In this edition of the reader story, 31-year-old Mr Yo (name withheld on request) explains how he has systematically structured his money management and tracks his financial goals. This is a follow-up to his previous audits: How I track financial goals without worrying about returns. (2021), My net worth grew 33% last year, but my focus is goal-based investing (2022).

About this series: I am grateful to readers for sharing intimate details about their financial lives for the benefit of readers. Some of the previous editions are linked at the bottom of this article. You can also access the full reader story archive.

Opinions published in reader stories need not represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless necessary to convey the right meaning and preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. They can be published anonymously if you so desire.

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We have also started a new “mutual fund success stories” series. This is the first edition: How mutual funds helped me reach financial independence. Now, over to the reader.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Thank you again for allowing me to write an article on your blog and for helping me learn so many things. My main motivation to write this is to force myself to document my thought process at this time and revisit (and hopefully write) it every year (at least once like this one) to see the evolution.

About me: I’m an engineer who passed out in 2013. I belonged to a lower-middle-class family. My interest in Excel helped me explore and enjoy reading/watching/trying things. Currently, I’m working with Chandan Singh Padiyar as my Fee-Only-advisor. I got married in November 2019 and have a daughter of 31 months now. I have a car loan from the company car lease plan. I’ve four dependents and a 20k minimum commitment to charity.

Basics: Term Insurance: 32x of current annual expense bought in December 2018 + office term insurance 20x.

Medical Insurance: office provided 3l +15l ( for me, my wife, daughter and my parents), personal insurance of 10l + 40l (for me, wife and daughter)

Contingency fund: 7 times monthly in-hand salary or 12 months of monthly expense + 3l of medical cash cover

Personal Accidental Cover: 19x of current annual expense bought in April 2022 + office accidental insurance of 21x

Goals: All the goals are color-coded for ease of tracing. They are listed below:

- Orange shades: Retirement

- Yellow shades: Home

- Purple Shades: Kid’s future

- Grey shades: Contingency

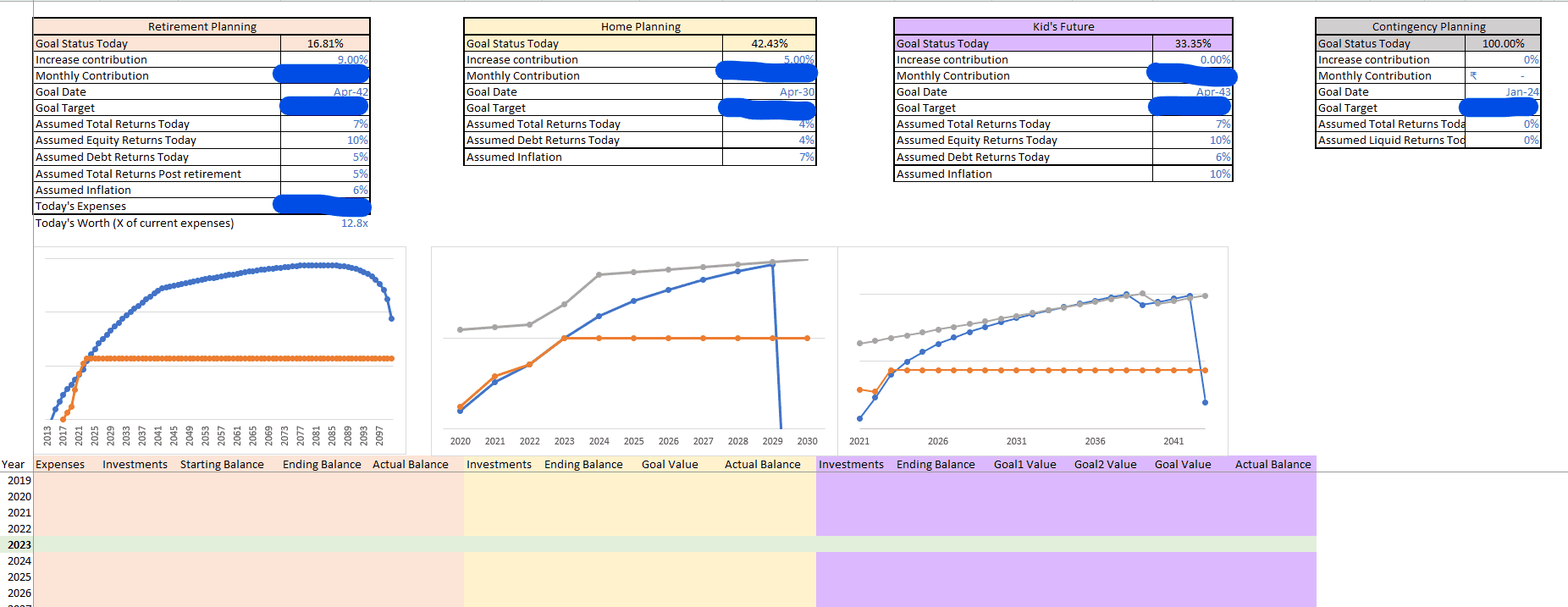

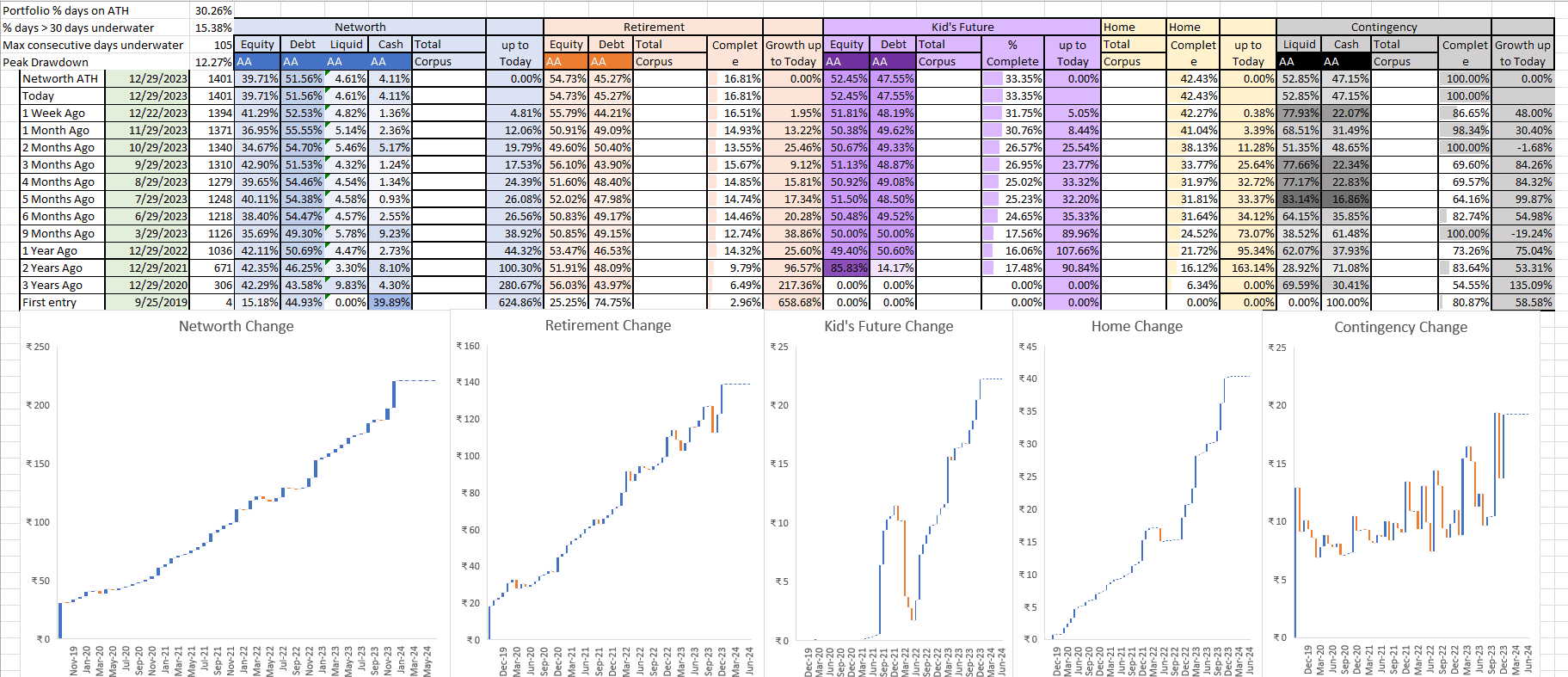

Assumptions, overview of plans and status of all goals are as below. All the graphs shown are plotted with the y-axis in log scale to appreciate the real growth rate. I made some modifications to plans this year. Some important ones are:

- Retirement

- Date from April 2050 to April 2042. The main motivation is rooted in closing retirement responsibilities by kid’s education.

- The above change also required aggressive investment targets, which I’ve tried to pull in with aggressive target investment contribution change from year over year 5% to 9%

- Impact of this shift also meant the percentage complete reduced from 27.27% last year to current 16.81%

- Home

- I’ve revised the target upwards by over 100% since last 2 years due to sudden jump in real estate market last couple of years

- Kid’s education

- I’ve reduced the return expectation for this goal from 8% to 7% due to falling debt fund returns.

- To have a safety net I’ve also reduced annual increase in contribution from 5% to 0% targeting faster corpus accumulation and giving more time for equities to provide returns

- Contingency

- Removed monthly contribution for this and increased the goal amount to a comfortable level

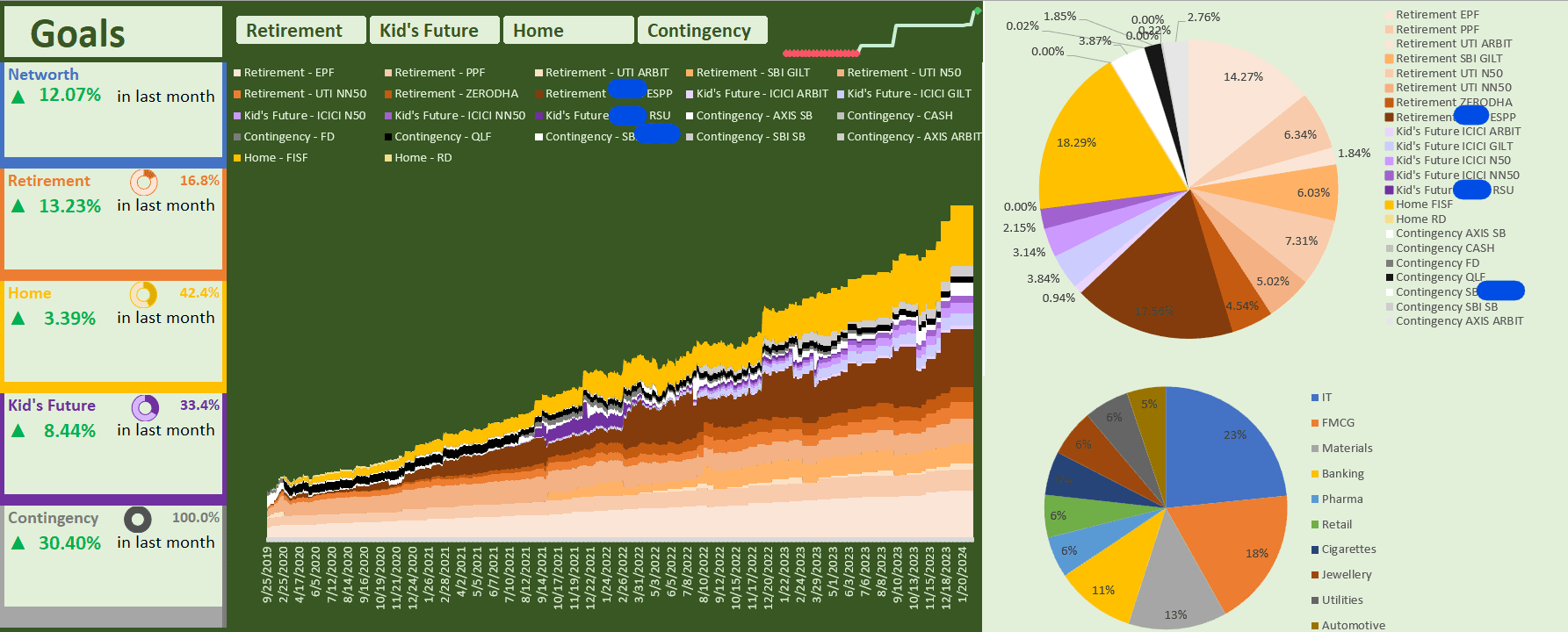

The distribution of the goals across different accounts and statuses is as shown below. Left side shows all the goals, their current completion status, movement in last month and their values (hidden). The central part shows the distribution across the assets in total networth with selectable filters from top centre. Next to it is networth movement in last 50 days. Right side shows asset allocation of today across accounts.

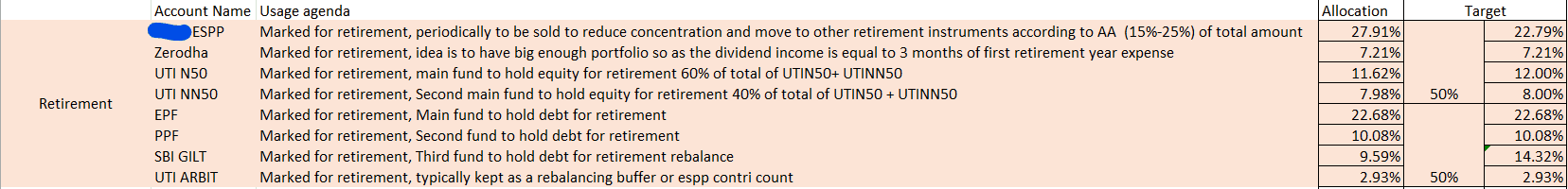

All mutual fund holdings are in direct plan growth option. Equity mutual funds are only index funds (UTI and ICICI) with a target 60-40 allocation between the top 50 and the next 50. In debt space, for very long term goals 10 10-year constant maturity gilt funds (ICICI + SBI) are used. For medium-term money market funds (Franklin) and for short-term liquid funds (quantum) and arbitrage funds (UTI + ICICI+AXIS) are used.

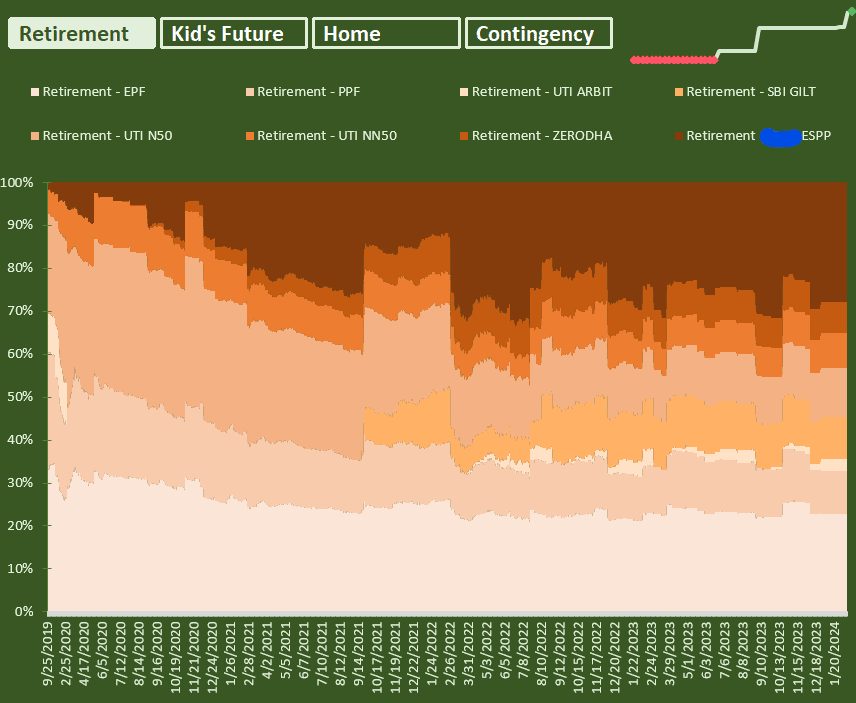

Retirement: I intend to retire not before 55 (that if the company keeps me). I can become Financially Free much sooner, and now I am targeting and trying for it. Last few years, quick growth in company has helped me move fast on this goal. The current corpus is equivalent to roughly 12.8x of current annual expenses. The evolution of investment philosophy and plan of investment is as shown below:

My asset allocation is tricky due to the large allotment towards company ESPP (employee stock purchase plan), RSU (restricted stock units) allocation, and large discounts/fast stock movement. I only invest monthly for this goal through ESPP contribution and EPF (employee provident fund) contribution (both autos deducted from salary pre-credit to account). Rest accounts are updated every few months (or when very skewed) to the target allocation (or nearby it) by either selling company stocks or fresh capital infusion. I make some investments in direct equity as a hobby and expect 0% returns (not including any details as it is about a 2-year-old portfolio, and I intend to cap it to a maximum of 10%. The evolution of asset distribution with time is as follows.

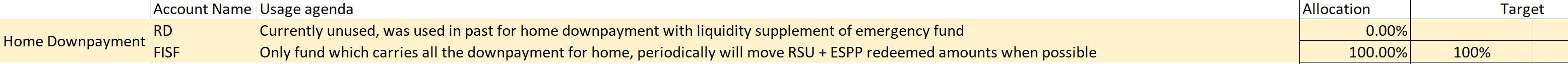

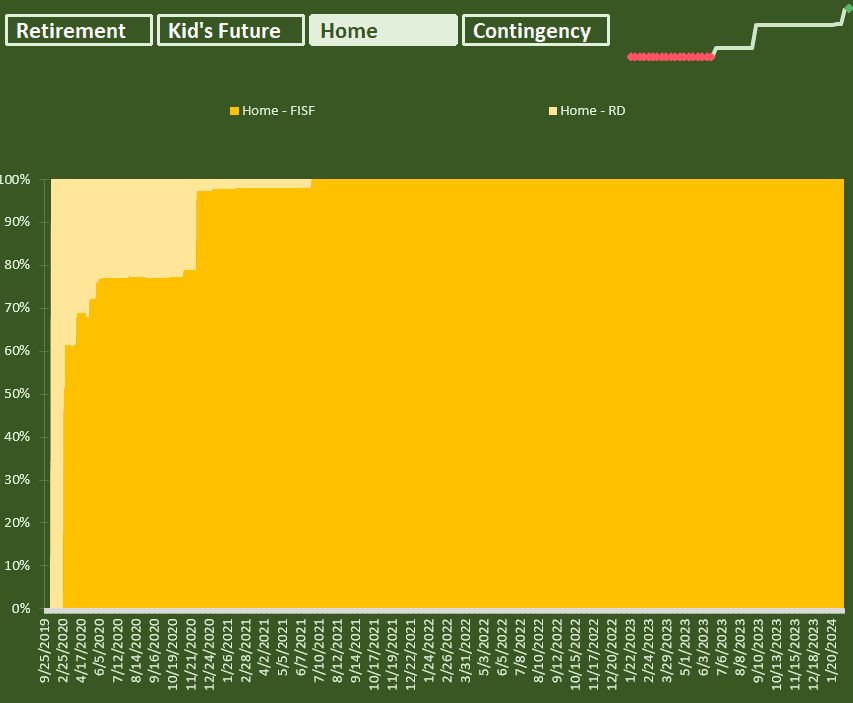

Home: I intend to have roughly 50% of the home’s purchase price accumulated before I go to buy. This is a tentative plan and has been revised a couple of times. This year, I increased it by more than 50%. Hopefully, I can have all the money for home ready and then get home to pre-close it anytime. Last year, I invested aggressively for this goal and hopefully would be able to next year. The philosophy and plan of investment are shown below.

As it is a short-term goal, the whole amount is kept in a debt fund (100% debt) with periodic inflows from selling company equity at opportune moments. In the early days, this goal was to share the amount with the emergency fund. But now it has been split once the emergency fund was sufficiently big. The evolution of asset distribution with time is as follows.

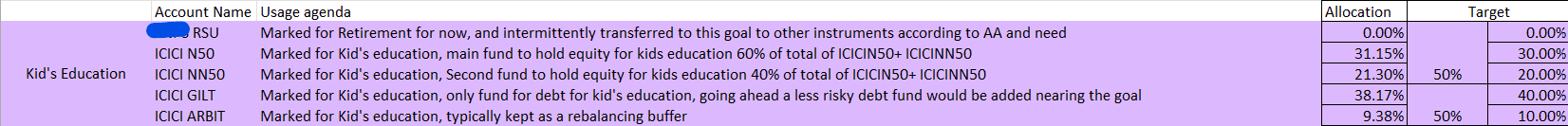

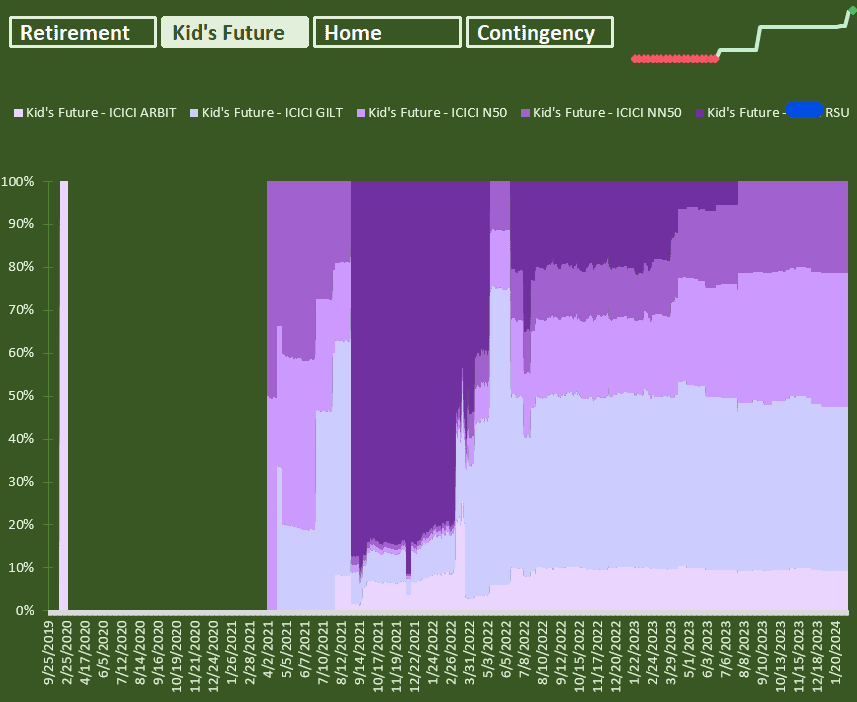

Kid’s Future: I intend to have a single goal for all undergraduation expenses, marriage expense,s and if sufficient, then post graduate expenses. I’ve not yet been able to decide if I want to plan for all the education or let her learn with education loan. I’ve modified the strategy to remove all company RSU’s (restricted stock units) for this goal and moved them in retirement. Philosophy and plan of investment is as shown below.

Asset allocation for this goal was very skewed last time and I’ve now realized that keeping RSU here will continue to complicate it. Hence I reshuffled the holding of this goal to the amount I had marked for this goal last year. The evolution of asset distribution with time is as follows.

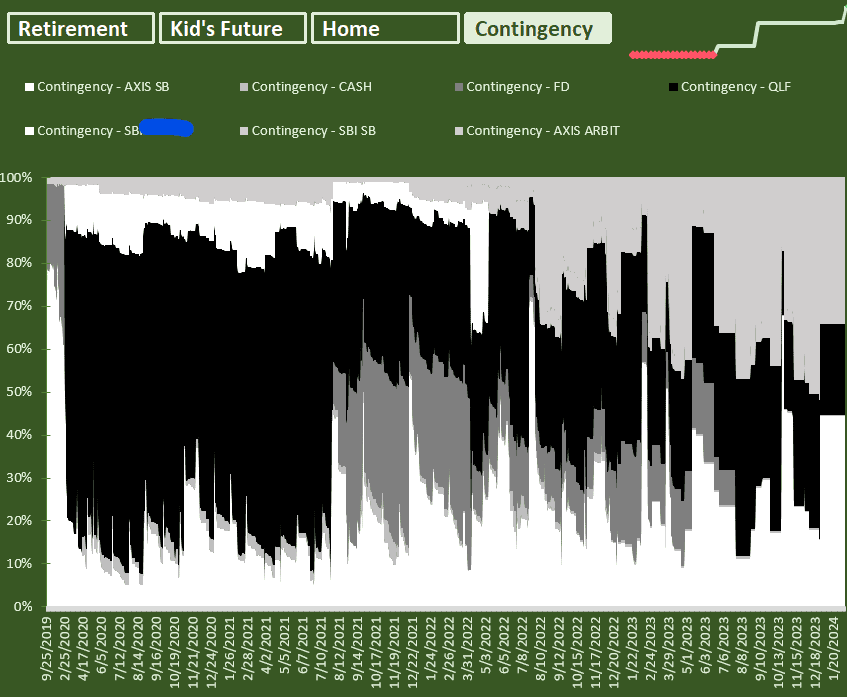

Contingency fund: I described this goal mostly in terms of basics. The next plan is to have a kind of sinking fund/very short-term goal fund (holidays)/equity opportunity fund/gadget replacement fund allotted within this category. I have suggested a nice name for it as an income stabilization fund. The idea for this fund comes from the need to manage my messy/variable salary structure. Many months due to different events my salary varies from negative to somewhat positive to normal salaries. Months with less salary are difficult to manage as the expenses more or less remain constant. Plan of action going forward is to sell company stocks at “opportune moment” or in “moment of need” and save it in axis arbitrage fund. The amount would be something like say 6 months salary. Once the amount goes below 3 months, I look out for the time to sell company shares (opportune moment). If I cannot sell it even when the fund goes below 1 month expenses, I sell the stocks irrespective of price (moment of need). This still needs some working and planning to be done. The evolution of asset distribution with time is as follows.

Thoda Gyaan:

I believe there is nothing which can give growth better than salary. I’ve never switched my company in all these 10 years+. I believe real value can only be extracted from organization as well as individual only after sufficiently long time (also I’m lazy). I try to follow same policy even for my holdings and not intend to change them much. I personally don’t track neither XIRR or CAGR or even investment amount. I only look at the movement of the portfolio month on month or even year on year. If portfolio is growing at steady pace it doesn’t matter if it is growing because of more investments or gains. The way I audit my goals at portfolio level with asset allocation and overall progress is by looking at the plan of goals graph y-o-y (first one in the goals section) and the growth of portfolio graph m-o-m below.

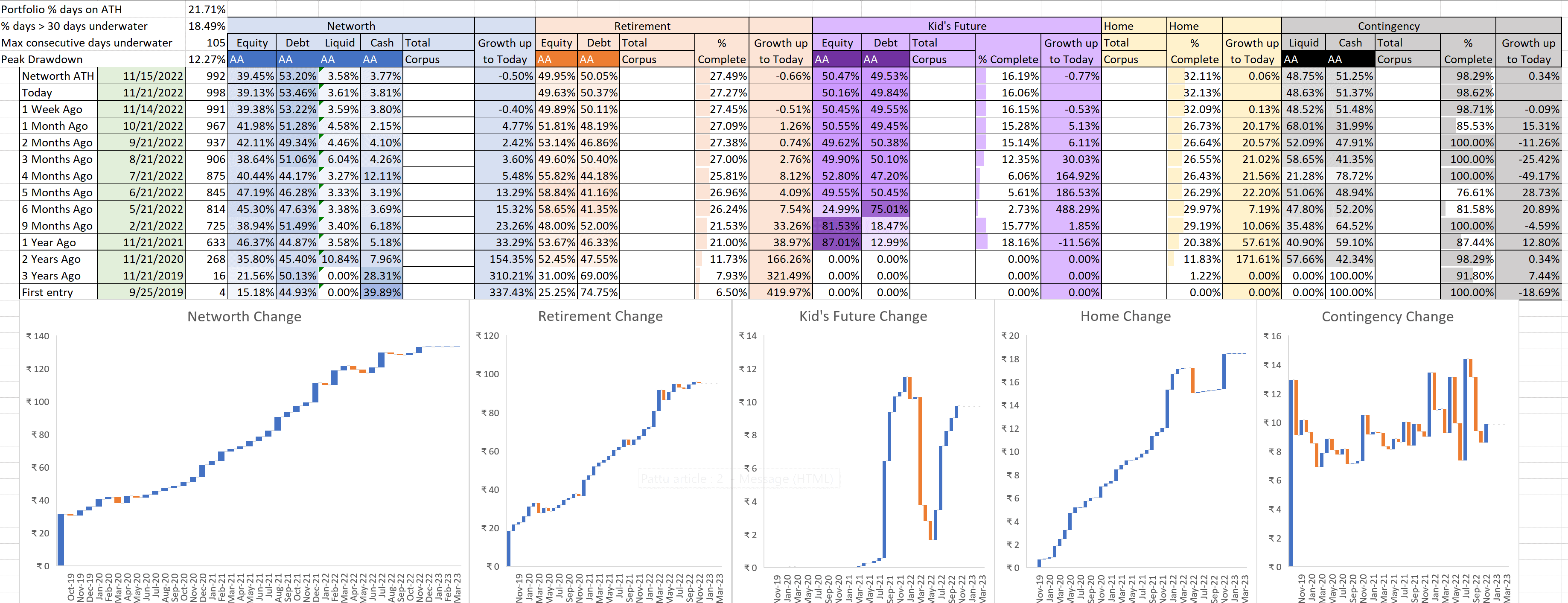

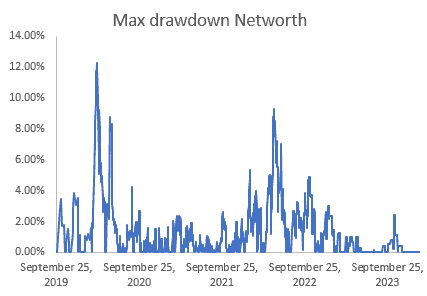

Being conservative person, I prefer to track portfolio level volatility or the risk by gauging 4 factors on top left i.e. % days on all-time high (ATH), % days when portfolio is below underwater more than 30 days, maximum consecutive days portfolio has been underwater and peak drawdown. Color shades which are equal to headers means the asset allocation is in line. Lighter shades mean less risky and darker shades means more risk. Y axis in the graphs below is calibrated to value 100 as of last years’ networth and other numbers are proportionately modified. First entry is the starting value of the all the goals before I started tracking using this tracker (25th September 2019).

Last year 21 Nov 2022:

This year 29 Dec 2023

Few Events of Last year:

- The net worth grew roughly 44% over last year (21 November 2022 to 21 November 2023 or 29 December 2022 to 29 December 2023) and 68% over 13 months (Last Audit 21 Nov 2022 to this Audit 29 Dec 2023) with the booming market though salary movement was minimal last year and this year.

- Lots of revisions in the goal amounts/date and investment plans

- I’ve decided to relocate from my current location to a new location (different city/state) which is costlier but convenient in other aspects. This would bring a significant amount of expense in short burst for which I’m boosting my contingency fund)

- The movement will also increase my monthly expense significantly and can hamper the ambitious target of early FI.

- My daughter will also start going to school which would also impact monthly surplus.

The remaining plans for the upcoming year are:

- Increase contingency fund -> create income stabilization fund within this goal.

- Keep watch on monthly expense jump and adjust retirement planning accordingly.

- Create hard copy of information (handbook) for my family to access everything in case of my non-availability.

- Have joint bank account

- Add nominations to all accounts

- Have a sample will

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2022 edition: Portfolio Audit 2022: The Annual Review of My Goal-based Investments. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower income.

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year, thanks to patient investing!

- Update: How I achieved investing nirvana.

- Twelveth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago, but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble, but now I aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth six years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

- Thirty-third audit: My journey: From Rs. 30 bank balance to financial independence

- Thirty-fourth audit: Our journey: From scratch to a net worth of 18 times annual expenses.

- Thirty-fifth audit: From a net worth of Rs. 6000 to auto-pilot goal-based investing

- Thirty-sixth audit: How I retired from corporate bondage at 46, two years ago!

- Thirty-seventh audit: How I learnt to keep it simple and build a net worth 19 times my annual expenses

- Thirty-eighth audit: How Abhineeth plans to achieve financial independence and build a house.

- Thirty-ninth audit: How Sahil plans to achieve financial independence by efficient tracking

- Fortieth audit: My Journey to a Ten Crore Portfolio

- Forty-first audit: Burdened with debt for several years, I am now aggressively investing in equity

- Forty-second audit: From Engineer to Librarian after Financial Independence and Early Retirement (FIRE)

- Forty-third audit: I lost six months’ income in F&O and ditched it for systematic investing

- Forty-fourth audit: My retirement plan to handle the harsh realities of the IT industry

- Forty-fifth audit: My investment journey: mistakes, 10 years of MF investing and recovery

- Forty-sixth audit: My MF portfolio is worth six crores despite multiple mistakes

- Forty-seventh audit: Saving, Investing, and Running Marathons: My 25-year Journey to Financial Independence

- Forty-eighth audit: Never Too Late to start: How I became financially savvy at 40

- Forty-ninth audit: My Investment Journey to a net worth 29 times my annual expenses

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. They could be published anonymously if you so desire.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)