Last Updated on February 12, 2022 at 6:16 pm

This is a mutual fund guide for first-time investors to start investing in the right way. It is designed in an easy-to-understand question and answer format. We believe that new investors in mutual funds should first ask and then seek answers to these questions.

Every time we focus on actions suited for our personal situation instead of worrying about best or optimal solutions, we become better investors. It is our hope that this collection will point new investors in this right direction. Many of the questions will have links for further information and proof for many of the assertions. Let us first take on some “popular questions”.

Which mutual fund is best for beginners? There is no such thing. Each individual has a different requirement and they need to consider if a mutual fund is suitable for that need and if yes, which category of funds is a good fit.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

How do you start to invest in mutual funds? You define your requirement; decide how much risk is suitable for your need; select an appropriate fund and start investing.

Are mutual funds good for beginners? Yes, but only for those willing to understand risks, create an investment plan and be patient

Can mutual fund make you rich? Yes. They certainly made me rich – Ten Years of Mutual Fund Investing: My Journey and lessons learned – but what return one gets depends on when they started investing, how they managed the portfolio and for how long.

Do you lose money in mutual funds? Yes and lose big too! It is not a joyride and returns after several years can be quite poor: 15-year Nifty SIP returns crash to 8% (51% reduction since 2014)

Which bank offers the best mutual funds? Never buy mutual funds from banks. Buy them directly from the mutual fund company (aka fund house, aka asset management company)

Which mutual fund gives the highest return? No one knows. No one can know. The best part is, one does not need to know. Of course, if you mean highest returns in the past that can be listed but it is of no use as past performance has no bearing on the future performance.

Is it a good time to invest in mutual funds? Time has nothing to do with it. It is a matter of how well you have planned and how well you have understood risks.

Which SIP should I invest in 2020? You do not invest in SIPs. You do not need SIPs to invest in mutual fund and the fund that you choose does not, should not depend the year!

Which SIP is best for 5 years? No such thing. Such questions only reveal how unprepared the person asking the question is. When you take the trouble to learn more about MFs, you will understand why. Hopefully, this FAQ will, at the very least, list the right questions to ask. Let us begin.

1 What is a mutual fund? A mutual fund is an entity that collects money from investors and invests it in either stocks or bonds or gold as per a pre-determined strategy.

2 Do I need to invest in mutual funds? No. There is no need to. Among the available investment options, mutual funds are but one choice. You can choose them if they are suitable for your need.

3 When should I invest in mutual funds? It depends. If you do not wish to invest directly in stocks (because you have better things to do or just don’t feel like it), you can choose equity mutual funds (defined below). If you would like to lower your tax outgo compared to a fixed or recurring deposit and if possible with better returns, you can choose debt mutual funds (defined below). The clearer you are about your need, the faster and confident you will be in taking decisions regarding mutual funds – well, this applies to anything in life!

4 Who issues mutual funds? Asset management companies (or AMCs or fund houses) create mutual funds. All AMCs will have to be approved by the government body, Securities and Exchange Board of India (SEBI). All mutual funds have to be whetted by SEBI before it is open for the public to invest.

5 What does investing in mutual funds actually mean? Suppose a mutual fund invests in ten stocks and total current market value of these stocks is 1.1 Crore. Out of this, the AMC deducts say, 0.1 Crore for operating the fund (this is known as the expense ratio). So the net value is 1 crore. Now the AMC will divide this 1 Crore into say, 10,000 parts. These parts are known as units. The cost of one unit is 1Cr/10,000 = Rs. 1000. This is known as the Net Asset Value (NAV) of the mutual fund.

Suppose the AMC has set a minimum investment requirement of Rs. 500. Then if you pay Rs. 500, you will get 0.5 units of the fund. Remember that the cost of one unit is the cost when you made the purchase. Suppose after one year, the NAV has fallen to Rs. 700 per unit and you wish to exit the fund (also known as redemption), then you sell your 0.5 units back to the AMC and get 0.5 x Rs. 700 = Rs. 350 back.

Yes, you invested Rs. 500 and got back Rs. 350 – a loss of 150 over a year. The point is, that you buy units at current NAV and sell units (fully or partially) at current NAV. This is what investing in mutual fund actually means.

6 Do mutual fund guarantee returns? Well, sales guys would love to tell you that “over the long term” you will get good returns from mutual funds, but the truth is, there is no guarantee. As the above example shows, you buy at current market value and sell at the current market value. Anything, literally anything can happen in between spectacular returns or spectacular losses. Unless you are mentally ready to accept this and learn how to minimize this risk, do not invest in mutual funds.

7 Are mutual funds safe to invest in? That depends on what you mean by safe! If by safe you mean capital protection – that is, you invest Rs. 500 and even if returns are zero, your Rs. 500 is safe – then no mutual fund offers such protection. Your capital will always be at risk. Just a matter of how big or how small a risk. If by safe, you mean – will the AMC run away with my money? Then no, it is highly unlikely that the AMC will do that. There are enough safeguards implemented by SEBI. Want to read more? Are mutual funds safe? Can mutual funds run away with our money or become bankrupt?

8 If mutual funds do not offer guaranteed returns and are risky, why should I invest in mutual funds? Well, you don’t have to! If (IF) you want higher returns, then you will need to take on higher risk. The risk is guaranteed, but returns are not. Life is tough! The question you should be asking is: If I do not take on any risk (that is choose guaranteed return products) will I be able to invest enough money to achieve my goals? You will need a goal planning calculator to find out. See: Can I Plan My Retirement With Recurring Deposits and Fixed Deposits?

If your answer is yes, then you do not need mutual funds or any risky uncertain return product. If the answer is no, then you need to take on some risk to try and get higher returns. Whether you use mutual funds for this or not is up to you.

9 What are the types of mutual funds? From an investing perspective, there are three types of mutual funds

- Equity mutual fund: A fund that invests at least 65% of its portfolio in Indian stocks

- Debt mutual fund or fixed income mutual fund: A fund that invests predominantly in bonds (a tradeable fixed deposit)

- Gold mutual fund: A fund that tracks the price of gold

- Hybrid mutual fund: A fund that invests in a little bit of equity, few bonds, a little bit of gold. That little bit can be constant or vary from time to time

10 I have heard about “growth option”, “dividend option”, “regular plan” and “direct plan” What are these?

Every mutual fund has options and plans. So if ABC is an equity fund, you will have an ABC growth option and an ABC dividend option. In a growth option, the fund manager (the person in charge of handling investments) will stay invests in stocks/bonds/gold at all times as per the investment strategy.

In a dividend option, the fund manager can, from time to time, sell some equity or bonds and distribute the profits to all unitholders (the investors) equally. This is known as a dividend option. Stay away from the dividend option. Growth option is all you need when you start.

Every mutual also has a regular plan and a direct plan. In a regular plan, commissions for the salesperson will be deducted from the NAV every day before it is published in addition to expenses for running the fund. In a direct plan, no such commissions will be deducted. So you can save significant amounts of money by choosing a direct plan. More importantly, you can avoid biased advice by choosing direct plans.

So our ABC fund will be available in the following flavours:

- ABC Fund Growth Option Regular Plan

- ABC Fund Growth Option Direct Plan<=== Pick this!

- ABC Fund Dividend Option Regular Plan

- ABC Fund Dividend Option Direct Plan

11 From where can I buy mutual funds? That depends on where you want the regular plan (why would you?!) or the direct plan. You can buy regular mutual funds from any place that does not talk about direct plans! Eg. Banks, All popular mutual fund news and star rating portals etc.

You can buy direct plans directly from the fund house (hence the name direct!) or via MF Utility an entity created jointly by fund houses. There are other methods, but I do not recommend those!

12 How do I start investing in mutual funds? You start by not being in a hurry to invest!

- Have a well-defined goal

- Understand How to select mutual fund categories suitable for your financial goals?

- Understand When to choose what mutual fund

- Understand what is asset allocation and decide on asset allocation for your financial goal

- Choose the type of mutual funds you need to invest in.

- If equity mutual funds are suitable for your need, then consider using index mutual funds. These would simply track the stocks in an index like Nifty or Sensex. You do not have to worry about fund managers leaving, fund performance dropping etc. Over the long run, the cost would be significantly lower and you can invest in peace.

- Choose the category of mutual funds in each type

- Then and only then choose the funds you want to invest

- Remember to pick growth option and direct plan

- Continued below

13 What do I need to start investing in mutual funds?

You first need to provide proof of your identity and proof of address to the fund house. This is known as “Know your customer” (KYC) process. You can complete the KYC process in two ways:

A: Select a fund that you would like to start investing in, then go to the website of the AMC and search for an office near to you. Download KYC form, fill it, take id proof and address proof (all standard ones will be good enough), take photocopies of these, download an investment form, fill it and submit it along with a cancelled bank cheque. You will be sent a folio no (this is an id for your account) by email. You can go to the AMC site register yourself and check your investment details. Further investments can be done online

B: You can go through the KYC process online (search for e-KYC and any fund house name) but the limitation is that you can only invest Rs. 50,000 a year in all funds combined.

14 How much should I first invest?

Most mutual funds have an Rs. 5000 initial investment limit. Then you can invest any amount above Rs 500 or Rs. 1000. So if you do not have Rs. 5000, save up and then complete the process in 13.

15 What is a SIP? How is it different from a lump sum investment?

A SIP or systematic investment plan is where you ask the mutual fund to deduct a certain amount from your bank on say the 5th or 15th or 25th of each month. You will be allotted units in your folio as per the NAV on the purchase date. In a lump sum investment, you buy units on any given day.

There is no difference between a SIP and a lump sum investment. Do not get confused. A lump sum is occasionally buying of units. A SIP is periodic buying of units. Read more:

16 Do SIPs offer any benefits? None. They will not make you disciplined. They will not lower the risk. So if you want to invest each month, do so once a month on your own. Read more: Don’t Be Fooled: SIP is NOT systematic investing! Also, Beware of Misinformation: Mutual Fund SIPs Do Not Reduce Risk!

17 I am not disciplined. Should I not start a SIP? If you are not disciplined, you will get nothing in life. A SIP will not help you. Go jump.

18 Why are you asking people to invest Rs 5000 first? Should they not start a SIP? Start with Rs. 5000 and observe how the value of the investment fluctuates day-to=day for a few months. Then start investing more. What is the hurry?

19 How do I get my money back from a mutual fund? You cannot! You buy units at current NAV value and you sell back the units at current NAV. There is no such thing as getting money. Remember at all times that mutual funds are market-linked instruments.

20 Can I save tax with mutual funds? There are equity funds knowns as Equity Linked Saving Schemes (ELSS). Your investments up to Rs. 1.5 lakh a financial year will be exempt from tax (section 80C). Each unit you purchase will be locked up for 3 years though.

21 How do I invest in a SIP? You cannot! You invest in mutual funds and when you buy mutual fund units automatically each month on the same date it is called a SIP. By the way, you do not need a SIP, and I strongly believe that you should not start a SIP.

22 I am surprised that you do not want new investors to start a SIP, but instead, want them to start with an investment of Rs. 5000. Why do you not want people to start SIPs? If you are surprised it is because you have been brainwashed by the junk that fund houses guys, their sale guys or silly journalists write. A mutual fund is a market-linked product where returns can fluctuate wildly. So the associated risk must be actively managed. A SIP does not put people in the right mindset for this. In fact, all fund houses and sales guys want you to do is to keep running a SIP and never close it.

They will never tell you about the risks because this means you will exit and that means fewer profits for them. So you need to have a hands-on approach to both investing and risk management. Manually investing each month is also systematic investing. Practice this and you can soon learn systematic risk management too.

23 I want to start SIPs and then learn systematic risk management. Will I be doing something wrong? You talked about risk management. So you are not one of those brainwashed zombies. Good for you. Sure, you can start your SIPs and practice systematic risk management too. This is how: How to systematically reduce the risk associated with a SIP

Also, a manual SIP also has pros and cons depending on the individual traits of a person. See: Manual Systematic Investment Plan (MSIP): Pros and Cons

So if you must start a SIP, watch that first Rs. 5000 you invested move up and down in value for a few weeks and then start one. I would, however, urge you to try an Rs. 100o or Rs. 500 manual investment directly with the AMC. It will take 30 seconds of your life, well maybe 45 seconds the first time. If you like it, keep doing it.

24 I think what you are suggesting is irresponsible and does take into account practical aspects of behavioural finance. People need to take charge of their finances, not start a SIP and hope for the best.

25 Also if people do not start SIPs, they will stop investing when the market goes down. Their money, their life. Since it is anyway easy to stop or pause a SIP online, they would be doing it anyway.

26 What should be my first mutual fund? Do not ask this question unless you have a clear financial goal; when you will need the money; how much of equity you should have for that goal (0% or 30% or 60% etc); where you will invest the rest of the money (fixed income instrument). If you do know how to do all this, use the Freefincal Robo Advisory Software Template and create a financial plan first. There is no hurry. If you invest first and plan later, it will be a mess. So take your time.

27 I want to save tax, can my first mutual fund be an ELSS fund? Well, it can be, but once you go through the above steps, you will recognize that tax saving is only incidental. Once you have the right asset allocation (how much equity to invest in and how much-fixed income to invest in), you will realize it does not matter what you select to save tax in. I would recommend that you do not use ELSS funds if you can save tax with EPF + VPF or mandatory NPS.

28 How does a SIP in ELSS work? What did I just tell you?! Anyways, each unit you purchase from an ELSS fund will be locked in for 3 years. So the units you buy each month via SIP will each be locked for 3 years. So 3 years after you started the SIP, only the units you purchased the first month will be free from lock-in, and so on.

29 How much return can I expect from an equity fund after 3 years? Let me think for a moment …. anywhere between -65% to + 89% (no I am not making this up). Stop expecting returns from mutual funds!! Want to know why? Read this

30 How much return can I expect from equity after 30 years? Anywhere between 3% to 16.72% (no I am not making this up either, well just a little bit). The point is when returns are not guaranteed, why are you expecting anything? This is why I keep saying don’t fall into the SIPing trap. Ask the right question partner! Like to see some data? See: Sensex Charts 35 year returns analysis: stock market returns vs risk distribution

31 I am planning for a 15-year investment and want to hold 60% equity in the initial years. How much return can I expect? Nice try, but you can do better than this. Try again.

32 I am planning for a 15-year investment and want to hold 60% equity in the initial years. What can I expect during the course of this investment? Now, this I like! So when you hold 60% equity, expect the entire portfolio to fall in value by at least 40-50% (not making this up). That is not going to be easy to face for anyone, expert or novice. So I would strongly recommend that you plan for a 10% return from equity after tax. Expect less and you not be disappointed! Also see: What Return Can I Expect From Equity Over the Long-term? Part 1 and What Return Can I Expect From Equity Over the Long-term? Part 2

34 How much equity should I hold in my portfolio? Good question! That is more important than where to invest. Simple thumb rules. Avoid all equity for money that you need within 5 years. Include only 20-30% equity for money needed between 5-10 years. Above that, you can increase gradually, but do not go above 50-60%. You need a good amount of fixed income in your portfolio. Watch this for more clarity.

35 I am young, why can’t I hold 100% equity for some years and then reduce it? Yeah, and I am Superman. You need therapy dude. You have been brainwashed into believing “over the long term” equity will give good returns. No, it will not. By holding 100% equity, you will lose precious time and money if you have a bad sequence of returns from the market. Safety first. Adventure later.

36 So I tried out your robo template and it says I need 60% equity for my goal. What does this mean? How do I go about this? This means that your portfolio should have close to 60% of equity at any time. This may be too much too soon for many new investors. So I would recommend that you start small. Say you are investing Rs. 1000 a month, allocate Rs. 800 to fixed income and Rs. 200 to equity and gradually increase equity to Rs. 600 over the next few months. Another reason what you should not start stupid SIPs.

37 Okay, I am finally ready to invest. Give a straight answer – what should be my first mutual fund? Assuming you are planning for a long-term goal like financial independence, the simplest choice would be a Nifty or Sensex index fund. You can choose one using this guide: How to select an index fund

38 How many equity funds should I choose? Start with one and stick with one for at least 1-2 years.

39 What only one? Should I not be diversifying my portfolio? Yeah, yeah you should, but most people di-worsify their portfolio by buying more. So don’t be in a hurry. Stick with one, it will give you all the diversification that you need for now.

41 I can invest Rs. 5000 a month and want to split it up into five Rs. 1000 SIPs. Please suggest the best funds to invest in Please don’t!. If you must start a SIP, then start ONE for Rs. 5000 a month

42 But is not splitting the money and investing in 4-5 funds a good way to spread risk and average returns? No, it is a good way to fool yourself that you are doing all that.

43 What is an NFO? You don’t need to know because you don’t need it. It just means a New Fund Offer. Every few months AMCs in search of fresh profits will launch new funds and make it appear special to lure you into investing.

44 Does the NAV of a mutual fund include its expenses? Every day mutual fund declares the NAV after about 8 pm or so. Before they declare the NAV, they will promptly remove the expenses for the fund and in the case of regular plans, commissions also. So the NAV is after expenses are factored in and all mutual fund returns that you see are after expenses and commissions.

45 I just started my SIPs and I want to learn about this “risk management”. Point me to a source.

46: I was told that if we invest in mutual funds we can enjoy the power of compounding. How does it work? There is no such thing as compounding in a mutual fund or a stock or anything related to the market. You buy at the current price and sell at the current price after a while. The selling price may be higher or lower than the buying price. We use the mathematics of compounding to understand how much the investment has grown (or fallen). That is all. Other than that, there is no magic of compounding or the magic of compounding. Do not take the nonsense peddled by sales guys seriously. If you want to enjoy the power of compounding, get a fixed deposit, recurring deposit, PPF, etc.

Compounding means, you invest Rs. 100 in a product that gives you a fixed return of 10% say. After one year, you will get 100 x (1+ 10%) =110. After one more year, 110 x (1+10%). That is the original amount plus the interest grows at the fixed interest rate. After one more year, 110 x (1+10%) x (1+10%) and so on. Thus compounding means an amount plus its interest receives an interest then the total amount receives interest and so on. Since there is no concept of an interest in mutual funds, there is no compounding too. Watch this if you prefer video and then this

47: I just saw an ad that said a mutual fund scheme has given an annualized return of 21.35% since inception. Does this mean the return each year was 21.35%?! No. Read what you asked again. You said, annualized return and that is not the same an “annual return”. To understand the difference and find out how annualized returns are calculated, try the most basic question about mutual fund returns.

48: Okay, how about: How are mutual fund returns calculated? Sounds good. Let us start with the SEBI rules and the universally followed convention of calculating returns. Returns for a duration of less than one year are absolute. For example, you buy at a NAV of Rs. 15 per unit in January 2018. The current NAV is Rs. 11 per unit. What is the return?

Since the duration is less than a year, we calculate the absolute return as (11 – 15)/15 = -0.267 or = -26.7%. The main problem with the absolute return is that time does not feature in the calculation. So the absolute return does not really mean anything.

Above one year, the annualized return has to be calculated. This is easy to do when you make only one purchase. Suppose you buy at a NAV of Rs. 15 on 1st Jan 2018 and you want to know the return as on March 31st, 2022. The first thing to do is compute the time elapsed in years. So (Mar 31st 2022 – 1st Jan 2018)/365 = 4.24 years.

Then we use the standard compounding formula: Final amount = purchase price x (1+ R)^n

Here, final amount = Nav on Mar 31st 2022= Rs. 11 per unit (say)

Purchase price = Rs. 15 per unit.

n = duration = 4.24 years.

R = annualized return.

^ means to the power of. For eg. 2^3 means you multiply 2 3 times = 2 x 2 x 2 = 8.

So here you multiply (1+R) by n times. Suppose n =3 for example,

Then to find the final amount we multiply the purchase by (1+R) x (1+R) x (1+R). This means that IF (repeat IF) the mutual fund grew as if it compounded as Q46, then R would the annualized return. Recognize that we are trying to understand the growth of a fund by assuming the same return applies to all years. This is very very far from true but this is necessary to compare the fund returns with an FD return where there is actual compounding. Remember there is no such thing as a fixed annual return in mutual funds. We are trying to measure growth assume there is one ONLY for the purpose of comparing it with a risk-free instrument.

Now, for the numbers given above, 11 = 15 x (1+R)^4.24. This has to be turned around to get R.

R = (11/15)^(1/4.24) -1 = -7%

49: I have heard of the term CAGR, what does it stand for?

CAGR is the compounded annualized growth rate and is the same as the annualized return mentioned above. You can see an example here.

50: I have a mutual fund SIP running, how does one compute annualized return for that? This is done by an approximation technique that you studied in 11th or 12th standard math. Since there are multiple investments involved, we try and find a single annualized return number that will fit each of them. This is known as the internal rate of return (IRR). When the investment dates are random, the math is modified a bit and the method is then known as extended IRR or the XIRR. Read more: What is XIRR: A simple introduction or watch this

51: What kind of returns can I expect from mutual funds? This depends on several factors. What type of fund that you are invested in. What category within that type you are invested in. When you started investing in it. In question 9 (part 1), we covered the types of mutual funds: Equity funds, debt funds, and gold funds. So you need to ask a basic question first. Please note that, even if we are clear about these, all we can do is only expect! Reality can be very different, especially from the past. Again see this.

52: When should I use equity funds? When should I use debt funds? When should I use gold funds? Is that basic enough for you? It sure is. Again this depends on your need. If you need money within the next:

5 years: Use no equity fund. Stick to only debt funds or better still, stick to bank deposits.

5-10 years: You can have a small exposure to equity funds and rest to debt funds or bank deposits.

10-15 years: Reasonable exposure to equity funds (40-50%) and rest in debt funds

15 years and above): Reasonable exposure to equity funds (50-60%) and rest in debt funds or PPF or EPF.

Stay away from gold funds as gold is riskier than stocks!

53: How to select a mutual fund? To be able to select a mutual fund, you need to be clear about two things. What is your need? (see part 1 for this and above) What type of fund is suitable for your need? Once you are clear about your need, the next question is, which category of mutual funds is suitable for that need? We just look at how to select fund types. From within a type, a category has to be selected next. For long-term goals and in particular, wrt equity funds, choosing an index fund over an actively managed fund would be easier to manage and low in cost.

54: How do I select a mutual fund category? So now, we know whether we need to use an equity fund or a debt fund or both for our need. How do we find a suitable equity fund category? How do we find a suitable debt fund category? This is what your question actually means. In order to select fund categories, you must be able to judge how much returns can fluctuate. That is you need to be able to measure risk (like we looked at measuring return above). So you need to ask me, how do I measure risk in mutual funds?

55: Why make it so complicated? Why can’t you just tell me in which fund I should invest in? If you want readymade solutions, use the Freefincal Robo Advisory Software Template, punch in your numbers and then find suitable funds from my Handpicked Mutual Funds September 2018 (PlumbLine). However, if you invest without understanding, then your losses are your own.

56: This sounds complicated and unnecessary. Can I just pay someone to help me select the right fund? Yeah, effort always seems unnecessary (at first). Okay, if that is the way you want to roll, ask me first, who should I not get mutual fund investment advice from?

57: Who should I NOT get mutual fund investment advice from?

- Banks, especially relationship managers. Better not visit banks or take calls from them, unless they want to verify your credentials

- Sales guys. That is people who will offer investment advice for “free” but will get commissions from your investment daily (from the NAV) and claim as if the commissions come from somewhere else. If you choose “direct plans”, you can get rid of both these issues.

- These are filled with sales guys looking for business

- Facebook groups like Asan Ideas for Wealth. Using it for finding the best bread toaster, not the best mutual fund

- People like me, who have no responsibility towards you. So what should your next question be?

58: Sigh! Who should I get mutual fund investment advice from? From a fiduciary. Say that with me: fi-du-ci-a-ry. A fiduciary is someone who is responsible for the well-being of your money. Someone who is expected to always act in your best interests. Of course, that is a definition on paper. In real life, you got to be careful. So you can safely get investment advice from a SEBI registered investment advisor who functions as a fee-only financial planner. These are professionals who will create a full financial plan for you in exchange for a fee and will suggest products that will not get them commissions or profit directly or indirectly.

59: Oh god! Finding a fiduciary seems harder than finding the right mutual fund! Can you help me find one? Yes, it is pretty hard, but I can help in two ways. Choose a fiduciary who:

- Charges a flat fee and not a fee linked to your income or assets. This is a proxy for commissions.

- Recommends only direct mutual fund plans. Make sure they do before you sign up. A lot of rule-breakers out there.

- is experienced and qualified, in addition to the mandatory SEBI registration as an investment advisor.

- can answer these tough questions satisfactorily

60: You said, you can help in two ways, what is the other way? Thank you for paying attention. For the last five years, I have been maintaining a list of such fee-only fiduciaries. Use this as a short-list, apply the above criterion and get going! Hundreds of readers from all over the world are working with them to become better investors.

61: I want to be a DIY investor, so tell me how do I measure risk in mutual funds? Come to my arms, friend! The first thing to recognize is, mutual funds are classified in two ways: (a) by how they invest and (b) the associated risk. So if we know how risk is measured, we quickly understand how to classify mutual funds. Then we will know which category to choose when and then finally pick a mutual fund. No, this is not hard, this is common sense, and it is often the first casualty.

There are many ways to measure risk, but we will start with the simplest as you can find this number in popular investment portals. This is known as the standard deviation. Suppose I go to my class of 50 and give them a coin and a measuring device and ask each of them to measure the thickness of the coin in turns. When they finish, I will get 50 answers for the thickness.

Suppose the instrument that I gave (remember a screw gauge from school or college?) is pretty accurate, I will get results that are not too different from each other: 1 mm, 1.1 mm., 0.98 mm, 0.99 mm, 1.2 mm, etc. I can now calculate the average thickness of the coin measured. I now ask, how much did each individual measurement deviate from the average? Since the instrument is accurate, the individual deviations will be small. The standard deviation is a measure of such individual deviations from the average.

If the instrument was faulty and the students were lazy in measuring, the spread in the results will be large. Hence deviations from the average will be large. Hence the standard deviation will be large. Now, let us head to mutual funds. Over the past 3 year periods, let us compute the monthly return. So we will have 36 data points. We can get an average monthly return.

We then ask how much did each monthly return deviate from the average. This is again the standard deviation and is the most straightforward measure of mutual fund risk. The higher the standard deviation, the higher the monthly returns fluctuate and the higher the risk. Debt mutual fund that invests in bonds will have a much lower standard deviation than equity mutual funds. Gold mutual funds will have a standard deviation that is comparable or even higher than equity mutual funds. We can study the standard deviation within a fund type and understand which are riskier than the other. Let us do this for equity mutual funds first. So now please ask, what are the major equity mutual fund categories?

62: I am supposed to be asking the questions here! Why are you tell me what to ask? It is annoying! Because if you do not ask the right questions, you have no way of finding the right answers. Now get on with it!

63: Sigh! What are the major equity mutual fund categories?

- Diversified equity mutual funds: These funds invest in stocks from different sectors at all times with vary market capitalization (see below for what that means)

- Thematic equity funds: These invest either in a particular way or invest in a particular type of stocks only

- Hybrid equity funds: In addition to stocks, they can also invest in bonds or gold, but they ensure that the annual average of the equity exposure is at least 65% to be classified as equity funds

64: What is market capitalization? The definition is the current market price times the number of available shares. This is also known as full market capitalization. Another definition is the free-float market capitalization, where only the shares that can be freely traded is used. That is shares held by the promoter or the government are excluded. Market cap is an important risk measure. Typically, well-established companies with several shares available for trading have a high market cap. This means that one can buy or sell a lot of those shares without affecting the price too much. So higher market cap means lower price volatility.

65: This means there should be a way to classify market cap so that risk can also be classified? You are catching on! Yes indeed, there is a large market cap or large cap, mid-market cap or mid cap and a small cap. What is large, middle or small is arbitrary, but SEBI now has come up with a definition.

Large Cap: 1 st to the 100th company in terms of full market capitalization

Mid Cap: 101st -to the 250th company in terms of full market capitalization

Small-cap: 251st company onwards.

Risk classification in terms of increasing risk: large-cap —> mid-cap —-> small-cap

66: Can you similarly classify the major equity fund categories? Sure!

Hybrid funds —> Diversified equity funds —-> Thematic funds (increasing risk)

67: What are the sub-categories under each major category? How are they classified in terms of risk?

This question will have full of jargon. We will try and explain some of them as we go along. We shall only consider equity funds.

Hybrid funds (increasing risk)

Arbitrage funds –> Equity Savings funds –> Conservative Hybrid –> Balanced Hybrid –> Multi-asset –> Balanced Advantage –> Aggressive Hybrid (phew!!)

Equity Funds (increasing risk)

Large Cap –> Large and Mid cap, ELSS –> Multicap, Value, Dividend Yield, Contra, Focused –> Mid cap –> Small cap –> Thematic/Sectoral

68: Which day of the month is the best for SIP or mutual fund deductions, and why? (This is a question I answered on Quora) First of all, this question is out of order. I forgot to include this up above, and it would be a pain to renumber now. So, I apologize.

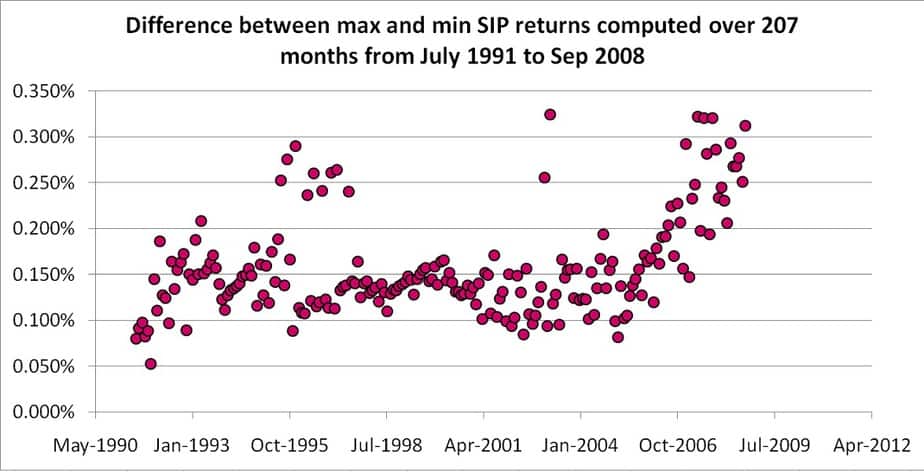

Answer: Any date will do! Why? See the difference below between the max SIP return and the minimum SIP return of 4147 10-year SIP returns. To compute this difference, we have used all possible 30 days in the month as the SIP date and considered every possible month from July 1999. There is no such special date! Stop searching for it. The full analysis is here

69: Why cannot I hold more of mid caps and small caps, as I am young? This is like pretty much like saying, returns from mutual funds are guaranteed – small caps will definitely outperform mid caps and mid caps large caps. Well, not so fast. They might or they might not. It is down to sheer luck. See: Large Cap vs Mid Cap vs Small Cap Funds: Which is better for long term investing?

You can choose to hold more of mid caps or small caps but also must be prepared to book profits and re-enter tactically periodically. Just buying and holding will not work.

70: What is a debt mutual fund? Suppose your dad invested Rs. 10,000 in a bank FD and the bank agrees to pay him interest once a year at the rate of 7%. Typically the FD is an agreement with the bank and your dad. What if, your dad could sell the FD for profit or loss before it is completed?

He wants to know if you will buy it. You check the rates of current FDs, and they offer only 6% interest. So you choose to buy your dads FD. Since his rate is higher, he sells for Rs 11,000 a profit of Rs. 1000. Once you buy, you start getting interested. On the other hand, if current FD offers 8% interest, you buy only for Rs 9000.

Thus a debt mutual fund buys such tradeable fixed deposits also known as bonds and tries to make a profit from interest and also buying and selling. Debt mutual are typically harder to understand than equity, and we will not dwell too much on those here. If you are interested, get my free e-book: Free E-book: A Beginner’s Guide To Investing in Debt Mutual Funds

I also have some basic YouTube videos

71: Do I need to use debt mutual funds, or are equity mutual funds enough?

You can use them but only if you understand various associated risks. For a start, stick to one equity mutual fund for long term goals and combine it with PPF or EPF + VPF for the fixed income part. If you want, you can start with a liquid fund like Quantum Liquid Fund to keep some rainy-day money for emergencies

72: What is a liquid fund? When should I use them?

A liquid fund is one that buys and sells short term bonds of duration 91 days or less. A liquid fund has many distinguishing features compared to all other mutual funds. Some are:

- Its NAV is declared on all days including non-business days.

- You can redeem money in about 48 hours. That is, if you make a redemption request today, you will get the money day after tomorrow (if tomorrow is a business day). That is, it will be processed in one business day or T+1. For other funds, it will take three business days to process (T+3)

- If you buy liquid funds before 2 pm on a business day, units will be allotted at the previous day’s NAV. If you purchase after 2 pm on a business day, you will get the same day’s NAV. For all other funds, buy before 3 pm on a business day it will be same day NAV, and after 3 pm on a business day, it will be the next business day’s NAV. (cut off times were changed during the lockdown

Note that liquid funds are marketed as “safe”. This is relative to equity funds and other debt funds and not absolute.

73: How are mutual funds taxed?

If you prefer video, check this out for an answer. When it comes to mutual fund purchase redemption and taxation, always think in terms of units. Also, there is an additional definition when it comes to tax.

Any mutual fund whose annual average of the equity held is at least 65% is called an equity mutual fund by the income tax department. All other mutual funds are called non-equity mutual funds.

Mutual funds are taxed only when you redeem them. For an equity mutual fund, the gain from each unit purchased less than or equal to 365 days ago is called short term capital gains. For a non-equity mutual fund, the corresponding period is less than or equal to 1095 days.

For equity fund, gain from units older than 365 days are called long term capitals gains. For non-equity funds, the units have to be older than 1095 days to qualify for long term capital gains.

Equity funds:

Short term capital gains are taxed at 15% plus cess

For equity mutual funds, the total long term capital gains from all older than 365-day units redeemed in a financial year is tax-free up to one lakh. Beyond that, it is taxed at 10% + cess.

Non-equity funds

Short term capitals are added to income and taxed as per slab.

Long term capital gains are taxed at 20% plus cess. However, before computing the capital gain, the purchase price of the units should be increased by taking cost inflation into account. This process is known as indexation.

Indexation means I ask, In the financial year of purchase, the cost inflation index (CII) was 200 (say). Today that is in the financial year of redemption, the CII is 300 (say). What is my purchase worth today?

This is given by (purchase price x 300)/200 = Indexed Purchase price

(same logic as elementary math: If five people eat 7 samosas, how many samosas will 13 people eat?!)

Therefore:

TCG (with indexation) = Sale price – Indexed Purchase Price

With indexation, it is taxed at the rate of 20% plus applicable cess.

74: Are mutual fund dividends tax-free? No! Dividends are taxed as per slab.

75: Why did you ask me to avoid dividends? They can increase my returns, right? No! Dividends are declared by selling bonds or stocks. So when the dividend is declared, the NAV of the fund will decrease by an amount equal to the dividend declared. So you have not gained anything extra. There is no difference in return between a growth option fund and a divided option fund.

76: Will I get more returns if I buy a mutual fund with lower NAV? No. NAV is just a number. What matters is how fast or slow the NAV changes with time to determine the return. So the rate of change of (future) NAV (which is unknown at the time of buying) is important and not NAV itself

77: Direct plan funds have higher NAV, does this not mean I will get lesser units? Is this not a loss? No, it is not. While you will get lesser units, the NAV lost due to commissions in a regular fund is a lot more. Or to be precise, the rate at which the NAV is lost due to commissions is way higher than the rate at which you keep getting a lesser number of units. So quit worrying. Read more: Direct Mutual Fund NAV is higher so Investors will get fewer units: Is this bad?

78: A mutual fund distributor told me, “The fund house pays me for the service I provide, so I do not charge a fee from clients”. Is this true? False! The fund house pays them commissions from your money everyday!! This is why the NAV of the regular plan fund is lower than that of the direct plan fund.

79: What is a closed-ended fund, and how is different from an open-ended fund? In an open-ended fund, units can be continuously purchased from the AMC (when you invest) and sold back to the AMC (when you redeem). In a closed-ended fund, the purchase is possible only when during the new fund offer period (a couple of weeks) and redemption is possible only after the tenure of the fund (this can be weeks or months or years)

80: What is FIFO concept in mutual funds? FIFO means first in, first out. Suppose you purchased 75 units of a fund in Jan 2019 and 100 units in Feb 2019. When you redeem say, 100 units in Jan 2020: The 75 units purchased first will be redeemed and then the 25 units from the second purchase will be redeemed. This is essential for tax computation. So the units purchased first (in) will be redeemed first (out).

81: What is an arbitrage fund? When should I use them? Arbitrage means buying high in one market and selling low in another for profit. Stocks are not only purchased at their immediate market price. One can draw up a contract to buy or sell stocks at a future price. Sometimes there is a mismatch in price between the spot purchase market and the future purchase market. Buying and selling the same stock in both markets can result in a risk-free small profit known as arbitrage. Watch this for a simple explanation

Arbitrage mutual funds are treated as equity funds for taxation. Since the up and down movement in NAV is a lot less than normal equity funds, they can be used as a tax-efficient alternative to debt mutual funds.

82: What is an equity savings fund? When should I use them? These hold a mix of arbitrage transactions, few direct stocks and some bonds (10% min). Do not use them as they can mislead you into thinking that they are safe but, are not.

83: What is a Conservative Hybrid fund? When should I use them? These hold a mix of 10-25% equity (including arbitrage) and the rest in bonds. Do not use them as there is no need for this mix!

84: What is a balanced hybrid fund? When should I use them? This will have 40-60% equity without arbitrage and rest in bonds. Do not use them as there is no need for this mix!

85: What is a multi-asset fund? When should I use them? This must invest in min 10% of gold, bonds, and stocks at all times. Rest is up to the fund manager. Some funds in this category like ICICI Multi-asset fund, are suitable for first-time investors who do not want to take on too much volatility.

86: What is a balanced advantage fund? When should I use them? The fund manager will adjust equity and bond allocation dynamically. Some funds may be suitable for conservative investors, but care is necessary for selection.

87: What is an aggressive hybrid fund? When should I use them? This will invest in 65% to 80% in equity (including arbitrage). This is suitable for new and old investors who can handle some volatility. See: Using Balanced Mutual Funds As The Core Equity Portfolio Holding

88: What is the difference between a Large and Mid cap fund and a multicap fund? To be frank, this is blurry. The large and mid cap will have a minimum of 35% Large Cap stocks and min 25% Mid Cap stocks, while multicap will have no such restriction. So in principle, a multicap fund could be a large cap fund! A user should either have a large and mid cap fund or a multicap fund as the only equity fund in their portfolio!

89: What is a Dividend Yield fund? When should I use them? These invest in companies that provide consistent dividends and therefore, net profits. The volatility will be less, but it can test investor patience. Best avoided by new investors.

90: What is a focused fund? When should I use them? Most mutual funds tend to invest in 30-60 stocks. A fund that is restricted to invest in 30 stocks is a focused fund. The volatility will be high, and if the fund manager gets it wrong, it can cause losses for the investor. Best avoided by all.

91: What are Thematic/Sectoral funds? When should I use them? These invest 80% of their portfolio in a particular theme (energy, consumption etc.) or type of stocks or a particular sector (banking, pharma, infra) of stocks

92: What should my equity fund portfolio look like?

It should have only one fund (unless you are a crorepati). That one fund can be one of the following (increasing risk):

- Multi-asset Fund

- Aggressive Hybrid Fund

- Large and Mid cap fund

- Multicap fund

If you want two funds then: Large cap fund (Nifty index fund will do), one mid cap fund (Nifty Next 50 index fund will do, yes it is a mid cap fund!) There are other possibilities, see Eight ways to combine Nifty Next 50 with active funds, but take it easy!

93: I have heard of something called portfolio rebalancing. What is it? Suppose you start with 50% equity and 50% fixed income and after one year, the equity portfolio has grown to 60%, this is an imbalance and higher risk. So once a year, you shift 10% from equity to fixed income to correct this to lower risk. This is known as portfolio rebalancing. Watch these videos for a simple introduction

94: Should I stop investing when the market moves and hits an all-time high? No. It will not serve any purpose as the money you have already invested is anyway facing the full risk of the market.

95: Should I book profits and move from equity funds to safe instruments when the market has moved up too much? You can, this is called timing the market to lower risk (not enhance returns), but there is no need for you to do so. See: Do we need to time the market?

96: Should I invest each month or can I wait for market dips? You can, but it will be of little use other providing you with some mental satisfaction. See: Buying on market dips: How effective is it?

97: Can I invest each month and also wait for market dips? You can, but it will be of little use other providing you with some mental satisfaction.

98: Can I invest in debt mutual funds for my long term goals? Yes, you can, as a new investor, I would recommend not doing so until you understand risk. Once you are comfortable, you can consider gilt funds.

99: What is an index fund? Can I invest in them? In an index fund, the fund manager simply tracks the stocks in an index like the Nifty without actively choosing stocks. This lowers the fund management fee and minimizes risk from fund manager choices, but does not offer protection when the market falls. Check this video to understand index investment options in India

100: What are exchange-traded funds (ETFs)? Exchange-traded funds are a type of index funds. Here a mutual fund investor buys and sells units from other unitholders like a stock using a demat account. How ETFs are different from Mutual Funds: A Beginner’s Guide. Also see: Interested in ETFs? Here is how you can select ETFs by checking how easy it is to buy/sell them

100: What should I do after I start investing in mutual funds?

- Do not buy more mutual funds!!

- Do not follow news, blogs, social media accounts on mutual funds.

- Do not look at your portfolio every day. Once a year is enough.

- Learn how to reduce risk in an investment portfolio

- Learn how to review your mutual funds in three simple steps!

- Remember that money grows best when it is left alone.

- Do not forget that investing without a goal will make it hard for you to manage risk.

101: Is this all that I need to know about mutual fund investing? We have only felt the tip of the iceberg. There are many more questions left, but this, I believe, is enough for a start.

You can download this article as an E-book: Beginners guide to investing in mutual funds

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)