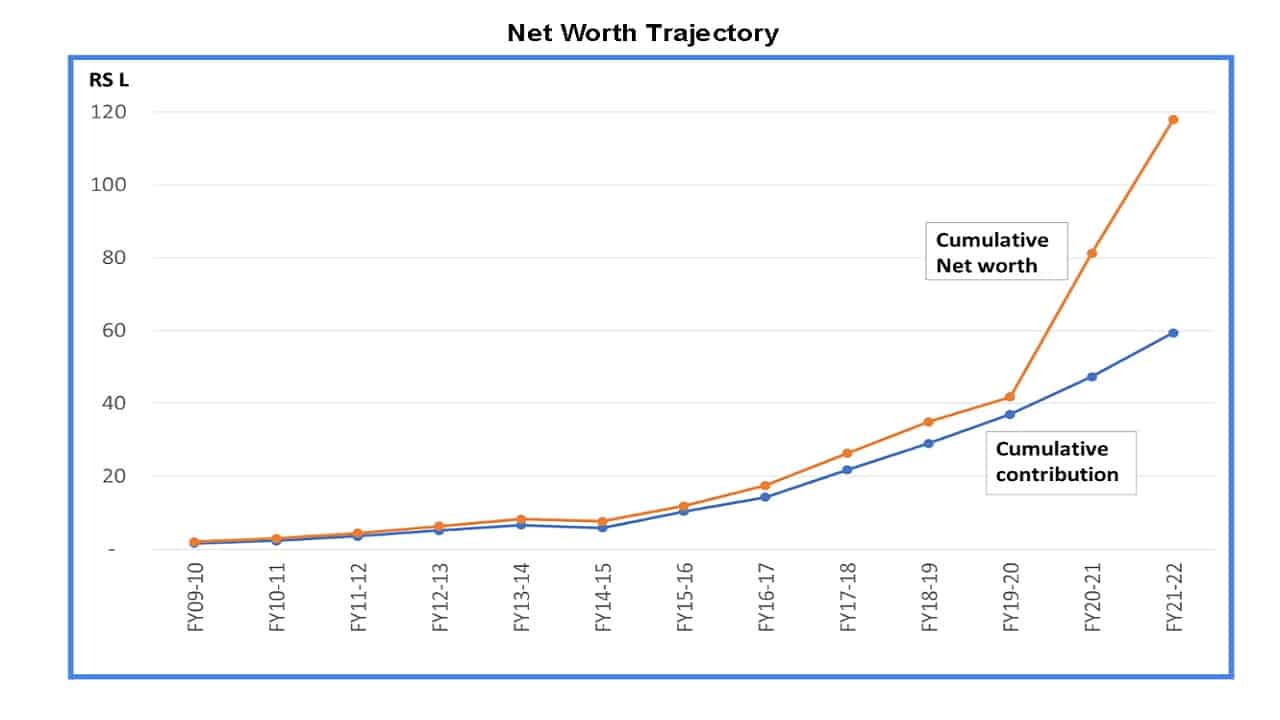

In May 2021, we carried a reader story by Mr G – My net worth doubled in the last financial year thanks to patient investing! Mr G has kindly consented to provide an update and explain how the following financial year was one in which he achieved “investing nirvana”.

About this series: I am grateful to readers for sharing intimate details about their financial lives for the benefit of readers. Some of the previous editions are linked at the bottom of this article. You can also access the full reader story archive.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning to preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

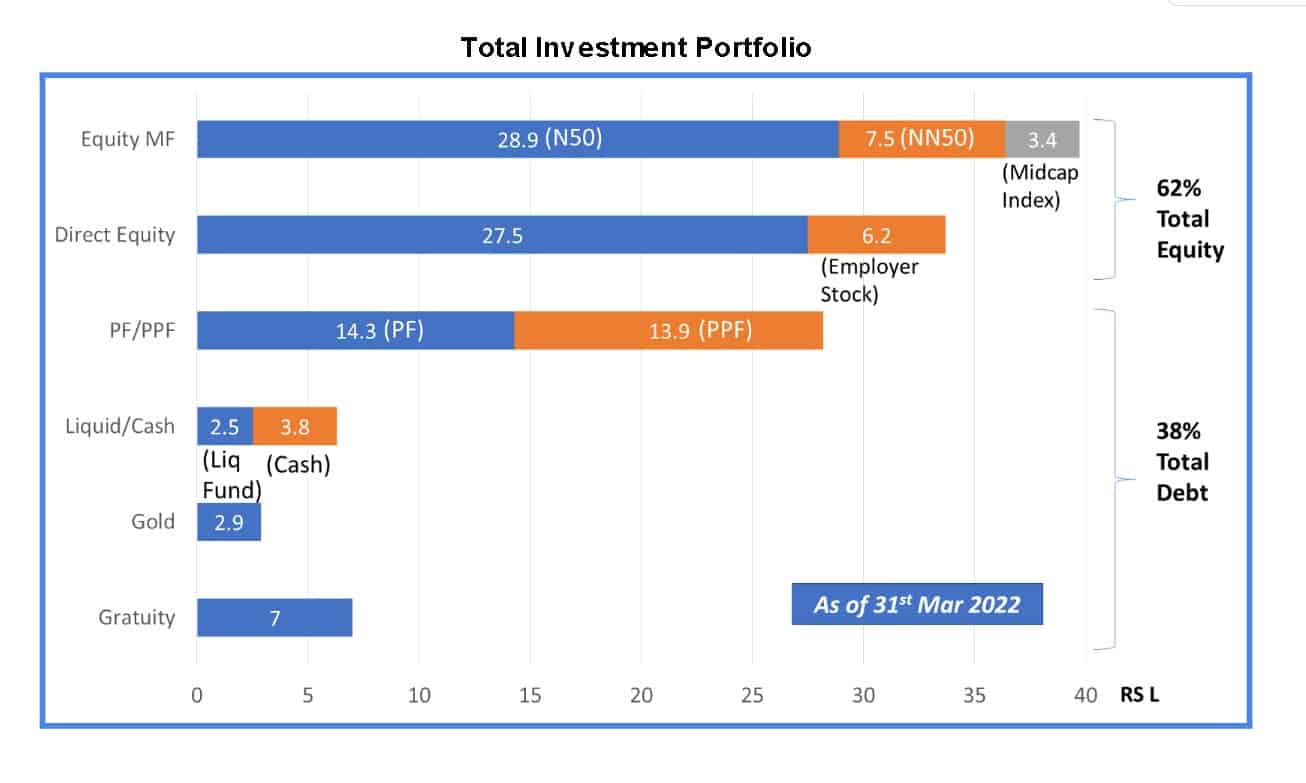

I had mentioned in my previous year’s audit that I achieved my desired asset allocation (AA) of 60:40 Equity: Debt by the end of the year. Reaching target AA really simplified my investment strategy, and I achieved a kind of “investment nirvana”. I know, it’s a bold claim. So let me elaborate, and you can decide for yourself on its merit.

(Note: In this article, I am referring to the FY21-22 period, i.e. April 2021 to Mar 2022. Markets have fallen, and interest rates have risen a lot since then, but nothing has changed from my investment strategy point of view. All the things mentioned in the article still hold true)

I have built my system of investment as follows. I calculate my E:D ratio at the end of each month. If equity is less than 60%, I invest in index funds to bring equity back to 60%. If equity is more than 60%, I keep the money liquid and ready for future investment.

This system is possible because I am in that sweet spot of my investment journey where my monthly savings is in the same range as typical market movements. In case the liquid corpus grows more than 10% of equity, I shift the excess to the PPF account (only up to 1.5L per account).

In case the liquid corpus depletes completely and more equity investment is needed, I plan to take out money from my PPF account (which is more than 15 years old. Though till now, that situation has not materialized). Coming to index funds, I have investments only in 3 funds – N50, NN50 and MidCap (all direct plans). While making fresh investments, I invest such that the ratio among the three funds is maintained at 70:20:10 (Which I believe closely mimics a hypothetical N250 index fund. Correct me if I am wrong).

So each month, my savings go to – mandatory PF, my employer stock (10% of salary goes towards employer stock purchase at 15% discount), and 3 Index funds (or PPF) per asset allocation. That’s it !!!

No FDs, no RDs, no NPS, no VPF, no debt funds, no gold, no direct equity, no active funds, no SIPs, no RE and thankfully, no crypto. I have retained my holding in only one stock I purchased many years ago (It’s done well over the years) and also have a small amount of gold that I had purchased earlier. However, I am not making any fresh additions to these.

This extreme simplification of the investment approach has led me to eliminate several things related to investments.

- I have stopped tracking my returns – Though it’s fun to know returns on equity investment (especially when markets are trending up), I realized it is not necessary for an AA-based investment strategy. I invest through the MFU portal; interestingly, it does not show IRR calculation. I used to track IRR using another app, but its free trial expired, and I did not renew it. Seeing the suspicious look I get when I tell any friend that I do not know my investment returns is funny. Ha ha.

- Stopped chasing after the best Mutual Fund to invest – “Which is the best fund to invest” is a popular query asked. Investing in index funds eliminates the need for that question. Of course, during any year, there will be funds that will beat index funds and others that lag behind. With index funds, I am protecting myself against severe underperformance, which is more important for me as my equity portfolio grows large.

- Stopped caring about market levels – “Is it the right time to invest in markets?” is another very common question. Again, AA based investing eliminates the need to bother about market levels. If my equity holding is below 60%, I invest, irrespective of market levels. The AA-based strategy naturally tends towards investing more during lows and less during quick market upticks.

- Eliminated need for tax savings investments – Last year, I moved to the new tax regime, as it was coming out to be slightly more beneficial in terms of tax outgo (as I do not have a housing loan EMI and my rent is low). It’s very convenient to have the freedom to invest freely without bothering about tax savings.

- No sweating over interest rate trajectory – Since I manage my AA leveraging only a PPF account, I do not need to invest in debt funds (as of now) and hence not sweat over interest rate movements. Plus, I am completely debt free, so all the more reason not to think of interest rate movements.

- Have not maximized my PF – This is another controversial move that many do not agree with. My employer gives the flexibility to set my PF contribution (can only increase, cannot lower). PF contribution (employer) is one of the few items which still gets tax benefits in the new regime (though above 2.5L interest is now taxable). But if I maximize PF, I will not have enough excess money each month to maintain 60% equity AA. Hence I am letting go of the tax benefit with the conviction that equity returns will outdo tax benefits over the long term. I saw the power of equity during the 2020 crash, which I used to invest heavily and get huge returns on the same. If all my debt component were locked in PF/PPF, I would not have been able to invest in the first place.

- Avoiding SIPs to manage short-term expenses – Since I do not invest through SIPs, my monthly savings is very lumpy, depending on the nature of expenses in that month or upcoming shortly. It’s always good to see money ready in my savings account for an upcoming expense (CRATON). Also, since I invest at the end of the month, I generally have cash ready for any unexpected expense, like car repair. I will just invest a lesser amount at the end of the month.

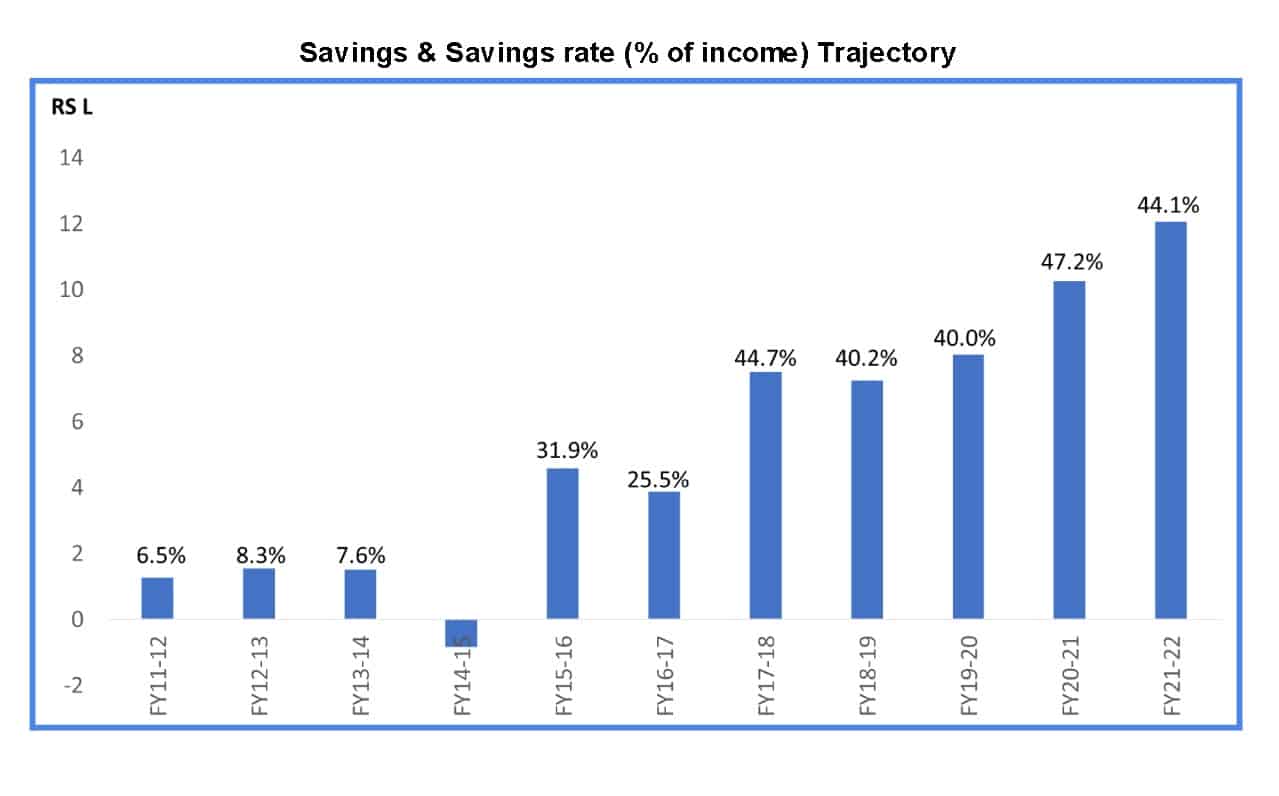

- Do not track my expenses – This is not exactly on investment but related. Inspired by an article from Pattu Sir a few years back, I shifted from tracking expenses to tracking monthly investment targets. Start of April each year, based on visibility into known expenses, I set a savings target for each month of the year. These targets help guide my spending behaviour. If I fall behind target savings, I start cutting discretionary expenses to get back on track. This has worked quite well, as I have achieved at least 90% of my savings target each year.

What do you think? Does my claim of achieving “investment nirvana” hold? Let me also admit I still have a long way to go in my financial journey, and many critical items are still pending to be actioned on, which I am delaying for no apparent reason.

- Proper emergency fund – I do not keep a large emergency fund, probably because I have not experienced any real emergency until now (very thankful to the almighty). Luckily I have a good support system from close relatives, who are ready to help in an emergency.

- Joint MF folio – All my MF folios are in my name currently. I need to create a fresh folio as a joint account with my spouse

- Personal medical Insurance – Though I have corporate health insurance and have opted for an additional top-up, many suggest having separate personal health insurance is good. It is a complex product to purchase, and I am dragging my feet on the same.

- Creating WILL – I am procrastinating on this one for no reason.

- Diversify outside of India – Currently, all my investments are within India. As my corpus grows, in future, I need to diversify into international markets to mitigate country risk. This is not an urgent matter, as in the short term, India seems to be in a good position.

- Planning for kids’ education – This is the elephant in the room. Currently, I have only one goal for my investments, i.e. retirement. Somehow, I cannot convince myself to plan separately for kids’ education. I plan to achieve financial independence before my kid reaches college. At that time, if need be, I will dip into my retirement pool to fund kids’ education.

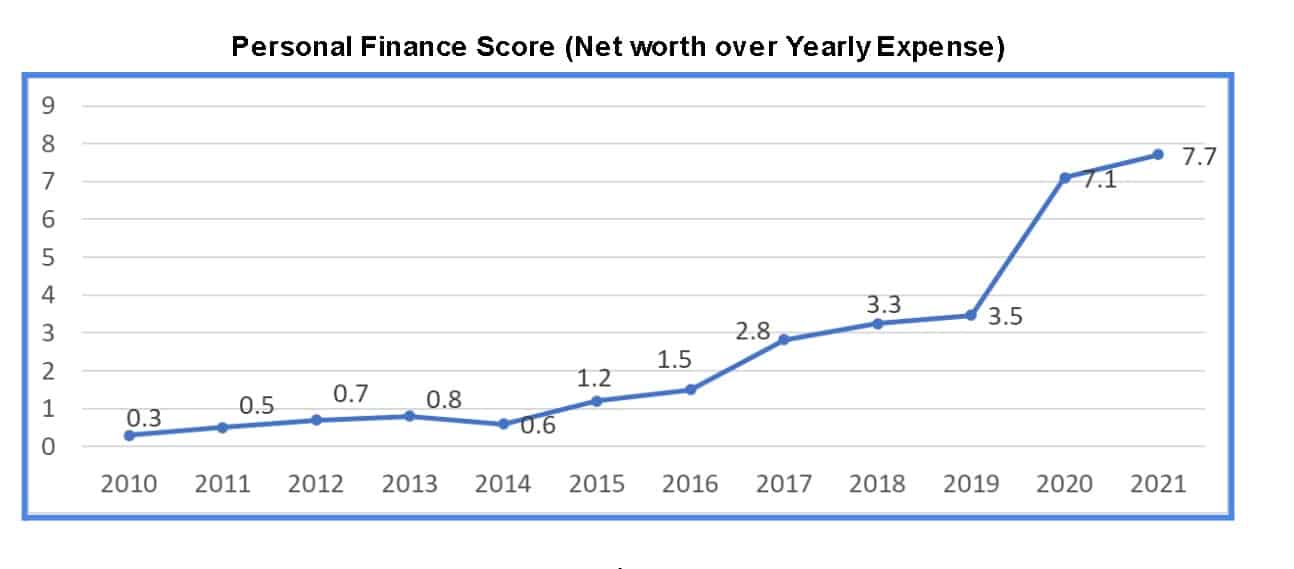

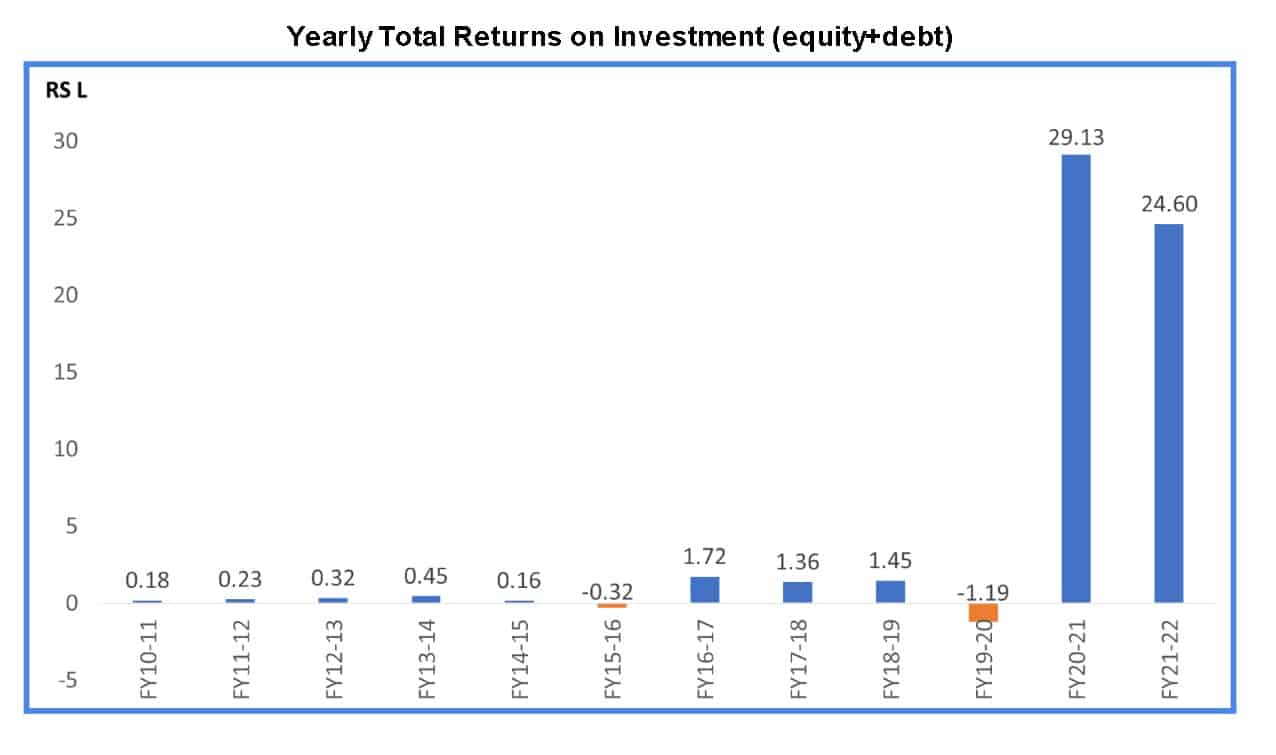

I conclude with some portfolio charts which are self -explanatory.

Plan for the future: My Plan is to continue with my current investment strategy for the next few years. The goal is to reach ‘lean FI’ in 3 years’ time. Hoping for the best.

Reader stories published earlier

As regular readers may know, we publish a personal financial audit each December – this is the 2021 edition: Portfolio Audit 2021: How my goal-based investments fared this year. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower-income

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year, thanks to patient investing!

- Update: How I achieved investing nirvana

- Twelveth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago, but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble, but now I aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth six years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

- Thirty-third audit: My journey: From Rs. 30 bank balance to financial independence

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)