Last Updated on February 12, 2022 at 6:20 pm

This is part one of an investment planning case study in which we consider how to create an investment plan step by step using real data obtained from readers belonging to different age groups. This is step 10 of Re-assemble, a series on the basics of money management aimed at beginners and young earners. So far we have covered 9 steps and all set to move on to investing – with a clear purpose. In step 10 of re-assemble, let us consider an investment planning case study and learn how to create an investment plan. Before that here is a brief summary of all Re-assemble posts.

Re-Assemble: a recap of the steps

Many of you may be on vacation this week. Now would be a perfect time to work on these steps.

Step 1: Listing your goals dreams and nightmares

Step 1: Listing your goals dreams and nightmares

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Step 2: Lay the Foundations to Get Rich creating an emergency fund

Step 3: How to buy Term Life Insurance

Step 4: How to choose a suitable health insurance policy

* Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit

* Star Health Comprehensive Insurance vs Religare Care Comprehensive Insurance

* Building a health insurance comparison chart + Cigna TTK vs Royal Sundaram Health Policies

* How to buy a Super Top-up Health Insurance policy

* How I selected a health insurance policy

* Why we all need a corpus for medical expenses and how to build it

Step 5: How to select a credit card for maximum benefit

Step 6: How to track monthly expenses and manage them efficiently

Step 7: How to close your loans and live debt-free

Step 8: How to buy a personal accident insurance policy

Step 9: Are you ready to let go and let your money grow?

Step 10: This post: Investment planning case study 1 for investors below 30.

Coming soon: other case studies and portfolio management with examples from readers.

Investment planning steps: How to create an investment plan

I was going to make a video out of this, but my voice gave out so, excuse me. First, let us have a look at the kind of questions people ask Google.

Most investors want quick answers and are impatient. If you are one of them, freefincal is not the place for you. There dime a dozen bloggers who dish out nonsense like top 10, bet mutual fund in 2018. Please consult them for some fast food free lunch. Re-assemble is for those who want to systematically manage their money and create an investment plan.

Step 1: Ask the right questions

If you ask wrong questions, do not expect right answers. The first question should be, What are the right questions to ask before investing?

We will start with the simplest two:

1.Why am I investing?

2.When do I need the money?

Step 2: Why am I investing?

- This has no financial or mathematical relevance

- It gives you purpose and purpose is crucial!

- Many say, “I don’t have a goal, I just want to save/invest”.

- Look harder! We all need to plan for financial freedom the moment we start earning!

- All of us have at least that one goal!

Money is there to be spent. We already have the money to spend for today’s needs (hopefully), by saving we aim to provide for near future needs. By investing we aim to provide for distant future needs.

Recognising the difference between saving and investing will only happen if we are not in a hurry to choose products.

Step 3: When do I need the money?

- This is crucial to determine how much “risk” you should take while investing.

- Your ability or appetite to handle risk is not as important!

- If you know when you need the money, you can decide where to invest!

Many investors are not clear about this and want to either maximize returns, minimize risk or both! Unless you are clear about when withdrawals will be made from an investment, you simply cannot taken on risk! This is the reason why step 1 matters. If you know why you are investing, you will know when you need the money.

If these seem obvious to you, come have a look at how people ask for investment advice at Asan Ideas for Wealth (and how people provide it!). Many spend years buying without thinking, suddenly realise their mistakes and want to correct it in a hurry and make those same mistakes again!

DO NOT BE IN A HURRY TO START INVESTING! INVESTIGATE AND PLAN FIRST!!

Step 3: when to invest where?

This is the next question to ask.

- What you need is an investment plan NOT A product!

- Investment plan = a basket of “products” which have different kinds of risks and therefore different returns.

- There is no risk-free investment plan and no risk-free product!

- Risks are not obvious and are visible to only those who look!

Take a fixed deposit. If we assume the bank will not run away with your money and honour the interest promise, what are the risks associated?

- Taxation will eat away gains

- Inflation will eat away gains – more dangerous because this is not visible until it shows up and hurts!

- When you renew or reinvest in an FD, interest rates will be low – reinvestment risk

- look around, you will see senior citizens who purchased wrong products because FD rates dropped after de-monetization – Stupidity risk

Inflation example: If you have Rs. 100 to begin with, and prices increase year on year at 7%, after 5 years, you can only purchase 75% of what you first did. That is 25% loss in your purchasing power. In about a decade, you will lose 50% purchasing power.

Step 4: What is an asset class?

- Products which have the same kind of risk and reward potential are referred to as an asset class group.

- EPF, PPF, FD, and RDs, RBI or corporate bonds held until maturity -> Fixed Income or Debt

- Bonds that are traded (by self or mutual fund) –> Tradable Fixed Income or Debt (higher risks)

- Stocks (Equity) –> Ownership (more risk than fixed income)

- Gold, Silver, Oil –>commodity (supply vs demand will result in huge price changes)

- Rupee, Dollar —> Normal currency (exchange rate fluctuations)

- Bitcoin, Litecoin –> Cryptocurrencies (get rich quick risk)

Step 5: What is Asset Allocation?

Remember that “how much returns will I get?” question? Well, unless you know where to invest and how much to invest, this cannot be answered.

- Investment portfolio = basket of different products

- Investment portfolio = basket of different products= basket of different asset classes

- A portfolio of equity + fixed income (two asset classes) is good enough for all goals. Stay away from Gold (as an investment) and other assets.

- Asset allocation = how much we are going to invest in equity and how much in fixed income

Step 6: when to invest where?

If you need the money within the next few years (<5), use more of Fixed income products with little or no equity.

Why? Risk of losing money is high! Due to stock market ups and downs

If you need the money several years (10+) away, use a balanced amount of fixed income and equity.

Why? Risk of losing money due to inflation and tax is high if you use only fixed income!

This is the reason you save for short-term goals using fixed income and you invest for long-term goals.

Investment Planning Case Studies Part 1: Unmarried and below 30 years of age

Upon my request, a few members of Asan Ideas for Wealth had filled the Freefincal Robo Advisory Software Template. I will use their inputs as examples and in part 1, shall consider two unmarried young earners.

Note to all participants: Please do not expect me to provide you with a financial plan!

Young earners should plan to Quit As Soon As You Start Working! You may not be interested in early retirement, but a simple plan for financial freedom should be in place and it is trivial to do this!

A simple plan to become financially free

Suppose Rs. 1000 = your total EPF contribution (forget EPS)

Assume this Rs. 1000 = 40% of your total investment.

Then total investment = 1000/40% = Rs. 2500

Invest 60% of 2500 = 1500 in an index equity fund.

Invest 40% in EPF (or NPS – only C and G, no E) Read more: A Guide to investing in the National Pension System (NPS)

Invest 60% in ICICI Nifty Next 50 Direct Plan Growth option (if you can stomach huge ups and downs)

Else invest in Quantum Long Term Equity Direct Plan Growth Option

Want to retire early or save up enough to become an entrepreneur?

Use the same asset allocation: 40% EPF and 60% Equity, but invest as much as possible. Download this free E-book: How to retire early in India.

What about tax savings?

This is trivial as long as you do not buy products in a hurry.

The EPF/NPS will cover some part of 80C. Invest more via VPF to max 80C and try to maintain 40%: Fixed Income and 60% Equity by adding more in Equity.

Read more: Making the best use of section 80C for tax saving: an example

short-term goal planning

This we will look at the goals of two young earners, Sanjay and Prempal.

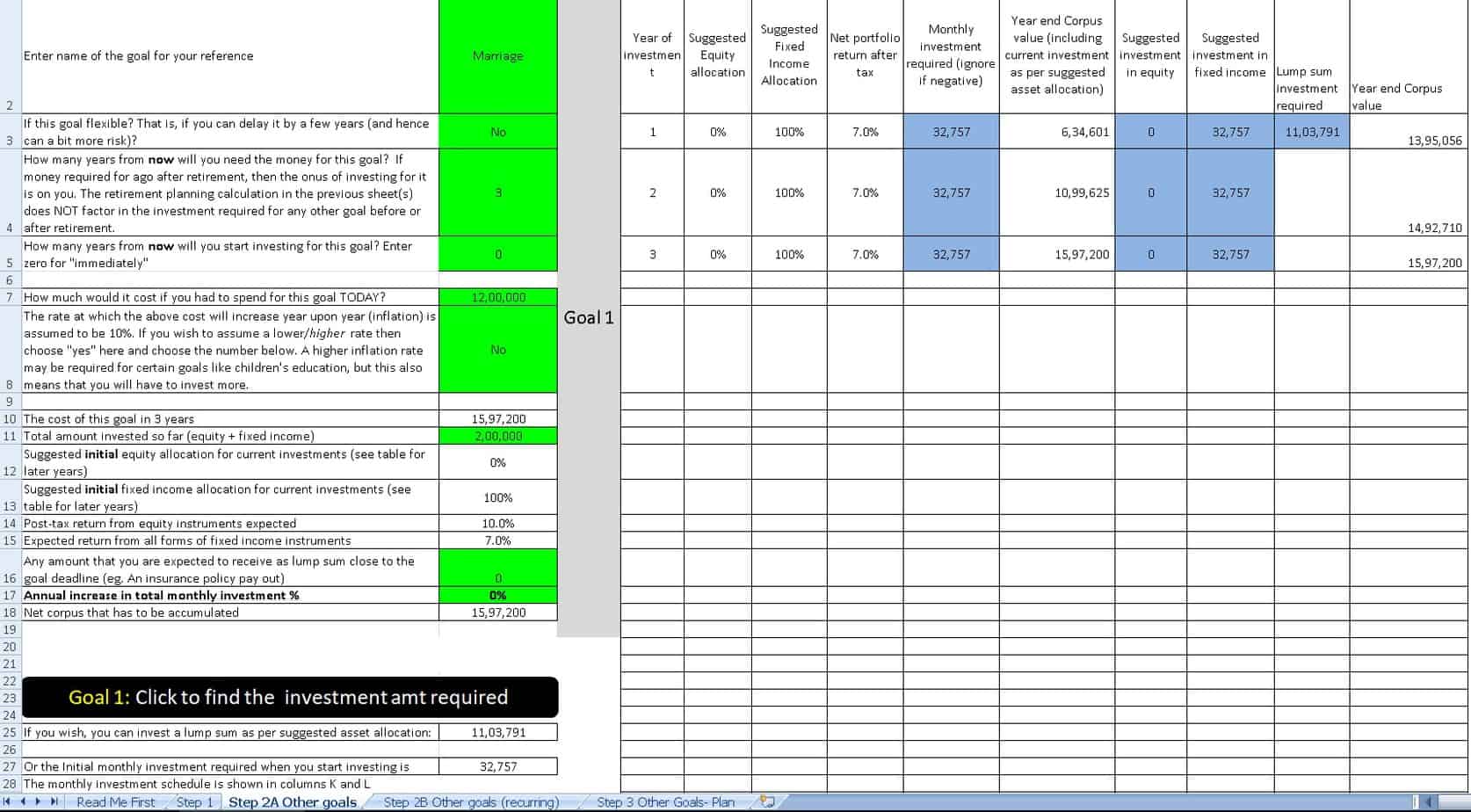

Sanjay’s marriage

Sanjay wants to plan for his marriage in 3 years. He estimates it would NOW cost him about 12 lakhs. So in three years time, with about 10% increase in expenses year after year, he will have to be ready with about 16 lakhs.

Since this goal is near-term, I would recommend that he use a simple recurring deposit. He already has 2 lakhs saved up. So assuming about 7% return, he will have to put in about 32-33K a month.

Naturally, there are guaranteed high-risk, with potential high-reward options, but that depends on his comfort level.

For example, Sanjay can aim for higher risk, returns and lower taxation with a corporate bond debt mutual fund, an equity savings funds or even a balanced fund, but I will discourage such gymnastics unless he has money backup!

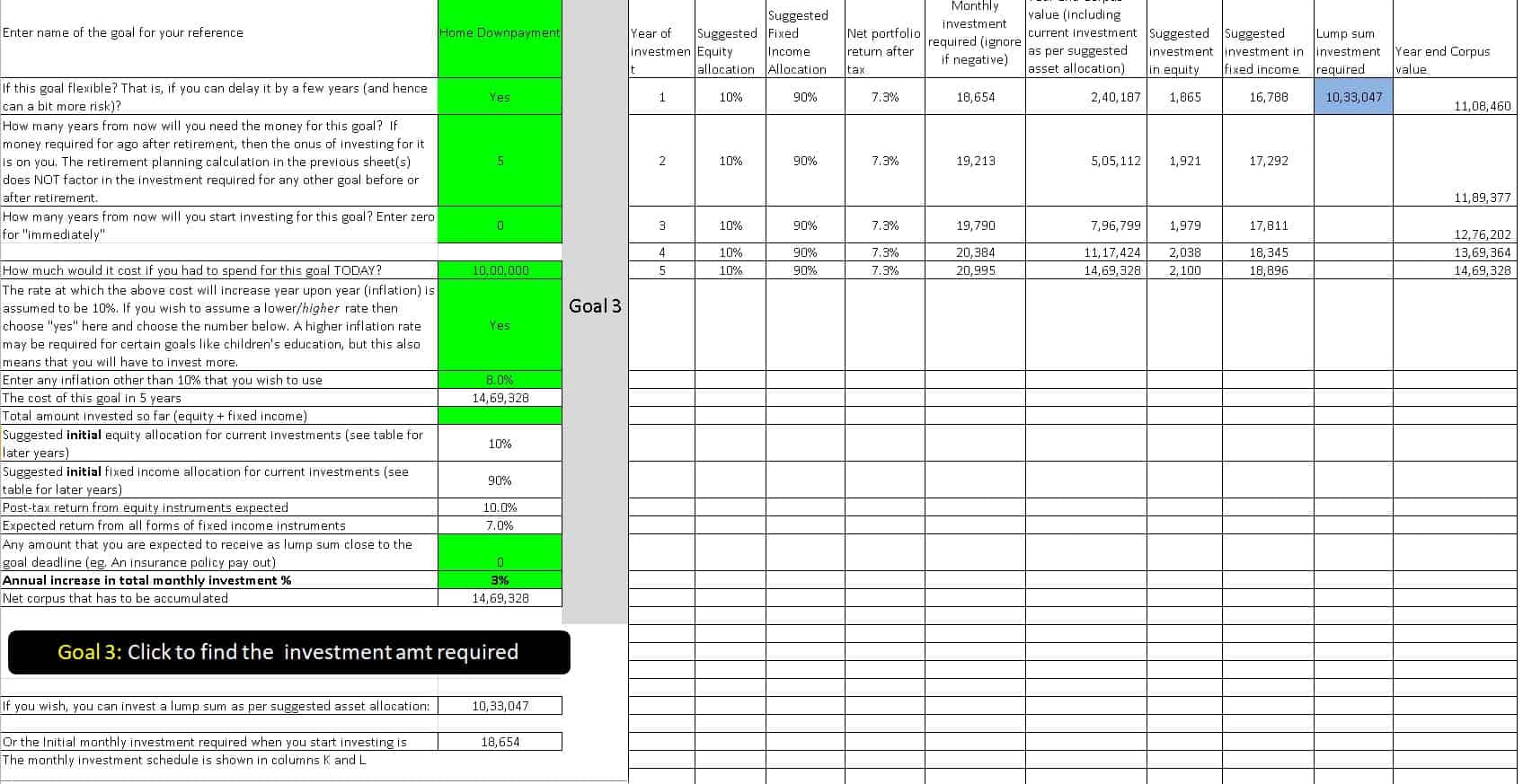

Sanjay’s house downpayment

Sanjay wants to build a downpayment corpus for a house he wants to buy in 5 years. This is a bit flexible so he can take on a little risk.

For those unfamiliar with equity, I would recommend only about 10-20% exposure. Rest can be in a simple RD or liquid fund.

There are so many ways to build the investment plan. The only takeaway from this post is that asset allocation matters. For short-term goals, if you take on too much equity, then you will have to worry about decreasing it before you need money, so it not worth it. Please also keep in mind that I am addressing young earners and first-time investors.

recurring goal planning

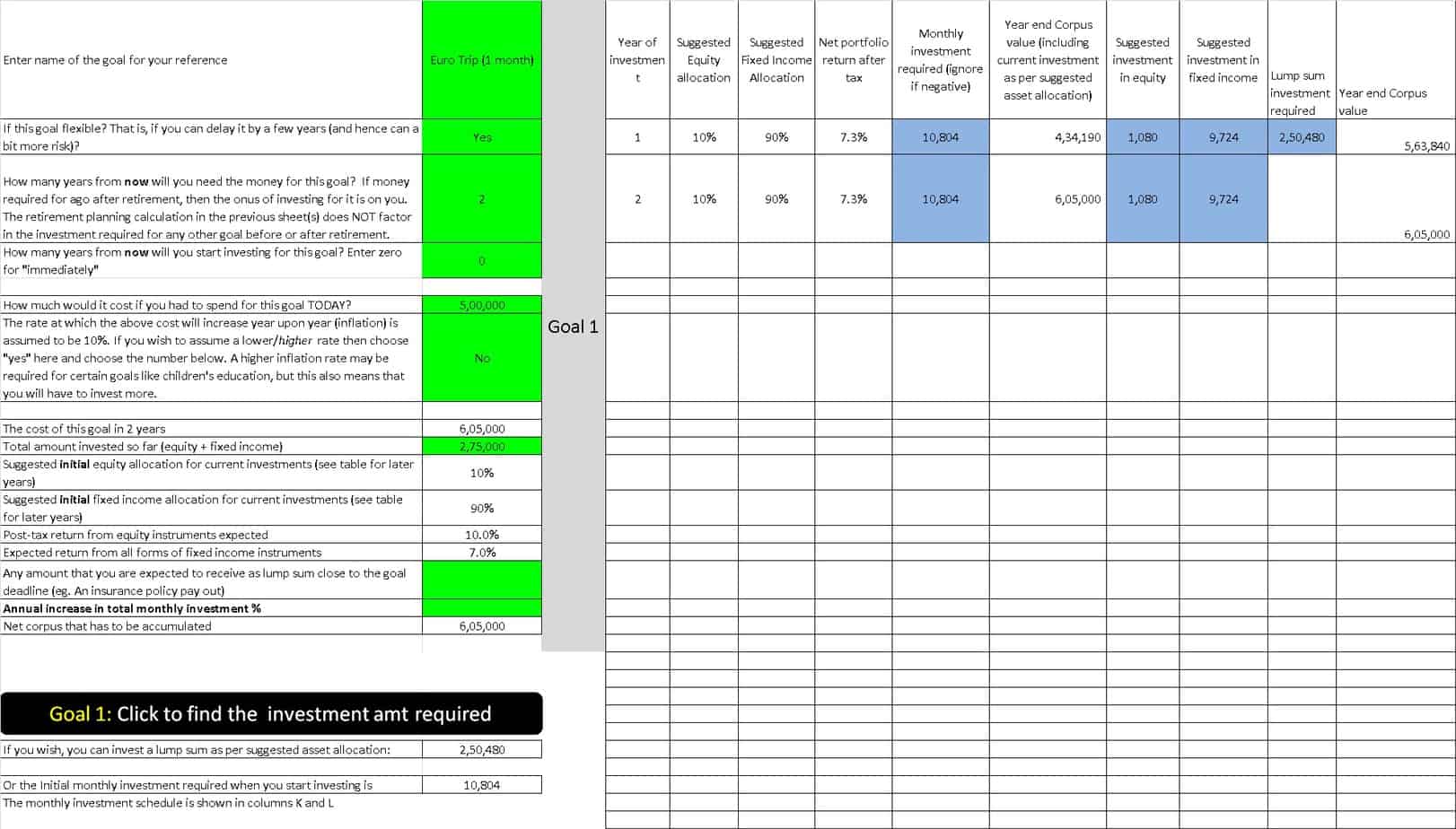

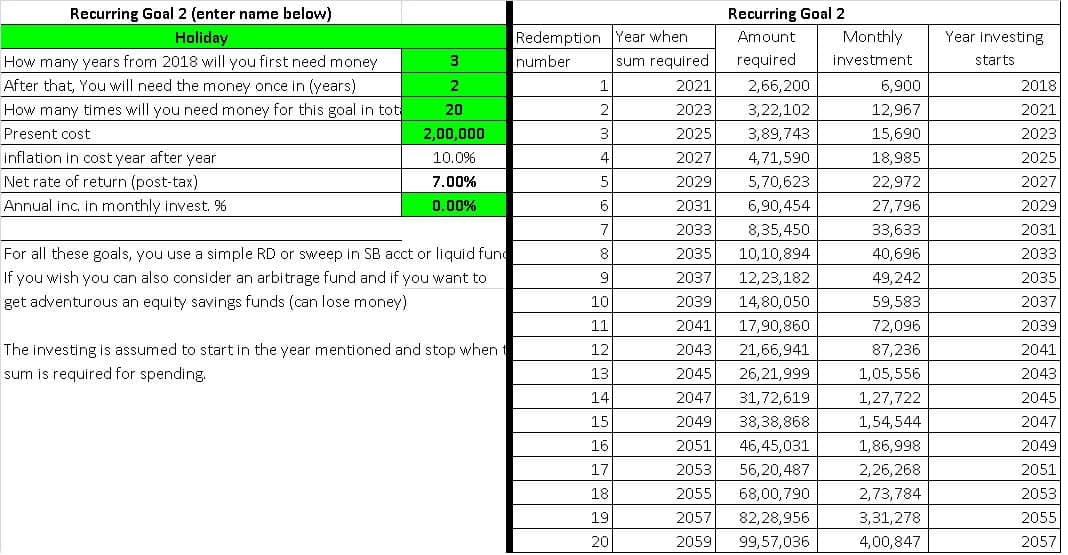

Premal’s European holiday for a month

You can click on each picture to read the inputs and suggestions made.

You maybe wondering why only 10% or 0% equity. The robo template only provides conservative suggestions. Maybe I should write an AI algorithm to offer more dynamics suggestions! Short-term investing in equity is like a lottery ticket. You cannot spend all your money buying tickets!

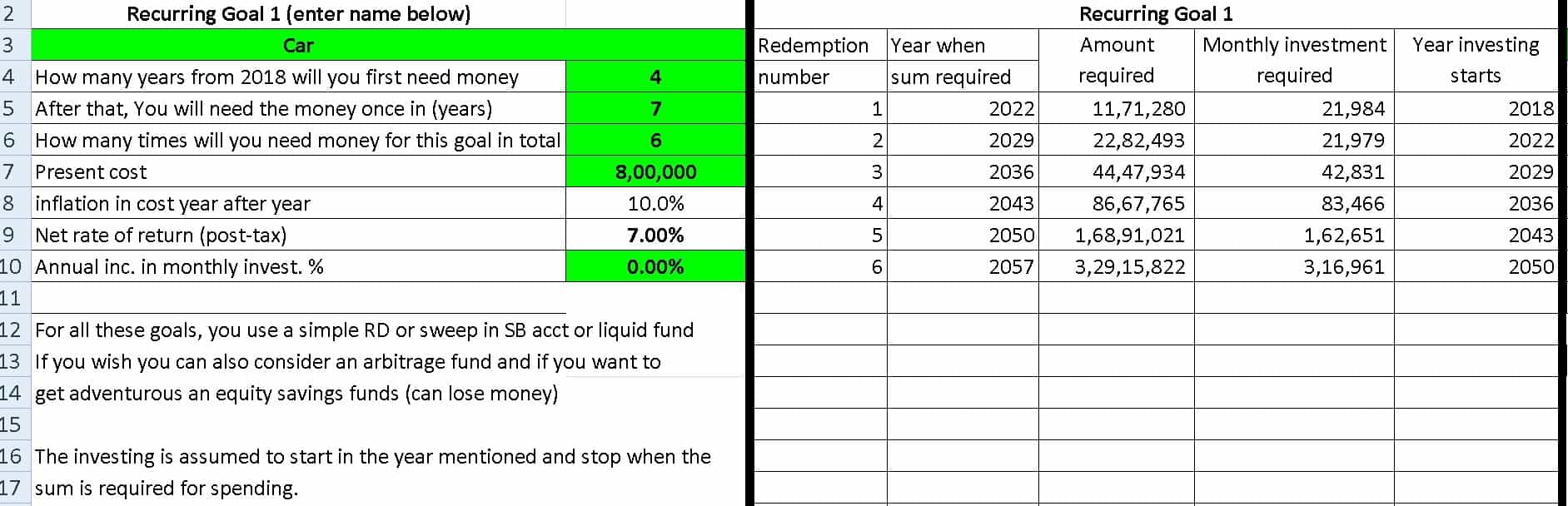

Sanjay wants to buy a car every 7 years

Sanjay wants to buy his first car in 4 years time. After that, he wants to buy a new car every 7 years and expects to buy 6 cars that way. With a current cost at 8L, inflation at 10% and return assumption of 7%, this is how much he will have to invest for each purchase.

Here the asset allocation is a bit difficult to decide. The above table assumes investing for the second car will sfart after the first car is purchased and so on. So each goal is near-term. But since it is flexible, Sanjay can take a chance with an equity-oriented balanced fund. Of course if the markets crash, he will have to say goodbye to the car for a few years. But this is the age for Sanjay to take a chance with flexible and dare I say, optional goals like these.

Sanjay wants to take a holiday every few years

Investment planning: Key takeaways

- Define your need

- Be clear about when you want the money

- Is your need flexible or rigid? If it is flexible, that is you can wait a bit, take a chance with some equity. If it is rigid, minimize or avoid equity

- There are multiple ways to create an investment plan. As long as the plan takes into account taxation, risk and liquidity, before investing, you will be fine.

- The tough part is not choosing investing products, but investing enough! It is childish to assume higher returns and invest less.

- Do not waste time worrying about products for short-term goals.

Thank you, Sanjay and Prempal for your contributions. Next week, we shall consider 30-year olds who have kids.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)