Last Updated on February 20, 2026 at 11:00 am

In this edition of the reader story, we meet Sriram discussing his journey from working as an electronic engineer to running a non-profit library after early retirement.

About this series: I am grateful to readers for sharing intimate details about their financial lives for the benefit of readers. Some of the previous editions are linked at the bottom of this article. You can also access the full reader story archive.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning to preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We have also started a new “mutual fund success stories” series. This is the first edition: How mutual funds helped me reach financial independence.

Throughout my educational journey, I pursued a path in electronics engineering, diligently working towards earning both my bachelor’s (in India) and master’s (in the USA) degrees. Upon completing my education, I ventured into the professional world and gained invaluable experience as a hardware engineer at reputable companies such as Sun Microsystems, Oracle, and AMD. I dedicated over 15 years of my career to these prominent organizations, striving to excel in my field.

During the early stages of my engineering career, I was filled with passion and enthusiasm for my work. However, this fervour was soon tempered by the harsh reality of the corporate world. Witnessing multiple layoffs at Sun Microsystems and Oracle opened my eyes to the fact that employees were often seen as mere numbers in the eyes of big corporations. This realization prompted me to reassess my priorities and explore my passions outside of the workplace.

In my quest for fulfilment beyond my professional endeavours, I discovered a newfound love for long-distance running and hiking. These activities provided me with a much-needed sense of solitude and introspection. During my long runs, I delved deep into self-reflection, engaging in a meditative process that allowed me to gain a deeper understanding of myself. It was during these moments of personal introspection that I felt a strong desire to connect with others outside

the confines of my work environment.

Motivated by this newfound perspective, I began seeking ways to make a positive impact outside of my professional life. I became involved in various charitable organizations, including the Association for India’s Development, Swaram, and the India Literacy Project.

These organizations, which focused on initiatives such as education and development, resonated deeply with me. Living in the Bay Area of California at the time, I wholeheartedly dedicated my time and effort to these causes.

As I immersed myself in the world of philanthropy, I found myself gradually climbing the ranks within Swaram’s organization. I eventually became Executive Producer and Board Member through hard work and dedication. The stage plays charitable initiatives and the incredible individuals I had the opportunity to collaborate with filled my days with purpose and joy. I spent more time at Swaram than at my corporate job at Oracle.

However, the tides of change soon came crashing down. In late 2016 and early 2017, Oracle’s hardware division encountered significant challenges, resulting in another round of layoffs. As someone on an H1B visa, I faced a difficult decision: find a new job within a few months or return to India without a job. Fortunately, I managed to secure a position at AMD that offered reasonable compensation. Nonetheless, this turn of events forced me to confront a dilemma.

While my volunteer work at Swaram and other charitable organizations brought me immense satisfaction, they did not provide financial compensation. On the other hand, though financially rewarding, my corporate job at AMD lacked the personal fulfilment I yearned for. This conflict propelled me to reevaluate my goals and aspirations.

Driven by the fear of another potential layoff in the corporate world, I resolved to save diligently and pursue a different path. I stumbled upon the Financial Independence and Retire Early (FIRE) concept during this period. The FIRE movement, which emphasizes living frugally, investing wisely, and achieving financial independence earlier, resonated deeply with me.

Eager to learn more about personal finance and investment strategies, I extensively researched the subject. I was particularly drawn to owning a rental property that could generate passive income. Although the concept intrigued me, the fear of making a substantial financial commitment held me back. Investing a significant portion of my hard-earned savings into a property was daunting, as any setbacks would significantly impact my financial journey for years to come.

Despite my reservations, I persevered. After nearly a year of careful consideration and

research, I mustered the courage to plunge. Though I lacked real estate and property management expertise, I purchased a rental property in Arlington, TX. Its affordability compared to California (where I had resided) influenced the decision.

Additionally, being an out-of-state investor added an extra layer of apprehension. Fueled by my burning desire to break free from the corporate world, I forged ahead with the purchase.

To augment my financial strategy, I maximized my 401(k) contributions and took full advantage of the mega backdoor Roth IRA option. These actions were essential in building a solid foundation for my future financial independence.

I consistently contributed to children’s education initiatives in India through my involvement with organizations like AID, Swaram, and the ILP. Recognizing education’s transformative power, I was convinced that investing in the younger generation was crucial for lasting societal change. The youth possess a malleability that allows for greater impact and a fresh perspective, making it easier to foster change from a clean slate. Therefore, supporting education became a significant priority for me.

As I pondered my post-FI (Financial Independence) plans, I embarked on the journey of fatherhood. Witnessing my firstborn’s early affinity for reading, my wife and I prioritised surrounding him with books. During our regular visits to the local library, I was captivated by the inspiring library system in the United States. The experience sparked a longing to provide similar opportunities for children in my hometown of Chennai, India.

I began collecting books for the library to turn this vision into reality. Some were purchased for my own children, while others were acquired through monthly used book sales at our local library. Towards the end, I initiated book drives at my children’s schools and contacted Bay Area friends, requesting used book donations. These efforts resulted in a substantial collection.

In May 2022, I decided to relocate to India, and by August, my shipment of book boxes had arrived. I officially registered my library as a non-profit trust in Chennai, Tamil Nadu, India, in mid-December. Finally, on January 1st, 2023, I proudly launched my non-profit children’s library, Prakrith Arivagam.

In the initial stages, my library had only a handful of regular members, with a few friends providing financial support. However, the membership numbers fell short of my expectations in the first three months.

Thankfully, my story caught the attention of Vikatan, one of the oldest Tamil magazines, and they featured it as a video on Vikatan TV’s YouTube channel.

Subsequently, Kungumam, another Tamil weekly, published an article about me and my library in their print and online magazines.

These two media coverages generated significant publicity for my library, leading to a surge in new member registrations. However, there was an unexpected consequence.

As word spread about the library’s popularity within my community, my house owner discovered that I had transformed my living room into a library. Unfortunately, he did not embrace having a library on his premises for unknown reasons.

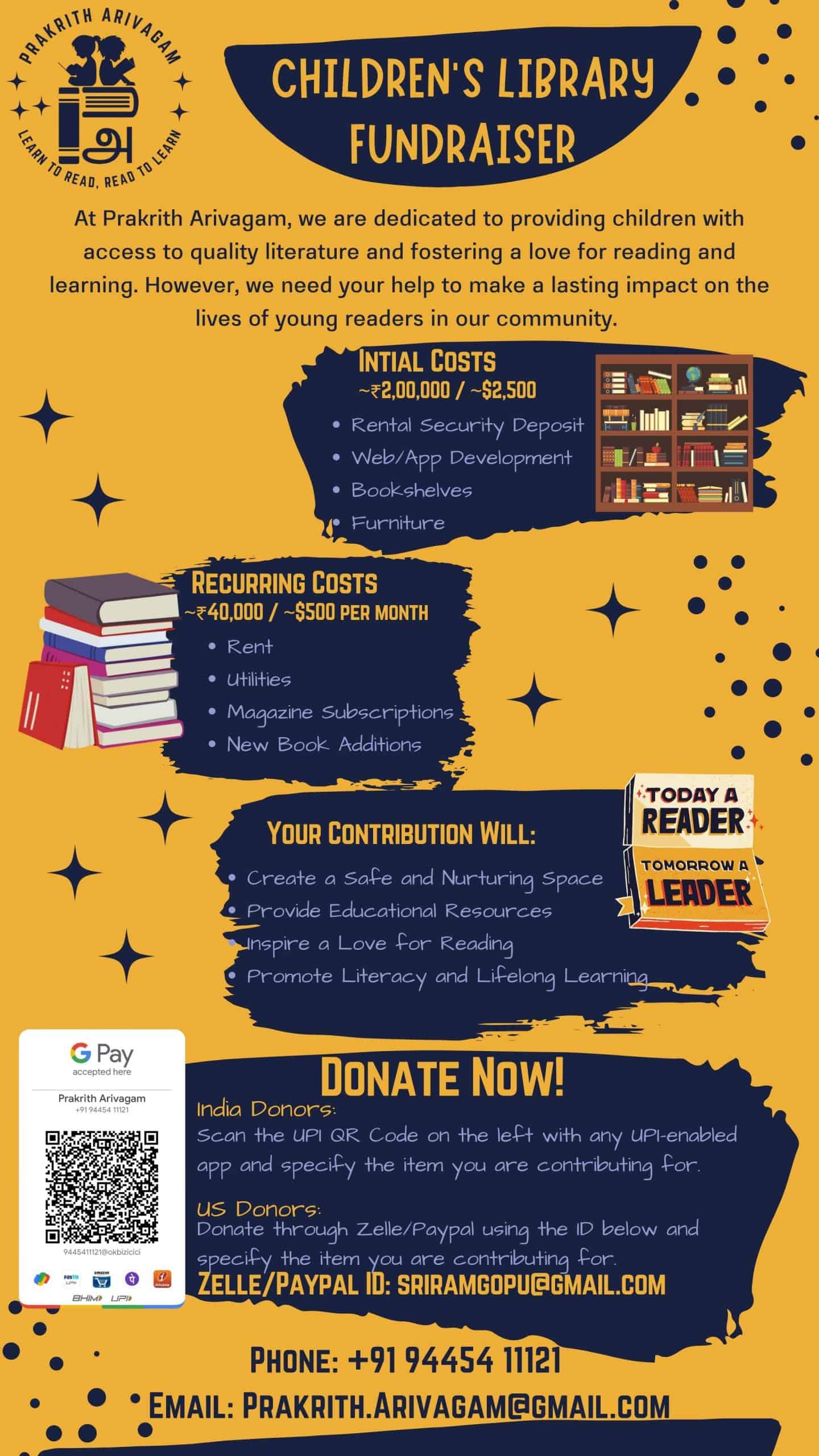

Consequently, I must now find a separate location for the library, which incurs additional costs, that I currently can’t cover. These expenses include commercial rent, utilities such as electricity and internet, and necessary furniture.

Though initially daunting, I am grateful to have supportive friends offering financial assistance. While I have not yet reached my fundraising target, I am confident I will attain it soon. Once the library is in its new location, I can launch a more aggressive publicity campaign without fearing displacement.

With determination, I believe that the library will become self-sustaining within a year or two, eliminating the need for regular and frequent fundraising efforts.

My journey towards financial independence and pursuing my passions has been filled with challenges and triumphs. As I continue to navigate this path, I remain committed to positively impacting the lives of others, particularly in the realm of education.

Through my library and involvement in charitable organizations, I hope to inspire and empower the next generation, helping them realize their full potential and create a brighter future for themselves and their communities.

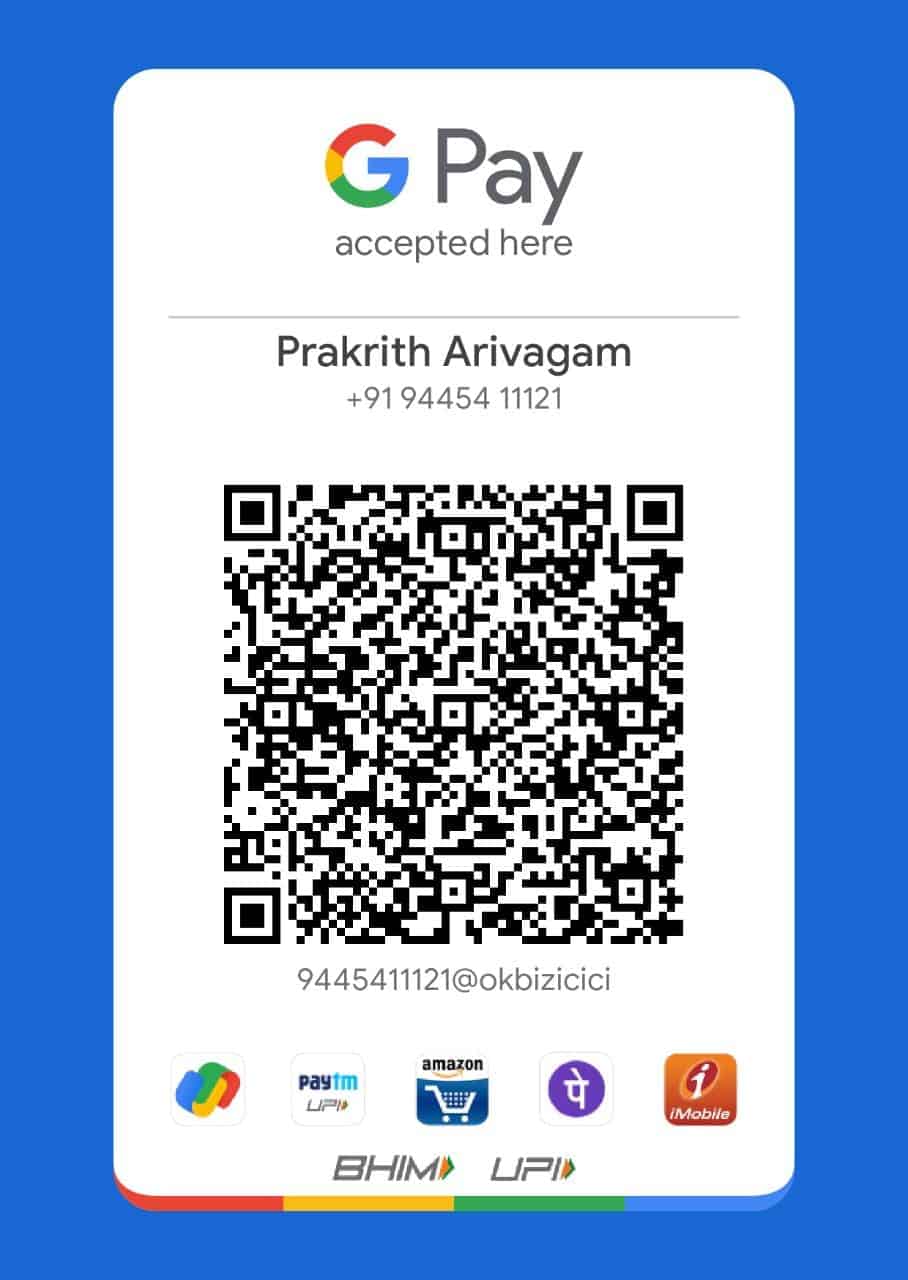

If you wish to contribute to Sriram’s cause, you can do so in the following ways.

Account Name: Prakrith Charitable Trust

Account # 50200077126322

RTGS/NEFT IFSC Code: HDFC0000676

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2020 edition: How my retirement portfolio performed in 2020. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower-income

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year, thanks to patient investing!

- Update: How I achieved investing nirvana.

- Twelveth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago, but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble, but now I aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth six years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

- Thirty-third audit: My journey: From Rs. 30 bank balance to financial independence

- Thirty-fourth audit: Our journey: From scratch to a net worth of 18 times annual expenses.

- Thirty-fifth audit: From a net worth of Rs. 6000 to auto-pilot goal-based investing

- Thirty-sixth audit: How I retired from corporate bondage at 46, two years ago!

- Thirty-seventh audit: How I learnt to keep it simple and build a net worth 19 times my annual expenses

- Thirty-eighth audit: How Abhineeth plans to achieve financial independence and build a house.

- Thirty-ninth audit: How Sahil plans to achieve financial independence by efficient tracking

- Fortieth audit: My Journey to a Ten Crore Portfolio

- Forty first audit: Burdened with debt for several years I am now aggressively investing in equity

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)