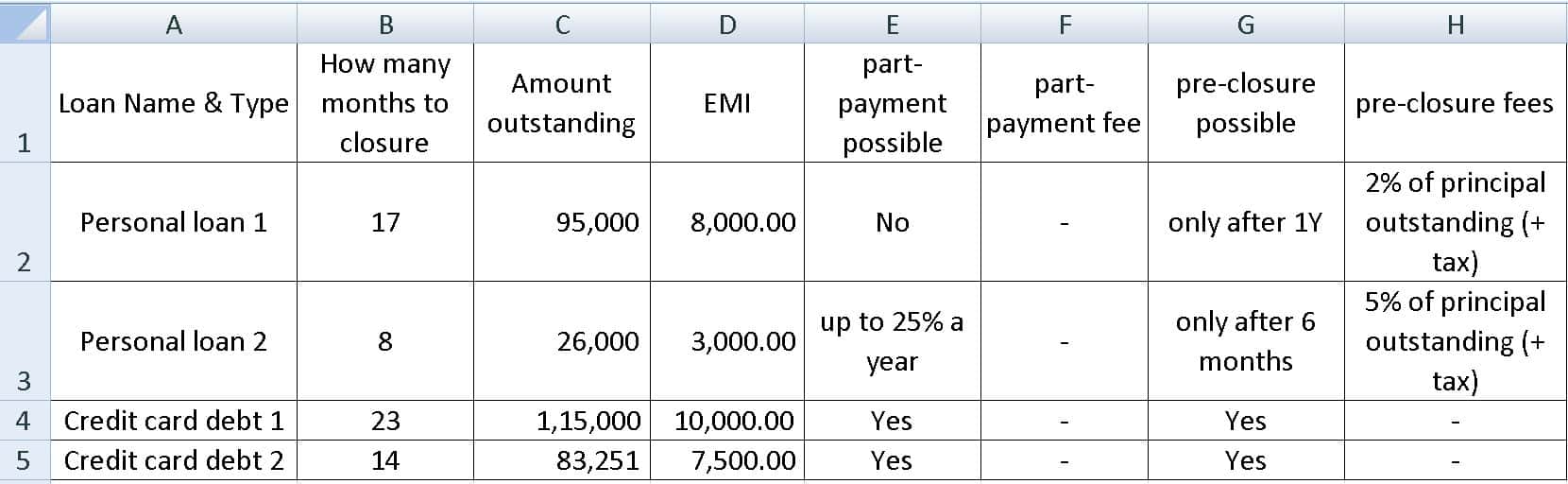

The biggest problem when you live in debt is the feeling that someone else is in control of your life and fear for your future. So the first step is to slow down and make a list. List making is a great way to slowly regain control of your life. It could be a list like this.

Please note above numbers were entered randomly for illustration only.

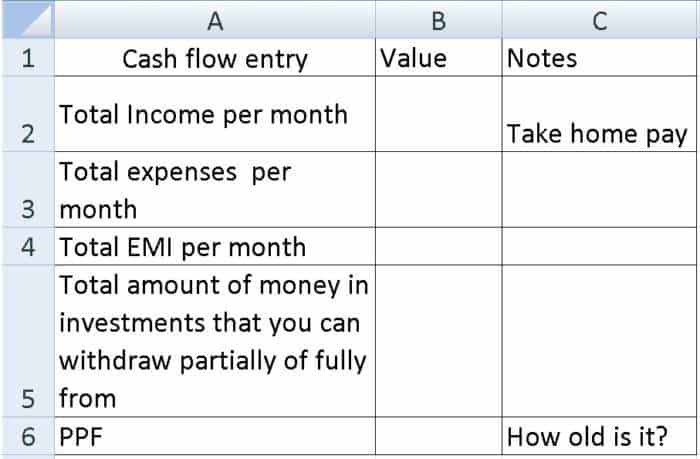

Then make a second list like this

The first list tells you what you owe and the second, what you have/get/spend. This is your roadmap. Your goal is to check off the items in the first list using the resources in the second list. Wait a minute, there is one important resource missing – the most valuable one, time

How to close your loans and live debt-free – B: Manage your time better

How is time management linked to closing loans you ask? On two accounts: (1) if we manage our time better, we can take better decisions and ensure we never find ourselves in overwhelming debt again. (2) Too much debt often means there is a need for a secondary income source. Time management is key to this.

Many people have asked me how I manage time between work, teaching, freefincal and AIFW – by doing one thing at a time 🙂 Yes, the most efficient way to parallel process is to serial process. There is a saying associated with the military that applies to time management and debt clearance:

Slow is smooth, smooth is fast!

This essentially means we can be more productive by planning well and doing things one at a time. Time management is about productivity. It not about when to do what. If you can be productive wrt to your existing duties, you will find the time to make more money. Loan/debt clearance is also about productivity and not about which loan to clear first. This is an important step in having a say in what goes on in your ilfe!

How to close your loans and live debt-free – C: This is not the time for math!

Questions like which loan should I close first – the ones with a higher interest rate, the one with depreciating asset etc. should be asked before you take the loan and not when you are neck deep in debt, struggling to make ends meet and waiting for the next pay date in the middle of the month.

1: First tell yourself, this is the last time that you will be in such a situation. Next time you need money, you will not borrow but use your existing resources. I told myself that when I borrowed and the fear of debt drove me to manage money better and then to freefincal (not passion: I see it as a regimen like the blogger Julie from the movie Julie/Julia)

2: This is not the time for math. This is not the time for calculating costs. Clearing loans is all about regaining your peace of mind, self-esteem and some measure of control in your life. It is about going from 4 loans to pay off (for eg.) to 3 loans to 2 to 1 and zero. It is about slowly checking thing off that list. Slow is smooth and smooth is fast.

method 1: So pay the shortest loan regularly and finish it off, if you spare some money from your existing assets, use to part-pay or pre-close the next longest loan.

method 2: Pre-close the shortest loan if you can scrap out some money and then focus on the next.

Whatever you do, try not to default on EMI payments. This could mean paying only a minimum due on your credit card and letting the debt get bigger. It is, what it is. No point worrying about it. Focus on one loan first, but do not neglect the minimum requirements of the other loans.

If 6 financial years have passed after opening your PPF, you can make partial withdrawals (50% of closing balance 3Y ago can be withdrawn each year). Before that you are eligible for loans (repayable in 36 months), you can opt for a loan (25% of the 1Y closing balance in 3Y and so on each year). However, if you cannot repay the principal within 36 months, there is a penalty of 6% + prevailing PPF rate. You can get the full set of rules from The PPF rule book from nsiindia.gov.in. It is better to withdraw if possible than take a loan.

Loans are also available after 3Ys from LIC policies. However, these are best avoided as the annual interest rate will be 10% or so.

If you are not the sentimental type, sell gold jewels at home. It is not a ideal choice, but at this stage, what is? You can always buy it back when you get your life in order.

Whatever you do, leave at least a few months expenses as an emergency sum

3: Try not transfer your credit card debt to another card or get a personal loan from a bank to close other debts. This can land you in bigger trouble if you do not stop to understand the terms of the transfer. It is not easy to find another lender with a low enough interest rate for the transfer to be meaningful if all costs are accounted for.

4: If you do not have any assets to part-pay or pre-pay, borrow from relatives or friends. If you cannot get it gratis (like I did), suggest that you will pay an interest rate say 1% to 1.5% above FD rates. So this will be a good deal for both parties (can you guess why?). Of course, if you already borrowed and did not pay back, don’t expect them to oblige again! Again risk premium at play!

5: Reduce expenses: I cannot stress the importance of this. Give up on the pleasures of life.

- As mentioned above, stop using your credit cards. Stop using your debit cards as well. Remove swiping from your life.

- Get rid of 3G or 4G from your phones. Use the office internet and stay away from it at home.

- Say no to all forms of eating out, watching movies etc. Every paisa counts towards part-payment of your loans. If your friends do not understand your behaviour, they are not your friends.

When my father was sick I also changed jobs and due to a “technical issue” during the changeover, I went three months without salary. This at a time when were we spending anywhere between 25,000 to 30,000 on his medicines. These are 2006 prices. If we had gone one more month without my pay, we would have had trouble managing basic expenses. This was a time when I used to squeeze out every bit from the toothpaste so that we could delay taking a new tube by a few days. Thanks to a relative, I found a way to obtain expensive injections for RBC growth at wholesale prices (my father had a form of bone marrow cancer). I used to buy as much of his medical equipment at wholesale prices as I could. This saved me anywhere bet 30 to 50K over the 1Y,8 months he was bed-ridden.

My point is:

Human beings are capable of infinite adaptability. The only problem is that they must first convince themselves of the reason to adapt. Sometimes life will offer you a reason (llike it did for me) but sometimes we have to dig deep and motivate ourselves to change. If you do not have the desire to become debt-free no one can help you.

6: FInd a second source of income: I asked FB group Asan ideas of wealth members about how they generate a second source of income. The answers were incredible. This is a compilation: Here Are 1001 Ways to Make More Money!

If you have a skill that can be used to make money, fine. Else you may need to work a second job in the evening – eg. deliver for Swiggy or dinner places, waiting tables etc. No such thing as an inferior job, just inferior money management. Either way, here is where the time management will help.

Debt reduction is the same as fat reduction

Both require consistent effort and discipline. Both will come back if we slip back to old ways. Both require a permanent modification in lifestyle for eradication.

How about education loans or home loans?

As mentioned above, these loans are usually not the result of hasty purchases. These can be pre-closed too, but take last priority as they come with cashflow benefits. I did not say tax benefit because – Can you really save tax with a home loan?!

For education loans consult: Paying off Education Loan in India

For home loans consult: Why this kolaveri to pre-pay home loans?! for an alternative way to pre-pay home loans without stress.

Home loan tools

Home Loan Transfer Calculator (Mortgage Refinance)

Excel Home Loan Amortization Schedule Template This will help you plan for systematic part-payment.

Your Call

Would you like me to write on how to choose home loans, cars loans and personal loans? It is not rocket science but if you wold like to me write about it, I will.

Remember

Slow is smooth and smooth is fast. If you keep at it, you will soon become debt free. Maybe it will waste a year or two of your youth, but the experience will guide you for the rest of your life. Best wishes for a happier 2018. Live long and prosper.

Do check out my books

| You Can Be Rich Too with Goal-Based Investing, my first book is now available at a 35% discount for Rs. 258. It comes with nine online calculators. Get it now. |

| Gamechanger, my second book is now only Rs 149 (25% off). Get it or gift it to a young earner |

| The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download) |

Use this form to ask Questions or reg. the robo template ONLY (For comments/opinions, use the form at the bottom)

And I will respond to them in the next few days. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

Error: Contact form not found.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)