In this edition of the reader story, we meet a 30-something tech consultant who often ignored logic and followed his heart, but still landed on his feet.

Opinions expressed in reader stories do not necessarily represent the views of freefincal or its editors. We must appreciate multiple solutions to the money management puzzle and empathise with diverse views. Articles are typically not checked for grammar unless it is necessary to convey the right meaning and preserve the tone and emotions of the writers.

If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail dot com. You can publish them anonymously if you wish.

Please note: We welcome such articles from young earners who have just started investing. See, for example, this piece by a 29-year-old: How I track financial goals without worrying about returns. We also have a “mutual fund success stories” series. See, for example, how mutual funds helped me achieve financial independence. Now, over to the reader.

Background

I’m in my mid-thirties and currently work as a tech consultant. My financial journey began way back in 2011, when I started as a software developer. In 2013, I bought land on the outskirts of Chennai (technically, it is Kanchipuram) and in a Tier-2 city for ₹5 lakhs. (Spoiler alert: those plots didn’t turn into gold mines.) Fast forward to 2018—I pursued an MBA, funded 50% from savings and 50% from an education loan. The MBA cost ₹20 lakhs, and yes, I still wonder if the ROI beats an index fund. After completing my MBA, I moved into tech consulting

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Investment Journey

2018-2019

- Armed with MBA wisdom (and a pinch of overconfidence), I jumped into stocks in Sep/Oct 2018. Invested ₹75K across 10–12 stocks. Highlights:

- Muthoot Finance – my shining star.

- Mindtree – bought at ₹800, sold at ₹650. (Math was never my strong suit.)

- Tata Consumer – bought at ₹220, sold at ₹195. It hit ₹400+ soon after. Timing is everything, and I had none.

- Yes Bank – bought at ₹230, sold at ₹100. Enough said.

- Also sprinkled money across random mutual funds like large-cap, small-cap, contra, banking, and debt funds. Basically, my portfolio looked like a buffet plate at a wedding.

- Many funds were from this list of funds to be avoided. https://freefincal.com/why-you-should-avoid-these-mutual-fund-categories/

- In 2019, I started binge-reading finance blogs and YouTube videos. Eventually, I found Freefincal and Dave Ramsey—finally, voices of reason!

- Loved Dave Ramsey’s “debt-free before investing” mantra. So, I focused on killing my education loan first.

- Sold all stocks in April 2019 for ₹73K and prepaid the loan. Some stocks were green, some red, but Yes Bank was a black hole. Lesson: Mutual funds > my stock-picking skills.

2019-2021

- I started following Freefincal’s Reassemble steps. Got a term insurance. And top-up health insurance

- Learned about Portfolio Construction and Asset Allocation—Eye Opener!

- “Most people have debt heavy portfolio because of EPF. It will be exceedingly difficult or take a long time for them to achieve 60% equity allocation. Rebalancing from EPF is not an easy option.” This quote lingered on my mind for a long time

- Covid Lock-down happened in 2020. Was expecting first child in May-2020.

- As a precaution, redeemed ELSS funds in April 2020 (invested in 2017). Even at covid lows, the cagr of the funds were 12%

- In April 2020, When the government announced partial withdrawal from EPF because of covid, I applied for the eligible amount hoping to invest in equity post the birth of my child.

- Confirmation bias. I was not sure when I applied if I was doing the correct thing. But after the article from freefincal on the topic I was relieved. https://freefincal.com/should-i-withdraw-from-epf-and-invest-in-equity-now/

- In May-2020, after the birth of my kid, I wanted to invest in equity but was not sure if the market will fall further or go up. So took the safe bet and closed the education loan with some of the capital. This is “The Art of Messing Up Correctly” Moment 1.

- June 2020: Biggest decision—buying a house for ₹60 lakhs in my hometown (tier-2 city).

- Took the plunge. Bought the house as an investment (I stay in my parental house) using loan. Total cost ₹67 lakhs, EMI = 50% of my salary.

- I wanted to invest in equity. Asked my parents to invest minor part of their salary in equities. They were reluctant. They preferred to invest in gold and other traditional instruments. When this house offer came, they suggested they will help with the house purchase (a bit of lumpsum for downpayment and supporting with the EMI if required).

- My calculation methodology/rationale (fun reference – Budget Padmanabhan Prabhu Style) was if I invest in equity, the principal will be from my contribution only. But if I invest in the house, as a family, the principal will be higher due to additional contributions from parents. I justified my rationale (again my confirmation/or some type of bias) with Pattu Sir’s general take that in the equation A=P*(1+r)^n, P is the most crucial factor. The returns “r” is out of control, but the principal “P” is in our control. We should try to maximize P. I am pretty that this was not Pattu intended when he says focus on P instead of R. His intentions are more on improving your income to increase the P.

- Decided to buy the house even after reading almost all articles on FreeFincal on the real estate topic. I agreed at that time (and even now agree) with Pattu’s view on avoiding real estate investments. This is when my irrational brain (with emotions) takes over my rational brain. This is my “The Art of Messing Up Correctly” Moment 2.

- Also, in 2020 Work From Home hype made Tier-2 city living sound like the future. Spoiler: offices reopened.

- Paid EMIs religiously and pre-paid whenever possible. Felt the EMI burden for the first time—education loan was peanuts compared to this.

- Mutual fund story: Invested ₹15K in HDFC Small Cap in 2019. By May 2020, it was ₹9K. Sold in Oct 2020 at ₹14K. Today, it’d be ₹50K. Do I regret it? Nope. (Okay, maybe a little.)

2022-2024

- Switched jobs during the IT talent war. Got a fat hike. EMI dropped to 25% of salary, so I doubled it to close the loan faster.

- Recently Freefincal ran a poll: pre-pay loan or invest surplus? Theory-me said “invest.” Real-me acted on “kill the loan!”

- This is a practical case (in a slightly different context) of why people are wrong about their risk appetites. https://freefincal.com/why-most-investors-are-wrong-about-their-risk-appetites/

- Closed the home loan in 2024 after 4.5 years. Total cost: ₹75 lakhs (₹55L mine, ₹20L parents).

- Maxed out kid’s SSY and wife’s PPF. Equity investing? Just ₹15K SIP/month.

2025 and beyond

- Post-loan life: Redirected EMI money to equity funds.

- Current allocation: 80% debt, 20% equity. Target allocation: 60% equity and 40% debt.

- Targets: ₹25L equity by 2026, ₹1Cr by 2030.

- Build core equity portfolio with mutual funds.

- Start stock investing after hitting ₹25L.

- Long-term goals: retirement, kids’ education/wedding, house in work city.

- Short-term needs: school fees.

- Short term wants – Classifying this as wants because I am having the itch (popular in Team BHP forum) to replace these stuff that are working fine but they need not be replaced.

- Gadgets:

My Android phone (2021), iPad (2019), and laptop (2016) are all past their official support period but still functional. The iPad is used regularly for kids’ online classes, and the laptop is mostly idle except for job interviews. I plan to replace them gradually, not all at once. - Automobiles:

My bike (2012) and my wife’s Activa (2013) are showing their age—low mileage and engine issues. Parents’ car (2010) is still in use for short city trips, under 200 km a month. - Travel:

We usually take one or two short trips within Tamil Nadu, Kerala, or Karnataka each year. I’d love to explore the North-East, Kashmir, Leh-Ladakh, and maybe even a Southeast Asian country or the UAE. - Solar Panel – Install 3KW solar panel in the house.

- Gadgets:

- Current State of Real Estate

- House Value – 75 Lakhs. Monthly Rent – 12K

- Plots Bought in 2013/14 – Less than FD returns.

- Plots my parents bought in 2017 has almost tripled in value by 2025.

- Learning – If investing in plots, invest in plots which will enter the city/corporation limits in the next 5 years. The plots I bought in 2013 are far beyond city limits and it may take another 10/15 years to become part of the city limits. The plots bought in 2017 by my parents grew in appreciation primarily because the locality became part of the city corporation. This is based on my limited experience in real estate. This can be a cause-and-effect fallacy as well.

Financial Instruments Used

- Insurance

- Term Life Insurance – Canara HSBC Life Insurance – 1.5 Crore

- Health Insurance – Top-Up Insurance 25 Lakhs for family. 20 Lakhs employer insurance for family with parents.

- Banking Accounts

| # | Account | Purpose |

| 1 | 1 Private Bank Salary Account | |

| 2 | 1 Nationalized Bank Account | Primarily for Investments |

| 3 | 1 Post Office Savings Account | For Emergency Funds |

| 4 | 1 Post Office Payments Bank Account | For UPI based Expenses |

| 5 | 1 Credit Card | Expenses. Using for the past 15 years with the same credit limit. |

3. Mutual Funds

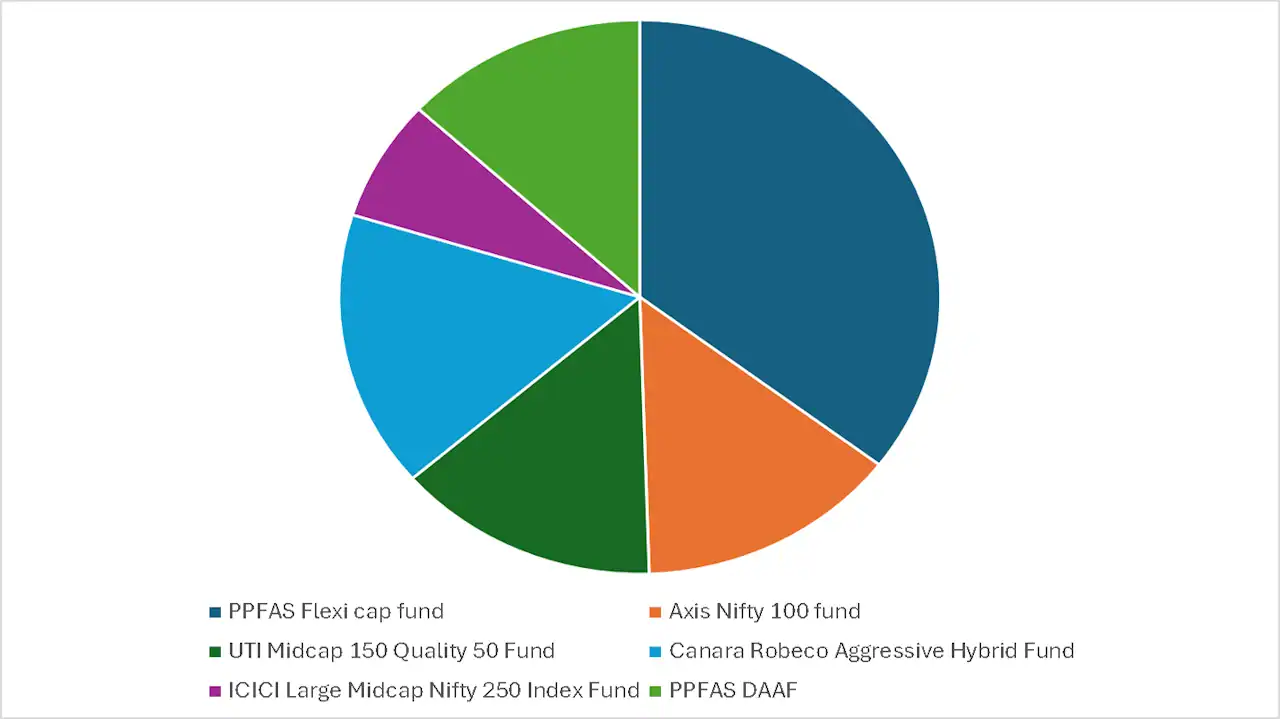

| # | Fund Name | Year Started | Weight | XIRR |

| 1 | PPFAS Flexi cap fund | 2021 | 35% | 16.5% |

| 2 | Axis Nifty 100 fund | 2022 | 14% | 13.8% |

| 3 | UTI Midcap 150 Quality 50 Fund | 2025 | 14% | 11.1% |

| 4 | Canara Robeco Aggressive Hybrid Fund | 2025 | 16% | 6.6% |

| 5 | ICICI Large Midcap Nifty 250 Index Fund | 2025 | 7% | 13.5% |

| 6 | PPFAS DAAF | 2024 | 13% | 4.3% |

4. Long Term Debt Instruments

- EPF, PPF, Wife’s PPF, Kids SSY

Mutual Fund Approach

Debt Mutual Fund Approach

- I do not have a clear approach on when and how to invest in debt funds. For short term goals, an RD is sufficient. I have a basic understanding of debt MFs https://freefincal.com/debt-mutual-fund-categories-explained/

- I invested in PPFAS DAAF as part of my emergency fund since I do not know when I would need those funds. So, I thought this may be efficient from both taxation and return wise.

- The requirement may arise in future when I must invest as part of debt allocation for long term goals when approaching the goal time.

Equity Mutual Fund Approach

- In theory, I agree with Pattu’s view on having only one nifty/Sensex index fund. https://freefincal.com/can-i-use-just-one-mutual-fund-for-all-my-financial-goals/

- But the returns in Midcaps and the risk reward ratio of midcap funds are too good to ignore. I have FOMO and do not want to lose out on the additional returns from the midcaps. The fluctuating experience with HDFC small cap fund in 2019-20 has ensured that I align with Pattu’s view on not requiring small caps in the portfolio.

- At present, since my equity allocation is less than 20%, I have followed a unified portfolio approach. https://freefincal.com/implementing-the-unified-portfolio-approach-in-the-wealth-accumulation-phase/

- Fund Selection Rationale

- PPFAS FCF – All the known reasons. Good returns, fund house, and fund manager philosophy etc etc.

- Ideally wanted to invest in Nifty LargeMidcap 250 Index fund. Not many funds were available in 2022.

- So settled down with Axis Nifty 100 Index fund and need one nifty midcap index fund.

- Went with UTI Midcap 150 Q 50 from NFO. I had decided to invest in the fund. Confirmation bias – Was happy to see Freefincal’s article on the fund https://freefincal.com/uti-nifty-midcap-150-quality-50-index-fund-review/

- Still proceeding with the UTI fund despite lower returns as well as the warning since I do not want to clutter the portfolio and the hassle of finding another fund. https://freefincal.com/why-nifty-midcap150-quality-50-index-performance-is-a-warning-for-factor-investing-fans/

- In 2025 added ICICI nifty LMC 250 Index fund. This is a redundant substitute of the above two fund.

- If I ever move from a unified portfolio to a goal-based approach, here’s the plan:

- ICICI fund will be assigned to one goal.

- PPFAS Flexicap will handle another.

- Axis Nifty 100 and UTI Midcap will be grouped for a third goal.

- Target Strategy: I came across an interesting idea on YouTube (thanks to Shankar Nath):

- “PPFAS Flexicap is basically a glorified asset allocator.” The suggestion was to replicate it using 70% Nifty 500 + 30% Nasdaq 100. The backtest looked solid (as Pattu and Fin experts say, “Show me a backtest that failed!”). So, my future plan is to implement something similar: 70% Nifty LargeMidcap 250 Index + 30% Nasdaq Index.

- Current Challenge:

Investing in Nasdaq isn’t easy right now. Mutual funds are closed due to SEBI rules, ETFs have a big price-to-NAV mismatch, and options like GIFT City or LRS feel like too much hassle. I’m exploring INDmoney, but after the Paytm Money experience, I’m cautious about tech platform lock-ins. - Global Diversification:

As Pattu says, most people don’t really know why they want global stocks or how diversification reduces risk. Honestly, I’m in the same boat—I understand it at a high level, but the technical details and nuances? Still fuzzy.

Apps and Tools Used

- I started investing in mutual funds in 2019 through Paytm Money, but later closed the account when they switched to holding MFs in Demat form instead of a Statement of Account (SoA).

- After that, I moved to AMC websites and apps. Initially (2022–2023), I invested manually every month by logging into each AMC app. Over time, this became a hassle due to website glitches and password issues. So, in 2024, I set up SIPs for automated investing to make life easier.

- Using MFCentral and Tickertape for a unified portfolio view and analysis.

View on Gold

- Gold is the hot topic in 2025, but here’s my take: I come from a South Indian family where gold is practically part of the DNA. Traditionally, families here hold a significant amount of gold as inheritance—often around 30% of total wealth, with the rest in real estate.

- Many experts suggest ignoring family gold when planning investments, but I disagree. If I add gold ETFs or gold mutual funds to my portfolio, my overall exposure to gold (family + portfolio) would be excessive. In a hypothetical scenario where gold prices crash (unlikely, but still), both family wealth and my portfolio would take a big hit.

- So, I prefer not to invest in paper gold.

Conclusion

Thanks to Pattu and Freefincal for guiding me through this rollercoaster. Without them, I’d probably be trading crypto and praying for miracles.

Reader stories published earlier:

As regular readers may know, we publish a personal financial audit each December – this is the 2024 edition: Portfolio Audit 2024: The Annual Review of My Goal-Based Investments. We asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: How Rohit’s early struggles defined his investment journey

- Eighth audit: Why my investments are still on track despite job loss and lower income.

- Ninth audit: How a retirement planning calculation scared me to take action

- Tenth audit: I made several investment mistakes but have turned my life around.

- Eleventh audit: My net worth doubled in the last financial year, thanks to patient investing!

- Update: How I achieved investing nirvana.

- Twelfth audit: My financial journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a negative net worth to goal-based investing.

- Fourteenth audit: From Fixed Deposits to Goal-based investing in MFs.

- Fifteenth audit: My 10-year financial journey – mistakes made and lessons learnt.

- Sixteenth audit (part 1): How I achieved financial independence without mutual funds or stocks.

- Sixteenth audit (part 2): Lessons from my financial independence journey and future investment plans.

- Seventeenth audit: How I plan to achieve financial independence and move to my native place

- Eighteenth audit: I used the current bull run to reduce my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his financial plan

- Twentieth audit: I plan to achieve financial independence by 46; this is my master plan

- Twenty-first audit: I have made many investment mistakes but am on course to financial independence by 45.

- Twenty-second audit: I felt worthless six years ago but have achieved financial stability today

- Twenty-third audit: My financial journey was directionless until age 40: this is how I made up for lost time

- Twenty-fourth audit: Why I increased equity MF investments by 275% and reduced PPF contributions.

- Twenty-fifth audit: How I track financial goals without worrying about returns

- Twenty-sixth audit: I am 24 and started investing 1Y ago, but what am I investing for?

- Twenty-seventh audit: How we plan to achieve a retirement corpus 50 times our annual expenses.

- Twenty-eighth audit: I thought equity investing was a gamble, but now I aim to hold 60% equity for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to building a corpus worth six years in retirement

- Thirtieth audit: My investment journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My investment journey: from product-driven to process-driven

- Thirty-second audit: How a young couple is trying to balance travelling and investing

- Thirty-third audit: My journey: From Rs. 30 bank balance to financial independence

- Thirty-fourth audit: Our journey: From scratch to a net worth of 18 times annual expenses.

- Thirty-fifth audit: From a net worth of Rs. 6000 to auto-pilot goal-based investing

- Thirty-sixth audit: How I retired from corporate bondage at 46, two years ago!

- Thirty-seventh audit: How I learnt to keep it simple and build a net worth 19 times my annual expenses

- Thirty-eighth audit: How Abhineeth plans to achieve financial independence and build a house.

- Thirty-ninth audit: How Sahil plans to achieve financial independence by efficient tracking

- Fortieth audit: My Journey to a Ten Crore Portfolio

- Forty-first audit: Burdened with debt for several years, I am now aggressively investing in equity

- Forty-second audit: From Engineer to Librarian after Financial Independence and Early Retirement (FIRE)

- Forty-third audit: I lost six months’ income in F&O and ditched it for systematic investing

- Forty-fourth audit: My retirement plan to handle the harsh realities of the IT industry

- Forty-fifth audit: My investment journey: mistakes, 10 years of MF investing and recovery

- Forty-sixth audit: My MF portfolio is worth six crores despite multiple mistakes

- Forty-seventh audit: Saving, Investing, and Running Marathons: My 25-year Journey to Financial Independence

- Forty-eighth audit: Never Too Late to Start: How I Became Financially Savvy at 40

- Forty-ninth audit: My Investment Journey to a net worth 29 times my annual expenses

- Fiftieth audit: How I audit my portfolio without tracking returns

- Fifty-first audit: Financial Lessons Learned During and After a PhD

- Fifty-second audit: Investment & Financial journey of a 23 year old

- Fifty-third audit: The system I use to draw income and spend after retirement securely

- Fifty-fourth audit: From Start-Up Employee to Millionaire: A Success Story of Resilience and Smart Investing

- Fifty-fifth audit: 25-Year-Old Software Engineer’s Investment Journey: From Stocks to Mutual Funds and Beyond

- Fifty-sixth audit: Crossing the Million Mark: Our Journey to the First Crore

- Fifty-seventh audit: Navigating Market Volatility: How an IT Professional Transformed His Investment Approach for Retirement

- Fifty-eighth audit: How Sahil achieved a 10X retirement corpus by efficient portfolio tracking

- Fifty-ninth audit: How I achieved financial freedom by 45 without onsite assignments or ESOPs

- Sixtieth audit: Building Wealth on a Government Salary: Lessons Learned

- Sixty-first audit: Minimalism, Index Funds, and Staying Calm: My Investing Journey at 28

- Sixty-second audit: Building Wealth and Breaking Barriers: How Swati Took Control of Her Financial Future

- Sixty-third audit: My financial journey: How I missed the Compounding Bus!

- Sixty-fourth audit: My MF investment journey: From thematic funds to a 3-fund portfolio

- Sixty-fifth audit: From Debt to ₹1 Crore Liquid Net Worth: My Journey of Financial Awareness.

These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail. You can also publish them anonymously.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)