In this edition of the reader story, we meet Anand Vaidya who had earlier explained how he used RBI Retail Direct to buy govt. bonds and create an income source. In this detailed article, he shares his financial journey from growing up in a low-income household to financial independence.

About the author: Anand studied E&C Engg, worked at Wipro and then left for a job in Singapore. He started his own IT consultancy in Singapore. After 15 years, he returned to India in 2011 and continued the same IT services co. He forced himself to retire in 2022 (hopefully, the corpus accumulated is good enough 🙂 ) and is now planning to focus on other interests in life (Travelling, Gardening, reading books, investing etc)

About this series: I am grateful to readers for sharing intimate details about their financial lives for the benefit of readers. Some of the previous editions are linked at the bottom of this article. You can also access the full reader story archive.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning to preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Please note: We welcome such articles from young earners who have just started their investing journey. See, for example, this piece by a 29-year old: How I track financial goals without worrying about returns.

We have also started a new “mutual fund success stories” series. This is the first edition: How mutual funds helped me reach financial independence. Now over to Anand.

I grew up in a low-income middle-class family. Unable to afford further education, I accepted a job in Wipro during Campus placement after finishing my Engg Degree. I started my journey with Rs 30 balance in my student bank account in 1989. This is where I am.

After working for a few years, I found a job in Singapore (American MNC). While working overseas corporate, the siren song of dot-coms (1999-2000) lured me and I joined a dot-com and had a great work experience (Linux was my passion and the job was full-time Linux admin).

Unfortunately, the company had to close down during the dot-com crash. And with that, the hope of $500K stock offer gains went down the drain 🙁

Flying Solo: I was jobless for a month in a foreign country with a wife and kid and no support or assets back home. Still, I jumped at the opportunity to take over a failing local company by buying out the shares of another founder who was leaving.

I and my partner turned around the company’s business model and were able to turn it profitable. Going from hardware sales to software services for a specific segment, the Science and HPC community in Singapore, helped us immensely. After a few years, I left the partnership and registered my own private limited company, which I wound up in Dec 2021.

Back In India: We lived about 15 years abroad, and decided to move back to India to support our elderly parents.

That’s when I started investigating income, expenses, taxation etc in India. I was not aware of the FIRE concept those days, but after preparing a detailed worksheet on assets, income and expenses, I realized that I was already FI (financially independent) but did not wish to stop working at age 44.

FI was achieved mainly due to Singapore’s high PF contribution rates (40%) and subsequent SGD-INR appreciation, and the generous profits we earned from Real Estate appreciation. We bought our flat during the lows of 2000 when RE was still down and sold in a hot RE market during 2011. Combined XIRR of about 14% (INR). No stocks or MF investments. Also, see: How I achieved financial independence without mutual funds or stocks

I continued my IT consulting and services for another 10+ years, after relocating to India, mainly because I liked my work and working with the clients I had and the additional income was good too!

Finally, decided to RE (retire early) from 2022. I am sure my hobbies and interests will keep me active and engaged. The lack of daily dose of IT problems, and calls at random times is a huge relief. I am now able to focus on doing what I like.

I like to think of two types of investments.

Investments-1: A Good Life, Living Well, Investment in Self

Enjoying current life. Especially when we are young, and life is uncertain, it is essential to live well and provide our family with great experiences – both daily living as well as holidays. This I consider as an investment in self that enhances Investments-2 (see later)

We can spend 50% of our income and save 50%. We should aspire and put all our efforts to maximise income growth rather than curtailing our expenses. A high enough income will make budgeting, worrying about expenses, and a lot more problems vanish.

While working in Singapore, the PF (called CPF), our apartment and Emergency Fund, and little savings in NRE-FD were all the “investments” I had.

The Harshad Mehta scam, (South East) Asian Financial Crisis which I lived through, then GFC 2008 etc convinced me to stay away from stock markets – and probably that was not a bad decision in those days! I had no idea and no inclination to buy stocks, though I did buy and exit UTI MEP-93

I always thought it was better to spend 50% income and live well and travel around the world (7 countries so far). Those “investments” in “experiences” are what we reminisce about and value most.

I will not swap another 1-crore or 2-crore in cash for the wonderful experiences of living a good life, travelling and being able to assist relatives in times of need.

Investments-2: Financial investments for wealth, future income

2011-2014: Mistakes and Early lessons.

After returning to India, I was keen to learn stock investing/trading but due to a hectic work schedule, I opted for MF investments. Most of the early (2011-2014) equity investments were done thoughtlessly – as recommended by an investment portal company, and whatever my bank asked me to invest and in buying plots of land in and around Bangalore.

I watched ETNow, BTV and CNBC religiously and panicked at every turn. Finally, I sold all my MF investments in early 2014, exiting with good profits on a small corpus, but the biggest gains were yet to come, which I missed out on! Some losses in ULIPs, MIPs etc complete the picture of an uninspiring investment journey!

I tried my hand at stock trading. Most of the trades were on the losing side. Fortunately, I realised that the stress and time wasted was not worth it and exited all stocks and quit trading with a no-loss, no-profit result and gave up stock trading for good.

Fed up with the stressful share trading and crazy biz channel “advice/tips”, I decided I needed something more meaningful and stable that would also take up less of my time. So I abandoned those TV channels and started reading online about Investing.

Some of my best early resources were JagoInvestor and freefincal. I really liked the data-backed analysis of Prof Pattabiraman. I started reading freefincal regularly. From Pattu’s frequent reference to AIFW (Facebook group Asan Ideas for Wealth), I joined AIFW too.

I wanted general rules of investing and not spoon-feeding so that I could adapt the general advice to my situation. That’s why I started reading financial blogs like freefincal, subramoney and some of the gems listed later in this article, rather than listening to advisors.

2015: Until 2014, all my investments were haphazard, slanted towards fixed income, random MF schemes and stocks. My systematic investing journey started only in 2015. The first thing I did is to draft a two-page “Investment Goals and Methods” document. Something like Why you need an investment policy statement.

I gradually started investing all fresh income into Equity MF and some portion in Debt Mutual Funds. I quickly built up my low maintenance portfolio. Redemptions happened only for a reason (moving from Regular to Direct, Single to Joint Folios etc) and never to lock in profit or to exit scare of losses in equities.

Some golden moments for buying did come up every year (2015, 2016, 2019, 2020, 2021 and so on) and I used these opportunities well. Buying deep dips (think 2020) gives an emotional satisfaction, especially when there is a V-shaped rally soon after!

My Current Status

We don’t smoke or drink and don’t like to party but do eat out frequently. So, our expenses are moderate and spent on worthy expenses (my definition). I don’t mind paying top dollars for high-quality products and experiences.

My long term goal is to give away half of my wealth to charitable organizations and the other half to my son. When? Which Assets? Something I need to work on.

The X Numbers:

X=Annual Expenses (with India travel only, no foreign trips)

6X = Emergency Fund

84X = Financial investments/Assets for income and wealth (excluding Emergency fund)

130X = Assuming some excess assets (RE, gold) are sold and added to financial assets.

So, I guess a portfolio level rate of return of around 1% should enable us to lead the lifestyle we aspire to for a long time to come. And no sideways markets, I hope. The long term portfolio level XIRR is about 10% pre-tax currently. I track Networth annually.

Term Insurance: None. With our age and assets, we don’t need Term insurance

Health Insurance: Based through son’s employer. Planning to get a super top-up for 50L soon.

Endowment, LIC: Yes, thanks to a relative Auntie, who did an emotional drama to sell a policy.

Asset Allocation: I’m at about 30:70 Equity: Debt now and planning to go 40:60, if possible in FY22-23, thus utilizing the current market drawdown.

The funds I am invested in: (self and spouse) (All direct, growth)

| ELSS | Axis LTE, Kotak Tax Saver |

| BAF (low vol) | Kotak BAF, DSP Dynamic Asset Allocation |

| Large caps/Flexicaps | Axis Nifty 100, Kotak Flexicap, DSP Flexicap |

| Midcap (to exit) | Axis Midcap, DSP Midcap |

| Non-Indian | Nippon US Equity |

10 funds may look like too much, but diversification across fund companies will imply at least 8-10 funds (2 schemes per co, 4 AMCs). Watching Axis scam progress and may exit Axis MF funds.

Equity MFs with large cap tilt, 40% midcaps and no small caps (exited in 2021).

I take exposure to small caps and sectoral (mainly tech and pharma) time the entry and exit. Just for fun.

The fixed income is distributed across Bank FD, AAA-rated NCD, Tax-Free Bonds, RBI FRB and my newfound curiosity: Central Gov bonds from RBI Retail Direct. Let’s see how it goes.

Debt funds: Mostly Ultra Short funds. One each of Corporate Bond (Kotak), Floating Rate (Nippon) and Gilt (DSP) funds complete the Debt portion

Rebalancing: I don’t rebalance on schedule as most experts recommend, but I rebalance when I get uncomfortable with gains or losses. I spend 10 seconds updating NAVs daily, so I know when I need to do something. It is not based on any hard formula (eg: 5%, annual) but just a gut feeling. 3-5% should be a good number to initiate rebalancing. Need to fix that.

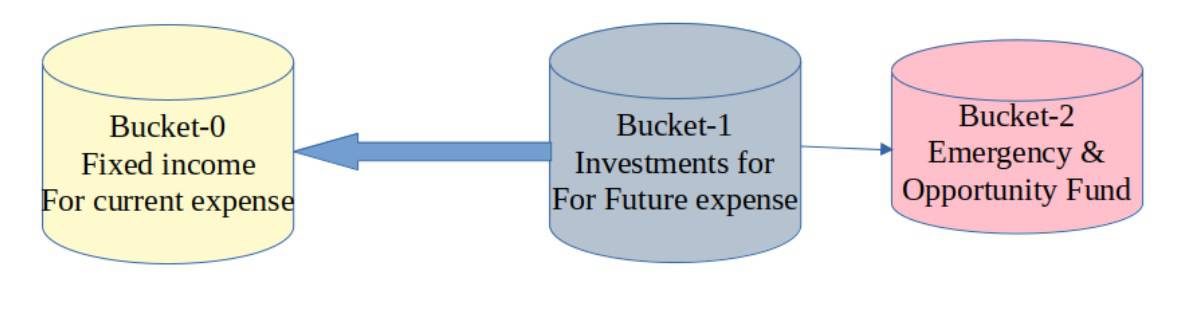

The Buckets: I found Pattu’s 5-bucket system cumbersome (even on paper) but maybe he has valid reasons to advocate that. However, I follow a very simple three-bucket system for now. I am open to adding more buckets if need be (after a few years)

Bucket-0: Current Income Generation (2022-2030): I and my wife will receive approximately 2X-3X fixed income (X=annual expenses). Mainly from Bank FD, AAA/AA NCD, Tax-Free bonds, RBI Floating Rate Bonds, Gov of India Bonds etc. Income tax will be paid without grumbling in this bucket because the stability of monthly income is more important.

I will move money from Bucket-1 to Bucket-0, choosing the source and destination depending on the market condition.

Bucket-1: Future Income / Wealth (2030-):

Debt: Contains a mix of long term Debt such as Gilt, Floating rate fund, Corporate Bond fund MFs and PPF.

Equity, Lower volatility: BAF (currently invested), probably add MAF or some Hybrid scheme (in future)

Equity Funds: Mainly Flexicap, Large & Midcap funds. Probably some Equity oriented Hybrid (in future). Growth-oriented, not value.

Tactical: Smallcaps and sectoral funds – I can handle Tech, and Pharma sectors but need to learn other sectors such as Banking/Financial, Commodity etc

There are switches between pure equity to BAF or Equity to long term debt within each bucket, tactically.

Bucket-2 Liquid, Emergency and Opportunity Fund: This bucket comprises a substantial sum held in liquid funds and FD with an overdraft facility. To be used during Medical or financial Emergencies.

Money can be drawn out temporarily if there is an attractive investment opportunity. But the withdrawn amount must be replenished within 30 days

The corpus is allowed to grow. Also topped up annually (during bull runs, windfalls) from Bucket-1

Direct Equity: I am not keen on direct equity mainly due to the research and taxation issues (splits, bonus, dividends, buy-sell etc). Probably will try out Pattu’s simple method sometime this or next year (2022)

Gambling: All gambling is completely avoided. Such products include crypto, IPOs, day trading, P2P lending, MLM and all unbelievably high return products. (IPO Rare Exception: LIC IPO)

Gold: Metallic Gold is an expense. And a poor investment. But maybe a good tactical bet if only we can time it. I stay away from Gold.

My Lessons

- Focus on your career, Earn well. Keep Learning

- Live Well. ( Nice house, quality daily essentials, memorable travel, taking care of family members, good education, morals for kids, adequate rest and entertainment etc)

- Have a continuous focus on Health: Eat healthy, exercise, sleep well, test (diagnostics) regularly, and manage stress.

- Save at least 50% income. 70%+ is doable if income is high enough.

- Have an Investment Plan, and write your Will

- Contribute to charities and needy people. Care for the environment.

- Log all expenses, categorise and have a 3-y, 5-y rolling expense number (spreadsheets make it trivial). If you don’t measure, you can’t find waste and eliminate it.

- Live an off-peak lifestyle. Everything becomes pleasant.

- You need not be a financial wizard, or trade stocks/options. Don’t watch financial TV or follow influencers.

- Read wise advice, that forces you to think, rather than provide capsules to swallow.

Gems, You must read regularly (finance related)

- freefincal: especially the PDFs

- SubraMoney: http://subramoney.com

- Stable Investor http://stableinvestor.com

- Sayan Sircar: https://arthgyaan.com/

- Prime Investor https://www.primeinvestor.in/

- BeMoneyAware https://www.bemoneyaware.com/blog/

USA:

- Josh Brown https://thereformedbroker.com

- Nick Maggiuli https://ofdollarsanddata.com/

- Morgan Housel http://www.collaborativefund.com/blog/

- Joe Udo RB40 https://retireby40.org

- Mr Money Moustache http://www.mrmoneymustache.com

- Howard Marks’ memos https://www.oaktreecapital.com/insights/howard-marks-memos

Ashal Jauhari’s Asan Ideas For Wealth FB group is very much worth joining, despite the dislike for Zuckerberg and his evil empire.

I haven’t read many financial books apart from Asset Allocation for Dummies, Psychology of Money, Commonsense Investing by Jack Bogle (CD) and some eminently forgettable ones. I intend to read at least 3-to 4 finance-related books this FY.

Reader stories published earlier

As regular readers may know, we publish a personal financial audit each December – this is the 2020 edition: How my retirement portfolio performed in 2020. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower-income

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year thanks to patient investing!

- Twelveth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble but now aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth 6 years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)