In this edition of the reader story, we meet Arun, who has most generously volunteered to share his investment journey with the DIY community. I say this because more people with his net worth are usually reticent and unwilling to open up. While sending the draft, he graciously said, ” I have nothing major to share other than do SIPs”! I beg to differ.

About this series: I am grateful to readers for sharing intimate details about their financial lives for the benefit of readers. Some of the previous editions are linked at the bottom of this article. You can also access the full reader story archive.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning to preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We have also started a new “mutual fund success stories” series. This is the first edition: How mutual funds helped me reach financial independence. Now over to Arun.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Recently I have touched the ten crore mark in my NSDL Statement (This is not my net worth). In the Asan Ideas for Wealth (aka ASAN or AIFW) FB group, we see questions like who stays invested for such a long time, has anyone ever made money in mutual funds etc. We also see aspirational questions with a target of 1 Cr, 10 Cr, and even 36 Cr recently. Since we don’t hear many success stories of multi-crore portfolios, let me share my experience with this journey.

- I reached this milestone at age 46, with 25 years of working experience. Started working in mid-1998. It has taken quite a while to reach the 10Cr mark in Equity + MF alone (without including RE, gold and other assets).

- I was born into a poor family. Neither of the parents studied beyond 8th grade. Growing up, life was a struggle with my father’s meagre income. There was a roof over the head and basic food on the table. Other than that, everything else was a luxury.

- Did Engineering from Tier 3 college and landed an IT Job through campus placement. That was my(our) ticket out of poverty and better life. Given the family’s condition, paying for tuition and hostel fees was a struggle. I completed the course with a small debt my father borrowed from his friend.

- From day one of employment, taking care of my family fell on my shoulders, and I continue to support my parents for day-to-day expenses until today (along with my siblings). Highlighting this to point out that the entire income was not available for investment, especially in the initial years.

- My spouse is a housewife, and we have two kids. In addition to supporting extended family, everything is built from a single income. There is no external support like winning a lottery, dowry, inheritance, or other such things.

- I am in my third job now. First was a mid-tier Indian company. Second was one of the WITCH company and currently into the third. None of the employers were exceptional paymasters. At the max, I held an entry-level Sr. Manager position in a services company. So, this is not built with high-paying VP / SVP / Startup kind of pay.

- I did travel onsite for short and long terms. That surely helped with saving and investing well. Also, in the last 2 years, pay has jumped significantly, which also helped. However, first 22 years is just normal IT career path (No FAANG like pay, no Startups, RSU or anything like that)

- Though I had to save from day 1 (there was no other choice), initial investments were all into FDs, Post Office schemes. Started first SIP mid of 2005. I have not stopped SIP even for a month since then. So that is about 18 years of continuous SIP. Funds have changed though.

- I relied on selection of funds based on VR rating or plumbline or morning star. Around Nov, Dec I use to plan for the SIPs for following year and submit forms in Cams or AMC office for next 1 year. I repeated this process until doing online has become normal in the recent times. This yearly option helped to step up based on cashflow (instead of automated step up)

- I had no great fund picking skills, no strategy to analyze, was poor in selling underperformer quickly. Only thing I did well was to buy and hold. I spend time before buying but once bought will stick at least for few years before stopping due to under performance. However, I was quite poor at getting rid of under performer.

- I have funds like DSP top 100, Quantum with 30-40 lakhs each. These are funds not going well for a long time. So, in spite of that, I could reach this target. So superior funds selection or exit strategy was not the play here.

- Recently I started diverting most of the investments to Index funds. Since 1% return is good enough to cover living expenses at the current stage, it does not matter if I get 12% in index fund or 16% in small cap fund. So, keeping it simple is what I am planning to do going forward.

- I did start Direct equity investing around 2006/07 and invested in a haphazard way (Reliance Power IPO says Hi). I realized that I am making a mistake and stopped investing around 2010/11. I restarted the direct equity end of 2019 after MF had a solid base. Now I have a select set of stocks (more like coffee can) and invest with an objective of building a dividend income portfolio. Hoping to reach yearly living expense from dividend alone. I am following similar approach of Pattu with DE portfolio.

- I did take help of financial planners during this journey. Each stage I hired; I was doing more than what I am supposed to do as per them. So, it has given a reassurance than course correction from this review exercise. Each time it was a different planner, some from the Freefincal list.

- While I have defined my goals, calculated how much to invest, and invested, I have also tracked goals like hit 1 Mil USD by 40 (It is a moving target due to currency fluctuation), Reach 10C INR before the age of 50. These were things learned from Subra’s blog and it gave some motivation to continue the investment journey month after month, what otherwise is a boring thing to do.

What did I do right?

- More than return, increasing the human capital is key to FI or reaching a big milestone. Though I did not have any business, side hussle etc, grabbing onsite opportunities and changing career was the only thing I did to increase the human capital. Last change moved to big league financially.

- Save and Invest from the first month salary. Situation forced to save and invest and cultivate this habit from the very first paycheck due to family’s financial background.

- Did not complicate the investments. In the initial days stuck to FDs and Post office schemes. Later it was mutual funds and Direct Equity. No chit, F&O, Crypto, PMS, AIF or any get rich quick schemes. Just did simple dull boring SIP.

- Did not buy real estate until I was sure when I needed. Always lived on rent. Finally built a decent home which will be my permanent home.

- Some amount of Luck. Though there were medical bills for self and family, nothing serious or chronic which broke the bank. Never been laid off or stayed without job also helped in the journey.

What could I have done right?

- I could have started my mutual fund journey at least five years earlier, in 2000. Lack of knowledge or guidance made it possible only in 2005.

- Started with 1000Rs SIP and stepped up slowly. I should have started with a larger amount when I look back.

- I continued as normal whenever the market fell, like Oct-2008 or Mar-2020. I did not stop but did not step-up investments as well. In hindsight, I should have increased my investments during this period.

- Though I did not make too many financial mistakes, I did buy an endowment policy. Again, a lack of knowledge and guidance led me here. This was before Subramoney, Asan group, and Freefincal days. So, nothing much could be done other than treat it like a learning cost. (Multi Crore mistake). Will write a separate post on the loss due to this mistake.

Some Statistics of this journey

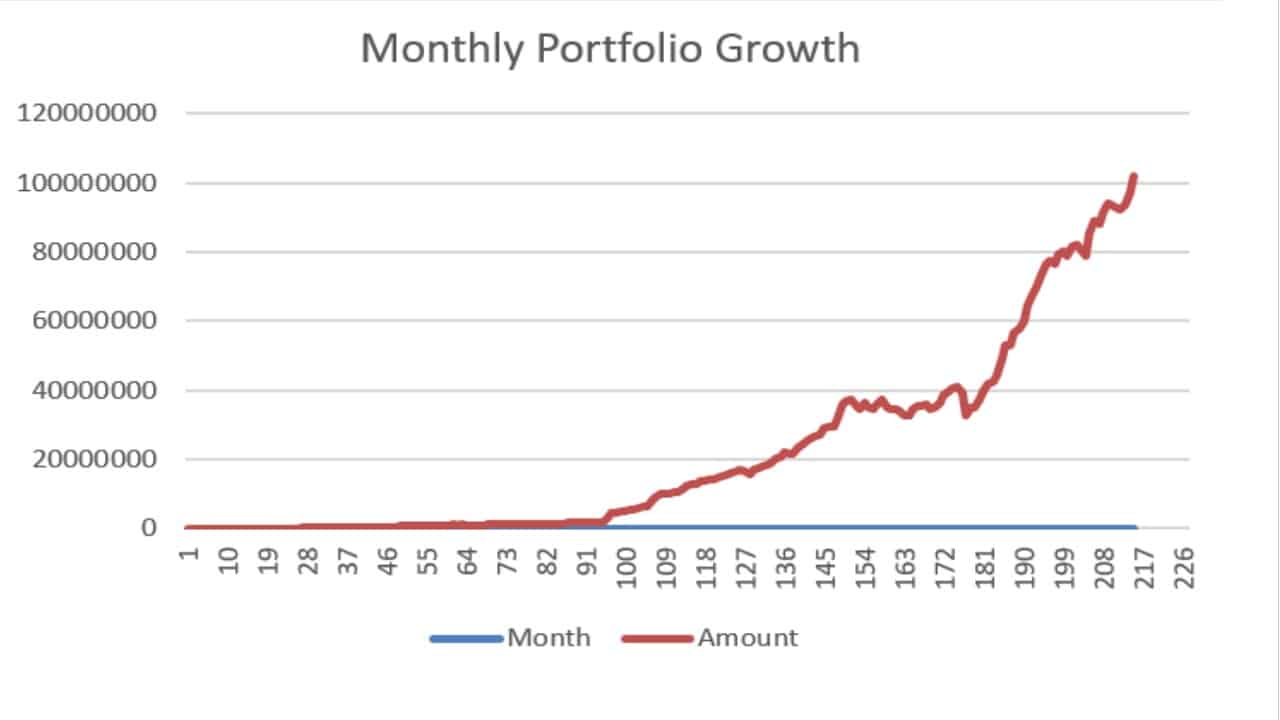

- I track based on the NSDL statement. So, the numbers are as of the end of each month. NSDL statement became a regular thing only in 2016. So earlier number may be slightly on the lower side and is an approximate value.

- The current consolidated MF portfolio return is about 11.4% per VR. Debt MF is 5-8% range, and Equity 10 to 20% range.

- Hit the first Crore mark in about 110 months from the initial mutual fund investment. (somewhere 100-110 range as this is an approx value) Thereafter, no of months to the next crore kept reducing. Now the change is every few months.

- Around month 96, onwards stepped up the investment amount and then the graph really took off. Also, continued investment during covid crash. So, bull run post that helped in a big way.

- The highest single-month decline was 18.99% in Oct 2008 and 16.03% in March 2020. The highest monthly gain is 13.09% (Nov-2017) and 11.22(Nov-2020), Apr 2014.

- The highest decline per month was about 62 Lakhs (Mar2020). The highest gain was 63Lakhs (Jul 2022).

- Plus/minus swings of 30-35 Lakhs per month have become a monthly affair. Once a portfolio grows, one must get used to this volatility and stay calm.

- The famous sideways market Pattu always talks about is visible in the graph.

Where am I today?

- I have reached Financial Independence number in Excel—however, no plans to Retire early. I belong to FI-NP-RE (Financially Independent, not planning to Retire Early) group. This is mainly due to a lack of hobbies or clarity on what to do after retirement. Job is not stressful to leave voluntarily.

- Current assets are roughly allocated as 1 Cr for each child for education, 0.5 Cr for each child’s marriage. That is 3 Cr. Remaining 7 Cr for retirement. I may not really need this much for education or marriage; however, overestimation is better. Also, this is not the net worth. So there is enough cushion in case of any emergency.

Future Plans

- Take debt mutual funds to about 3C. So, at 4% return, that would be 12Lpa. This should cover the living expenses. Jan to Dec 2022 notional gain from Debt MF was 10+ lakhs. Jan to May 2023 gain is 6.8 Lakhs with a lesser investment base so far. Current actual notional gain is higher than 4% from Debt MF. So, plan based on 4% should give some cushion for future.

- Debt portion of Portfolio is confusing part. If we follow traditional approach of 40% Debt, then will end up 4-5 Cr in Debt which seems like a sub-optimal approach once portfolio reaches certain size. Please share your thoughts on how to manage in cases like this.

- Planning to get 6lpa pre-tax dividend income. Jan to Dec 2022 made about 3lks. 2023 should cross 4 lakhs. So will continue to invest until targets are achieved. Hope to take this to one year living expense someday. I am not bothered about me under performing index or paying tax at 30% for this part of the portfolio.

- Any other investable surplus is being diverted to mutual funds. Mostly Index funds. I am getting rid of older funds and exit some fund houses completely and moving to Index to trim the portfolio. It is a challenge given the size and capital gain impact. Will spread this over few good years.

- No plans to venture into PMS, AIF, FnO or any such things as of now. No plan to start a business. No interest in more RE (Residential or commercial). Will consider Retirement home in future. No other RE unless situation demands a change.

- Non-Retirement withdrawals should fall during 2025-2032. As amounts gets deployed for such goals, will reassess the situation. Will hire a planner if required.

- As Subra says, return matter in the later part of the investment journey than the start. Reached a stage return and time invested matters. I don’t have much control on return but for investment horizon I can do what is humanly possible to be healthy and live longer.

- I have taken fitness and heath seriously. FITTR group helped here in a big way. I am at my best physical shape in my 40s. I hit gym 6 days and hit 15K steps daily. I lift reasonably well and in best muscular shape of my life. BMI and all blood markers are in good range. Hope no sudden health surprise comes up to derail the progress.

- Finally, charity and giving back to causes is an ongoing process. Will step up and continue as long as possible.

In Summary, I had no special talent, skills, or family background—just an average IT guy who did dull and boring SIP for 18 years and created some wealth. By saving and investing regularly, anyone can achieve good financial status. I want to thank Ashal, Pattu, Subra, and members of the ASAN group for valuable lessons and teaching throughout this journey. Hope to come back and share a bigger and better milestone in future. Until then, Happy Investing!!!

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2020 edition: How my retirement portfolio performed in 2020. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower-income

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year, thanks to patient investing!

- Update: How I achieved investing nirvana.

- Twelveth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago, but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble, but now I aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth six years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

- Thirty-third audit: My journey: From Rs. 30 bank balance to financial independence

- Thirty-fourth audit: Our journey: From scratch to a net worth of 18 times annual expenses.

- Thirty-fifth audit: From a net worth of Rs. 6000 to auto-pilot goal-based investing

- Thirty-sixth audit: How I retired from corporate bondage at 46, two years ago!

- Thirty-seventh audit: How I learnt to keep it simple and build a net worth 19 times my annual expenses

- Thirty-eighth audit: How Abhineeth plans to achieve financial independence and build a house.

- Thirty-ninth audit: How Sahil plans to achieve financial independence by efficient tracking

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)