Last Updated on October 8, 2023 at 1:37 pm

Each week I try and answer generic questions from readers. Here is this weeks edition. If you have a question, you can use the form below and I will address it next week (if I can).

Abhi: Hello Mr. Pattabhiraman, Trust you are doing good! In the first chapter of your book “You can be rich too” (Chapter: “Where are you today”) you introduce the concepts of one’s Networth, income statement, cash flow statement & goal sheet. Your workbook for the chapter also asks the reader to prepare them. I found the Networth calculator (this is part of the nine calculator modules that come with the book). However, there seem to be no templates for income statement or cash flow statement. Even the help section of the site doesn’t talk about these two statements. Are they not necessary? If they are required for later stages of financial planning, can you please share the link to such tools that you may have developed? Look forward to hearing from you Abhi

Pattu: Good question! The networth calculation serves only one purpose. It tells you where you stand today. Beyond a point it is not very useful. I strongly believe that once I account for

- my unpredictable future needs via life, health, accident insurance and a healthy emergency fund

- my predictable future needs by investing in a suitable asset allocation and as much as possible, as early as possible, everything else will fall in place.

This is the reason I did not feel any need for those sheets beyond the hand-written worksheet templates. You can read more about this here: How tracking investments instead of expenses changed my life!

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Rakesh: Hi Pattu, Had a query on Real estate. Suppose a person bought an apartment for 60 lakhs in 2009 and sold it for 1.2 cr in 2017. What will be the tax implication? What if he invests all the amount in MF – liquid, debt and equity, does he still need to pay any tax? Appreciate your reply. Thanks, Rakesh

Pattu: In this case, there is no change in the tax implication due to the shift of CII base year from 1980 to 2001. The long-term capital gains computed after indexation will be taxed at a flat rate of 20% + cess.

The gains (up to 50 Lakh) can be set of by investing in Section 54EC designated bonds for 3Y. At current rates, the post-tax return will be more or less equal to an SB account for those in 30% slab.

If the investment is not made in this bond or if a new property is not constructed with the gains, tax as mentioned above has to be paid.

An illustration is here: Long Term Capital Gains Computation with base year 2001

Ps: I am not answering your other question. Please consult a SEBI registered fee-only financial planner from this list

Sandeep: Pattu Sir, Help out with views on employer provided superannuation fund. While listing all assets, how accumulated value is accounted as my asset side? In terms of liquid or semi-liquid asset or shall I exclude it from total asset value calculation?

Pattu: It is part of your fixed income or debt asset allocation. Liquid or semi-liquid does not matter.

Avinash: Sir, Have you done any article on how mutual funds work. Most of your articles are on how to analyze MF performance. Is a there a general guide on how MF works. How people contribute the money.What happens to the money contributed. Do MF managers buy stocks every month with the money that is contributed. How much commission do they take home. Who regulates MF market. Is this same as stock market regulator. What happens to the fund when people withdraw. Who are MF managers. How they get selected. How much control do consumers have on MFs. What happens to the dividends given on the stocks held by the MFs. Who are these CAMS etc.Can Mf redemption linked to the bank account. Is the redemption instantaneous. How one can get started.(Direct MFs you have covered to an extent i guess) A example plan to get started in say a SIP plan.Then how to analyse the performance(This I think these are your current articles). Are these covered in your latest book.

Pattu: There is no fun in writing about stuff that is well covered by other authors (unless I need to sell mutual funds). I try and cover lesser known aspects of mutual funds from time to time. Some of the answers to your questions can be found here:

When do mutual funds declare dividends?

Understanding the Total Expense Ratio of a Mutual Fund

How much control do consumers have on MFs? I don’t know what you mean by control. The only way you can question performance (if that is what you mean) is by exiting the fund! For other problems, you can uses SEBI online complaint system.

Investing in a fund is the very last step. The book covers how to define a goal, choose a suitable asset allocation, pick a fund based on quantitative and qualitative parameters and analyse performance.

I will try and covers the basics of a mutual fund later.

Krishnapratap: Hi Pattu Sir, 1. What is the guarantee that MF that will always give positive returns and that to beat inflation in long term say 10 years or above? 2. What kind of returns one can expect from Liquid Funds, Balanced Funds, Small Cap, Large Cap, Mid Cap and Equity Funds? My question is how much minimum returns one can expect for a period of 10 years or above for all categories of MF?

Pattu: You may have heard the standard mutual fund disclaimer, past performance is not indicative of future performance. This actually means,

past returns are not indicative of future returns, because past risk is the minium guarantee when it comes to future risk.

There is absolutely no guarantee that an instrument linked to market value on day to day basis will produce any guaranteed except risk. The only way around this problem is:

manage risk effectively: Simple Steps to De-risk Your Investment Portfolio

Expect risk and returns, not just returns = keep expectations lower

What Return Can I Expect From Equity Over the Long-term? Part 1

What Return Can I Expect From Equity Over the Long-term? Part 2

Under-promise to over-deliver.

I and Ashal expect only 10% from equity 10+Y from now. This keeps us calmer, with no itch to churn the portfolio. And once you realise that returns do not matter, you become a zen-like investor. (meditative – looking inward and not outward = noise).

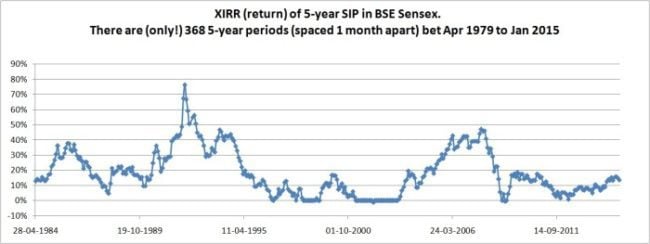

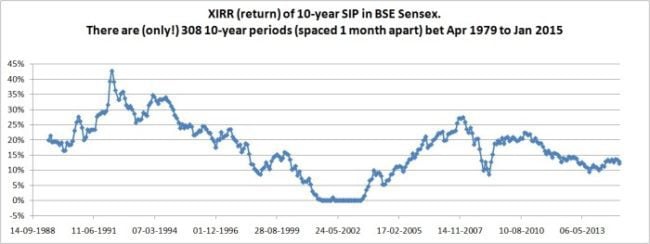

Here are graphs that I will never show if I had to make a living selling mutual funds.

5-year rolling SIP returns

10-year rolling SIP returns

15-year rolling SIP returns

Notice the number of times the return has fallen below 10% (before taxes).

If you want guarantees that your SIP investments will ‘work’ or help you achieve your goals, you are barking up the wrong tree.

These are taken from: Dollar Cost Averaging aka SIP analysis of S&P 500 and BSE Sensex

If you (anyone reading this) marry into a SIP thinking that is all you need to do because India is a “growth story”, the jokes on you.

In response this yapping, I always get asked:

Why should I invest in equity if it comes with no guarantees?!

What would you choose between certain death and a shot at being alive?

Equity investing is like fire. You can’t afford to do without it, but get over confident it will scar you for life.

Mutual Fund Equity investing changed my life. In 8Y I went from a net worth of – 3 lakhs (debt) to financially independent. With disciplined investing and disciplined portfolio management, anyone can do it.

Expect minimum risk first, then minium returns will become clearer.

Here are some conservative estimates over 10Y

Liquid Funds 5-6%

Balanced Funds 10%

Small Cap 10%

Large Cap 10%

Mid Cap 10%

The most dangerous behaviour that I have observed is, many investors cannot invest a lot of money. So they want to make up for that by expecting more and taking more risk in the hope that it would lead to more returns. Hope is not a strategy.

Jay: Can MNC funds (2 of them) be considered as diversified MFs? They do seem to have better diversification than the NIFTY MNC index although there is a theme associated with them. Can they be considered for long term investment?

Pattu: Why two? Are you referring to the Birla and Util funds? Amusingly both have severely underperformed wrt Nifty MNC (price) index. When the stock universe narrows, so should the time over which we judge the fund?

In any case, there should be considerable overlap between the two MNC funds. You certainly can consider one of these for long term investment, as long as they are no the only funds in the equity basket.

Padma: Sir, I have gone through a few online MF Portfolio management tools with auto upload of transaction history via a consolidated transaction statement across all registrars generated through CAMS. Very few offer to auto upload CAMS statement and analyse portfolio data and VRO Portfolio tools provides a lifetime XIRR of all my transactions uploaded as per CAMS statement . What I am interested to know is XIRR between any two dates of choice in respect of the set of transactions made by me , which would be useful to know how my portfolio performed during select phases of markets. I tried doing this by generating & uploading statements as per dates of my choice within which I wish to analyse performance. The process of upload takes only paired transactions of buy & sell made between the selected dates and prompts to delete purchase transactions made before the start date of statement / analysis, as corresponding sell transaction is not appearing within the statement duration. Ideally the algorithm should take NAVs between start & end dates of the uploaded statement and use those returns for XIRR computation, in respect of those purchase / switch-in transactions which were made before the start date. Can I do this analysis with auto upload on your blog. If not can you please suggest what are the online resources both free or paid models where such XIRR analysis can be done. All the better if such resources throw some light on other qualitative parameters of portfolio and provide sectoral orientation of our portfolios at periodic time frames e.g., each quarter/ half year/ yearly within the selected dates for analysis. Thanks a lot and appreciate your valuable service. if you can provide such portfolio management tools with great analytical, presentation & excel export features, whether free or on paid model, it will be highly appreciated by serious MF investors and also highly patronised. Thanks once again Sir.

Pattu: I don’t know a way in which the consolidated statement can be auto-exported to Excel, but I am building a tool in which similar analysis can be done. Watch this space 🙂

Ranjan: Is it advisable to rebalance a portfolio comprising 100% “Balanced” funds which by definition have to maintain an Equity:debt ratio of approx 60:40 by themselves ?

Pattu: Not 60:40, balanced funds must have min 65% equity over a year and they typically hold more. I would recommend treating them as pure equity funds and rebalance with debt from elsewhere.

Dilip: Can you please suggest a tool/excel, which allow us to maintain Personal Portfolio Finance of all LIC/Expenses/Bank/Equity/MF (SIP/lumpsum) ? Also where can I find what portfolio scripts are there within my Total Portfolio of MF?

Pattu: You can do this online at Perfios. I got a tracker for mutual funds and another for PPF. It is easy to integrate these two. I don’t believe in tracking expenses, but you can also integrate any free expense tracker in Excel with these. Alternatively, there is a google sheet for stocks + mutual funds.

Gaurav Mehta: Dear Sir, I have read your views on NPS and understand that you are not much in favour of voluntary NPS. However, I wanted your opinion on my specific situation. I am in 30% tax bracket and have health, term insurance, & emergency fund in place. I can invest the ~15K (saved in taxes from voluntary NPS investment of 50K) in equity funds. Does it make sense to do so? What I like about NPS is its balanced equity fund like nature (by opting for 50-75% equity option) and additional tax break outside 80C/D. Also, as per current rules, only about 20% of the corpus will be taxable at the time of withdrawal, which can also be staggered to reduce tax liability.

Pattu: You are mistaken in your understanding of NPS taxation. You will have to buy an annuity for min 40% and the pension from that will be taxable. That is a big waste of money. Out of the rest 60%, 40% can be withdrawn tax-free and 20% is taxable as per slab. Please do not assume your tax slab in retirement will be lower!

The tax break outside 80C is provided for the benefit of the PFRDA to sell NPS. Rest is up to you.

Shrikant: Hello pattu, pl comment upon- is there any change in the taxation on dividend recd from MF in the hands of individual upto Rs. 10.00 lakhs? Recent change of 10% tax dividend tax is applicable to whom? pl clarify. thanks shrikant

Pattu: It does not apply to MF investors. Only stock investors.

Rakesh Dadhania: Dear Pattu sir, thank you for doing wonderful job. in overall financial planning, I am trying to follow the principle of equity:debt ratio, shall I PF and PPF amount as a part of DEBT component? thank you.

Pattu: Yes you should. Thank you.

Abhyankar: want to calculate the shortfall for all goals based on present corpus accumulated? Based on the past returns is there any method to calculate if the goals can be met or not?

Pattu: This is not easy to do as equity returns can be poor for years together. I would suggest taking stock every year with the goal calculator and revised inputs (course in hand), but more serious questions about whether the goal can be met or not can be considered only after a few years.

Shailesh: The mutual fund statement do not give XIRR/CAGR in the form. The tools developed can give the result and i tried it but it is time-consuming for me to enter different transactions (redeem/STP/SIP) in different folios. Is there any other way to “upload” transactions in your tool? Is there any other method to calculate XIRR?

Pattu: How I wish this is possible! I hope someone reading this can help.

Ask Questions with this form

And I will respond to them next week. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you.

Error: Contact form not found.

Pune Investor Workshop Feb 26th, 2017

The second Pune workshop will be held on Feb 26th, 2017. You can register for this via this link

You Can Be Rich Too With Goal-Based Investing

Gift it to your Friends and Relatives whom you care more. Already follower of Pattu and Subra’s forum. Ordered 4 more copies to give gift to my friends and eagerly waiting to read

The best book ever on Financial Freedom Planning. Go get it now!

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 341 15% OFF

Kindle at Amazon.in (Rs. 244.30)

Google Play Store (Rs. 244.30)

Infibeam Now just Rs. 307 use love10 to get additional 10% OFF.

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

Also Available At

Bookadda Rs. 371. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)